Summary:

- Tesla, Inc.’s Model Y became the global best-selling car in 2023, silencing doubts about EV desirability.

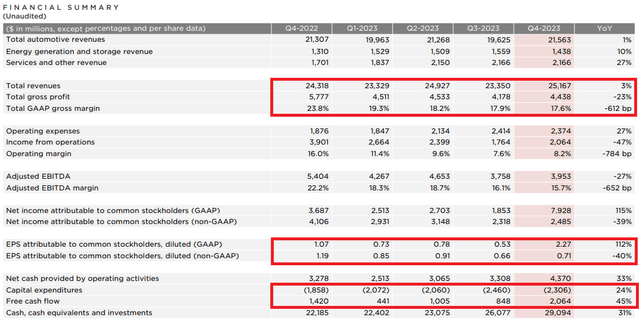

- Yet, the company is experiencing sluggish top-line growth, with Q4 showing a mere 3% YoY increase and contracting profit margins.

- Uncertain EV demand, ongoing price wars, and the lack of 2024 guidance on profit margins and growth pressure Tesla’s stock.

- Trading at over 60x its earnings and facing a year of expected flat EPS growth in 2024, I’m downgrading Tesla’s stock as the market currently presents better opportunities.

FREDERIC J. BROWN/AFP via Getty Images

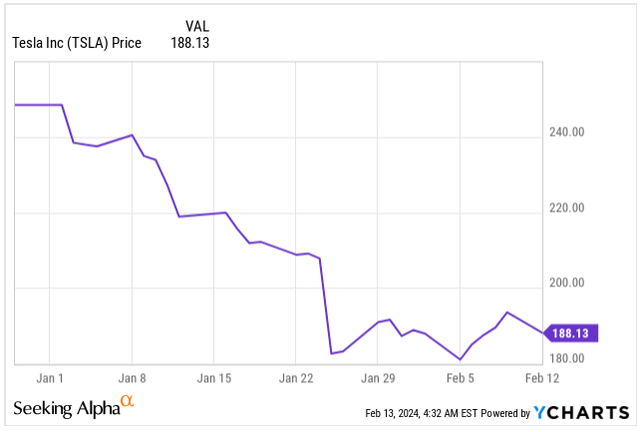

After a stellar 2023 where Tesla, Inc. (NASDAQ:TSLA) stock soared, doubling in value at one point before settling 53% higher by year’s end, 2024 has brought a harsh reality check. The stock has plunged over 24%, fueled by disappointing Q4 earnings and revenue that fell short of expectations.

This performance has shaken investors, causing them to question Tesla’s continued presence in the “Magnificent 7” group of high-flying tech stocks.

Concerns are amplified by a looming electric vehicle (“EV”) price war that threatens profit margins, and the rising competition from cheaper Chinese electric vehicles that could chip away at Tesla’s market share.

Price Development (Seeking Alpha)

Back in October, I covered Tesla, brimming with optimism about their industry-leading margins and market share resilience amidst the price war. Since then, things haven’t exactly panned out that way, as the stock has taken a 26% nosedive, leaving a bitter taste for some investors.

Yet, with the price drop, Tesla’s overall risk profile becomes more attractive. So, let’s revisit the company’s situation and my updated vision for its future trajectory.

Business Update

2023 witnessed a remarkable feat for EVs: Tesla’s Model Y ascended to the throne of global best-seller with over 1.2 million models delivered, silencing doubts about their practicality and desirability.

In the U.S., overall EVs crossed the 1 million sales mark, solidifying their presence with a 7.5% share and representing a crucial step towards electrification.

However, the narrative takes a slight turn when examining growth trends. The heady days of 50% YoY growth witnessed between June 2022 and 2023 are fading, casting a shadow of doubt on the ambitious target of 50% EV sales by 2030.

The growth has fallen to 35% YoY in November 2023.

Several factors are contributing to this slowdown:

- Fuel Price Shift: As gasoline prices plummeted from $5 to $3 per gallon, the urgency to switch to EVs subsided, making combustion engines more competitive.

- Affordability Challenge: Despite recent price reductions, the average EV price tag of $52,000 remains a significant hurdle compared to cheaper gas-powered vehicles.

- Inventory Blues: Production outpacing demand has led to a growing stockpile of EVs, with longer “days-to-turn” (57 days currently, compared to 40 for gasoline cars and 17 for hybrids).

It’s crucial to remember that this slowdown doesn’t negate the significant progress made. EV adoption is still in its early stages, and fluctuations are to be expected.

The industry must address issues like pricing, expand affordable options, and invest in charging infrastructure to maintain momentum and navigate these temporary hurdles.

Naturally, the slowing industry growth and falling prices per vehicle, amidst stiff competition from BYD Company (OTCPK:BYDDF), Ford (F), BMW (OTCPK:BMWYY), and Mercedes-Benz (OTCPK:MBGAF), have had an impact on Tesla’s Q4 earnings. The company reported only 3% YoY revenue growth, delivering $25.16 billion.

Bloomberg reports a surprising shift in price dynamics: Tesla’s top-selling EVs, the Model 3 and Model Y, boast starting prices lower than the average transaction price for other cars in the U.S. This means their entry-level variants could be more affordable than many gasoline-powered options.

The key driver is the $38,990 (before taxes and fees) starting price for the base rear-wheel-drive Model 3. This represents an $8,700 saving compared to the national average for new cars and trucks. Even compared to other EVs, it’s impressive – their average transaction price in the U.S. currently sits around $52,000:

- Model 3 witnessed a general decrease in average price from $66,000 in 2018 to around $42,490 in 2024.

- Model Y introduced in 2019 at $55,500, saw a gradual increase to $68,490 in 2022, followed by a decrease to $48,490 in 2024.

While Tesla’s recent price cuts may cost the company $1.2 billion annually, they represent a bold gamble aiming for price parity with traditional gas-powered cars and trucks. This move, though impacting short-term profits, could significantly drive future demand for EVs, ultimately positioning Tesla as a dominant player in the clean energy market.

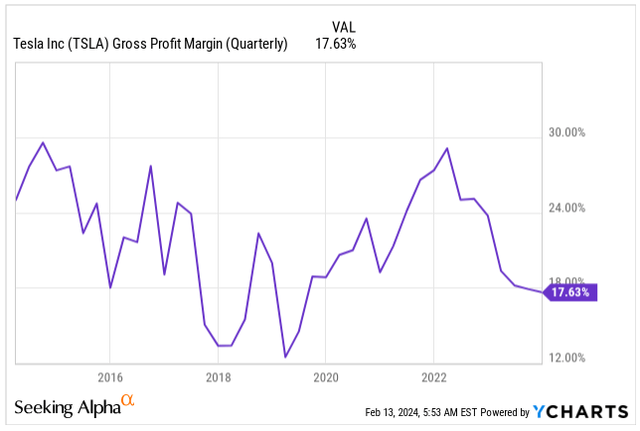

However, the immediate effect is evident in a 612 basis point YoY drop in gross margin, currently sitting at 17.6%. This signifies a trade-off: immediate financial sacrifice for potentially exponential market growth in the long run.

As a result, the EPS in Q4 has fallen by 40% to $0.71, taking a significant hit.

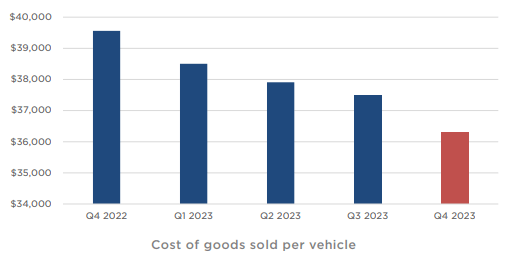

While the price war may grab headlines, the real story lies in Tesla’s impressive cost reductions. Despite the early challenges of ramping up Cybertruck production, the cost of goods sold per vehicle has shrunk to just above $36,000, marking a sequential decline.

Even as they approach the natural limits of cost reduction for existing models, Tesla shows no signs of slowing down, actively pursuing further efficiencies across all stages of production, from raw materials to final delivery.

However, predicting future auto gross margins remains a complex endeavor. Numerous factors beyond their control, such as fluctuating tariffs and local incentives, add significant uncertainty to the equation.

COGS per Vehicle (TSLA IR)

While 2023 offered impressive growth, Tesla seems cautiously optimistic about 2024. Vehicle volume growth rate may fall significantly as the company focuses on launching its next-generation car at Gigafactory Texas. This marks a transition period between the “global expansion” of the Model 3/Y platform and the company’s next big bet.

Despite claiming “very far along” development of a low-cost vehicle, Tesla remains tight-lipped about specifics, leaving investors anxious. The lack of details on pricing strategy and expected profit margins further fuels the uncertainty, contributing to the ongoing stock price decline.

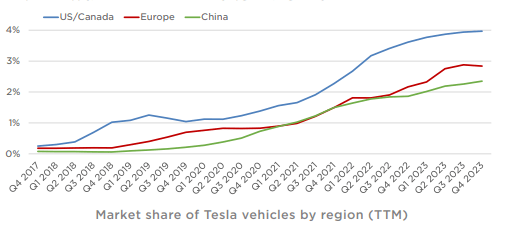

However, it’s not all doom and gloom. Despite these challenges, Tesla’s market share continues to rise in both the U.S. & Canada and China, defying pressure from Chinese competitors. While Europe shows signs of plateauing, the strong presence in key markets provides some cushion.

Overall, 2024 presents a mixed bag for Tesla. While navigating a crucial transition period with limited guidance adds anxiety, the company’s existing momentum and continued market share gains offer some hope. The success of the next-generation car and future strategic decisions will ultimately determine the year’s true outcome.

TSLA Market Share (TSLA IR)

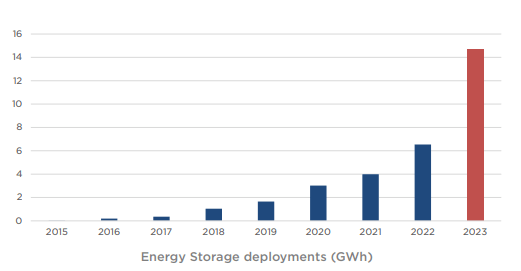

Tesla’s growth story extends beyond vehicles: the energy storage segment delivered explosive YoY growth, surging from 6.5 GWh in 2022 to nearly 15 GWh in 2023, a triple-digit increase. This momentum isn’t expected to slow down. Looking ahead, Tesla anticipates faster growth in energy storage than the automotive business, fueled by the ongoing ramp-up of the massive 40 GWh Megafactory in Lathrop.

Energy Storage Deployments (TSLA IR)

While traditionally focused on vehicles, Tesla’s “Services & Other” segment is quietly emerging as a significant growth engine. Last year saw it transform from a $500 million loss in 2019 to a $500 million profit in 2023, showcasing a remarkable turnaround. This momentum seems unstoppable, with triple-digit growth rates projected for the future.

In fact, I wouldn’t be surprised if this segment evolves into the next major growth driver, rivaling even the automotive business.

Risks

Although Tesla spearheaded the electric vehicle revolution, its path forward is no longer a paved highway. Several hurdles loom on the horizon, demanding attention and strategic responses:

- Fiercer Competition: Established automakers and nimble startups are flooding the market with compelling EVs, eroding Tesla’s once-dominant market share. The battle for customers intensifies, potentially pushing profit margins down.

- Price Wars Unleashed: The fight for market share has triggered a cutthroat price war, benefitting consumers but squeezing Tesla’s profitability. Maintaining its premium brand image while navigating this price pressure will be crucial.

- Slower EV Adoption: The anticipated surge in EV adoption may not materialize as quickly as hoped. Consumers’ choice paralysis, infrastructure limitations, and affordability concerns could hinder Tesla’s ambitious growth plans.

- Subsidy Sunset: With government subsidies for EVs diminishing, the price gap between EVs and gas-powered vehicles widens. This could pose a challenge, especially in price-sensitive markets.

- Geopolitical Instability: Trade tensions and supply chain disruptions add further uncertainty. Ensuring efficient production and managing risk across borders will be essential for Tesla’s operational stability.

- The Elon Musk Factor: While he’s been the driving force behind Tesla’s success, Elon Musk’s public persona and impulsive actions can sometimes overshadow the company’s achievements. Striking a balance between his vision and responsible leadership is key to maintaining investor confidence.

Valuation

Tesla’s stock has embodied the wild swings of market enthusiasm and fear. The past three years saw valuations fluctuate from 30x to a staggering 340x earnings, reflecting dramatic shifts in growth expectations.

While achieving its first positive net income in 2020, Tesla’s subsequent EPS growth has slowed:

- 2020: $0.75 (37.2x YoY increase)

- 2021: $2.26 (2x YoY increase)

- 2022: $4.07 (0.8x YoY increase)

- 2023: $3.12 (0.23x YoY decrease).

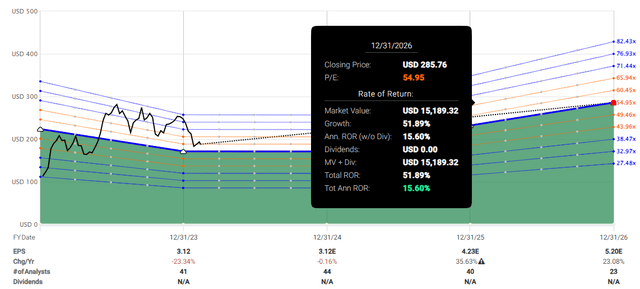

Unsurprisingly, such volatile growth translates to volatile stock prices. Currently trading at 60.31x its blended P/E, while lower than its historical high, the future picture remains murky.

Analyst forecasts polled by S&P Global paint a mixed picture:

- 2024: $3.12E (0% YoY growth)

- 2025: $4.23E (36% YoY growth)

- 2026: $5.20E (23% YoY growth).

These diverse expectations suggest 2024 might be a transitional year, marked by a peaking price war and uncertainties in the EV market. Assuming a “reasonable” 27%-28% average annual EPS growth in subsequent years, Tesla’s valuation presents several perspectives:

- 2024E Earnings: PEG ratio of 61.31 (high in my view)

- 2025E Earnings: PEG ratio of 1.67 (indicating potential).

Considering ongoing headwinds and management’s limited guidance, the current valuation seems stretched, despite trading lower than its historical peak.

While Tesla could still deliver a 15% annual return if it surpasses current EPS growth expectations especially in 2024, I believe better investment opportunities exist in the market today.

Given the uncertainties and lack of clear direction, I am downgrading Tesla stock to “hold” until a more promising path emerges.

Return Potential (Fast Graphs)

Takeaway

Tesla reigned supreme in 2023, with the Model Y claiming global EV best-seller status and EVs crossing 1 million sales in the U.S.

However, the initial surge in EV sales with 50% YoY growth seen in June 2023 has slowed to 35% by November 2023, raising concerns about achieving the ambitious target of 50% new vehicle EV sales by 2030, a goal set by the U.S. government.

Fuel price drops, affordability hurdles, and inventory buildup are putting the brakes on growth. But this slowdown doesn’t negate the progress made. The industry needs to address pricing, expand affordable options, and invest in charging infrastructure to maintain momentum.

Tesla’s Q4 reflects the slowdown, with lower revenue growth and falling per-vehicle prices. However, a bold gamble emerged: starting prices for Model 3 and Y are now lower than the average U.S. car price, potentially driving future demand. This aggressive move comes at a cost, with gross margin dropping significantly.

While short-term profits suffer, Tesla’s impressive cost reductions across production stages offer hope for long-term success. However, predicting future profitability remains challenging due to external factors.

2024 shows cautious optimism with a focus on launching the next-generation car. Lack of details on pricing and profitability fuels investor anxiety, contributing to the stock price decline.

Despite the challenges, Tesla’s market share continues to rise, offering some solace. The company’s future hinges on successfully navigating the transition period and executing its next big bet. The success of the new car and future strategic decisions will ultimately determine Tesla’s fate.

Although Tesla’s current valuation sits beneath its historically high range, limited visibility on future EPS growth prompts me to downgrade the stock to “hold.” Other opportunities in the market offer greater potential with lower risk in my view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.