Summary:

- Tesla, Inc.’s business model marks it as a highly sustainable technology conglomerate, yet its lucrative and multifaceted business operations are not being properly valued by the stock market.

- Using reasonable estimates of Tesla’s likely revenue and profit from sales of products and services in various markets, I calculate that Tesla’s 2030 EPS will be ~$409 per share.

- Due to the market’s severe undervaluation of Tesla’s stock relative to 2030 estimates, I strongly recommend that all long-term investors buy and hold Tesla’s stock through 2030 and beyond.

Justin Sullivan

Introduction

Tesla, Inc. (NASDAQ:TSLA) is, in some ways, a difficult company to describe. It makes cars, and most of its revenue comes from vehicle sales, so it would be easy to simply call it a car company. Yet for a car company, it is involved in many other areas that other car companies do not, and probably should not, go into. Solar panels, solar roofs, home and grid-scale battery storage, battery recycling, electric vehicle (“EV”) charging station deployment, autonomous transportation software development, robotics, and the development of Artificial General Intelligence (“AGI”) are just some of the many side hustles, so to speak, that Tesla is engaged in alongside its core EV production business.

Due to the many current and prospective business lines of Tesla, some have taken to describing it as being not a simple carmaker, but as, in the words of an analyst at Oppenheimer, a technology conglomerate that is just well-known for selling cars. I am inclined to agree, and I believe that along with its car business, Tesla’s many ancillary activities, once mature, will make it a titan in the business community the likes of which we may never have seen before.

Taking the long view, I will describe Tesla’s current and future divisions and product offerings, and how the element of sustainability, for itself and for the world, is baked into its businesses. I will also calculate the potential upside for some of the company’s divisions where Tesla is likely to introduce a product or service that may see significant projected demand. My general guide for analyzing the opportunities here will be a Seeking Alpha blog post about how to analyze growth companies, as well as my gut checks on my and others’ financial projections of Tesla’s business lines and products.

Throughout this article, I will explain why I think Tesla’s record of execution on its long term goals, coupled with its most recently stated long term goals to date, demonstrate that the company’s stock is vastly discounted against the company’s likely future performance.

A Note On Tesla’s Foresight and Execution

Tesla’s EV manufacturing prowess and foresight cannot be understated, and Tesla’s foresight in particular, as well as its successful execution of the vision of its leader, CEO Elon Musk, will lay the foundation for much of what I believe the company is capable of achieving over this decade and beyond.

On Tesla’s foresight, I will give two examples. The first is Musk’s prediction of Tesla’s future capacity. In 2014, Musk predicted that Tesla would produce 500 thousand vehicles in 2020, despite also thinking Tesla had a 10% chance of surviving as a new car company in its early days. But lo and behold, Tesla made almost exactly 500k vehicles in 2020, and survived its high cash burn period of mass production that Musk described as “production hell.”

The second example of Tesla’s foresight is that in order for Tesla to be able to exponentially increase its production and minimize supply chain issues, it would need to buy large amounts of materials, specifically battery materials, in advance. Doing this requires huge amounts of faith in the company’s ability to sell every car produced in the future at an accelerating rate, as well as the ability to project future supply needs of a business product with exponentially-growing demand. Tesla understood this, and made long term contracts with battery material suppliers and battery cell suppliers to guarantee battery supply for its massive number of future vehicles, years before most of the investing world cared about lithium ion EV batteries, let alone the supply chain for them. The result was a smooth battery supply that enabled Tesla to focus on growing its operations throughout the 2010s, which was a resounding success.

These examples highlight that while Tesla and Musk may make impossible-sounding declarations about goals the company may have, these goals should not be dismissed despite how mad they may seem at face value. Tesla has a track record of taking big swings to achieve big goals, even when many assume these goals are out-of-reach for the company. In other words, I think that the mind-boggling numbers and performance achieved in the past somewhat validate the mind-boggling numbers and performance claimed in the future by Tesla, Musk, and many bullish analysts examining the company.

Tesla’s Financials

Before I dive into the many projects and businesses at Tesla, I will first touch on its past and its finances, and my thoughts on TSLA’s valuation after the stock’s sharp rebound in 2023.

Tesla’s Dark Beginnings – The Headlines

The story of Tesla’s financial past, and its past as a startup in general, is quite intriguing. Among the anecdotes are Elon Musk’s last minute filing of paperwork for a critical funding round for Tesla in 2008, without which the company would have gone bankrupt; Tesla’s bumpy production and rollout of its original Roadster; Tesla’s Autopilot program being implicated in a man’s gruesome death in the early days of the company’s self-driving software journey; Tesla’s over-automation disaster, when Musk tried to replace many workers with robots to increase productivity during the Model 3 ramp, only for the effort to backfire; and, many more.

Of course, in the background of it all was Tesla’s constant parade of naysayers who said its electric vehicles would never take off, that Tesla would soon be just another bankrupt car company, that it was dependent on selling zero-emission-vehicle tax credits to survive and might never produce organic profit, that it used accounting tricks to appear more financially sound that it was, and other criticisms.

As interesting as a deeper dive into the company’s history would be, this article’s focus is on its future, which is a long enough read on its own. But I wanted to highlight here that Tesla as a company has faced quite a bit of negative publicity and difficult circumstances in its past, a fact that should be noted in any comprehensive review of the company since it was an ever-present part of the company’s early days, and likely still affects the company to this day.

Tesla’s Dark Beginnings – The Financial Struggle

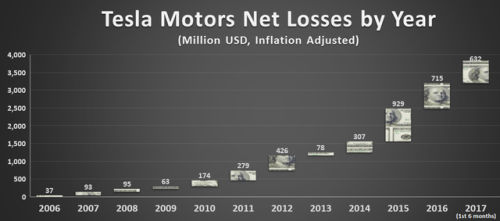

Tesla’s financial history can be summed up in three charts. The first would be a chart of Tesla’s accumulation of losses, from its early days until just a few years ago in 2017:

Tesla’s History of Losses (Tumblr)

With losses increasing and accelerating, “bankruptcy” was probably on the lips of many inside the company for a time.

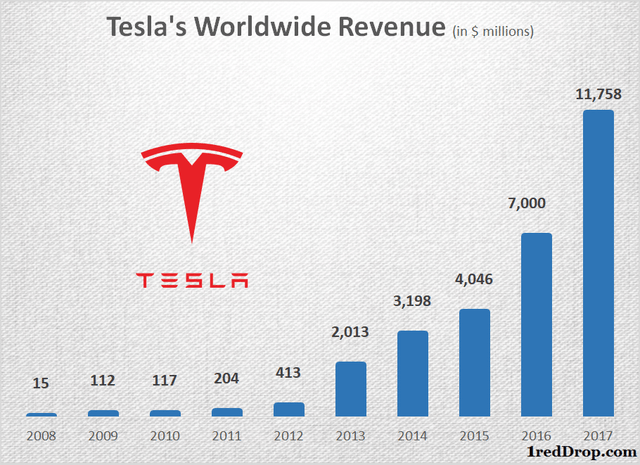

But all was not lost. The second chart is one of Tesla’s revenue, again from the company’s early days to 2017:

Tesla’s Historical Revenue Growth (1reddrop.com)

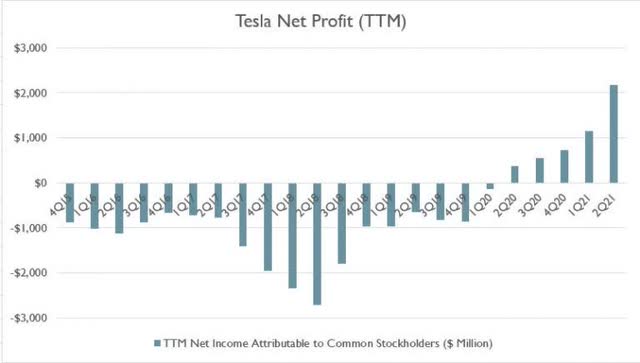

So far, the story was that the losses were piling up, even though the revenue was climbing too. The question, then, was whether Tesla would be able to eventually convert that revenue to profit, instead of losing it to debt. It was a close call, but in the early 2020s, as seen in this chart of Tesla’s net income, we finally got our answer:

Tesla’s Historical Net Income (stockdividendscreener.com)

After its dark beginnings, Tesla finally posted a profit in 2020, and began to consistently earn profits every quarter afterward, with the chart above showing an exponential rise in net income from early 2020 to mid-2021, to complement the company’s exponential revenue growth.

Tesla’s Dark Beginnings – The Comeback and the Present Day

Today, Tesla looks nothing like the struggling startup of a few years ago. Nowadays, the company regularly nets greater gross margins on its vehicles than the rest of the auto industry. Its lossmaking has completely reversed, allowing the company to gain $22 billion in cash at time of writing, with only $5 billion of debt that the company can pay off at any time. Tesla’s net income has risen since mid-2021, remaining resilient in the $2.5-3.5 billion per quarter range in the face of the economic fallout from one of the most aggressive rate hiking cycles in American history by the U.S. Federal Reserve Bank. Meanwhile, revenues for the company have continued to rise, with quarterly revenue doubling from nearly $12 billion in Q2’21 to over $23 billion in Q1’23.

Tesla’s financial position has never been better, and it stands as proof that the company has left the growing pains of its startup era behind.

Tesla’s Valuation – Deceptively Overvalued

Moving on to TSLA’s valuation, I acknowledge that all valuation metrics for the stock look awfully inflated, due largely to the run up in its stock price that saw it more than double year-to-date, but let me cut to the chase – I think TSLA is actually incredibly undervalued. I will explain my stance on Tesla’s undervaluation in greater detail later in this piece, but I will explain here why I think TSLA’s ostensible overvaluation compared to its so-called sector peers is misleading.

First, if ever it was appropriate to analyze Tesla and its stock as part of the consumer discretionary sector, it is not appropriate now. Tesla is a technology company, and is best analyzed and compared as such, including analysis regarding its peers, sector, and valuation.

Second, Tesla’s current maturing business lines, namely EVs and energy generation and storage, are almost certain to outperform Wall Street’s expectations as they grow and contribute significantly more to revenues and profits. Observant investors’ eagerness to pile into TSLA before these predictably large revenues and profits lower valuation metrics to more digestible levels is quite reasonable, considering the market’s tendency to look at least 1-3 years ahead regarding a company’s prospects when valuing it. The market assigning a premium valuation to Tesla in the form of a forward P/E ratio of 77 at time of writing therefore makes sense to me.

Third, even the current premium assigned to TSLA is miniscule compared to the company’s likely future performance going into 2030, which I think the market isn’t pricing in yet. To better understand what investors and the market are missing, we have to take a closer look at Tesla’s many developing products, services, and operations to see how they will contribute to massive growth for the company and the stock.

These activities within Tesla will be what I cover throughout most of the rest of this article, starting with what the company is best known for today…

Tesla – A Sustainable EV Manufacturer

Let’s begin with Tesla’s most prominent role and business: its role as an EV maker.

Tesla makes more profit per vehicle than competitors while selling fewer cars, earning 8 times more profit on its cars than Toyota (TM), the top carmaker in the world by volume. Tesla is also accelerating its car sales, in line with its mission to “accelerate the advent of sustainable transport by bringing compelling mass market electric cars to market as soon as possible.” Notably, for year Tesla has increased its sales and revenues without utilizing a dealer network or paying copious amounts of money per quarter to advertise its vehicles, choosing instead to pour its funds into R&D to improve its products; meanwhile Tesla’s competitors (e.g., Ford (F), GM (GM), VW (OTCPK:VWAGY), BMW (OTCPK:BMWYY), Mercedes-Benz (OTCPK:MBGAF), Volvo (OTCPK:VLVLY), Nissan (OTCPK:NSANY), Honda (HMC), Hyundai (OTCPK:HYMTF), Kia, Stellantis (STLA), Subaru (OTCPK:FUJHY), XPeng (XPEV), Nio (NIO), BYD (OTCPK:BYDDY) (OTCPK:BYDDF), etc.) all spend many millions of dollars, if not billions, on ad budgets, which do not improve their products at all.

Tesla is also positioning itself to sell more cars annually (20 million by 2030) than the top 2 carmakers combined sold in 2021, in part by constructing more gigafactories to build smaller, more affordable cars. This mind-boggling claim of 20 million vehicles by 2030 strongly parallels Musk’s once-laughable 2014 prediction of reaching 500 thousand vehicle deliveries in 2020, so considering how that turned out, don’t bet against Tesla on this 20 million prediction yet. As Tesla accelerates production and sales, racing past its competition, its higher vehicle profits will make it a clear winner in the EV space, and also in the entire automotive space as all cars go electric.

First point of sustainability: sustainability of EV profits via production of affordable mass market EVs, lowering costs of car-building, maximizing revenue, and minimizing unnecessary parts and processes. Tesla will also optimize design (in line with Elon Musk’s fundamental development principles), and minimize spending on unnecessary activities that do not improve the company’s products, including PR departments, advertising, and dealer networks.

This promotes financial health and continued profitable operation of the EV business, and lays out a sustainable path to continued profitable mass-market EV production.

Tesla – A Sustainable Energy Generation Provider

In addition to EVs, Tesla produces solar roofs and panels. With the company’s somewhat controversial purchase of SolarCity in 2016, Tesla managed to get a foothold in the solar panel market, which is experiencing rapid expansion.

A few trends to note: the lifetime cost of producing solar power is fairly low compared to other energy sources, and is still falling; solar panels are increasing in efficiency; and Tesla’s energy generation installations are growing year-over-year, even if Tesla’s solar sales at present are less explosive than observers may have hoped for.

Still, Tesla’s solar business allows people to generate free renewable electricity so that they can rely less on the traditional grid, which generates much of its power from fossil fuels.

Second point of sustainability: allowing individuals and commercial entities to generate solar power and avoid carbon-based energy usage, reducing carbon emissions and thereby reducing climate change. This will help keep global climate stable and sustainable for human life and activity.

Tesla – A Sustainable Energy Storage Provider

Tesla’s home and grid-scale battery storage business has been accelerating recently, as has the demand for battery storage in homes and at power plants. To support this acceleration, Tesla is ramping up its battery production, expanding its footprint in Fremont and Shanghai to satisfy the demand for energy storage solutions.

Aided by Tesla’s aforementioned battery foresight, prompting the company to buy battery materials in large quantities years in advance, its deployment of battery storage will allow consumers to store the renewable energy they generate for use during periods of reduced or non-generation (e.g., at night or on windless days), further reducing individuals’ dependence on the traditional energy grid while empowering power plants to switch to renewables. This will ultimately lead to a steeper decline in fossil fuel usage as individuals and power plants/utilities find it easier to rely totally on renewable energy.

Third point of sustainability: storing renewable energy to be used in times of need. This allows for more balanced distribution of renewable energy generated (e.g., solar), and makes renewables as viable to use for energy as fossil fuel sources that contribute to climate change. Tesla’s home and grid-scale storage thus helps mitigate climate change by encouraging emissions reductions, like Tesla solar does.

Tesla – A Sustainable Battery Producer and Recycler

Tesla’s Battery Production

Tesla is interested in more than just providing batteries for energy storage – it also invests in producing and recycling those batteries as efficiently as possible.

Tesla purchased three patents related to proprietary battery production methods in mid-2020, shortly before its Battery Day event, during which the company demonstrated significant upgrades to its battery production processes. In 2021, it was revealed that this may have been accomplished by purchasing the three patents of a small Canadian battery production firm for a total of $3, in what appears to have been a shadow acquisition by Tesla. Possibly through this new patented process, Tesla senior VP Drew Baglino stated that as of 2020, “the company could reduce cathode production costs by more than 75 percent by reusing the water needed to make the component.”

This is a development with big implications. High water consumption is a concern in many manufacturing processes, including battery manufacturing. Furthermore, Tesla’s water usage was a key point of contention for environmentalists in Germany when they sued to oppose the opening of Tesla’s Berlin gigafactory. Giga Berlin’s closure on this basis would have significantly hampered Tesla’s expansion plans, and would have ended the possibility of Tesla producing EVs locally in Europe. While Tesla was victorious against the environmentalists, the company still opted to use this new process for its battery-making, likely to take advantage of the cost savings of the new water-efficient process.

In addition to reducing the amount of water required for its batteries, Tesla is taking steps to reduce the amount of cobalt needed as well. This is a boon for both Tesla and human rights, since the metal fluctuates greatly in price and could harm Tesla’s battery price stability, and because the metal is mostly sourced from Congolese mines with poor labor practices.

As such, for its future battery projects, Tesla’s efficiency in its use of water and other natural resources, and its avoidance of resources tied to exploitative industries, will lead to more sustainable battery production in the future, and will reduce disruption to the environments and societies where it builds its facilities.

Tesla’s Battery Recycling

Since 2021, Tesla has routinely sought to recover more than 90% of the battery material in used cells. This is in conjunction with its partnership with Redwood Materials, a private battery recycling firm that recovers battery material at an even higher rate (95%) than Tesla, then sells the recovered material to its customers. In essence, Tesla is partaking in and promoting a closed-loop battery system in which all its batteries are made from recycled material.

Tesla and other EV makers’ recycling of batteries and use of recycled material for new batteries will ultimately reduce, if not eliminate, both the need for battery-related mining in the service of EV companies, and the harms to the environment that stem from mining as an industry. As explained in this article on the benefits of recycling instead of mining, recycling battery materials will ease the strain on the materials supply chain, because the supply used will be continuously circulating and readily available when needed, instead of being stuck in the ground waiting to be drilled for and dug up. Recycling will also result in starting materials with fewer impurities, due to having been purified already for their first cycle in a product’s life. It is quite likely that recycled battery material will become much, much cheaper to produce than mined material, because the high purity of recycled material reduces the need for most refining processes and expenses involved in using it.

Finally, recycled materials will likely also be overproduced and stored when not in need in order to account for fluctuations in demand for a given recycled material. For example, if recycled cobalt is all the rage for a certain class of products, demand will stretch the supply of recycled cobalt thin; however, if the product demand reverses and cobalt demand likewise recedes, the recycled cobalt will simply be stored when these products are disposed of and given to the materials recyclers. The recyclers will then lock up the recovered cobalt and wait for another spike in demand for it to be used again. This will reduce the possibility of shortages for battery materials and other related commodities (barring obscenely and unpredictably high demand), stabilizing the prices for recycled materials compared to mined materials, especially as these closed-loop recycling supply chains mature.

Tesla, Redwood, and others following their lead are thus helping to make the process of obtaining battery materials more reliable, less costly, and less prone to price fluctuations. In this, they are making sure that the supply of such materials will never be lacking in the EV industry in the long term by promoting a closed-loop system for batteries, which is, by definition, a sustainable business model.

Fourth point of sustainability: sustainability of the battery supply chain via its internal battery recycling and materials recycling partnerships. In time, this will result in a closed-loop battery supply chain, which will ensure further stability and sustainability of battery supply for Tesla and others interested in storing renewable energy, thereby contributing to increased renewables production that minimizes climate change impact from the energy sector.

Tesla – A Sustainable EV Charging Provider

Tesla’s Charging Advantages

Tesla’s charging network has received approval for funding from the US government on the condition that company open up its network for use by non-Tesla owners. On a related note, the reliability of Tesla’s chargers is unmatched, according to JD Power. This is a win-win for Tesla. Its charging network’s widespread availability increases the appeal of buying an EV by increasing the supply of available and reliable fast chargers and simultaneously decreasing EV owners’ range anxiety, and as a bonus, Tesla will be paid by the US government to open its chargers up to other EV brands; both outcomes are fully in line with Tesla’s mission to encourage EV adoption.

Better yet, Tesla will almost certainly be taking a hefty cut of the revenue gained by non-Tesla owners for charging on its network. Considering the head-and-shoulders quality of Tesla’s charging network compared to competitors like ChargePoint (CHPT) and EVgo (EVGO), the move to open up its charging network could help mint Tesla as the preferred EV charger in the U.S. and internationally, making Tesla’s charging network, per Reuters, “the universal filling station of the EV era.”

True, Tesla’s rise and future dominance may not endure indefinitely as competitors with respectable quality arrive on the scene, but Tesla’s leading quality in the EV charging market is not to be ignored. Its network’s quality advantage will ensure that it remains quite popular over time, and should allow it to take market share from leaders like ChargePoint. Also not to be ignored is Tesla’s current dominance in DC fast charging, where it had already cornered almost 60% of the US fast charging market, by number of ports installed, by the end of 2021; furthermore, Tesla had plans to expand its network further and faster in 2022 by tripling its size.

All in all, Tesla’s charging network’s superior quality, fast charging leadership, and widespread inclusivity of EV brand access should lead to reliable contributions to Tesla’s revenues.

Tesla’s Charging Business – Financial Implications

In this Seeking Alpha article considering the financial implications of operating Tesla’s charging network, Tesla CEO Musk said he is aiming for 30% gross margins or 10% profitability. I question if he is sandbagging the numbers.

If Tesla’s charging stations in the future are mostly or totally powered by renewable energy generated on site, and no funds are spent purchasing renewable power, then Tesla would see much larger margins from charging. In exchange, Tesla would only need to spend on charger repair costs, which I assume are low, infrequent, or both, and of course the company would spend on the one-time charger installation cost. This is the direction I anticipate Tesla will go, since the company prefers self-sustainability in its products, and will likely have enough storage and generation capacity produced by its gigafactories to increase onsite energy production to meet or exceed daily charging station demand.

If this is the scenario going forward, i.e., one in which Tesla does not have to pay for renewable energy for its chargers, then I would up the projected EV charging financials to ~60% gross margins, and 30-40% profitability. The above Seeking Alpha article on EV charging financials assumed that in the author’s bull case for annual numbers by 2030, Tesla would make $9 billion in revenues and $1 billion in net profit, for an estimated market share of 2.4% percent. Ironically, when performing a gut check on these numbers, my thoughts were similar to the author’s when he parsed charging revenue estimates from Goldman Sachs (GS): these seem like conservative figures for 2030. I would estimate that due to its chargers’ enduring quality leadership and continued mass production of charging stalls, Tesla’s share settles at 15% of the global charging market by 2030, bringing revenues to $56.25 billion, and netting Tesla $22.5 billion in annual profits, assuming 40% net profitability.

In a more bullish scenario, if other EV charging options continue to be lower in overall quality, Tesla’s EV chargers will likely maintain their current competitive advantage amongst the EV charging competition, and become the dominant fueling stations of the EV market by an even wider margin. More EV makers would then follow Ford and GM in partnering with Tesla for access to Tesla’s charging network, with most of the world’s EVs using Tesla chargers frequently. As more deals like these continue to be made, Tesla revenue from charging would accelerate, boosting gross margins and total profitability to even higher percentages reaching truly SaaS-like levels, so to speak. While I won’t speculate on the financials for this scenario, suffice to say it would make Tesla’s EV charging network an even bigger cash cow for the company, while helping to make EV range and fueling access a nonissue for prospective EV customers.

Fifth point of sustainability: sustainability of long distance EV travel and convenient fast EV charging, which enables widespread EV adoption. Since EV adoption is critical to replacing gas vehicles, one of the largest sources of carbon emissions, Tesla’s EV charging infrastructure further enables EV adoption, which directly helps to reduce carbon emissions and promote climate sustainability for humanity.

Tesla – Sustainable Car Insurance Provider?

The global auto insurance market is several hundred billion dollars, and is set to grow by a CAGR in the high single digits as 2030 approaches. Meanwhile, Tesla is offering, and growing, its Tesla Insurance product to take advantage. If Tesla Insurance becomes preferable to other auto insurance by offering lower prices, greater convenience, better coverage, etc. based on the company’s data advantage over insurance competitors, then as Tesla cars become widespread, so too will Tesla Insurance, even if Tesla Insurance is restricted to only Tesla cars. Tesla will then be able to capture a decent size of this growing market, which will likely bring in significant revenues and profit.

Keep in mind, Tesla Insurance’s successful growth story isn’t set in stone yet. For example, if Tesla vehicles capture only 2% total of the global car insurance market at its present size, and Tesla’s insurance profit margin averages about 10 percent, then Tesla would secure about $14 billion in revenue per year, and $1.4 billion in profit ($700B auto insurance market today X 2% market share X 10% profit margin). Considering Tesla’s ~$80 billion of revenue and ~$12 billion of net profit in 2022, insurance wouldn’t be a significant side business for the company under these conditions, even if the auto insurance market doubled by 2030.

However, considering the greater-than-average safety of Tesla vehicles and their lower-than-average crash rates, Tesla’s insurance business could sustain higher profit margins than its competition, since Tesla Insurance is less likely to see payouts by consumers due to reduced accidents in Tesla vehicles. In fact, this article discussing Tesla’s insurance opportunity surmises that Tesla could achieve SaaS-like gross margins of ~70% on its insurance offerings, implying SaaS-like net profit margins of ~40% in the long term (according to the Rule of 40 for successful SaaS companies). All else being equal, with a market share of 2%, these margins would imply an annual net profit of $5.6 billion.

But other factors need to be considered as well, such as estimates that the global car insurance market could rise to nearly $1 trillion by 2027; further, the #1, #2, and #3 market share holders in the auto insurance industry worldwide each held around 5% share circa 2022. Moreover, as Tesla scales up vehicle production, Tesla Insurance will have a bigger vehicle base, and probably more market share, to draw from in order to contribute revenue and profit to the company.

If Tesla becomes a market leader in car insurance and gathers, say, 10% global share (a round number representing the combined global share of #1 and #2 car insurance leaders Geico and State Farm), and assuming a steady $1 trillion auto insurance market in 2030 along with SaaS-like 40% net profit by Tesla by that point, then the company’s net profit could reach as much as $40 billion annually. For context, this annual net profit from insurance is twice the size of Tesla’s gross profit from car sales in 2022. To put it mildly, Tesla’s insurance business could make the company quite a bit of money, especially if it is able to become a dominant player in the space with a superior product.

To be sure, Tesla’s dual role as an insurer and carmaker could raise ethical and antitrust concerns as its cars begin to dominate roads, collecting data on drivers that makes its insurance ever more (anti?) competitive against traditional car insurance, and subsequent litigation and mitigation regarding these concerns could hurt the Tesla Insurance growth story. Still, due to the legal requirement to purchase some form of car insurance in many places, including the U.S. and Europe, Tesla’s entry into the market will result in a legally mandated, and therefore inherently sustainable, source of revenue and profit, especially if it becomes a popular insurance provider.

Sixth point of sustainability: sustainability of profits derived from data-driven car insurance coverage.

Tesla – Sustainable Autonomy and Robotaxi Producer?

Tesla is an Autonomy Leader

With the long-awaited Tesla Dojo supercomputer finally coming online, Tesla will be able to process driving data collected from its vehicles faster than ever before, bringing the company much closer to cementing its status as a successful autonomous driving software developer and officially creating Level 4 or Level 5 Autonomy. For context, I will describe Tesla’s unique approach to autonomous software training, list common critiques of it, and note the advantages of its approach that set up its autonomous software, called Full Self-Driving (“FSD”), for long term success.

Tesla, Inc. allows some Tesla EV drivers to use a beta version of its FSD software on roads, and collects that vehicle data on how, when, and where drivers have to correct the software while driving; this approach allows FSD to train on real-world data with real drivers’ input. The common complaints about this are at least twofold: first, Tesla’s software should not be using customers as guinea pigs to train its autonomous software, as it is unsafe to give customers an incomplete autonomous software package to trust with their safety, and this method of data collection amounts to unethical experimentation on its customers; second, Tesla’s use of a modest number of cameras, few other sensors, and a near-complete lack of LIDAR (short for “laser imaging, detection, and ranging”) sensors, will result in worse autonomous performance compared to competitors like Mobileye (MBLY), Waymo, and others who favor having many more cameras and sensors, and much greater use of LIDAR.

As an AI and machine learning academic explained regarding Tesla’s Autonomy advantages, Tesla’s ability to collect massive amounts of real-world data primarily from cameras (mimicking how humans would see the road with the eye) makes Tesla’s FSD more likely to become a good substitute for human eyes when driving in the real world. FSD’s training on drivers’ responses to real world stimuli will also enable it to similarly mimic driver’s reactions. This two-pronged approach will make Tesla’s autonomous software an all-purpose solution for most, if not all, driving needs and conditions, allowing it to be used on nearly any road that can be navigated by people.

LIDAR-based solutions, on the other hand, work well for mapping a constant and unchanging road environment, but since things change frequently on roads in the real world, LIDAR-based self-driving software will likely be inferior as an all-purpose Autonomy solution. Tesla’s LIDAR-based competitors also have less data, in miles driven, that they can draw from when training their autonomous software, since Tesla uses a much larger car fleet with many more miles of data to train on. Tesla’s competitors will therefore take longer to train their software regardless of sensor number or sensor type, since they are far behind Tesla on the critical element of data collection. Additionally, fewer cameras and sensors means fewer points of failure that could disable Tesla’s self-driving capabilities, likely resulting in fewer instances of spontaneous failure of Tesla’s system compared to competitors’. These differences will further highlight Tesla’s dominance when autonomous software is ranked by customers in real-world conditions, driving consumer demand toward Tesla’s FSD software, and away from competitors who will increasingly be seen as lagging behind.

Some have actually suggested that once Tesla succeeds at Level 5 Autonomy, competitors will attempt to license FSD from the company in order to take a shortcut to gain Level 5 Autonomy, sidestepping years of expensive trial-and-error to complete autonomous software in-house. Further supporting this notion, CEO Musk has expressed openness to licensing FSD to other automakers in the future, almost certainly for a fee or other form of compensation for the use of the software.

To recap, Tesla’s departure from the industry’s standard methods of training Level 5 Autonomy software is likely to make the company a leader in producing it, and may result in yet another new revenue stream if other automakers license Tesla’s FSD. However, even if FSD licensing does come to pass, that isn’t where the real money from FSD will be made.

First Comes Autonomy, Then Comes Robotaxies

Naturally, Tesla intends to capitalize on the creation of Level 5 autonomous software by allowing customers to install it in their vehicles for several thousand dollars for full ownership, or for a few hundred dollars on a subscription basis. Tesla ultimately aims to empower these customers to convert their cars to “robotaxies,” i.e., autonomous vehicles that transport passengers for a fee. Musk has already proposed a basic business model for car owners who want to participate, and the lucrative nature of the endeavor for the company (~20% gross margins selling private vehicles vs. up to 70% gross margins for robotaxi services) may incentivize Tesla to produce many vehicles just for use as robotaxies, owned and operated by the company. Some have taken this to its logical conclusion, stating that Tesla could, and even should, use robotaxies as a way to end private car ownership, with travelers abandoning their vehicles to use Tesla’s lower cost-per-mile robotaxi service indefinitely.

Regardless of how FSD is monetized by the company, its completion and use as Level 5 autonomous software would be very beneficial for motorists and pedestrians, if for no other reason than for safety. People kill each other with motor vehicles a lot – the World Health Organization estimates that over a million people per year are killed in car accidents. If these can be reduced by Level 5 software from Tesla, or from any self-driving company, then it would save the world many tragic deaths going forward, and make them preventable at the touch of a button.

Among these benefits, FSD’s official and complete rollout by Tesla will allow users to simply relax in their car without maintaining the constant state of alertness required by driving, as well as reduce the stress caused by other reckless drivers on the road since users’ cars will be able to safely manage them. In fact, with this software on roads, reckless drivers themselves will become incredibly rare, as they would also outsource their driving to Tesla’s autonomous software. This software would also reduce the risks of people driving, or rather riding, in otherwise dangerous road conditions or circumstances, such as on long road trips when the car’s occupants are tired, or at night when roads are harder to see, or when inclement weather makes controlling the car more difficult. All of these benefits will compound to further reduce the number of accidents and fatalities from human driving, not to mention the reduction in property damage, lawsuits, repair costs, and insurance claims and payouts that will take place after Level 5 software hits roads.

The many benefits of Level 5 software will make Tesla’s FSD and other autonomous offerings an essential part of driving in the future, as regulators acknowledge the increased safety and other pros of using the software in vehicles – and like the seatbelt, autonomous driving software may even become a requirement on roads in the future as regulators begin to fully appreciate the benefits. Tesla’s FSD and robotaxi deployment will likely face some pushback from ride-hailing industry incumbents like Uber (UBER) and Lyft (LYFT), as well as the autonomous software competition, but I think Tesla’s offerings will manage to disrupt these firms and carve out sizable positions for themselves in the transportation industry, paving the way for Tesla’s FSD and robotaxi fleet to become a mainstay on roads and bring in unexpectedly large revenues to the company.

Robotaxi Financial Implications – Lee and Douma’s Back-of-the-Napkin Math

Speaking of FSD/robotaxi revenue, Tesla commentators Dave Lee and James Douma discussed the possible financial implications of Tesla robotaxies being used for transport. An article with the highlights can be found here, and features a video of the two Tesla observers’ thoughts and rationales for their estimates. Notably, the pair is comprised of an avid Tesla investor (Lee) who has bought and held shares since 2012, and a machine learning/artificial intelligence expert and enthusiast (Douma) who has analyzed Tesla’s software for some time. Both of these men have been paying attention to Tesla’s moves for years, and I think it is safe to say that they are sufficiently knowledgeable, both in their fields and about Tesla, to come up with reasonable estimates of possible robotaxi revenue and profit.

Based on Lee and Douma’s Google Sheet summarizing their thoughts and various assumptions, they believe that, taking a 20% share of revenue from Tesla owners opting in to the robotaxi network, Tesla will get $121,000 per vehicle per year during the vehicle’s operation. However, Douma projects that while at most 10% of Teslas on roads will be used as robotaxies by 2024, either at the behest of owners or as produced by Tesla for that sole purpose, the percentage of robotaxies as part of Tesla’s fleet will spike to 50% by 2025, implying an even higher percentage of robotaxi Teslas by 2030.

I am a bit uncertain how to process these possibilities, since it is impossible to know the split between robotaxies from private owners vs robotaxi-only Teslas in the latter half of the decade, or how high the percentage of robotaxies in the total Tesla car fleet will really be by 2030. Tesla’s future revenue stream and profit share from this business is difficult to conceptualize without insight into these and other variables.

Let’s say, for simplicity’s sake, that Tesla produces no robotaxies of its own in 2030, and let’s say that 50% of its fleet is made up of robotaxies from private owners by 2030 (with a more plausible slow climb to 50% robotaxi fleet share by 2030 compared to Douma’s prediction). In this scenario, half of a 20 million vehicle fleet collecting $121,000 per vehicle in revenue for Tesla would amount to $1.21 trillion. Tesla would have received robotaxi revenues gradually approaching this number from 2025 onward, but by 2030, $1.21 trillion would be the annual take rate for the company, meaning that for every year robotaxies are running from 2030 on, Tesla would be collecting more than $1 trillion in revenue like clockwork. This revenue will likely be pure profit to Tesla in the end, going right to the company’s bottom line.

This math seems to defy reality. How can a simple car company create a product or service that brings in over $1 trillion on the low end of estimates? Baffling as it is, it may well happen. Apple (AAPL), currently one of the most valuable public companies on Earth with a $3 trillion market cap, only made some slight alterations to its flagship physical devices, and added some new updates to its software and new software packages and services – it pulled in $400 billion in revenue in 2022. Meanwhile, Tesla intends to offer an entirely new service centered on self-driving cars, a first in transportation, and intends to triple Apple’s revenues in just robotaxi profit, on top of its revenue from private car sales and the other business lines the company is planning to establish. If true, does this mean Tesla’s market cap is set to be more than three times Apple’s by 2030, i.e., over $9 trillion? That is what the math is implying so far.

Of course, the assumptions in these calculations could be wrong to the downside – but they could be wrong to the upside as well. In any case, Tesla’s robotaxi revenue will be easy money for Tesla to pick up every year, all based on the company successfully solving Autonomy.

Seventh point of sustainability: sustainability of transportation industry leadership by developing, deploying, and monetizing general-purpose autonomous driving software.

Tesla – Sustainable Automated Workforce Provider?

While this is unquestionably one of the more speculative developments Tesla is working on, it has the potential to generate massive demand very soon. As the age of Baby Boomers (generally first born in 1946) starts to meet the average age of death (generally around 78 in the U.S. and developed countries), one can reasonably infer that beginning in 2024 (1946+78) and beyond, the Baby Boomer generation will start to die en masse, resulting in a period of rapid population decline.

Over time, as Boomers die off, the workforce in wealthier nations may need additional labor to replace them – labor that may not be easily accessible, barring changes in these nation’s immigration policies or birthrates. Some form of labor supplement, like robots, would therefore be needed, and perhaps even preferred, to make up the difference. With robots specifically, they could perform jobs that ordinary workers in successive generations would gladly abandon (e.g., farm work, factory work, etc.) in favor of the types of jobs the Boomers left behind (e.g., adjunct professor, consultant, writer, etc.). Elon Musk describes this labor shift as robots taking on tasks/jobs that are repetitive, boring or dangerous, freeing people to do things that they actually enjoy; he further claims that with the automation of labor, “the future of physical work will be a choice.” With basic labor automated thusly, humans would indeed be free, or forced, to engage in other activities.

Depending on one’s view, this could mean that people whose financial stability relied, and still relies, upon these types of jobs that are likely to be automated away will be deprived of the opportunity to continue such work; it could also mean that with such jobs off the job market, these people would choose to pursue more engaging and safer pursuits, finding new niches in unexpected positions or filling the hole left behind by semi-retired Boomers in the workforce.

Regardless of one’s view, competent robot “workers” would cost less to operate than human workers, since they would not need healthcare, food, or wages to function, only charging, repair, and maintenance. Additionally, they would likely be much more productive, since they could be operated at all hours with no breaks except to charge their batteries, and would never need to take a vacation or sick leave. Should Tesla produce them at volume, many companies would purchase them solely to cut costs and increase margins, since labor expenses are a large portion of the costs to produce items or deploy services. This would result in sizable sums of revenue, and ultimately profit, flowing to Tesla.

In short, on the subject of a humanoid robot workforce, if Tesla builds it, they will come, and Tesla is certainly building it. If population decline is a greater threat in the medium to long term future than overpopulation, humanity’s labor force may need to be supplemented with robotic workers to keep global productivity from plummeting due to the reduced number of living workers. This shift would likely bring several possible side benefits to the labor market, and may improve the lives of many would-be workers, making Tesla’s humanoid robot (powered by the same Tesla AI team managing Dojo and FSD) a game-changer for the labor force in the coming decades.

Eighth point of sustainability: sustainability of the workforce and global productivity.

Tesla – Sustainable Artificial General Intelligence Creator?

This is the most speculative development Tesla is working toward. I hesitate to use the phrase “working toward” to describe the company’s efforts because frankly, AGI creation is not an explicit goal of Tesla or its management, but a theorized byproduct of other operations within Tesla, namely the company’s robotics division and autonomous vehicle software division. As Elon Musk surmised, “Tesla AI might play a role in AGI, given that it trains against the outside world, especially with the advent of [Tesla’s humanoid robot] Optimus.”

As fantastical as it may sound, it is far from impossible. Amazon’s (AMZN) attempt to provide data services for specific entities, coupled with the failure of that business model, forced it to create a new solution that set the stage for what we now know as Amazon Web Services, or AWS. In effect, the internal operations and demands of Amazon resulted in the company unintentionally creating a titan of cloud storage and cloud computing. It is therefore plausible that the complexity of Tesla’s data-heavy and compute-heavy software demands will similarly result in the company creating software capable of “thinking” for itself, so to speak, in most or all given scenarios in order to process these demands, i.e., the creation of AGI.

One should keep in mind, though, that the full story of how and why AGI is created is not yet written. It may well be that it is created by accident from Tesla’s other operations, but according to recent reports, Musk is establishing his own AI firm, xAI (formerly or alternatively known as X.AI Corp.), to try to develop AI projects to compete with the likes of Google (GOOG, GOOGL), Meta Platforms (META), Microsoft (MSFT), OpenAI, and others. The ultimate goal of Musk’s new venture is to steer AI away from harming humanity in the future. As a result of Musk’s more concentrated AI efforts via this new firm, it’s possible that AGI is actually created in this facility first. Nonetheless, should Tesla instead be the birthplace of AGI, the company would similarly do its best to train its AI to not harm humanity, since Musk still leads Tesla and would direct the company to shepherd any Tesla-born AGI to be an ally to humanity.

Also, if Tesla creates it, Tesla would not only gain a place in the history books as the first company to create AGI from scratch (assuming other AGI-focused companies don’t create it first), but Tesla would also be able to deploy this AGI to engage in countless pursuits. The company could utilize its AGI in all of its devices as a troubleshooter/problem solver in case of severe device strain, damage, or other adverse operating conditions; it could market this AGI as a superior virtual assistant, combining the best qualities of Amazon’s Alexa or Apple’s Siri with the best known AI advancements, surpassing Microsoft/OpenAI’s ChatGPT; it could also let other companies license its AGI to do with it what they wish, and collect almost pure profit from that revenue stream.

In an altruistic move, Tesla could even open source its AGI with a few limiting conditions, as it has done with EV patents in the past. The possibilities, and revenues, that Tesla could derive from creating AGI in-house are as alluring as they are unknown, for while the amount of money Tesla would make off of AGI is hard to estimate due to a lack of clarity on probable use cases, it is almost guaranteed that the sums Tesla will make could be unfathomably large.

To sum up this section, something as powerful and as versatile as AGI in Tesla’s arsenal may not have clear use cases in the near or even medium term, but at some point in the future, if Tesla creates it, AGI may become incredibly useful for the company, and to many companies and organizations should Tesla choose to open source it. The unknown capabilities of AGI could make it very valuable to the company, and could pay off in myriad ways we cannot predict today. AGI could give Tesla the ability to solve problems in ways no other company can without this technology, so it would likely lend the company some flexibility or a competitive edge in addressing various unforeseen future issues, or capitalizing on otherwise-missed opportunities.

However, in line with the concerns and priorities of CEO Elon Musk, Tesla’s biggest contribution to the creation of AGI will probably be making sure that it doesn’t go rogue and kill anyone, which would certainly be sustainable for the species and the AI product.

Ninth point of sustainability: sustainability of lucrative, flexible, pro-humanity AGI.

A Note on Speculating on Tesla’s Future Businesses

For the more speculative areas Tesla is getting into, I would argue that the degree to which they are speculative is based on the level of demand one can expect for the products Tesla wants to sell in those areas.

Autonomous software, I think, is the least speculative of the company’s speculative projects, because the demand for having a car take you where you want to go has been long established. Taxi drivers, personal chauffeurs, and other drivers are essentially personified autonomous driving software programs that are more error-prone and require food and wages. The replacement of these positions, and the possible replacement of both private vehicles and driving as a practice, are fairly predictable outcomes if Tesla’s autonomous software is developed to Level 5 Autonomy, especially if it lowers the cost-per-mile of transportation.

Tesla’s humanoid robot demand is less self-evident, but very much present due to the benefits laid out in the automated labor section, e.g. no wages, healthcare, leave, or food necessary, can be operated all the time, only have to pay for energy and repair costs, etc. A case might be made to replace human workers outright by the Tesla Bot, as it may be known, but it is unlikely that most workers will be replaced, and the case for replacement will be solid in certain spaces and for certain tasks; additionally, the Bot will likely be preferred as a way to fill the void in the labor market created by the deaths of the post WWII generation in developed countries and around the world as it begins dies off in large numbers starting this decade. Thus, I think speculation on Tesla’s robot relative success is warranted, as there are multiple upcoming catalysts for its demand.

Regarding Artificial General Intelligence from Tesla, I am uncertain what demand may exist for it. AGI could be used for complex tasks such as predicting future outcomes of geopolitical and economic events and their implications decades into the future based on given conditions, or it could be used for simple matters such as planning a person’s day, like a high-end calendar app. For a product or innovation this revolutionary that has never existed before in any capacity, the possible demand could be as large as that the demand for all human activities: infinite. On the other hand, it could fail spectacularly to generate interest and demand from consumers, making it a massive flop. This is why I think AGI development at Tesla is the most speculative project the company has; the demand for it is simply unknowable at this time. I would actually caution against investing in Tesla with the expectation of success for this sole project, but I do acknowledge that for the risk taken, the reward would likely be astronomical if demand is on the high side of expectations.

For all of these potentially high-demand products, Tesla’s success is of course contingent on the company being able to create and sell large volumes of products/services that will meet this demand, just as the company is successfully selling large volumes of EVs to satisfy massive EV demand.

Putting It All Together – Tesla and TSLA Stock are Unsustainably Discounted

Tesla and TSLA in 2030

Based on the many business lines Tesla will likely have going in the future, and their considerable impact on Tesla’s bottom line and stock price, I decided to do an experiment: crunch the numbers to find Tesla’s 2030 EPS, or earnings per share, using projections from the business lines of Tesla with the best financial visibility.

EPS is comprised of total earnings in a given year divided by the number of outstanding shares that year, so I added up projected earnings of Tesla’s insurance, robotaxi, and EV charging businesses, which I previously estimated in the article, plus earnings from Tesla’s EV sales which I will quickly estimate below, plus Tesla Bot earnings, based on statements from CEO Musk cited by Farzad Mesbahi, another Tesla observer.

(Full disclosure: Farzad Mesbahi is an ex-employee of Tesla, Inc., and while he reportedly did not depart on bad terms, his views on Tesla’s prospects may be tainted by a degree of positive or negative bias towards his former employer. I cite him here due to the feasibility of his estimates and his intimate knowledge of the company, having worked at Tesla for around 4 years, and I am aware of no cause for a conflict of interest regarding Mesbahi and Tesla beyond the above statements about him.)

From prior calculations, I estimate Tesla’s earnings from charging ($22.5B), robotaxi ($1.21T), and insurance ($40B) should total $1.2635 trillion. For the EV sales business, I will assume that the average price of a Tesla vehicle, after the introduction of cheaper vehicles at around $25k, brings the average price from $45k, (the average price of Tesla’s Model 3/Y variants according to Tesla’s website at time of writing) to ~$30k, assuming more $25k cars comprise a slight majority of Tesla’s 20 million car fleet over Model 3/Y cars by 2030. At a sales price of ~$30k per car, 20 million vehicles sold, and a net profit margin assumed to normalize at 20% by 2030, Tesla’s EV earnings would be $120 billion. Added to Tesla’s other businesses, we arrive at about $1.38 trillion.

Lastly, according to Musk, as cited by Mesbahi, Tesla’s bot business could stand to count for the majority of Tesla’s valuation; if true, it would likely represent a majority of Tesla’s earnings too, i.e. more than the combined earnings total of Tesla’s businesses so far. Assuming a 55% share of earnings coming from the Tesla Bot vs 45% of earnings from the other businesses, Tesla Bot’s earnings should amount to $1.69 trillion in 2030. $1.69T plus $1.38T equals $3.07T in earnings.

Assuming Tesla’s outstanding shares will increase by an average of 11.6% per year for the foreseeable future, based on Tesla increasing its outstanding shares by 2.5 times between early 2010 and early 2023, with the outstanding share number in early 2023 being 3.47 billion, Tesla’s outstanding shares by early 2030 should amount to 7.5 billion. Keep in mind that I will not be using the compound annual growth rate of Tesla’s outstanding shares, which would be a more conservative 7.3%, and more favorable to Tesla’s EPS calculation.

In the end, then, $3.07T of earnings divided by 7.5 billion shares equals earnings per share of $409 in 2030, far from this year’s forward EPS of $3.53, and representing a compound annual growth rate of 58%. Assuming a 2030 P/E of 35, not unreasonable for a seasoned growth company, we get a stock price of ~$14,300 for TSLA in 2030.

As a reminder, Tesla’s energy generation, energy storage, battery recycling, and other business lines are not accounted for in this EPS estimate, meaning both the EPS and price per share in 2030 could be much, much higher than I have calculated here.

Tesla and TSLA’s 2030 Estimates Reveal a Steep Discount by the Market Today

I recognize that tallying up Tesla’s likely revenue and profit for 2030, a point too far into the future for many investors to consider, might seem like a fool’s errand since future business performance is often hard to predict years in advance. However, the opportunities in front of Tesla, should the company continue to execute on them as it has on past endeavors, are too big to dismiss, far from unpredictable, and far from impossible for the company to take advantage of. Accordingly, I believe it would be appropriate to price these opportunities into the company’s projected financials and stock performance, as the company is incredibly well-positioned to fully capitalize on them.

With all this in mind, I believe that Tesla, at this early point in its potentially massive growth story, should be valued at a P/E of 400 today, which would at least account for 1/10th of Tesla’s projected growth up to 2030. Notably, this P/E would be 7 times larger than the forward P/E of 56 for Nvidia Corporation (NVDA), the stock of which is regularly panned by Seeking Alpha analysts for being “obviously overvalued,” and has become a poster child of what we might call the 2023 Tech Stock Spike. This indicates that my estimates for TSLA’s fair valuation might be considered a bit extreme at this time.

Modulating my EPS calculations for greater palatability, if we exclude Tesla’s robotaxi and humanoid robot gains, the two largest 2030 profit contributors, my earnings calculations from the charging, EV, and insurance businesses alone result in an estimated EPS of ~$24 in 2030. This puts Tesla in the range of Broadcom’s (AVGO) forward EPS of $42 at time of writing, and based on this list of companies with the highest EPS, Tesla’s lower EPS would probably still rank among the list’s top 100 companies, if not the top 20, out of the thousands of publicly traded firms today. With this $24 EPS estimate, at a reasonable growth firm 35 P/E ratio in 2030, Tesla’s stock price would be nearly $850 per share.

For all its enthusiasm about the company, as demonstrated by its support of Tesla’s ostensibly generous 77 P/E ratio, the stock market has priced in almost none of this. At a P/E of 35, Tesla’s 2023 forward EPS of ~$3.50 results in a share price of ~$120; the market is valuing Tesla at ~$275 per share with a P/E of 77, more than double that of a reasonably-priced growth firm. Yet even excluding robotaxies and robots, the market, at this 77 P/E ratio, is only pricing in 32% of Tesla’s $850 share price in 2030, despite the massive growth clearly ahead of the company for it to reach just $24 of EPS.

If the market is pricing in only a third of the blatantly obvious business growth for Tesla into 2030, it is probably dismissing outright the fairly obvious growth on the horizon for Tesla, i.e., robotaxies, robots, and the other businesses with less financial visibility but clear financial upside, like energy generation and storage. This is why I am comfortable using the words “TSLA” and “undervalued” in the same sentence, and why I think even value investors should consider this name, contrary to conventional wisdom: TSLA is actually in deep value territory relative to 2030 estimates.

Tesla is primed for moonshot growth, according to relatively clear trends in its business units and based on its history of execution on its EV business, yet these are being dismissed by the stock market almost entirely. As a result of this dynamic, Tesla’s current pricing by the market is completely unsustainable, as the company’s projects will generate increasing investor attention as they start ramping up and contributing to Tesla’s revenues, profits, and EPS. Investors will then pile into the stock when they belatedly realize how much Tesla’s earnings are set to grow.

As an aside, while researching for this piece, I came across Australian YouTuber Steven Mark Ryan, posting on the channel Solving the Money Problem, who stated that he believes Tesla is “the best risk-adjusted opportunity in the stock market today.” I initially dismissed this as influencer hyperbole, but having crunched the numbers and done some gut checks, I understand why he says this, and I believe he is likely correct.

Tesla, Inc., appears to be severely undervalued by the market in even a very conservative bear case scenario for 2030, meaning the company is all but certain to reward clear-eyed, forward-looking investors who invest in it today, hold their stock throughout the decade, and marvel at the company’s staggering shareholder returns between now and then.

Investor Implications – A Message to the Bears and Shorts

If any Tesla bears or TSLA short sellers have managed to make it this far into the article, I have a brief message for you: betting against this company, verbally or financially, is almost certainly a mistake.

At best, you will get some short term cheers from like-minded bears/shorts and supporters, and maybe some decent capital gains if you play your cards just right. But in the long term, depending on how you stand against the company, and for how long you do so, you could face anything from embarrassment, when supporters, allies, and business partners realize that you were mistaken about the firm’s prospects, to severe capital losses. If and when Tesla’s stock spikes to new levels, it will crush shorts as margin calls pile up, and destroy capital held in anti-Tesla-themed ETFs like the AXS TSLA Bear Daily ETF (TSLQ) and the Direxion Daily TSLA Bear 1X Shares ETF (TSLS), which are already down by 25-30% since their market debuts.

While I cannot direct anyone to make any decisions regarding their money or their conduct, based on what I know and believe about this company and its future prospects, I urge you to reconsider your position on the company, financial or otherwise, before it’s too late.

Risks to Thesis

The risks to my overall thesis are numerous, but all ultimately boil down to one possibility: Tesla underperforms my calculations and expectations.

Tesla may misunderstand the markets for its products, and could therefore fail to properly market its products to generate expected sales. Maybe demand is perfectly targeted but weaker than expected, or completely nonexistent. Maybe Tesla cannot ramp up supply, leading to anemic sales despite high demand. Perhaps Tesla’s competition in most or all of these areas finally introduces better or cheaper substitutes that customers want as much as, or more than, Tesla’s products. Or, maybe, just maybe, all of Tesla’s products eventually flop for all of these reasons and more.

I do not believe any of these scenarios will come to pass this decade. Maybe in the 2050s, when new management is running the company after the retirement of the current leaders, but for the period between now and 2030, I don’t see any of these risks panning out in any meaningful way, never mind impacting the thesis.

Summary and Conclusion

While some of the businesses Tesla is involved in now or in the future are somewhat speculative, almost all are expected to see stable or growing demand over the next several years. Demand for labor, using projected job growth as a proxy, is already set to increase in the U.S., and likely most of the world, for the rest of the decade, which could be a boon to Tesla’s Bot sales. The increase in EV demand has been talked about to death, boosting Tesla’s EV sales. For most of Tesla’s business projects, I could go on. The basic point is that Tesla is making products that can satisfy demand in multiple markets.

As such, significant upside should be for Tesla, due to the expected S-curve of the company’s growth in each market; Tesla is either dominating in nascent, expanding markets and selling products to capitalize on these market opportunities (e.g., EV sales, grid-scale storage), or rapidly taking market share from incumbents in established markets (e.g., car insurance, taxies/ride-hailing). The company is thereby engaged in growing its presence in multiple businesses and industries, riding multiple S-curves that will result in what I can only describe as monstrous growth, to borrow the phrasing of analyst Trip Chowdhry of Global Equities Research.

Since the company’s stellar record of execution in growing its EV business suggests similar success in its other business ventures, Tesla, and likewise TSLA, seems to be an excellent pick in the long term. Consequently, long term investors of all kinds, from growth-minded investors to value seekers, would do well to buy up shares now and hold on for dear life – in other words, feel free to HODL around TSLA for the rest of the decade.

In my opinion, for one reason or another, the market is not properly accounting for Tesla’s relatively straightforward growth trajectory. In order to illustrate why the market is wrong, and to what degree, I have calculated what essentially amount to 2030 price targets of ~$850 in my bear case, and ~$14,300 in my base case, both of which are far above what the market is willing to pay for TSLA today. This is my first time establishing price targets for a company’s stock, and while I hope to never repeat this exercise, the explanations and calculations used to reach these targets demonstrate why I now believe that Tesla, Inc. is perhaps one of the best growth companies one can own today.

Accordingly, as the stock of a company with a multitude of massively lucrative current and future projects in its pipeline, coupled with a history of strong execution, I rate TSLA a strong buy for all long-term investors.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.