Summary:

- Tesla, Inc. shares broke a seven-month high this month, as it extends an 11-day run of gains that have added close to $200 billion to its market cap.

- Recent developments to extend Supercharger access for non-Teslas have only bolstered investor confidence in the quality of Tesla’s fundamental prospects, overshadowing near-term demand risks and margin pressures from price cuts.

- Tesla stock continues to be a winner on external considerations beyond fundamentals alone.

Visionkick/iStock Unreleased via Getty Images

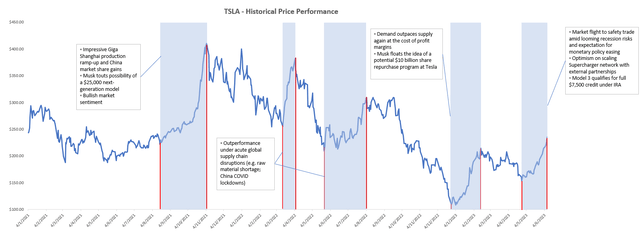

Tesla, Inc. (NASDAQ:TSLA) stock continues to rally past a seven-month high this week, fueled by market optimism on a potential path for monetary policy easing this year, alongside a “flight to safety” rotation into tech havens amid looming recession risks. Tesla’s recent announcements to open up its Supercharger network to rivals Ford Motor Company (F) and General Motors (GM) have also reinforced investor confidence in its market leadership and mission-critical role in the secular transition to electric. Taken together, recent news has largely overshadowed concerns about near-term demand risks and margin deterioration, as Tesla continues to put on display the myriad of levers left to pull to keep its stock gains afloat.

While Tesla stock remains overvalued from a fundamental perspective – especially after its recent rally – Tesla’s valuation has, admittedly, proven historically that its momentum does not feed on the underlying business’ performance alone. And considering incremental value accretive factors in its favor – spanning the rising likelihood of monetary policy easing, and other industry-specific news to bolster its market leadership appeal – there is likely more room left for the stock to run, which risks keeping bears on the slow burn.

Tesla Opens Up the Supercharger Network

Tesla CEO Elon Musk’s earlier plans to open up the Supercharger network for external automakers have taken a step forward in recent weeks. Rivals counting Ford and GM have both recently announced partnerships with Tesla that would provide their existing and upcoming electric vehicle, or EV, models with access to the Supercharger network across North America.

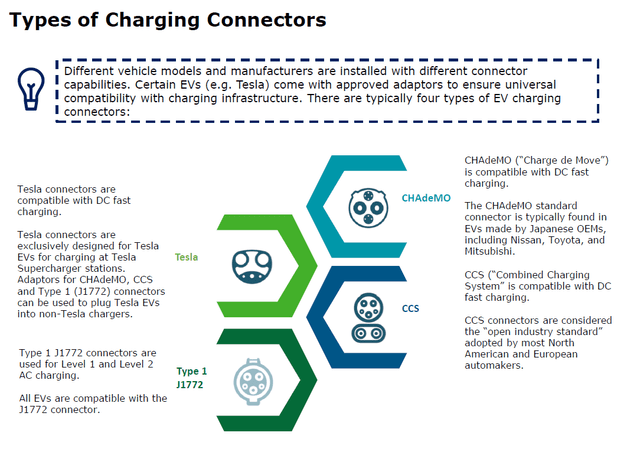

Specifically, Ford and GM EVs will soon gain access to the 12,000 Superchargers across North America that will become open to non-Teslas beginning 2024 (the Supercharger network has more than 17,000 plugs across North America in total). Existing EV models, which are typically fitted with the combined charging system (“CCS”) connector, will be able to charge on the Supercharger network using an adapter that Musk had previously stated “wouldn’t be cost-prohibitive.” But beginning 2025, both Ford and GM will incorporate Tesla ports to enable “direct access to Superchargers,” improving accessibility and convenience to prospective EV buyers looking to ease range anxiety.

Tesla’s recent decision to open up its Supercharger network – a key competitive advantage for its brand – is likely driven by several incentives. This includes the need to assuage range anxiety and narrow the EV adoption gap observed between the U.S. and fast-growing markets like China and Europe, which would inadvertently benefit the company’s demand environment. Despite improving battery technologies and increasing availability of public charging infrastructure across North America, range anxiety remains one of the key barriers to the transition to electric, second to affordability.

With EV adoption gaining momentum, as corroborated by an acceleration in the segment across all key markets spanning the U.S. (+50% y/y), China (+100% y/y), Australia (+90% y/y), and Europe (+17% y/y) in 2022, opening up the Supercharger network in North America comes at an opportune time for Tesla. The network’s fast-charging capability would also bode well for improved battery technologies incorporated in the latest EV models, optimizing utilization across Superchargers – more than 200 EV models available in the market today boasts “at least 249 miles of range” on a single charge, with at least 50 of them now being sold across North America.

Opening up the Supercharger network, starting with two of the most reputable automakers in North America, would likely bolster adoption and reinforce the longer-term demand environment for Tesla.

It is better for Tesla that more customers buy Mach-Es versus ICE vehicles.

Source: RBC Capital Markets.

The ratio of available public chargers to EVs is roughly at 18-to-1 in the U.S. today. And the availability of public fast chargers, like plugs provided by Tesla’s network, is even rarer, with downtime exceeding 20% versus Superchargers’ uptime of 99.95% on average. This compares to a count of 7-to-1 in public chargers to EVs in China – the world’s largest and fastest-growing EV market – highlighting the importance of supporting infrastructure to boost adoption.

Tesla may also be looking to become the industry charging standard, and maintain its dominance in the public charging market with EVs entering mainstream adoption. This would likely improve utilization on the Supercharger network, and aid related margins over time. Opening up the Supercharger network would also be a viable route for Tesla to start partaking in the growth of competing automakers by enabling an incremental stream of scalable revenues that its competitors like Ford and GM may not be able to directly benefit from in the longer-term transition to electric.

For instance, there are certain corners of the auto market beyond passenger vehicle sales that Tesla has yet to gain a stronger grip on – including light- and heavy-duty commercial fleets. Specifically, Ford and GM remain best-sellers in the related commercial markets across North America, with each boasting a share of more than 40%. By opening up the Supercharger network to those external competing fleets, Tesla effectively furthers its reach into opportunities that otherwise would have been less or non-accessible.

By opening up its North American Supercharger network to non-Tesla vehicles, the EV titan also paves the way for further access to government funding towards the build-out of public charging infrastructure. More than $30 billion in new investments have been poured into the EV economy since President Biden had signed the Inflation Reduction Act into law last summer, alongside $7.5 billion allocated through the Bipartisan Infrastructure Bill towards building out the U.S. public EV charging network. Taken together with funding beyond public sources, more than $24 billion having been invested into the build-out of EV charging infrastructure in 2022 alone across the U.S. And that number is expected to reach as much as $1.9 trillion by 2050, underscoring an expensive endeavor that Tesla could partially recoup by keeping its doors to public funding open.

In the meantime, opening up the Supercharger network will also improve utilization and scale to expand margins in Tesla’s services and other revenues. This would make the strategy a potential compensator for the delayed realization of deferred Full Self-Driving subscription sales into revenue due to lingering regulatory uncertainties.

But it is not all sunshine and rainbows – opening up the Supercharger network to non-Tesla vehicles has significant downside implications to the EV titan’s fundamental prospects as well. With the Supercharger network’s open availability providing greater public charging access to encourage better EV adoption rates, prospective car buyers may be incentivized to consider more affordable non-Tesla models, effectively diluting Tesla’s market share. And the lost auto sales may not be sufficiently compensated by incremental charging revenue within the foreseeable future, adding to the urgency for a mass market-priced Tesla offering – like the highly speculated “Model 2” that Musk has been putting off.

Well, we’re not currently working on a $25,000 car. At some point, we will, but we have enough on our plate right now, too much on our plate, frankly. So, at some point, there will be.

Source: Tesla 4Q21 Earnings Call Transcript.

Fundamental Analysis Update

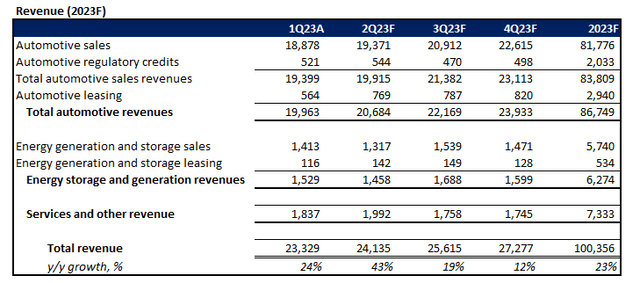

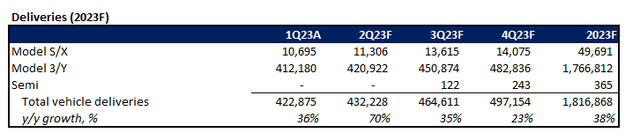

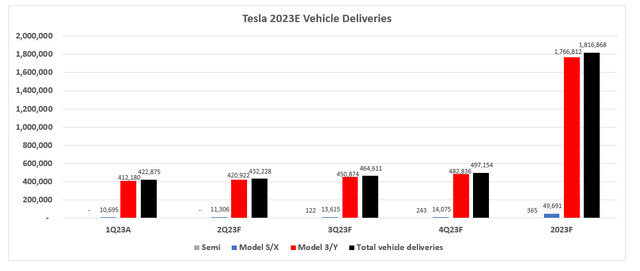

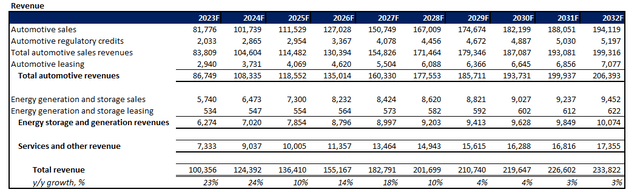

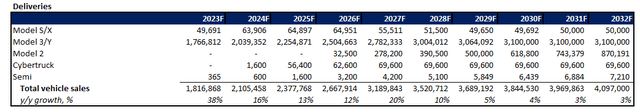

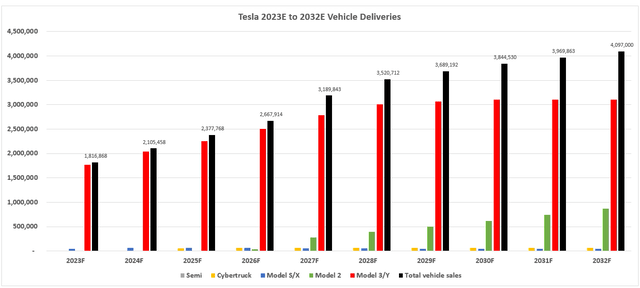

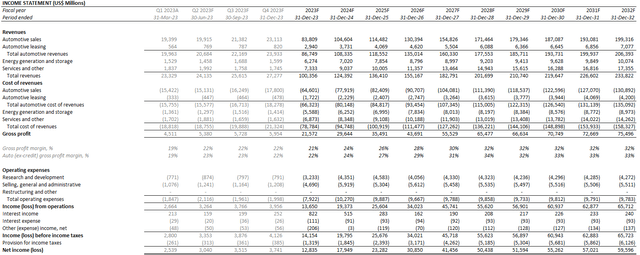

Adjusting our fundamental forecast for Tesla’s actual first quarter results, with additional consideration for recent developments and changes to its demand environment, the company is expected to grow revenues by about 24% this year to more than $100 billion. Specifically, its core vehicle sales operations will drive the bulk of full-year deceleration, with growth totaling 22% y/y to finish at about $82 billion. This takes into consideration a modest ASP in line with Tesla’s aggressive pricing strategy in recent months to overcome growing signs of sluggish auto demand as consumer sentiment weakens on looming recession risks. Full year deliveries are likely to exceed 1.8 million units, with the Model 3/Y remaining the core driver, helped by a competitive pricing strategy as well as the incremental demand that is expected to stem from all of its models’ eligibility for the full $7,500 purchase credit under the IRA.

As part of the 2023 Inflation Reduction Act, eligible businesses and tax-exempt organizations can claim up to a $7,500 credit when purchasing new Tesla vehicles with a gross vehicle weight rating (GVWR) of up to 14,000 pounds. All Tesla passenger vehicles qualify for this incentive:

- Model S.

- Model 3.

- Model X.

- Model Y.

Additionally, Semi qualifies for a tax credit of up to $40,000.

Source: tesla.com.

And over the longer term, considering reasonable expectations for greater competition and further dilution of Tesla’s first-mover advantage in the industry, total revenues are expected to expand at a CAGR of about 9% through 2032. Specifically, core automotive revenues and deliveries are likely to average about 9% annual growth over the next decade, with take rates normalizing more prevalently approaching 2030 due to the combination of competition, and expected ASP reductions on Tesla’s longer-term plans to focus on affordability.

So, basically, price really matters. I think there’s just a vast number of people that wanted to buy a Tesla car, but can’t afford it…And it’s always been our goal at Tesla to make cars that are affordable to as many people as possible, so I’m glad that we’re able to do so.

Source: Tesla 4Q22 Earnings Call Transcript.

Meanwhile, auto (ex-credit) gross margins are likely to stay pressured by the combination of ongoing, though improved, production ramp-up costs at the new manufacturing facilities in Texas and Berlin, elevated material costs, as well as the lower ASP go-to-market strategy for auto sales. They will likely stay in the low 20% range – a modest improvement from the 19% observed during the first quarter – with further ramp-up back towards the 30% range by mid-decade when anticipated vehicles designed on the lower-cost third-generation platform are expected to enter start of production.

Meanwhile, services and other margins are likely to improve further over time. This is in line with the anticipated benefits of improved utilization on the Supercharger network by permitting access to non-Tesla vehicles over the longer term, even without expectations for meaningful incremental impact from FSD sales given ongoing uncertainties on that front, contributing further to Tesla’s consolidated profitability.

Valuation Analysis

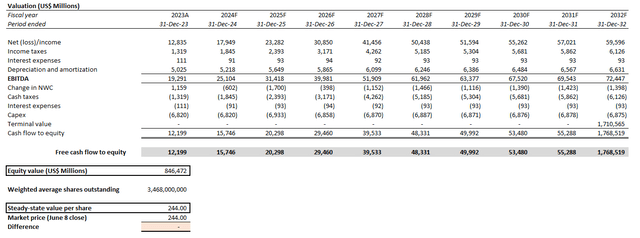

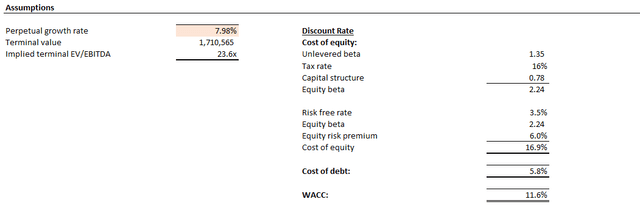

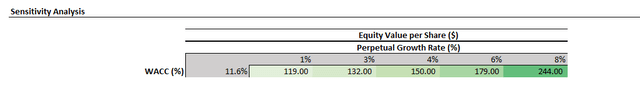

Based on the discounted cash flow (“DCF”) analysis on projected cash flows taken in conjunction with our fundamental forecast for Tesla, with the application of an 11.6% WACC in line with the company’s capital structure and risk profile, the stock’s current price at about $244 apiece implies an 8% perpetual growth rate. This prices in future growth that exceeds the pace of economic growth across Tesla’s key operating regions, representing a significant premium attributed to its market leadership and prospects in the global transition to electric.

Considering solely on fundamentals, by applying an estimated perpetual growth rate of around 4%, which includes a reasonably sized premium on top of the typical pace of about 2.5% to 3% in line with the economic expansion of its core operating regions to reflect Tesla’s dominance in the EV market, the stock should trade closer to the $150-range in line with our previous analysis.

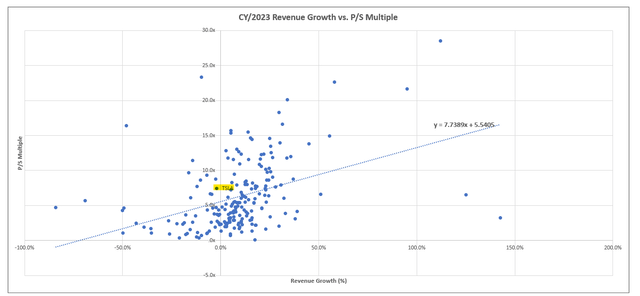

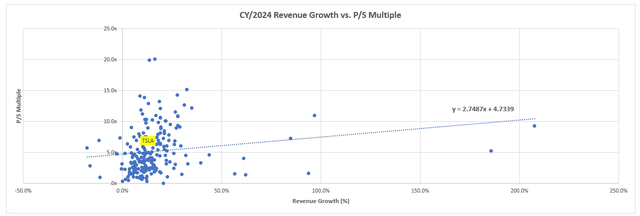

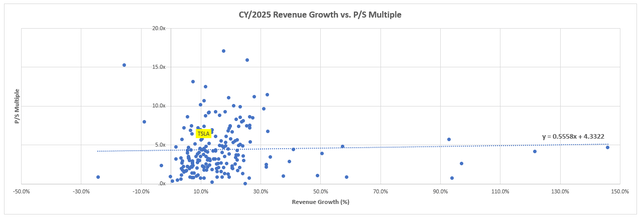

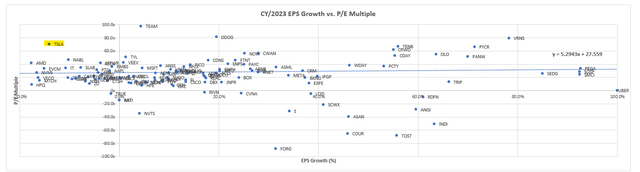

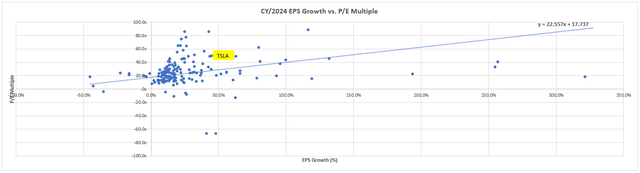

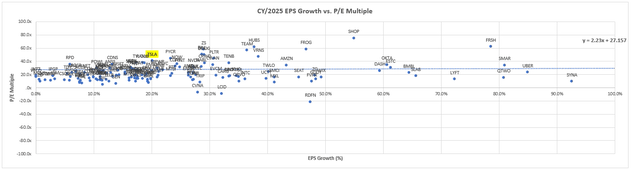

And considering a multiple-based valuation approach, Tesla’s current market value at about 8x estimated sales remains largely in line with the broader tech peer group considering near-term prospects. But at about 70x estimated earnings, the stock prices in significant optimism into the underlying business’ profit outlook, despite headwinds to its margins ahead. [peer comp]

i. Sales Growth vs. P/S Multiple – Technology

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

ii. EPS Growth vs. P/E Multiple – Technology

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

This likely reflects the incremental premium that market’s flight to safety trade has added to Tesla stock. Despite slightly compromised margins over the near term as Tesla shifts its preference towards growth, the consolidated business remains profitable with a robust balance sheet and cash flows to sustain continued operations, as well as further-out initiatives to bolster its market share gains, which bodes favorably with investors’ preference amid the risk-off market climate.

Investors are entering a new month with little clarity on interest rates and the economy. That’s boosting the appeal of stocks with robust cash flows and promising revenue growth, even if they come with hefty price tags.

Source: Bloomberg News.

We expect the growing flight to safety-driven rotation into tech havens to remain a boon for the Tesla stock over the coming months, as recent data shows further deterioration in the economy with risks of a recession on the rise. The weakening economy is also dialing up market expectations for a pause in monetary policy tightening, and potentially some easing before the end of the year, which would further the appeal of Tesla’s future cash flows and drive valuations higher.

Beyond macroeconomic factors, Tesla also continues to surprise markets with a consistent line-up of levers to pull that would boost the appeal of its shares. This includes Musk’s recent attempt to float the idea of share buybacks totaling as much as $10 billion as long as Tesla’s board approves, which had previously buoyed optimism for the stock. Despite the lack of follow-up, the company does exhibit balance sheet strength to execute such an endeavor should its shares perform below expectations. Tesla’s recent introduction of a low-cost third-generation vehicle platform also paves way for future new model announcements – with the timing of which at Musk’s discretion – that could imply further share gains, representing another potential catalyst for the stock.

There is also AI left on the back burner, which, although Musk has been cautiously optimistic about it, could be used to further the Tesla stock’s appeal. Taken together with the Tesla stock’s lofty premium at current levels amid a shaky market backdrop, the set-up risks introducing incremental volatility to its performance in the near term.

The Bottom Line

Despite being fundamentally overvalued, Tesla, Inc. stock’s set-up is likely not yet ripe for a selloff. The recent extension of Supercharger access to non-Teslas only adds to market share gains for Tesla’s underlying business across the EV value chain, emboldening investor confidence in the stock’s upside potential. Under the current market climate where profitable growth and quality earnings take precedence, Tesla stock looks supercharged for further upsides over the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!