Summary:

- Tesla, Inc.’s full self-driving, or FSD, technology could secure regulatory approval and be implemented in China soon, giving the company a competitive advantage in the Chinese EV market.

- China is the largest EV market globally, making it crucial for Tesla to launch FSD services in the country.

- Tesla’s FSD technology could potentially be licensed to local automotive manufacturers, further solidifying its position in the autonomous driving market.

Monty Rakusen/DigitalVision via Getty Images

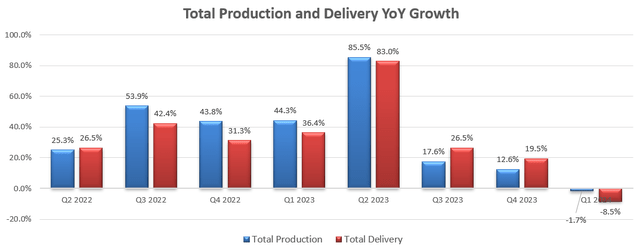

I presented my bullish view on Tesla, Inc. (NASDAQ:TSLA) in my previous article published in July 2023. The company released their Q1 earnings on April 23rd, with a 1.7% decline in total production and 8.5% drop in total deliveries for the quarter. I am encouraged by Tesla’s AI-based full self-driving, or FSD, technology, and I think their FSD technology could secure regulatory approval and be implemented in China soon. I, therefore, upgrade Tesla stock to “Strong Buy” with a one-year target price of $243 per share.

Why China FSD is so Important for Tesla

As reported by the media, Tesla CEO Elon Musk met with China’s No 2 official in Beijing on April 28th to discuss the potential rollout of FSD driver-assistance system in China. It is likely for Tesla to secure the regulatory approval for overseas transfers of Tesla’s data in China. To comply with local data security requirements, Tesla established their local data center in Shanghai in 2021.

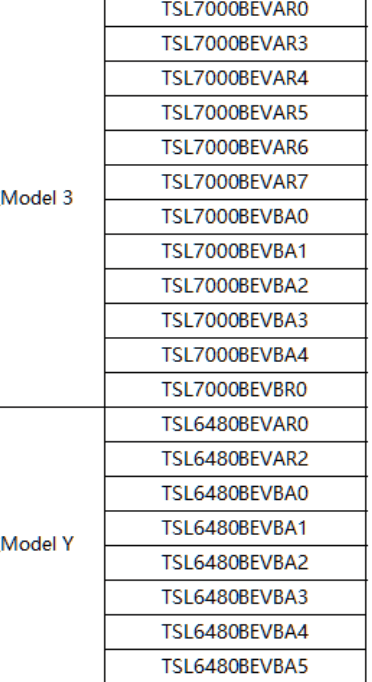

On April 28th, China Association of Automotive Manufacturers (CAAM) announced that Tesla’s Model 3 and Model Y have passed the local security requirements concerning privacy and data collections. (note: CAAM only provides information in Chinese, please use 3rd party translation services to access data).

CAAM Report

Why is it important for Tesla to launch FSD services in China? I think there are several long-term benefits for Tesla:

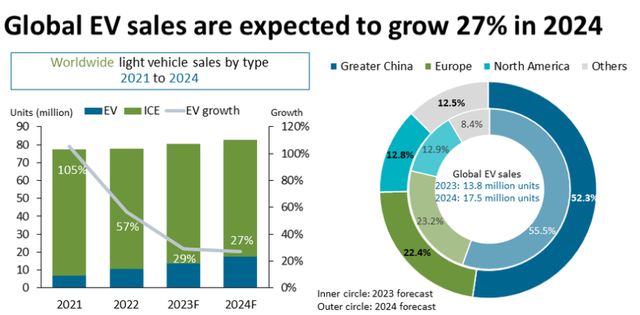

Firstly, China is a significant market for EVs. According to IEA, EV sales in 2023 were 3.5 million higher than in 2022, a 35% YoY increase, and nearly 60% of new EV registrations occurred in China, surpassing Europe’s 25% share and the U.S.’s 10% share. Evidently, China has become the largest EV market globally.

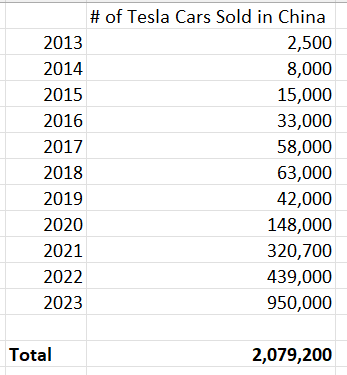

Tesla has been investing in China for many years. According to the China Passenger Car Association’s (CPCA) data, Tesla has experienced strong growth in China, with total car sales surpassing 2 million units as of December 2023. Please note that CPCA only provides information in Chinese, and investors need to use third-party translation services to access information.

CPCA

On March 29, 2024, Tesla announced that they had produced a total number of 6 million cars. As such, on an accumulated basis, China represents around more than 1/3 of Tesla’s global deliveries.

Chinese consumers are embracing new technologies, such as e-commerce, social network and digital payments. Therefore, for EV manufacturers, autonomous driving technology is key to success. Without FSD in China, Tesla would face notable disadvantages compared to local players. The local players, including BYD Company (OTCPK:BYDDF), XPeng (XPEV), Li Auto (LI), Baidu (BIDU) and Huawei, are all heavily investing in their in-house autonomous driving technologies.

Secondly, as communicated over the earnings call, Tesla has accumulated over 300 million miles driven by FSD V12. For FSD AI training, real-life driving miles are crucial for data inputs. As pointed out in my previous coverages, I think only Tesla has the capability to perform extensive AI training for autonomous driving. Currently, 35,000 Nvidia (NVDA) H100 GPUs have been utilized for AI training at Tesla, and they expect the number of GPUs to reach 85,000 by FY24. If Tesla secures the regulatory approval for local FSD in China, Tesla is going to have explosive driving data for AI training. As pointed out earlier, Tesla has more than 2 million cars driving in China. It could potentially propel Tesla’s FSD to be even more advanced than current standards.

Lastly, with the regulatory approval in China, Tesla could potentially license their FSD technology to local automotive manufacturers. In my view, Tesla possesses the best technology for autonomous driving, making it less logical for every automaker to independently develop their own autonomous driving technology.

Q1 Result and FY24 Outlook

Due to the weak market conditions, Tesla experienced sluggish growth in both total production and delivery figures, declining by 1.7% and 8.5%, respectively.

As communicated over the earnings, several automakers have delayed their EV strategy, and shift resources to hybrid and other alternatives. I remain confident that EVs are the right long-term strategy. The current hurdles for EV adoptions include:

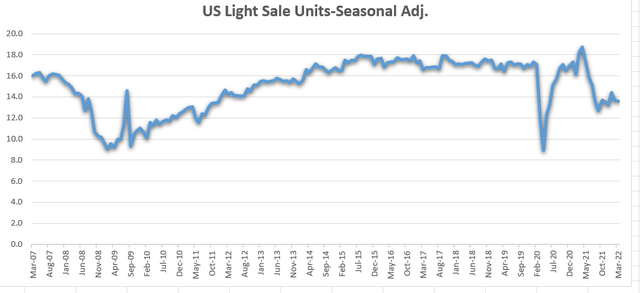

- -High Interest Rates: The current macro environment is detrimental to sales of large-ticket and discretionary product sales, including light vehicles. As depicted in the chart below, U.S. light vehicle sales have been quite weak in the post-pandemic periods.

- -Shift from Early Adopters to Mass Market: similar to other innovations, innovators and early adopters have been the primary customers for EVs. After several years of adoptions, the market currently needs to penetrate the mass market. For mass market customers, there are several hurdles that need to be overcome, including charging stations, maintenance costs, driving range, and price.

Addressing these challenges, the national grids need to be upgraded to satisfy the demands for large-scale EV charge stations, and more EV charge stations must be built to facilitate mass adoption. While it will take several years to overcome these challenges, I view EVs as the most sustainable solution for vehicles in the future.

For FY24 outlook, I am considering the following factors:

- – Canalys research predicts that global EV market will grow by 27.1% in 2024, reaching 17.5 million units. I think the forecast published in January 2024 was quite optimistic with an assumption that the interest rate will be cut several times in 2024. Assuming the Fed will not lower the interest rate anytime soon, the EV market growth could be challenging in 2024.

- -Price Cut: As reported by the media, Tesla has cut $2,000 off the prices of three of their 5 models in the U.S. in April 2024. Previously, Tesla has already reduced their price in China. Several reasons contribute to the price cut. The easing situations of global supply chain and chip shortages have allowed Tesla to reduce their input costs, enabling the company to cut prices to stimulate demands. In addition, the price cut would benefit for the mass adoption of EVs. The market expects Tesla to launch a small EV priced around $25,000 to make EVs more affordable to most families. Having said that, the price cut would affect Tesla’s sales growth in FY24.

In short, I expect Tesla will deliver 23% volume growth and -3% growth in price in the near future.

Valuation Update

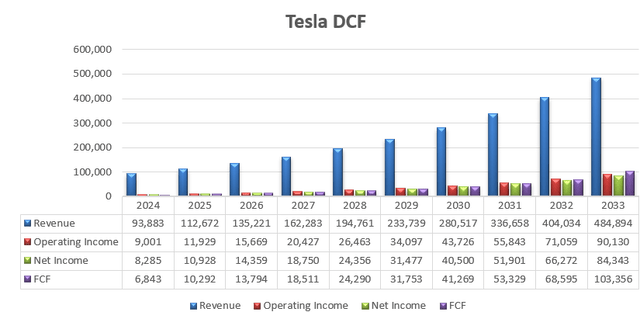

As discussed, I forecast Tesla will achieve 20% revenue growth in the near future, reflecting the ongoing penetration growth of EV market, current challenging macro environment, and downward pressure from ASP.

For the margins, I am considering the followings:

- -Tesla announced it would cut 10% of staff globally, about 14,000 jobs. As indicated over the earnings call, Tesla is expected to generate >$1 billion annual savings, including the layoffs and other cost optimizations. Based on my calculations, the cost savings could lift their margin by around 100bps.

- -As pointed out in my previous coverages, FSD is mission-critical for Tesla, and investors should not merely view Tesla as an automaker. Their AI-based FSD technology has the potential to be a game changer in the future, and I don’t think there are any other automakers that possess the capabilities in autonomous driving technology. For AI-based technology, data inputs are the key for the LLMs. FSD is a subscription service, and as the technology advances, it could bring in notable recurring revenue for Tesla with higher margin.

- -Tesla continues to refine their unboxed manufacturing process, aiming to reduce manufacturing costs and accelerate the manufacturing process.

Putting it all together, I forecast Tesla will deliver 120bps margin expansion from operating leverage from gross profits, offset by 20bps headwinds due to price cuts. The revenue, operating profits, net income, and FCF forecast can be found below:

Tesla DCF – Author’s Calculations

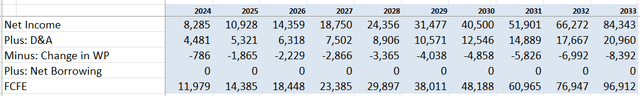

I calculate their FCFE by adjusting net income with depreciation/amortization, net change in working capital, and net borrowings.

Tesla DCF – Author’s Calculations

The cost of equity is calculated to be 17.4% assuming: risk-free rate 4.22% (US 10Y Treasury Yield); beta 1.89 (SA); equity market risk premium 7%.

After discounting all the future FCFE, the one-year price target is calculated to be $243 per share.

Key Risks

- -Cybertruck Recall: Recently, Tesla recalled their 4,000 of their 2024 Cybertruck vehicles to replace the accelerator pedal assembly. The product recall would incur one-time costs for Tesla in FY24. While automobile recalls are quite common in the industry, investors should closely monitor quality issues for Tesla.

- -As indicated in the DCF section, Tesla is a highly volatile stock with a beta of 1.89. For any investors seeking stable growth, Tesla is not suitable for them. In addition, if investors lack confidence in Tesla’s FSD technology, they should avoid investing in Tesla.

- -China Competition: There are at least 10 local EV makers in China currently, with several other companies attempting to enter the market. While Tesla leads the EV technology, it is important not to underestimate the growth and technology advancements of these Chinese players.

Conclusions

I view the potential regulatory approval for FSD in China as a near-term catalyst for Tesla’s stock price. Over the long term, the growth in China FSD could potentially enhance Tesla’s AI-based FSD technology, giving it a tremendous competitive advantage over other EV makers. Consequently, I have upgraded Tesla, Inc. stock to “Strong Buy” with a one-year target price of $243 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.