Summary:

- Shares of Tesla, Inc. have dropped ~20% after reporting Q2 results, creating a well-timed buying opportunity.

- The market focused on declining vehicle shipments, which may be an indication of pent-up demand as Tesla looks to release its Robotaxi in October and the next-gen Model 3 in 2025.

- Meanwhile, the energy business doubled y/y in Q3 as sales of Powerwall and Megapack took off, and is contributing generously to the company’s gross profit and overall profitability.

- Tesla remains modestly valued at the mid-30s adjusted EBITDA multiple, considering it still represents a very low market share of global vehicle sales.

ollo

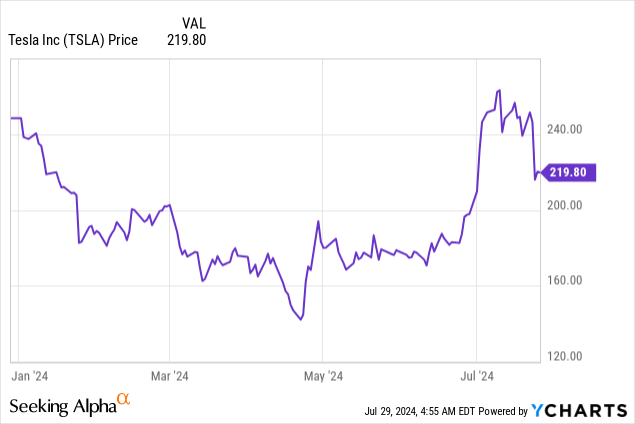

Q2 earnings season is well underway, and Tesla, Inc. (NASDAQ:TSLA) has been one of the biggest disappointments so far. The world’s largest electric vehicle maker remains down double-digits year to date, with shares falling nearly 20% from near-term peaks after posting lackluster Q2 results.

Investors focused on one thing and one thing only: declining vehicle production and deliveries, and weaker automotive revenue. But in my view, investors who have a longer-term perspective on Tesla have the opportunity to buy this dip at an attractive discount.

I last wrote a bullish note on Tesla in June, before the company’s Q2 results and when the stock was trading at ~$175 per share. Despite the weaker production statistics in Q2 and the slightly higher share price since my last note, I am retaining my buy call on this stock. Tesla remains one of my core long-term holdings and a stock that I think still has plenty of runway to go. Investors who are stuck on the company’s latest quarterly results and the volatility of its shipment metrics, in my view, are “missing the point” of this transformational company that is set to not only electrify global driving, but automate it as well.

Decline in vehicle deliveries are less meaningful when Tesla is approaching major product releases

Let’s start with the biggest elephant in the room: declining vehicle shipments, which is the main reason that Tesla slid sharply after reporting Q2 results.

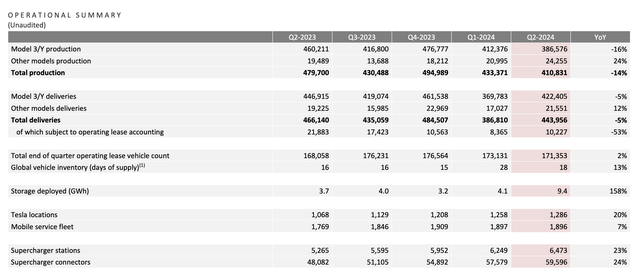

Tesla vehicle metrics (Tesla Q2 earnings deck)

Total production in Q2 declined -14% y/y to 410.8k units, while total deliveries declined -5% y/y to 444.0k units. Model 3/Y deliveries declined -5% y/y, while the other models (S and X) grew 12% y/y.

To me, these volatile intra-quarter shipment figures are not indicative of Tesla’s long-term potential, especially when it’s approaching two major product launches. The company pushed back its Robotaxi product announcement to October 10th of this year (the fully self-driving version of its vehicle, a wholly integrated car whose software represents a vast improvement over current FSD capabilities which are currently available as a software add-on to existing vehicles). At the same time, it also pulled in the announcement of its next-gen mass-market vehicles sometime in the first half of 2025.

The fact that it was Model 3 and Y deliveries that fell y/y is especially telling. Unlike smartphones, Tesla is not on a predictable, every-year product cadence. Thus, it makes plenty of sense that buyers are holding out and waiting for the next model to be released, especially as Elon Musk has strongly hinted that the newer vehicles will be even more affordable than the current generation.

So, in other words, we shouldn’t penalize Tesla too harshly for weaker near-term results that may be building anticipation for the next wave of vehicles.

Gross margin continues to recover

Another major positive point that was largely overlooked in Tesla’s second-quarter earnings in light of the deliveries decline: the company continued to see stabilization in gross margins.

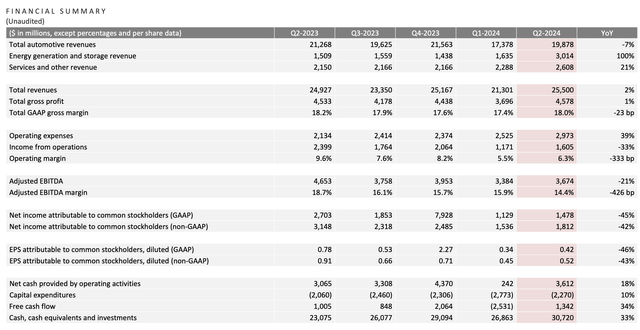

Tesla trended financials (Tesla Q2 earnings deck)

As shown in the chart above, Tesla’s GAAP gross margins slid up to 18.0%, an improvement of 0.6% sequentially (though down -0.2% y/y). It’s the highest GAAP gross margin in four quarters, which is a major relief after so much negative press over Tesla’s ongoing price cuts.

We note as well that operating margins improved 0.8% sequentially versus Q1, even better than the gross margin improvement. In my view, if we’re looking ahead to revenue growth in FY25 powered by new vehicles and pent-up demand, we may have reached Tesla’s trough in profitability.

Energy is driving fantastic growth

For much of Tesla’s history as a public company, investors have largely treated the company’s non-automotive segments as non-core, the same way that investors barely care about Alphabet Inc.’s (GOOG) (GOOGL) “Other Bets.”

But in Q2, Tesla’s energy subsidiary (which consists of its Powerwall at-home energy storage station, and its commercial Megapack) was a much more meaningful contributor. Despite a -5% y/y decline in vehicle shipments and a -7% y/y decline in automotive revenue, Tesla’s total revenue grew 2% y/y to $25.50 billion, beating Wall Street’s expectations of $24.76 (-1% y/y).

The contributor behind the beat was the energy segment, which achieved 100% y/y growth in revenue to $3.0 billion, or 12% of Tesla’s total.

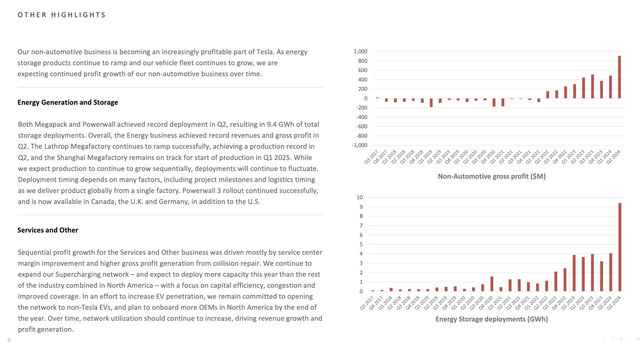

Tesla energy segment highlights (Tesla Q2 earnings deck)

The company notes that Megapack and Powerwall have reached a record 9.4 GWh of deployments. Gross profit from the non-automotive segment also reached nearly $1 billion, as shown in the chart above (versus $4.6 billion in total Tesla gross profit dollars), which is a much more meaningful share than revenue. Moreover, the company notes that Energy still has a strong backlog of open orders. Per CFO Vaibhav Taneja’s remarks on the Q2 earnings call:

We previously talked about the potential of the energy business and now feel excited that the foundation that was made over time is bearing the expected results. Energy storage deployments more than doubled with contributions not just from Megapack but also Powerwall, resulting in record revenues and profit for the energy business.

Energy storage backlog is strong. As discussed before, deployments will fluctuate from period to period with some quarters seeing large increases and others seeing a decline. Recognition of storage gigawatt hours is dependent on a variety of factors, including logistics timing, as we send units from a single factory to markets across the world, customer readiness, and in the case of EPC projects on construction activities. Moving on to the other parts of the business, service and other gross profits also improved sequentially from the improvement in service utilization and growth in our collision repair business.”

Again, I think the massive growth in energy revenue and sharp improvements in profitability were vastly overlooked by investors in light of weaker vehicle shipments – but longer term, this business will continue to drive incredible operating leverage for Tesla.

Risks, valuation, and key takeaways

Of course, Tesla is not without its risks. The global macroeconomy, particularly in markets like Europe and Asia, continues to send weak signals that are delaying many big-ticket purchases like cars; and moreover, Tesla’s rivals continue to multiply overseas.

At the same time, however, it’s difficult to argue against Tesla, which is the leader in the EV pack with the greatest installed market share and still tremendous greenfield market opportunity to convert gas vehicle drivers into Tesla owners.

From a valuation perspective: at current share prices near $220, Tesla trades at a market cap of $688.74 billion. After we net off the $30.72 billion of cash and $7.75 billion of debt on Tesla’s most recent balance sheet, its resulting enterprise value is $665.77 billion.

Tesla’s TTM adjusted EBITDA margin has clocked in at 15.5%. If we conservatively assume no margin leverage going forward on FY25 consensus revenue expectations of $116.1 billion (+17% y/y), FY25 adjusted EBITDA would be $18.00 billion – putting Tesla’s valuation at 37.0x EV/FY25 adjusted EBITDA.

This is certainly no value stock. But, for a company that is set to release major market-leading products this year and next, and when electric vehicles are still less than 20% of the global vehicle market, I’d still say Tesla is at a very reasonable entry point.

Stay long here and use the dip as a buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.