Summary:

- It is common knowledge that Charles Munger, vice chairman of Berkshire Hathaway, has concerns about Tesla, Inc.

- As a bull on Tesla, I will analyze two of his points to argue against my own thesis.

- The first point concerns the profit margin, especially when compared to BYD Company Limited.

- And the second involves Tesla CEO Elon Musk’s execution ability, again especially when compared to BYD CEO Chuanfu Wang.

- After all, Munger also advised us not to comment on a topic until we can argue against ourselves better than others.

winhorse/iStock Unreleased via Getty Images

Thesis

Readers familiar with my writings probably already figured out the following two things about me. First, I have been a long-term bull on Tesla, Inc. (NASDAQ:TSLA). I have authored a series of articles arguing for its long-term potential, not as a car manufacturer, but as a platform. And second, I am very fond of Berkshire Hathaway Inc. (BRK.A) vice chairman Charles Munger both as a person and as an investor. When he speaks, I listen attentively both for life wisdom and investment insights. And a heads-up: you will see me quoting Munger a few times in the remainder of this article. Probably not the best article for you if you hate the man and/or what he says.

And it just so happens that Charles Munger has made some pretty strong comments regarding Tesla. So, following his tip on fighting ignorance, the thesis of this article is to address two of his points and argue against my own thesis. The purpose is to look for disconfirming evidence for my thesis rather than confirmatory evidence (which is human nature) so that I am more conscious of the risks. And here comes the first Munger quote on fighting ignorance:

Charlie Munger: At times in my life, I have put myself to a standard that I think has helped me: I think I’m not really equipped to comment on this subject until I can state the arguments against my conclusion better than the people on the other side. If you do that all the time; if you’re looking for disconfirming evidence and putting yourself on a grill, that’s a good way to help remove ignorance.

In the remainder of this article, I will concentrate on the following two points: one regarding the profit of Tesla compared to BYD Company Limited (OTCPK:BYDDF), and the other regarding Elon Musk compared to BYD CEO Chuanfu Wang. He’s made many other comments on Tesla, which are also valid. But I think these two are the most relevant ones. And also, it helps to limit the length of this article by focusing on them only.

TSLA’s profit vs BYD’s. Munger lauded (see this BusinessInsider report) BYD for growing rapidly in its home market and leaving Musk in the dust. “BYD is so much ahead of Tesla in China it’s almost ridiculous,” The billionaire investor pointed out that Tesla cut its car prices in China last year, while BYD was able to raise prices.

Elon Musk vs. Chuanfu Wang: Munger had mixed comments about Musk. And the latest comments made during Daily Journal‘s annual meeting probably summarized his overall thoughts. He said that “My policy on Elon Musk is that he’s a very talented man but also peculiar, so I don’t buy him and I don’t sell him short.” On the other hand, his comments on Wang are one-sided. He praised the man as “a combination of Thomas Edison and Jack Welch – something like Edison in solving technical problems, and something like Welch in getting done what he needs to do. I have never seen anything like it.”

And next, I will elaborate on my thoughts regarding both points. And per my usual style, I will use objective data whenever possible in my analysis.

Profit: Hardware vs. Software

As Munger commented, it is certainly true that BYD had raised its car prices when TSLA had to cut its prices. However, what has happened in the past two or three years is really not representative given the pandemic, China’s lockdowns, and also the dramatic changes in raw material prices. Furthermore, Tesla has also demonstrated its ability to successfully raise prices without hurting sales.

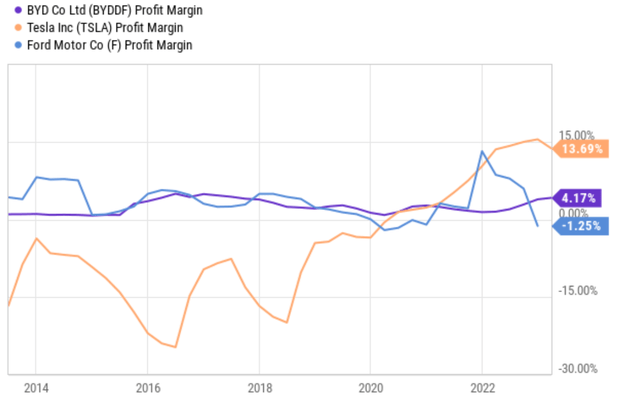

Overall, Tesla’s profit margin was higher than that of BYD (or other EV makers) as seen from the chart below since 2020. To wit, BYD has been maintaining an average margin of 3% ~ 4%. It is a remarkable margin compared to traditional car makers like Ford Motor Company (F). And the fact that BYD was able to maintain it consistently in a highly competitive and cyclical sector shows its strength. However, since 2020 after Tesla has become profitable, TSLA’s margin is significantly higher than BYD.

Another factor that Munger may have ignored is that the business model for electric vehicles (“EVs”) may be very different from traditional cars. As detailed in my earlier article comparing TSLA to YouTube, traditional cars have always been a hardware business. However, the future EV industry could be a platform business, more like the operation software for the PC industry. Musk’s recent comments echoed, and probably also exaggerated this point. He said on a conference call that:

Tesla has the wherewithal to sell cars at zero profit and then earn immense sums later off driverless software. And that “We’re the only ones making cars that technically we could sell for zero profit for now, and then yield actually tremendous economics in the future through autonomy.”

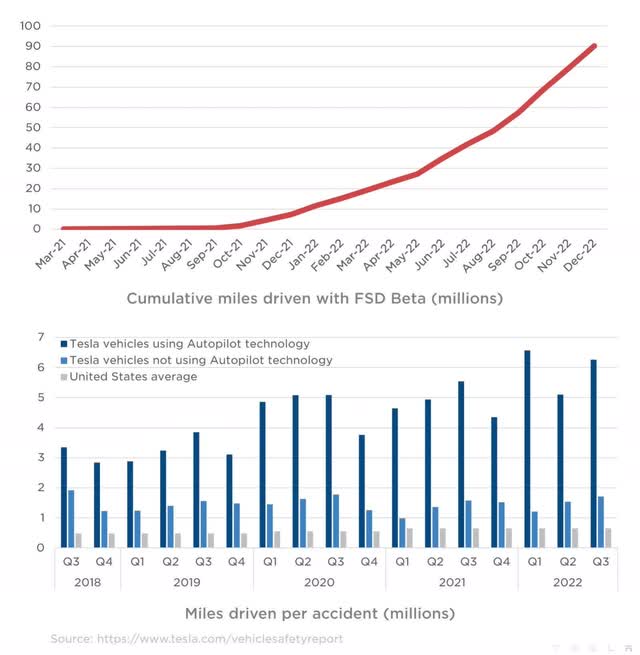

I think it’s too early for TSLA to sell EVs at zero profit. It is well-known that Musk has his own timescale. But I think he is seeing the eventual direction correctly and Tesla is well-poised to capitalize on this potential. As an example, with the rapid maturation and expansion of its autonomous driving technology such as its Full Self-Driving (“FSD”) platform (see the chart below), TSLA does have tremendous potential to profit in many related areas. Possibilities are truly limitless. A few immediate ideas include the autonomy software itself, its applications in other autonomous and robotics applications, auto insurance, and also auto-maintenance and after-sell services.

Chuanfu Wang vs. Elon Musk

First, I totally agree with Munger’s comments on both men. I admire Wang as much as Munger. And Munger’s comment that Wang is a combination of Edison and Welch is more insightful than any other comments I’ve heard about Wang. And I also agree that Musk is more peculiar and colorful than Wang, and many of the things that he did/said are simply unlikeable.

Therefore, the focus here is not on their personalities or vision. Discussions along these lines eventually boil down to objective judgment. Here I will focus more on execution ability, which could be better anchored by data.

It is well known that Elon Musk’s compensation at Tesla is evaluated based on a performance-based compensation plan that was approved by Tesla’s shareholders. The compensation plan is designed to incentivize Musk to achieve specific and measurable milestones that are critical to Tesla’s success. And Musk has successfully achieved 11 out of the 12 tranches, a good testimony of his executive ability.

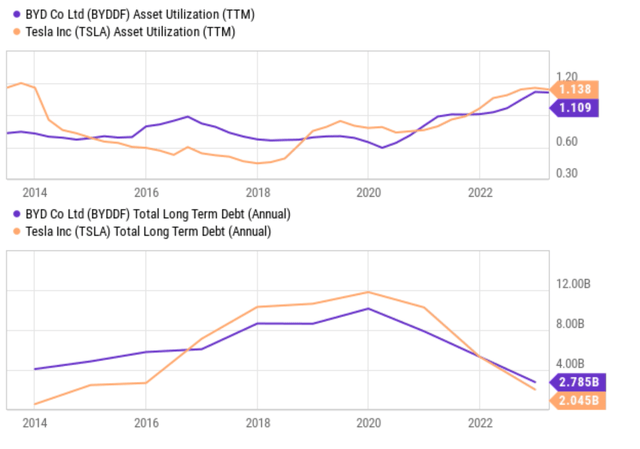

And if you look a bit closer, you will see that Wang and Musk are remarkably similar in their execution and capital allocation. CEO has a couple of knobs to adjust to run their business and two of the key knobs are asset turnover ratio (“ATR”) and leverage. And the next two charts show how these two CEOs are turning these knobs over the years.

The trends are just remarkably similar – both quantitatively and qualitatively. To wit, both BYD and TSLA have been consistently improving their ATR over the years. Their ATR both hovered around 0.6x a few years ago. And both have steadily improved to ~1.1x now, an improvement of around twofold. To better contextualize things, the ATRs for traditional automakers such as Ford and General Motors (GM) are on average ~0.5x.

And both CEOs are masters of capital allocation as seen in the second chart. Both BYD and TSLA have dramatically reduced their leverage from the peak level in 2020 (right before the rate hikes began). Among the knobs that CEOs can turn, leverage is a double-edged sword. And I’m always suspicious when a company’s profitability goes up because of the use of more leverage. But clearly, it is not the case here for either one of them. Both CEOs were able to improve profitability (as shown in earlier charts) while reducing leverage significantly.

Risks and final thoughts

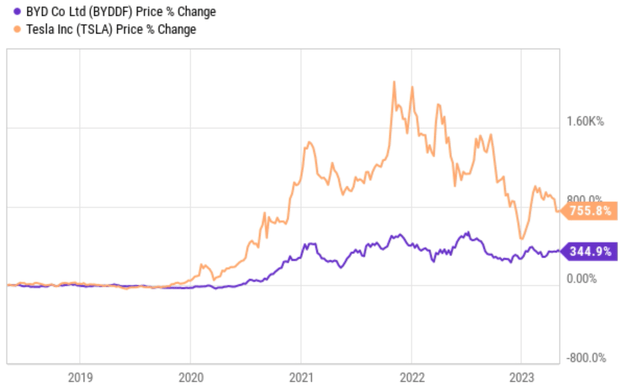

To conclude, Charlie Munger has made some very good points about Tesla. And he has good reasons to like BYD better. Overall, both stocks have rewarded investors spectacularly over the years, as seen from the chart below. TSLA’s price has appreciated by 755% in the past 5 years, and BYD’s price by 344%. Munger and Berkshire entry points into BYD are even earlier and better. The conglomerate invested $232 million into BYD in 2008, and the market value of the investment soared by more than 30 times in 15 years. In Munger’s words, “That’s a pretty good rate of return.”

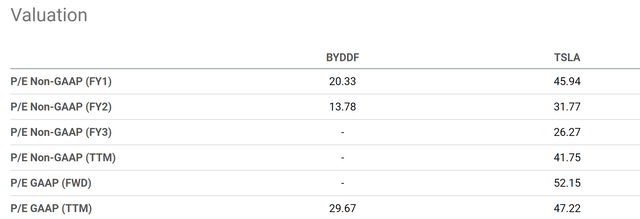

To reiterate, the goal here is not to dismiss Munger’s concerns or to prove him wrong. His comments are valid. The goal is to provide a full view so both bears and bulls are aware of both the upside and downside risks. The downside risks Munger pointed out are 100% valid. TSLA certainly faces fierce competition risks, especially in China. And Musk himself is an uncertainty. In the meantime, due to TSLA’s larger price rally in recent years, the stock is trading at a substantial premium relative to BYD and other EV stocks (see the second chart below).

However, I won’t recommend investors to be bearish purely on the basis of the valuation metrics for growth stocks. Especially nonlinear growth stocks like TSLA that have the potential to enjoy the platform benefits.

Source: Seeking Alpha data Source: Seeking Alpha data

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.