Summary:

- Based on developing technical patterns, I expect Tesla, Inc. to reach $334 in the next 30-90 days, and potentially $385-$400 in the coming months.

- Thanks to more affordable electric models and the return to normal operations at their Shanghai production plant after a shutdown, Tesla is expected to announce a 74% increase in second quarter deliveries to near 450,000.

- Despite recent downgrades from Morgan Stanley and Goldman Sachs, Deutsche Bank raised its price target for Tesla to $260 from $200, indicating potential upside.

Justin Sullivan

In March of this year, I published an article with Seeking Alpha charting a potential breakout pattern for Tesla, Inc. (NASDAQ:TSLA) stock. That has now materialized and is well underway, as the electric vehicle (“EV giant”) suffers a so-far slight pullback hovering around the mid $200 region after suffering a series of downgrades in recent weeks.

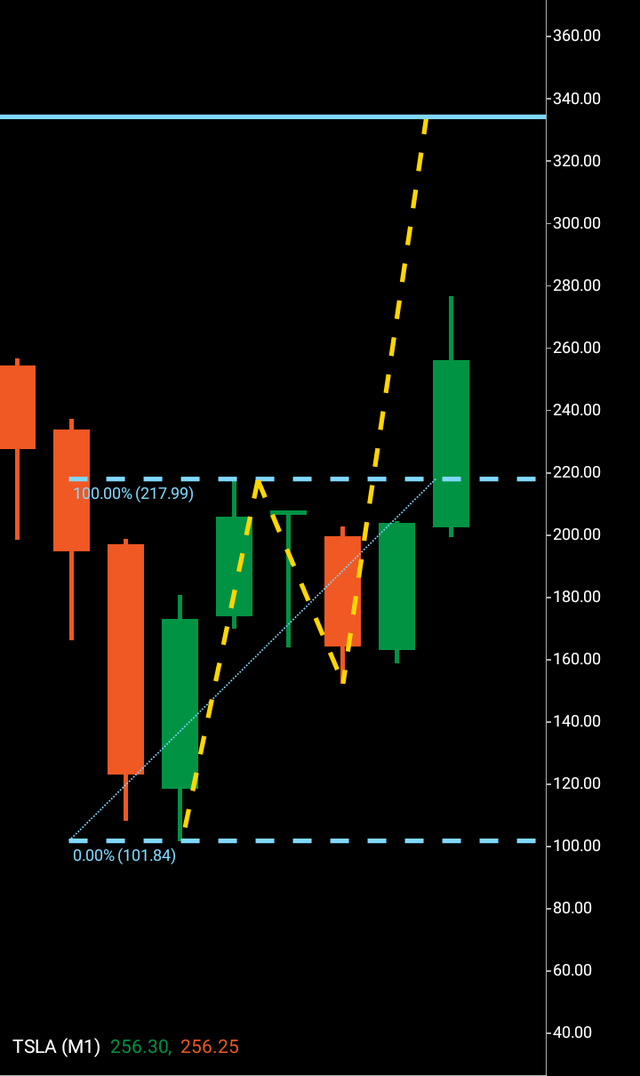

Firstly, we can look at my exact notes at the end of the March article before we delve into the company’s latest news as Tesla looks to bypass a rejection on the weekly chart presumably from the downgrade announcements and head to the $334 price area.

Final comments from the article in March this year:

“For the moment, there is a technical future price reading potentially created and resistance must be broken above first. I am issuing a hold until $217 is broken above where I will be issuing an updated article with Seeking Alpha with a buy signal if price gets driven above $217 where I will be looking at a direct target of $334 in the next 60-120 days if resistance is broken above.”

Of course, my first Tesla article in early 2022 attempted to chart a bearish pattern from $708-$176 which, inclusive of a stock split a number of months later, came true. Additionally, I added a following bearish target of $176-$122 in the latter part of last year, which also saw completion with Tesla so far bottoming at $101 and moving north to $217 to create its first bullish wave pattern and a possible future price target above the $300 region.

Tesla is reportedly due to announce second quarter deliveries very early in July. According to Factset, the numbers are up a whopping 74% to near 450,000, which would be a huge increase from 2022. Factors include Tesla’s continued march to make its electric models more affordable. Also assisting in this possible jump in deliveries is the fact that their Shanghai production plant has been able to return to normality after suffering a shutdown for a number of weeks last year, affecting and distorting production numbers and forward projections.

Banking heavyweights Morgan Stanley and Goldman Sachs were amongst several downgrades this week past, but Deutsche Bank did raise its price target to $260 from $200 this Monday, seemingly siding with potential upside to come for the company.

In fact, it is interesting that Tesla has found buying rejection at $276 in the past week, returning to the $240 price area before now looking to re-challenge and bypass the former. Should it bypass $276, there is another wave on the weekly chart showing a target of $385 actually. However, first let’s look at how the $217-$334 structure is shaping up on the monthly chart.

Tesla monthly three wave pattern (C Trader )

The third wave breakout above $217 has so far been strong despite suffering downgrades towards the end of the month. The candle is looking to finish positively, showing a lot of buying appetite. It will be interesting to see if the temporary $276 rejection on the weekly chart gets bypassed, opening the door towards the $300 region and on to the target.

To summarize, I am issuing a buy signal for Tesla on the basis of its third wave breakout and would expect Tesla to achieve $334 in the coming 30-90 days as per my original prediction, once $217 was broken above from the March article. Additionally I would not be surprised to see the $385-$400 region attempted in the coming months, either, but first am focusing on $334 as a primary target.

About the Three Wave Theory

The three wave theory was designed to be able to identify exact probable price action of a financial instrument. A financial market cannot navigate it’s way significantly higher or lower without making waves. Waves are essentially a mismatch between buyers and sellers and print a picture of a probable direction and target for a financial instrument. When waves one and two have been formed, it is the point of higher high/lower low that gives the technical indication of the future direction. A wave one will continue from a low to a high point before it finds significant enough rejection to then form the wave two. When a third wave breaks into a higher high/lower low the only probable numerical target bearing available on a financial chart is the equivalent of the wave one low to high point. It is highly probable that the wave three will look to numerically replicate wave one before it makes its future directional decision. It may continue past its third wave target but it is only the wave one evidence that a price was able to continue before rejection that is available to look to as a probable target for a third wave. The link to the Ward Three Wave Theory can be found in my bio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.