Summary:

- Tesla’s stock has crashed nearly 70% since its high-flying days last year.

- Now, at around 20 times forward earnings, Tesla is becoming cheap.

- Tesla has excellent potential long-term, and the lower its share price drops, the better the buying opportunity.

- At around $120, Tesla becomes a strong buy, and the stock is a gift if it falls near $100.

Dimitrios Kambouris

Tesla’s (NASDAQ:TSLA) stock has gone in reverse, dropping to its lowest level in more than two years. The share price has crashed nearly 70% since its high-flying days in 2021. Nevertheless, Tesla is in a prime position to continue dominating its segment and should grow revenues significantly while expanding profitability simultaneously. Transitory factors such as Elon Musk buying Twitter and other noise should not impact Tesla’s expansion and long-term profitability potential. Tesla has a delivery report coming up, and the company could surprise to the upside, leading to a more profitable-than-expected Q4.

Moreover, Tesla is becoming cheap on a P/E and even on a P/S basis. Disregard the noise! Tesla is a buy in the $120-$140 range, and the stock becomes a conviction strong buy if it gets down to about the $100-$110 level in this bear market.

How Cheap Would Tesla be at $100?

For starters, $100 is 76% below Tesla’s ATH in 2021. At $100, Tesla would trade at 24 times this year’s EPS estimates and just 18 times next year’s consensus analysts’ figures. Ok, so the stock is not at $100, but the closer it gets, the more interesting it becomes. At $134, Tesla is trading at about 22 times forward EPS estimates. This valuation is inexpensive for a dominant, rapidly expanding, market-leading company like Tesla. Therefore, the lower it goes, the better, because it will provide an excellent long-term buying opportunity. The stock is a buy in the $120-$140 range here. Below $120, Tesla becomes a strong buy, and it’s a gift if it ever comes down to $100.

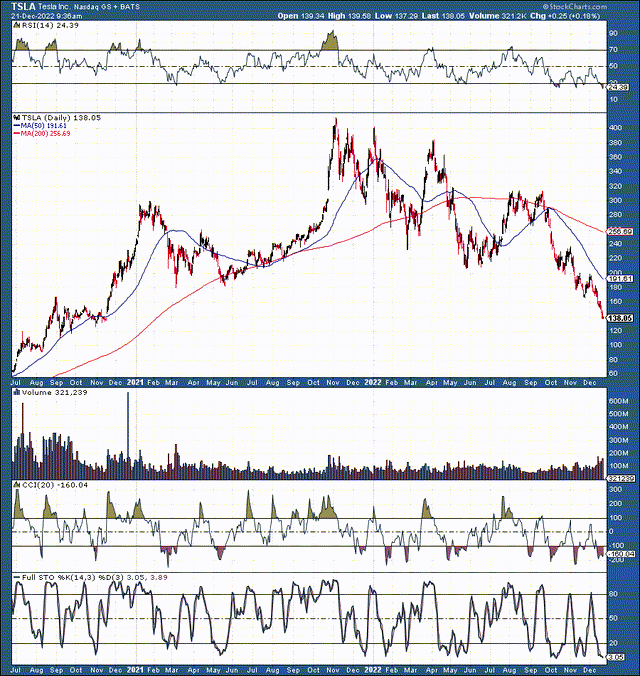

Technically Speaking: Tesla – 30-Month Chart

TSLA (StockCharts.com)

Tesla’s given up significant gains over the last year. The stock is down by nearly 70% in this bear market, and it may even worsen. However, was this spectacular decline a big surprise to people? All the tech giants went through significant downturns, and Tesla’s stock is still dealing with the heat. Nevertheless, the RSI is below 25 here, illustrating that the stock is significantly oversold. The full stochastic is only 3.05, implying a possible short-term shift to more positive momentum. The problem with Tesla’s stock is that it is still in a downtrend. Therefore, a near-term bounce may be temporary, and the stock could ultimately bottom lower, around the $110-$120 range.

The Upcoming Deliveries Report

Tesla should announce its Q4 deliveries soon, and the market expects 450-465K vehicle deliveries for the fourth quarter. However, Tesla could surprise higher, delivering 475K or more vehicles in the final quarter of 2022. 475K or more car deliveries should surprise the market, reflecting positively on Tesla’s stock. Despite the transitory global slowdown, demand remains high for Tesla vehicles, and the company plans to unveil its fifth gigafactory in Mexico soon.

Disregard the Twitter Drama

There is a great deal of focus on what is happening at Twitter, which is not helping Tesla’s stock. The “Twitter Drama” continues weighing on the sentiment surrounding Tesla and the company’s stock price. Do investors think Elon Musk will forget about Tesla and focus most of his attention on Twitter instead? I don’t think so. First, Elon Musk is accustomed to optimizing multiple companies simultaneously. Mr. Musk has experience running SpaceX, Tesla, and other corporations. Also, Musk is looking for the right CEO to take over the helm at the struggling social media giant. Nevertheless, the Twitter drama shouldn’t spill over and impact Tesla’s long-term operations.

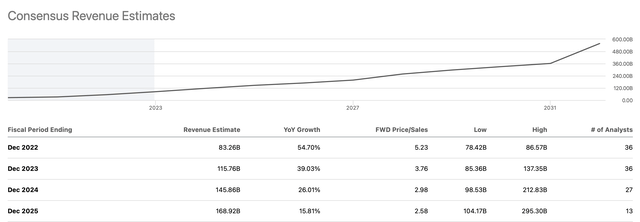

Ramping Up Revenues

Revenue estimates (SeekingAlpha.com)

Tesla’s consensus estimated revenue growth is 55% this year and 39% in 2023. Moreover, the company should experience robust double-digit growth for several years, offering a high probability of surpassing current depressed estimate figures. Therefore, we should see 15-25% revenue growth continuing beyond 2025.

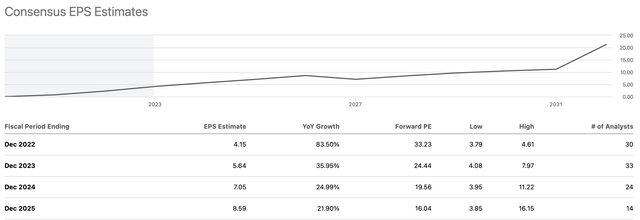

EPS Growth to Expand

EPS estimates (SeekingAlpha.com )

The consensus EPS estimates for 2023 are for $5.64, but the company can earn $6-$7 next year. Therefore, Tesla’s current forward P/E ratio is around 19-22. Moreover, Tesla could make close to its higher-end estimates in 2024 and 2025. Thus, the company’s EPS could run up to approximately $10 and $14 in the coming years. Provided that Tesla earns around $14 in 2025, its current valuation is less than ten times the 2025 EPS potential.

Where Tesla’s Stock Could be in A Few Years

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $85 | $132 | $185 | $250 | $330 | $429 | $550 | $686 |

| Revenue growth | 57% | 55% | 40% | 35% | 32% | 30% | 28% | 25% |

| EPS | $4.50 | $7 | $10 | $14 | $19 | $25 | $32 | $40 |

| EPS growth | 99% | 56% | 43% | 40% | 36% | 32% | 29% | 26% |

| Forward P/E | 19.6 | 22 | 23 | 24 | 25 | 23 | 22 | 20 |

| Price | $137 | $220 | $322 | $456 | $625 | $736 | $880 | $950 |

Source: The Financial Prophet

Tesla Risks

Risks exist for Tesla – The company may miss earnings and revenue estimates. Furthermore, a slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla to move higher. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider these and other risks before committing any capital to a Tesla investment.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long a diversified portfolio with hedges.

Are You Getting The Returns You Want?

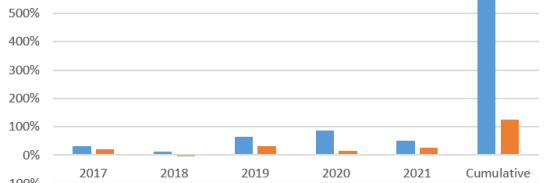

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2021 return 51%), and achieve optimal results in any market.

- Our Daily Prophet Report provides the crucial information you need before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!