Summary:

- I decided on a short bet against Tesla, Inc. this year in July when shares were around $280.

- I saw five key risks and, despite the share price depreciation since then, there is still room for them to play out, in my view.

- I decided to use Put options and, I am up over 120% due to the options leverage.

- However, Q3 2023 earnings, and especially the earnings call haveconvinced me to continue the short bet.

mphillips007

Investment Thesis

I started my short bet in July and have described it in an early-September article. My view back then was (and still is as you’ll see): while Tesla, Inc. (NASDAQ:TSLA) is fundamentally solid and has good long-term prospects, shares are priced for perfection. I saw several short- to medium-term risks that could result in a significant price drop if any of them materialize.

Those risks were:

- Further reducing profitability (margins).

- Growth below expectations.

- A forever FSD beta.

- Issues with the Cybertruck release.

- Dependency on government subsidies.

There has been a deterioration in almost all of those five risks since July, with maybe the exception of FSD. Q3 results have shown a reduced growth rate combined with lower margins. The Cybertruck was not released in September and Elon Musk made disastrous remarks about production readiness and profitability during the Q3 earnings call. The EU is looking into Chinese EV subsidies, and the biggest exporter of cars from China into the EU is Tesla. Only FSD has seen some bullish news about AI and the Dojo supercomputer, but at this point, there is still more hype than tangible positive outcomes, in my view.

The momentum is not favorable for Tesla now. I think that shares could test the 200 range. If the range does not hold, I think there is more room downward than upward. Therefore, I will keep my short bet going, although I am already up more than 120%.

In the article, I will give an update on where I see Tesla on each of the five risks, and also on my approach to the short bet using Put options.

Further reducing profitability

Tesla’s operating margins in Q3 were 7.6%, the lowest since 2020, and more than two percentage points down QoQ. The company is clearly prioritizing volume growth over revenue and margins to keep up and increase demand.

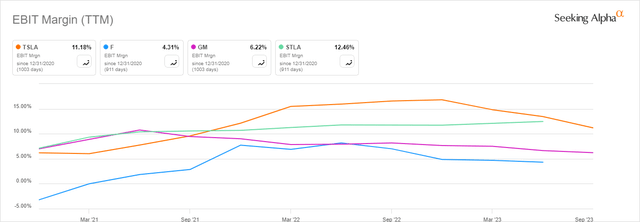

Tesla reduced prices in the U.S. again in October, after Q3 deliveries came in below expectations. The starting price of Tesla cars (Model 3 and Y) is now less than the average price of a car in the U.S. On the flip side, if you take profitability as the key measure, Telsa has become an average mass-market automaker. Tesla’s margins are still above General Motors (GM) and Ford (F) but below Stellantis (STLA). (Note – Ford and Stellantis still need to announce Q3 2023 results).

Profit margin comparison Tesla, GM, Ford, and Stellantis (Source: Seeking Alpha)

Tesla bulls often claim structural cost advantages on Tesla’s side compared to other auto manufacturers, supporting the ability to keep cutting prices and stay profitable. To me, this looks inconclusive. Operating margins are going down faster (from 17.2% to 7.6% YoY) than gross profit margins (from 25.1% to 17.9% YoY), meaning Tesla’s cost base is increasing.

This is not in line with the narrative that Tesla is aggressively cutting costs. It looks like price cuts will continue to be the main driver Tesla will use to hit its 1.8 million 2023 delivery target. Therefore, I see a risk that profitability will go down further.

At least Tesla will have a hard time doing better than the 7.6% in Q3 2023. Its profitability depends on the ability to sell EVs, and for the next quarters, this means Model Y and Model 3 sales and the margins the company can achieve there. There is not much momentum from anywhere else. The Cybertruck is not going to help. Nominally the energy and storage business had a 148% YoY growth in Q3, but that picture is very different if you look at the last quarters. YoY sales for the segment jumped to 1.529bn billion in Q1 2023, in the two subsequent quarters sales were basically flat with 1.509bn in Q2 and 1.559bn in Q3.

Growth below expectations

Tesla intends to grow unit sales by around 50% per year. The company says it will be more than 50% in some years and less in other years, so the guidance allows for some flexibility.

Last year unit sales grew by 40.3%. Telsa still expects to sell 1.8 million cars this year. The company will need to deliver more than 475,000 cars in Q4 to meet its target, after 435,059 in Q3 and 466,140 in Q2. Even if it achieved that, the growth rate would still be only 37%.

Next year does not look good either, meaning Tesla will likely miss its growth target three years in a row, and this together with a deteriorating margin. Based on the Q3 EPS of 0.53 the (annualized) GAAP P/E ratio is almost 100. There is still more room downwards for the stock, in my view.

Tesla could even set itself up for a situation where the company is demand-constrained (relative to the growth ambition) and supply-constrained at the same time. During the Q3 earnings call, Elon Musk said the company will slow-walk the planned Giga Factory in Mexico to see how the macroeconomic environment turns out. According to the Q3 earnings presentation, the current installed production capacity (excluding Cybertruck) is just 2,225,000 million cars. This is a lot less than the 2.7 million Tesla needs to deliver to achieve a 50% growth rate from 1.8 million this year (assuming it achieves that number).

A forever FSD beta

Of course, there is always AI and the possibility that FSD and robotaxis will make up for profit shortcomings later. Only I do not think this is likely to come anytime soon.

During the Q3 2023 earnings call, Elon Musk again said that Tesla’s future lies in the company solving autonomy. For this to happen, Tesla would have to prove that its autonomous driving software is safer and at least as capable as a human driver. However, we do not have any actual data on driver intervention, system failures, and accidents per distance driven, etc. Tesla has avoided releasing information like that, and we can only speculate why. I know that a lot of people think differently, but I find it hard to take their goal of a robotaxi service seriously without that information.

As the recent license suspension for Cruise in California shows, regulators are taking concerns seriously. And it really does not matter how many H100s the company has installed, and whether it has done this faster than anybody else before, as Musk said on the earnings call.

Issues with the Cybertruck release

In my previous article, I made the point that I admire the boldness of the Cybertruck design. I am certainly not the only one, and the Cybertruck is probably the most anticipated car ever to be released.

Almost four years after its announcement (in November 2019) Telsa still has not announced a price or a specification for the Cybertruck. But at least there is a delivery date now. The company posted on X – apparently without any irony – that the first deliveries are on track for November 30.

Source: X

However, Musk also spent a good part of the earnings call reducing expectations. He admitted that production is much harder than building a prototype and warned that it will take 12 to 18 months for the Cybertruck to be cash flow positive. You have to ask yourself though: what if this never happens? Did he not know the issues at the last earnings call or did he choose not to tell?

Investors should remember that the Semitruck is still in pilot production almost a year after the first vehicles were delivered.

I think this has the potential to become even worse given the hype around the Cybertruck. While we have no specs and no price, Tesla is shooting at the car with a Tommy gun.

Source: X

This is an odd way to do a product release, in my view. As a way of comparison, Mercedes (OTCPK:MBGAF) will sell an all-electric version of the iconic G-Wagon SUV starting in 2024. Journalists have already been invited to drive pre-production versions of the car themselves and we can read about it in detailed reviews.

Dependency on government subsidies

The transition to electricity is to a large extent not market-driven but caused by government policies to meet a climate emergency. Accordingly, Tesla is a major beneficiary of various kinds of government subsidies, and this is the case in all three of its major markets, the US, China, and Europe.

Those policies are costly and can change. Germany is a recent example of what happens when subsidies end. Since September 1, companies are no longer receiving the so-called environmental bonus for new EV purchases. As a consequence, EV registrations were down 29% YoY in September.

Aside from the general political risk, Tesla is especially affected by the European Union probe into whether China’s electric vehicles industry is receiving unfair subsidies. The largest exporter of cars manufactured in China into Europe is not a Chinese company, but Tesla. According to a Bloomberg article Tesla exported 93,700 cars from China to Europe in the first 7 months of 2023.

There are no immediate consequences, and maybe there will not be any at all, but this should be a reminder that those subsidies are probably not here forever, or for everybody.

How is it going so far?

Since I live in Austria, going short directly on a U.S. stock is difficult. I decided to buy Put options with a duration of 4 to 6 months and plan to continuously roll over the options to the next 4 to 6 months at about the midpoint of the duration, so every 2 to 3 months. This comes with costs, so I do not want to do it too often. I have done it once since I started in July.

The Put options limit my losses if things do not go well, but there is of course still the possibility of a total loss. You should never invest more than a very small part of your portfolio in options. (If you are new to options, there are a lot of websites with good information. The SEC website may be a good start).

I decided to go for options that are not quite in the money but with a strike price not more than 10% below the share price. This limits the loss rate, but on the flip side also the leverage of the options.

The first options I bought expired in mid-December with a strike price of $275. Tesla shares stood at $279 at the time of buying. The options I currently hold have a strike price of $270 and expire in March 2024. I intend to keep them until sometime in December. I have reinvested the gain from the first set of options, and I am now up around 120% in total.

Conclusion

Despite the recent price adjustments, Tesla shares still have more potential to go down than up, in my view. The only way I see for shareholders to profit is through share price appreciation, but the high valuation means that significant profit increases are already priced in, despite the risks. The high valuation also means that Tesla’s cash flows do not support a high dividend yield nor share buybacks.

Therefore, I will keep my short bet going.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.