Summary:

- Tesla, Inc.’s revenue totaled $23.3 bln (+24.4% y/y), down from our forecast for $24.2 bln due to a lower revenue in the EV sales segment.

- The company sold more EVs than we had expected (422.9 thousand EVs compared with the forecast for в 366 thousand), but the selling price for the Model Y was lower.

- EBITDA totaled $3.71 bln (-17.2% y/y), exceeding our forecast for $2.68 bln.

- Tesla is a good investment for a long-term investor. The company not only develops cars that are sought after, but also builds infrastructure through its charging stations and solar panels for homes.

jetcityimage

Investment thesis

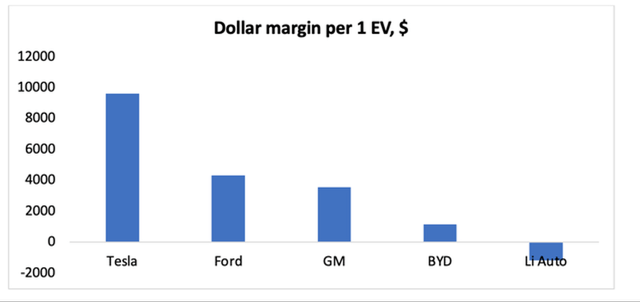

Tesla, Inc. (NASDAQ:TSLA) is a growth company. It actively exploits the power of its brand name to pass increased costs onto the consumer. In 2022, Tesla set a course for an expansion by boosting production of existing electric vehicle (“EV”) models. However, Tesla should face hard times in 2023. Tesla itself has accumulated a surplus stock of electric cars, which it will have to sell off in 2023 amid falling real incomes and a potential US recession. In response, Tesla has engaged in a price war with other electric car manufacturers. Tesla has the potential to do so because the company holds the highest-dollar EV margin in the industry. Rating is BUY.

The situation on the EV market

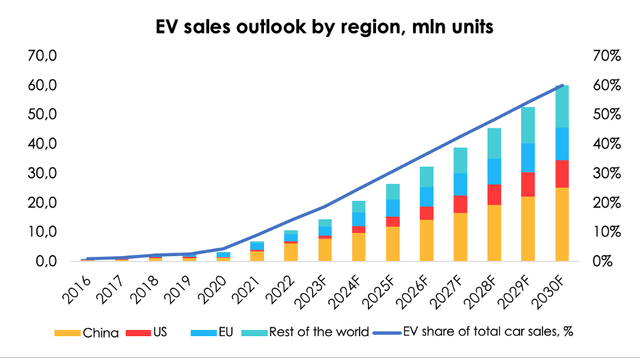

Despite the crisis of 2022 and the decline in real personal incomes, the total number of EV sales worldwide increased to 10.5 million units, up 57% y/y. That growth in demand for EVs was mostly driven by China, which is the largest market for EV sales, making up about 60% of all EV sales.

From January 1, 2023, China stopped providing subsidies to buyers of electric vehicles. Initially, the subsidies were supposed to come to an end in 2020, but they ultimately were extended until the end of 2022 due to the pandemic and its economic consequences. Originally, China introduced subsidies for EV purchases due to a significant discrepancy between the price of an electric vehicle and an internal combustion engine (“ICE”) vehicle. Many companies since then have come a long way in reducing the cost of EV production, and the average prices for EVs have gone down closer to the average prices for classic cars.

Thus, the average price of 1 EV in China has fallen from $70.2 thousand to $33.4 thousand since 2015, whereas prices in Europe and the United States have increased from $51.4 thousand to $58.6 thousand and from $53 thousand to $63.8 thousand, respectively. The reason for such a rapid price decline in China was not only technological improvements, but also a significant increase in competition among producers (there are more than 300 EV manufacturers in China).

There’s one subsidy for EV buyers that China will have until the end of 2023, which exempts them from the 10% tax on car purchases. Initially, the subsidy was also supposed to expire at the end of 2022. China’s system of green loans, which regulates EV output, also remains in place for now. If a company exceeds the government-imposed target for EV production, then it has the right to sell green credits, which provide it with an additional source of income. If a company does not meet the target, it has to buy green credits or pay a fine to the government.

In general, EVs continue to gain popularity across the world. We estimate that in 2022 EV sales made up 22.3% (+9.7 pp y/y) of total car sales in China, 5.5% (+1.3 pp y/y) in the US, 28% (+8.5 pp y/y) in Europe, and 4.6% (+2.1 pp y/y) in the rest of the world.

1Q 2023 has also been positive for the EV market. EV sales totaled 258.9 thousand units (+45% y/y) in the US in 1Q 2023, with EVs making up 7.2% of all cars sold. The picture is similar in Europe, where EV sales totaled 1178 thousand units (+53% y/y) in 1Q 2023, with EV sales making up 36.6% of all cars sold. In China, EV sales totaled 1586 thousand units (+26.2% y/y) in 1Q 2023, with EV sales making up 30.8% of all cars sold.

As a result of high demand for EVs from individuals in various parts of the world, despite a looming U.S. recession and declining real incomes, we are maintaining our outlook for global EV sales to reach 60 mln units by 2030.

Following the results of 4Q 2022, many analysts and experts were skeptical about the price wars starting in the EV market. But the fact remains that they have now started. In the U.S. market, Tesla has reduced the price of the Model Y, which is already the best-selling car in the US and European markets, to $47 thousand, pushing the price of an EV lower than the U.S. average selling price for a new car (by about 2%) and well below the U.S. average price for an EV (by about 26%). After Tesla first lowered prices for its EVs, about 40 different car brands followed suit and entered into a price war.

Tesla has one of the most stable positions in this sector due to its high dollar margin per EV.

Despite the positive results of 2022 and 1Q 2023, there is still an imbalance of supply and demand in the EV market. For example, Tesla produced 440.8 thousand EVs, but sold 422.9 thousand EVs in 1Q 2023. On the positive side, Tesla is likely to have left behind its biggest gap between sales and production, which was observed in 4Q 2022 and amounted to 7.8%. The gap is currently 4%.

In general, a similar situation is observed in some other markets. China produced 1.65 mln EVs in 1Q 2023, while only 1.586 million EVs were sold (a gap of 3.8%). In the U.S., inventories of EV producers jumped by 70% y/y, while EV sales climbed by 45% y/y, which also indicates a gap between production and sales, something that was not observed in 1Q 2022.

Tesla’s financial results

Tesla sold 422.9 thousand EVs in 1Q 2023, compared with our forecast for 366 thousand. However, the average selling price of the Model Y was lower than expected. We had expected the average price of the Model Y to be $61 thousand, but the actual price was around $47 thousand.

We are leaving the outlook for EV sales in 2Q-4Q 2023 unchanged, and therefore, pegging the total sales in 2023 at 1882 thousand EVs (+40.4% y/y). The outlook for EV sales in 2024 and 2025 has also been left unchanged.

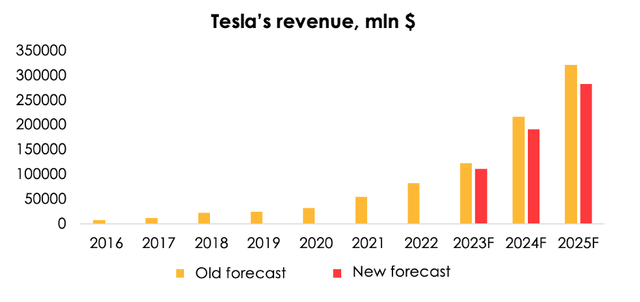

However, because of the decreased price for the Model Y – the main model in Tesla’s lineup – and slight adjustments in the energy generation and services segments, we are lowering the forecast for Tesla’s revenue from $122.4 bln (+50.4% y/y) to $111 bln (+36.4% y/y) for 2023 and from $321.6 bln (+48.7% y/y) to $282.3 bln (+47.7% y/y) 2025.

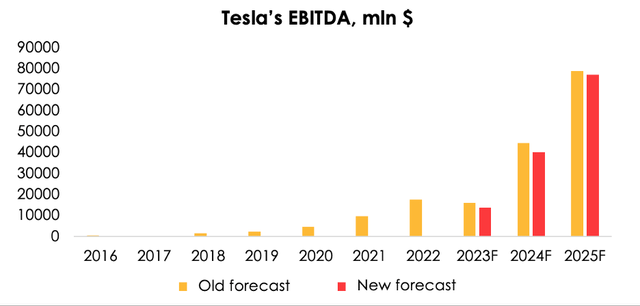

Given the contraction of revenue due to the lower price for the Model Y, we are lowering the forecast for Tesla’s EBITDA Tesla from $15.8 bln (-9.2% y/y) to $13.6 bln (-21.8% y/y) for 2023 and from $78.8 bln (+77.7% y/y) to $76.8 bln (+92.2% y/y) for 2025.

Tesla has adjusted its guidance for capital expenditures over the following years. The company anticipates that capital expenditures will range from $7 bln-$9 bln every year from 2023-2025, which exceeds our previous expectations for $6 bln in 2023 год. We now expect Tesla’s capital expenditures will total $8 bln every year from 2023-2025.

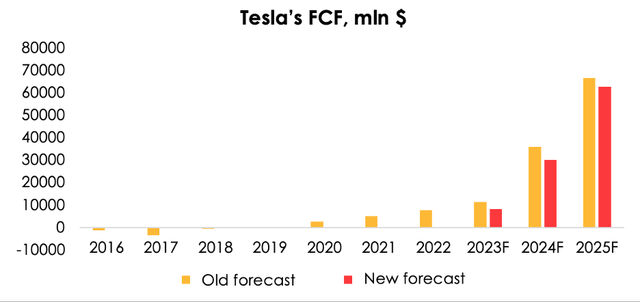

Given the reduction of the forecast for Tesla’s EBITDA and the increase of the forecast for its capital expenditures, we are lowering the forecast for the company’s free cash flow from $11.3 bln (+48.7% y/y) to $8 bln (+5.2% y/y) for 2023 and from $66.6 bln (+86% y/y) to $62.6 bln (+107% y/y) for 2025.

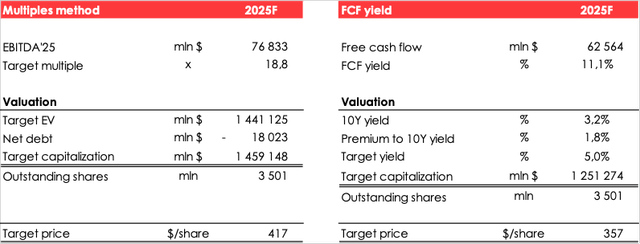

Because Tesla now is one of the best-selling cars not only among EVs, but also among classic cars, we have decided to revise the basic multiple for Tesla, using the basic multiples of major traded companies in the auto industry (GM, Ford and Toyota) as a basis. As a result, we are lowering the basic multiple for Tesla from 15.2хto 9.75х. This approach makes the valuation more «market-based» and removes a wide gap between the valuations that are based on the EV/EBITDA method and the free cash flow (“FCF”) Yield method.

Valuation

Based on our new assumptions, we are assigning a BUY rating to Tesla, Inc. shares. The fair value price is $313. The share price estimate of $313 has been achieved by computing two average estimates of the company’s valuation, based on different methods, and discounting them at the rate of 13% per annum from 2025.

Risks:

- The beginning of a global recession that will hit consumers and demand

- Aggressive entry of Chinese manufacturers into the world market, which will take away market share from Tesla.

Conclusion

Tesla, Inc. is a good investment for a long-term investor. The company not only develops cars that are sought after, but also builds infrastructure through its charging stations and solar panels for homes. Also, Tesla is nurturing plans to produce a robotic humanoid, the Optimus, to perform repetitive tasks at plants, but there have been no official announcement so far. Rating on Tesla, Inc. stock is BUY

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.