Summary:

- Tesla, Inc.’s price cuts have failed to boost sales and have resulted in reduced revenue and lower profit margins.

- Sales in Q4 are not trending towards new records, raising concerns about meeting analyst forecasts.

- Tesla’s quality and service issues, including safety concerns and poor customer service, need to be addressed for long-term success.

Xiaolu Chu

Failure of price cuts

Tesla, Inc. (NASDAQ:TSLA) sales growth has slowed noticeably over the last five quarters. Cracks started to appear in the growth story in the second half of 2022, but deliveries were maintained through the end of the year because of a strong backlog. Once that backlog was depleted, Tesla tried to revitalize the lackluster sales by making drastic cuts to prices. The price cuts seemed to be working at first because, in January, Elon Musk was predicting 2 million sales in 2023.

But even with continuing massive price cuts and the help of a renewed $7,500 tax credit in the USA, sales this year have been disappointing, and the sales target has been dialed back to where it was before the price cuts, at 1.8 million.

The price cuts have resulted in reduced revenue and lower margins, but did not boost sales sufficiently to keep pace with production. I think it safe to say that the price cuts have failed to make the impact that Tesla expected.

More of the same in Q4

Analyst consensus is for Tesla to sell 482,000 cars in Q4, an increase of 47,000 (11%) over Q3. Meeting that consensus would also reach the 1.8 million targeted for 2023.

We are halfway through the quarter and China sales are lagging Q3 by about 2%, European sales for October were flat compared to July, and sales in the European countries that report daily registrations show only a small increase in Q4 over Q3, most of the increase coming from the upgraded Model 3. Much will depend on the timing of shipments from Shanghai, but China and Europe sales are not trending toward the new records that will be needed to meet analyst forecasts.

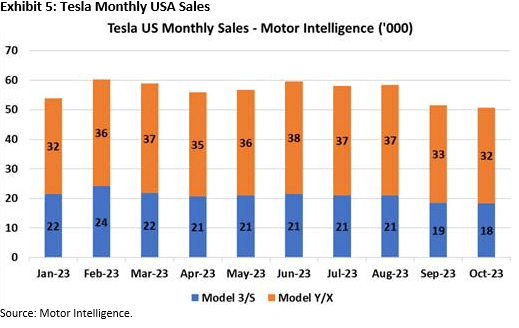

U.S. sales in October were the lowest of any month this year, according to Motor Intelligence (see chart below).

Tesla monthly sales USA (Motor Intelligence)

Tesla’s investor relations department, in a rare communication, indicated that Tesla is “in an intermediate low growth period.” I interpret that as a warning that Q4 results are going to come in below expectations.

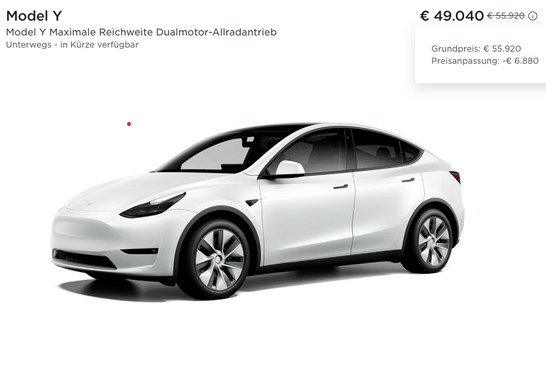

Tesla has once again resorted to price cuts to drive sales, Model Y inventory is being offered at a significant discount in some European countries, and most models are discounted in the U.S. for the remainder of the quarter.

12% Tesla discounts in Germany and Austria (Tesla website)

It appears that, if Tesla sales volumes meet expectations for Q4, it will be at the cost of a further erosion of profit margins that have already declined from one of the highest among major automakers to one of the lowest.

Questionable strategy

Investors should be questioning the strategy. The price cuts have lowered resale values, negating much of the benefit for those trading in an older car for a new one, they have not had the desired impact on sales volumes, and they have destroyed profit margins.

Quality and service need to be addressed

Tesla should instead, be focusing its attention on improving quality and service. The cars, in my view, are gaining a reputation equivalent to the Yugo and Lada. Social media sites and forums abound with complaints about Tesla vehicles, and Consumer Reports ranks them among the least reliable cars. Many buyers, especially those in lower income groups who rely on a single car for their daily transport, must surely be turning away from Tesla even as the cars become more affordable.

However, social media posts are anecdotal and difficult to quantify; there are also buyers who claim that the build quality issues are exaggerated. When a Tesla catches fire or drives through a shop window, it makes the news and the news spreads faster than it might if an internal combustion engine (“ICE”) car had done the same thing, so potential buyers could be responding to media bias in choosing to stay away from Tesla. To get an unbiased view, we must look at other data sources.

The JD Power survey

The JD Power survey of new vehicle defects places Tesla 28th for initial quality out of 32 brands, but it only looks at faults during the first 90 days of ownership. The results of the survey are widely published in the automotive press and in mainstream media, and a low ranking must impact sales. But the JD Power survey only counts the number of defects, it places no importance on the severity of the defect; a minor glitch in the function of the radio qualifies as a defect equal to a steering wheel falling off. Many Tesla buyers are buying the car for its supposed technological advances and are prepared to forgive minor details in the build quality.

The NHTSA safety complaints database

The National Highway Traffic Safety Association, NHTSA, keeps a database of safety-related complaints submitted by vehicle owners. There are a few frivolous, non-safety-related complaints in that database, but the vast majority of the complaints are serious safety concerns. That database provides a method of quantifying the more serious defects and making an unbiased comparison between different makes of vehicles.

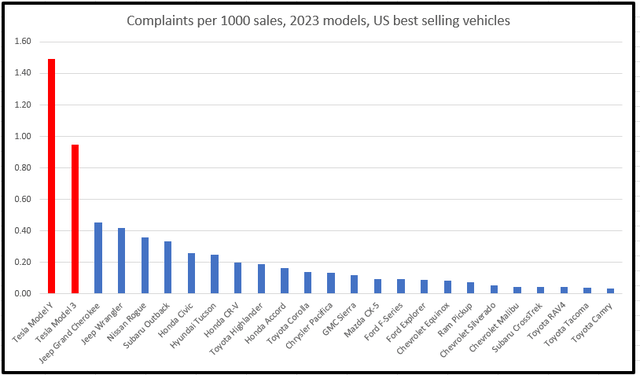

For the first 3 quarters of 2023, Tesla Model 3 and Y sales were about 4% of the U.S. car and light truck sales but accounted for more than 20% of the complaints about 2023 model year vehicles.

On the basis of number of complaints per vehicle sold, Tesla is not the worst. Other electric car manufacturers also seem to be struggling with design and quality issues. Hyundai Motor Company (OTCPK:HYMTF) EVs (Ionic 5 and the Genesis GV60) have a problem with charging cutting out because of overheating charge ports, the Volkswagen AG (OTCPK:VLKAF) ID4 has an issue with the driver’s door opening while driving, and General Motors Company (GM) Cadillac Lyriq has a problem with headlights. But those are newer model cars with relatively few sales, and the problems will likely be fixed in later versions.

The Tesla Model 3 and Model Y have by far the highest number of complaints among the best-selling cars, including ICE cars, as shown in the chart below (2023 vehicles, complaints submitted up to Sept 30th):

Complaints per 1000 cars sold (25 best-selling vehicles) (NHTSA database)

Toyota’s 2023 RAV4, which outsells the Model Y, has 16 complaints, compared to 425 for the 2023 Model Y and 164 for the Model 3.

I used the RAV4 for comparison because of Elon Musk’s statement in the Q3 earnings call, which shows the strong emphasis that he puts on price rather the quality as a driver of sales. I quote:

“I mean, to be totally frank, if our car costs the same as a RAV4, nobody would buy a RAV4 or at least they’re very unlikely to” – Elon Musk, Tesla Q3 earnings call.

I think many would disagree.

The key complaints

Three areas in particular are responsible for many of the complaints:

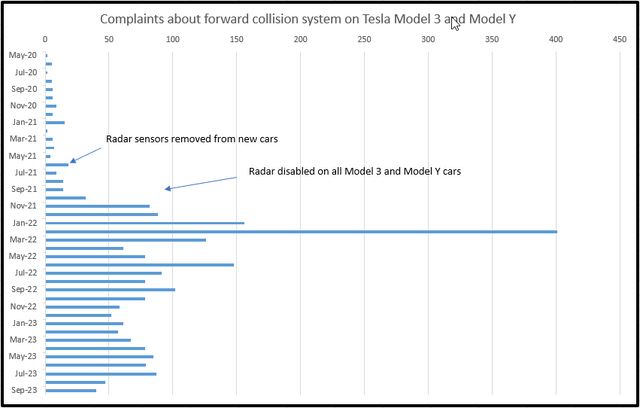

1. The forward collision avoidance system.

As of the end of September, there were 305 complaints related to malfunction of the forward collision avoidance system in 2023 Model 3 and Model Y vehicles. Complaints include failure of the automatic emergency braking system to detect objects in front of the car, and false warnings about forward collision when no object is present in front of the car. This is particularly annoying for those who have Tesla insurance because Tesla increases your premiums if you get too many forward collision warnings. However, the majority of complaints are about “phantom braking,” the tendency of the car to brake for no reason at highway speeds.

Incidences of phantom braking and complaints about the forward collision system have increased sharply since Elon Musk removed radar sensors from the cars.

Complaints about Tesla Forward Collision Avoidance (NHTSA database)

Many of the complaints mention multiple instances of phantom braking, and several owners say they do not use the cruise control or autopilot because of this problem. It is quite clear that Tesla’s vision-only collision avoidance system is dysfunctional, and Tesla doesn’t appear to have a remedy for this problem. Complaints are still being received at the rate of about 2 per day.

Elon Musk doesn’t seem to be aware of the impact his actions have had, both in the elimination of radar and the removal of a few hundred dollars worth of ultrasonic sensors that operated the parking assist features. I quote again from the Q3 earnings call:

“Any fool can reduce the cost of a car by making it worse and just deleting functionality and capability” – Elon Musk, Tesla Q3 earnings call.

Is he calling himself a fool? An even bigger fool would be someone who is aware of his error and fails to recognize and correct it.

There is no way to determine how many sales Tesla has lost because of the elimination of radar and the deletion of parking sensors. I suspect it is significant.

2. Loss of steering

A new and potentially very serious issue has emerged with the 2023 Model 3 and Model Y. The NHTSA database contains 105 complaints starting with one complaint in March of 2023 and increasing to an average of one complaint per day in August and September.

Owners complain of an intermittent loss of power steering, or a complete lockup of steering.

This problem only affects 2023 models. Tesla has been replacing steering racks but has not made any attempt to recall defective cars. That recall seems to be seriously overdue.

3. Sudden unintended acceleration

This has been a problem with Tesla cars for several years. NHTSA investigated the issue in 2021 after a petition was submitted by a member of the public, but that petition was dismissed after Tesla claimed that all the incidences under investigation were a result of the driver pressing the accelerator instead of the brake.

However, a second petition, submitted by Ronald Belt, an expert in automotive systems, claims to have identified a manner in which Tesla’s speed control system can record a false signal indicating that the accelerator has been pressed, and cause the car to accelerate when in fact the driver has his foot on the brake.

This second petition is still under review by NHTSA.

The problem persists, as the NHTSA database contains 38 complaints about sudden acceleration in 2023 Model 3 and Model Y vehicles. This far exceeds the number of similar complaints about other vehicles. The claim that Tesla drivers mistake the brake for the accelerator at a rate that is orders of magnitude more than drivers of other cars is simply not credible.

These are the three most commonly reported safety issues with 2023 Model 3 and Model Y. There are many other complaints including complete system breakdown and disabling of the car, dysfunctional wipers, suspension failures, loose and detached steering wheels etc.

German TUV

Further evidence of safety defects in Tesla cars comes from Germany where cars must be inspected after 3 years, and every second year thereafter. This is the first year with enough Tesla Model 3 inspections to qualify for inclusion in the statistics. The results place the Tesla Model 3 in last place out of 111 cars, with one car in seven failing a 3-year safety inspection, almost three times higher than the average. The German TUV inspection is a physical inspection of the car; it will not expose software issues like phantom braking or sudden unintended acceleration. The key problems with the German cars were associated with the suspensions. German sales will certainly be negatively impacted by the report which was issued earlier this month.

Tesla service

Of course, there are many satisfied Tesla owners who don’t have problems with the cars. But if you are one of the unlucky ones your difficulties are compounded by having to deal with Tesla’s notoriously customer-unfriendly service centers.

There are many complaints on forums and social media about Tesla’s service, including owners who claim they will never buy another Tesla because of the poor service.

But don’t expect much help from consumer protections in the USA. A judge recently decided that Tesla buyers faced with high repair costs and long wait times have no cause for complaint because they should have been aware of the issues when they purchased the car. That’s a strange decision that was declared a win for Tesla but it

Conclusion

Tesla’s automotive revenue peaked in Q4 of 2022, and attempts to boost sales by drastically cutting prices have not had the impact that was expected. The result has been:

- Reduced gross margins.

- Reduced operating margins.

- A 44% fall in GAAP earnings per share

- Flat sales for the last 4 quarters

- A 40% fall in used Tesla prices

- A cheapening of the Tesla brand.

But Tesla so far has failed to address serious issues with the quality of its products and its service. Getting cars out of the factory gate apparently supersedes other priorities in Tesla’s factories, and CEO Elon Musk simply cuts prices if the cars don’t sell. It’s a race to the bottom that Tesla cannot win.

There is no reason to believe that former profit margins can be restored without a major shift in the company’s attitude towards its customers. The safety issues outlined above must be addressed, as they open the company up to warranty and liability claims which will be a future drag on earnings if they are not resolved.

Tesla must spend more money on opening new service centers and training service staff, and on improving the quality of its products. Customers will likely not accept higher prices for the same cars, or any further cheapening of the cars by removing more features.

The rise in Tesla’s share price this year defies all logic. The shares are priced for massive growth, but it is hard to see where that growth is going to come from, and for that reason, I rate Tesla, Inc. shares a strong sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I will probably short this stock after the Cybertruck hype has died down.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.