Summary:

- Tesla, Inc. dominates the EV market, but AI technology will move it to the lead long term in the Robotaxi market when it reaches L4.

- Tesla’s strategic shift to an AI-driven approach in autonomous vehicles sets it apart from competitors using LiDAR technology.

- Tesla’s cost-effective AI-driven system and scalability position it for higher revenue growth compared to LiDAR-based systems.

Justin Sullivan

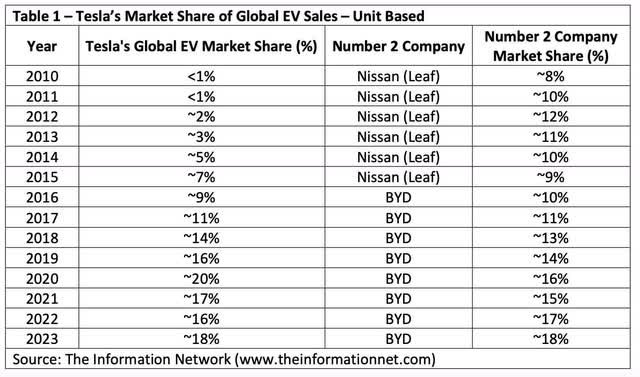

Tesla, Inc. (NASDAQ:TSLA) has been one of the dominant EV companies. In the period 2010-2012, Tesla held a minimal market share as the company started scaling production with its Roadster and early Model S vehicles, as shown in Table 1.

Market share increased in 2013-2017 with the introduction of the Model S and Model X, further increasing after 2018 with the introduction of the Model 3, according to The Information Network’s report entitled “Global and China EV Batteries and Materials: Technology, Trends and Market Forecasts.”

This dominance is difficult for investors to process when Elon Musk commented that “Tesla is an AI company, not a car company.” I raise this point because Tesla’s efforts in the Robotaxi industry are often negated when compared to competitors like Alphabet Inc.’s (GOOG) Waymo, Amazon.com, Inc.’s (AMZN) Zoox, and Baidu, Inc.’s (BIDU) Apollo, General Motors Company’s (GM) Cruise, and Aptiv PLC’s (APTV) and Hyundai Motor Company’s (OTCPK:HYMTF) Motional.

The current status of each of these robotaxi competitors to Tesla in terms of actual ride-sharing coverage and ridership varies significantly across different regions. But one thing they have in common is that they are in various stages of achieving Level 4 self-driving capabilities. Tesla, in contrast, currently operates at Level 2 autonomy. The difference lies primarily in the degree of autonomous driving capabilities and the need for human intervention, according to BMW:

- L2: The vehicle can control both steering and accelerating/decelerating. Here automation falls short of self-driving because a human sits in the driver’s seat and can take control of the car at any time.

- L4: This is considered to be fully autonomous driving, although a human driver can still request control. In level 4, the car can handle the majority of driving situations independently.

Tesla’s Full Self-Driving (“FSD”) package, considered to be at Level 2 autonomy, is far from achieving the full autonomy required for L4. But Investors need to consider Tesla’s strategy that has increasingly emphasized its artificial intelligence (“AI”) and software capabilities.

The key difference between Tesla and Robotaxi competitors is its strategic decision to shift from LiDAR to an AI-driven approach in its autonomous vehicles. LIDAR (Light Detection and Ranging) is a remote sensing technology that uses laser light to measure distances.

Tesla’s strategy, on the other hand, employs a combination of cameras, radar, and its FSD computer.

The Cost Dynamics: LiDAR vs. Tesla’s AI and Neural Networks

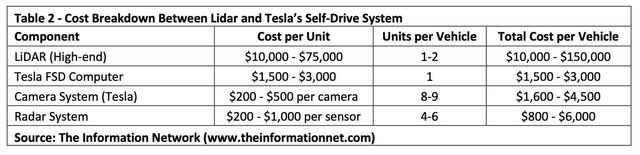

In Table 2, I show the cost breakdown between Tesla’s FSD self-driving computer and Robotaxi competitors. High-end LiDAR sensors vary in price and can cost between $10,000 and $75,000 per unit, and the Robotaxis requires one or two sensors. Total cost per vehicle ranges from $10,000 to $150,000.

Also in Table 2, I show pricing for Tesla’s three components – the FSD computer, which costs between $1,500 and $3,000 (1 required), cameras, priced between $200 and $500 each (8-9 required), and radar systems priced between $200 and $1,000 (4-6 required).

The total cost for Tesla’s system ranges between $3,900 to $13,500 per vehicle compared to a LIDAR cost between $10,000 and $75,000.

Centralized AI Training Costs

Tesla employs a combination of cameras, radar, and its FSD computer. The FSD computer costs between $1,500 and $3,000 per unit. Each vehicle requires eight to nine cameras, priced between $200 and $500 per camera, and radar systems that add another $800 to $6,000 to the total cost per vehicle. This brings the total cost for Tesla’s AI-driven system to a more affordable range of $3,900 to $13,500 per vehicle, making it central to Tesla’s strategy to scale its autonomous vehicle operations and penetrate the mass market.

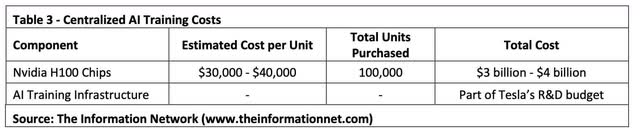

Tesla’s AI-driven system requires a significant investment in the use of NVIDIA Corporation’s (NVDA) H100 chips used to train Tesla’s neural. Each H100 chip costs between $30,000 and $40,000, and Tesla is reported to have purchased 100,000 units, equating to a total cost of between $3 billion and $4 billion.

These upfront costs, although high, enable Tesla to continuously refine its AI models as it moves from L2 to L4. Table 3 presents my analysis.

Scalability and Production Costs

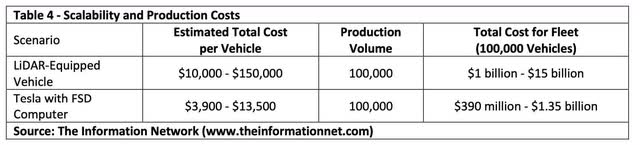

As shown in Table 4, equipping a fleet of 100,000 vehicles with LiDAR could cost between $1 billion and $15 billion, depending on the technology and specific sensors utilized.

In contrast, Tesla’s AI-driven FSD approach, as noted above, utilizes more cost-effective components, such as cameras and radar, and the cost of outfitting 100,000 vehicles ranges between just $390 million to $1.35 billion.

This lower cost enables Tesla to deploy large Robotaxi fleets, as well as achieve higher revenue potential through mass adoption.

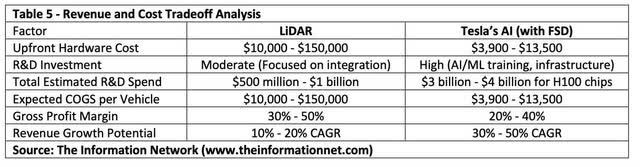

Revenue and Cost Tradeoff Analysis

Revenue and cost tradeoffs are necessary to consider when comparing LiDAR-based systems to Tesla’s AI-driven FSD technology, as shown in Table 5. LiDAR systems, which offer high accuracy and reliability and enable L4 autonomous driving, have substantial upfront hardware costs, ranging from $10,000 to $150,000 per vehicle. R&D investments for integrating LiDAR into autonomous systems are moderate, however, ranging between $500 million and $1 billion.

In contrast, Tesla’s AI-based FSD system, as noted above, costs between $3,900 and $13,500 per vehicle. However, R&D spending is significantly higher, with the AI and machine learning infrastructure costing $3 billion to $4 billion, largely driven by the price of the Nvidia H100 AI processors.

While R&D costs are high, Tesla’s lower hardware expenses and scalable technology position it for greater revenue growth. I project a compound annual growth rate (“CAGR”) of 30% to 50%, compared to the 10% to 20% CAGR for LiDAR-based systems.

This analysis underscores Tesla’s potential for higher long-term profitability through broader market penetration as it migrates from L2 to L4.

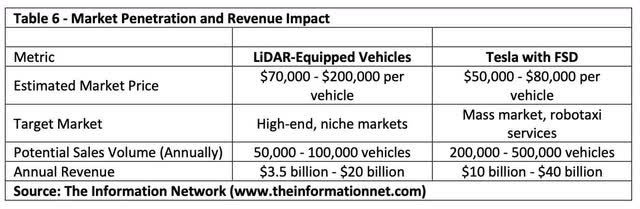

Market Penetration and Revenue Impact

I estimate the market prices of LiDAR-equipped vehicles ranging from $70,000 to $200,000 per vehicle. These vehicles are typically positioned in high-end, niche markets due to their significant costs. Annual sales volume for these vehicles could reach 50,000 to 100,000 units, generating between $3.5 billion and $20 billion in revenue, according to my revenues.

On the other hand, Tesla’s FSD system is designed for the mass market, with current vehicle prices lower and ranging from $50,000 to $80,000. With this pricing strategy, Tesla can target a broader audience, including Robotaxi services.

I estimate potential annual sales volumes of 200,000 to 500,000 vehicles and annual revenues between $10 billion and $40 billion. This represents a 2x-3x revenue increase over LiDAR-based systems.

Investor Takeaway

Tesla, Inc. is thus well-positioned to dominate the mass market, particularly in the Robotaxi sector, particularly when it reaches the L4 autonomy, which could be in 3-5 years. This cost advantage, detailed in this article, not only enables Tesla to deploy larger fleets more efficiently but also positions the company to dominate the mass-market segment, including potential Robotaxi services in the long term.

However, the gap between L2 and L4 autonomy is substantial, with L4 systems capable of full self-driving without human intervention in specific environments. This feature is still in development at Tesla. This delay could potentially impact Tesla’s competitiveness in the autonomous vehicle market in the short term.

Of Tesla’s competitors, Waymo employs an advanced LiDAR system that costs between $100,000 and $200,000 per vehicle. The company targets urban areas with its Robotaxi services, aiming for a market share of 10% to 20% by 2030. Waymo expanded its Robotaxi coverage in Los Angeles and San Francisco, operating a commercial service 24 hours a day, seven days a week throughout the city of San Francisco since receiving approval from the commission in August 2023.

Cruise, a subsidiary of General Motors, also uses a similar sensor suite and a projected market share of 10% to 15% by 2030.

Zoox, an Amazon.com, Inc.-owned (AMZN) company, differentiates itself through its custom-built autonomous vehicles designed specifically for urban environments. Its autonomous ride-hailing service will soon be starting its first public ridership in Las Vegas.

Baidu Apollo has successfully demonstrated in various pilot programs across China. Apollo’s open-source platform allows for collaboration with numerous partners, making it a central player in the Chinese market for autonomous vehicles.

Motional, a joint venture between Aptiv and Hyundai, has formed partnerships with ride-hailing companies such as Lyft to integrate its technology into existing transportation networks. However, it recently discontinued autonomous tests and a food delivery program with Uber Eats in Santa Monica, California.

I rate Tesla stock a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.