Summary:

- Tesla, Inc. Q3 results were disappointing, with lower-than-expected EPS and negative trends in revenue growth and margins.

- As revenue growth and margins were the biggest drivers of their premium valuation, the multiples we are seeing now are not justified.

- This makes me believe that Tesla stock is overvalued here and my analysis leads me to a sell rating.

jetcityimage

Tesla, Inc. (NASDAQ:TSLA) is one of those stocks that people tend to feel pretty strongly about. Some focus more on the future and the huge potential in autonomous driving and other technologies that Tesla is working on, and some others focus more on the status quo and follow sound investment principles, that caution against buying high P/E companies in unproven industries.

I’ve covered the stock once before, here, and issued a SELL rating because of overvaluation. I simply couldn’t justify paying 76x earnings in a high-interest rate environment with 5% long-term yields. Today I want to take another look at the stock, after another earnings report has been released, and try to provide you with an objective look at where things are today and where they might be headed in the future.

Q3 Results

Tesla third quarter results were in many ways disappointing. Reported EPS came in at $0.66 which was quite a bit below expectations of $0.73. More importantly, the results revealed negative trends in growth and margins. As a result, Tesla’s valuation has gotten a bit cheaper at 60x earnings, but future prospects have also come into question.

So let’s dissect this one metric at a time.

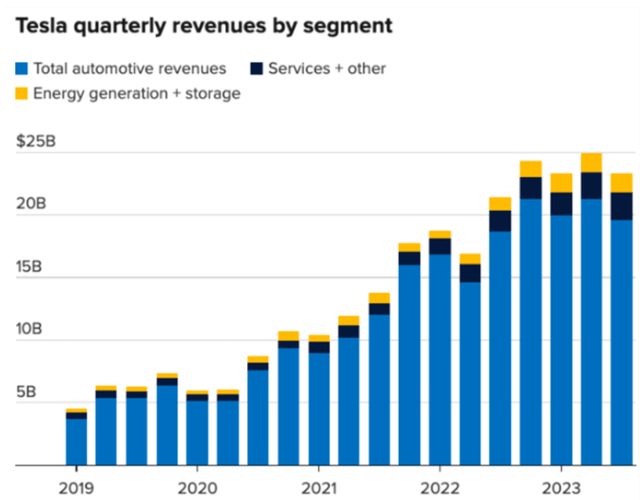

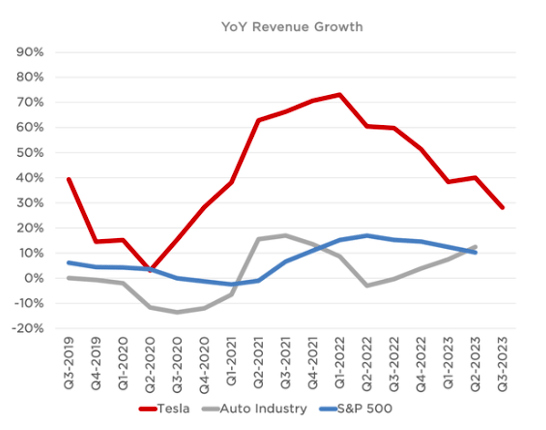

First and foremost, Tesla has been miles ahead of the competition in terms of their ability to grow revenues. This was, in my mind, the single biggest argument why the stock deserved to trade at a premium to peers. During 2020-2022, Tesla averaged 40-50% annual revenue growth, while the auto industry as a whole saw growth of just 10% on average. Unfortunately for Tesla, as evident from the chart below, growth has slowed materially since the peak in Q1 2021. To make matters worse, Q3 revenue has actually grown by only 9% YoY – below the average of the auto industry.

What this means is that Tesla has lost, at least temporarily, one of the biggest drivers of its premium valuation.

TSLA

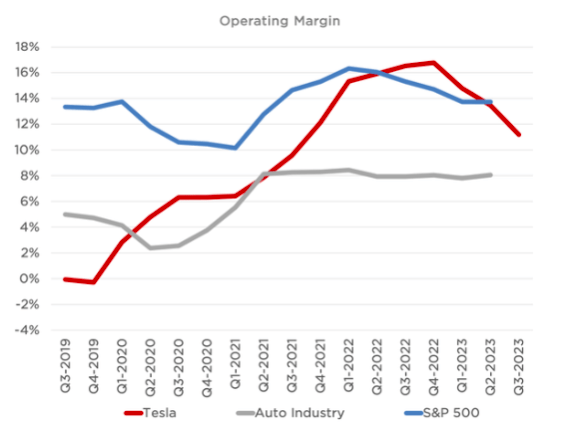

Beyond revenue growth, Tesla has also dominated competition in their margins, being essentially the only electric vehicle (“EV”) maker that could make cars and make a profit. For years, Tesla has averaged a gross and operating margin of 25% and 15%, respectively, while the Auto industry overall was some 50% lower. But similarly, to growth, margins seem to be coming down to a point where during the third quarter the operating margin decreased as low as 7.6%, which is in line with the Auto industry.

TSLA

The bulls argue that Tesla is not a car company, but here’s the problem I have with that. The company generates 90% of its revenues from car sales, so that kind of makes it a car company, doesn’t it? At least for now. In the future, as other business lines grow, the proportion of car sales will decrease, of course. It’s quite normal that as tech companies mature, their hardware revenue stagnates and further growth is derived primarily from services growth. A great example of this is Apple (AAPL). This is where full self-driving (“FSD”) could come in and add meaningful incremental profit for Tesla.

But my expectation is that it won’t push overall earnings growth higher, just replace the portion that Tesla now derives from cars with the “services” component. As a result, I see a longer earnings growth runway, but not necessarily higher annual growth potential. But for now, we have to compare Tesla to other automakers, even if we assume a Tesla-specific premium because the day when service revenue becomes meaningful to Tesla’s bottom line remains years away.

Objectively, the two key reasons why Tesla deserved some sort of premium – higher revenue growth and higher margins, have both disappeared in Q3.

Moreover, margins might actually take a further hit in Q4 for two reasons. First, as the company tries to catch up to its delivery target of 1.8 million vehicles, it may need to decrease prices beyond the already announced price cuts earlier this year. Second, the recent start of deliveries of the Cybertruck, which began just a few days ago, won’t help either, at least not in the short term.

CEO Elon Musk has noted, in relation to the release of the Cybertruck, that the production ramp-up will need at least 12-18 months and lots of capital before becoming profitable. So really, the only edge that Tesla has on the rest of the Auto industry is a promising future for its many business lines beyond car production. But with 90% of revenues from car sales today, the question is how much of a premium is that worth? 10%, 20%, a 100%?

Valuation

Traditional automakers such as Ford (F) or Toyota (OTCPK:TOYOF) trade at P/Es of 7-10x. Tesla currently trades at 5-6x that, which seems like a stretch given what we’ve seen. Of course, it is possible for a stock to deliver upside even from a P/E of 60x, but some serious EPR growth is needed.

In the case of TSLA, the consensus is currently for 25-35% EPS growth over the next two years.

I find that level of growth very hard to achieve given what we’ve seen in Q3, but let’s give Tesla the benefit of the doubt here. Extrapolating 30% EPS growth until 2027, and assuming a 30x exit multiple which would put TSLA along the best of the best tech firms such as Microsoft (MSFT), the total annual expected return from today’s levels is about 8%, roughly in line with general market expectations.

So, we can get a market-level return from Tesla in our base case. For anything above that, we would need EPS growth of >30%, which is extremely ambitious, especially in the medium term with a weakening consumer and a potential recession in 2024. The bear case is that Tesla fails to grow, as it did during Q3, and the stock re-rates lower. In this case, I wouldn’t be surprised to see the stock slip to $100 per share.

All things considered, I don’t find the risk-reward particularly appealing, but can see someone wanting to buy if he is a true believer in substantial growth of business lines beyond car production. Even in that case, however, I would wait for Q4 earnings in January, which I don’t expect to be very good.

To be clear, I am not recommending shorting Tesla with the risk I am about to mention, but rather staying on the sideline. So the risk here is really an opportunity cost of a missed opportunity in the case that a recession does not happen, which will mean that consumers won’t weaken and sales will rebound. Then, Tesla will be able to increase their unit prices to previous levels, which would drive margin expansion.

Conclusion

I rate TSLA a SELL here because the two main metrics that could (somewhat) justify a 5-6x premium to traditional automakers – higher revenue growth and higher margins – have both deteriorated significantly lately. This has put Tesla’s financial metrics pretty close to that of its legacy peers. Moreover, the recently announced release of the Cybertruck is unlikely to help profitability in the short term (quite the opposite). As it stands, the only justification for a premium at this time is future potential business lines beyond car production, such as FSD. I believe that Tesla will eventually be able to replace growth in its car production with service-related revenues, similar to what Apple did. But this is likely many years in the future and, therefore, beyond the scope of valuation today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.