Summary:

- There is massive cost pressure on EVs in order to boost demand and to compete effectively with low-priced Chinese exports.

- There has been a “flood” of Chinese EVs in the European market, and they have gained 8% share of EVs sold with possible increase to 15% by 2025.

- Tesla has been forced to make a number of price cuts in 2023 which has reduced operating margin from 17.2% in the year-ago quarter to only 7.5% in the recent.

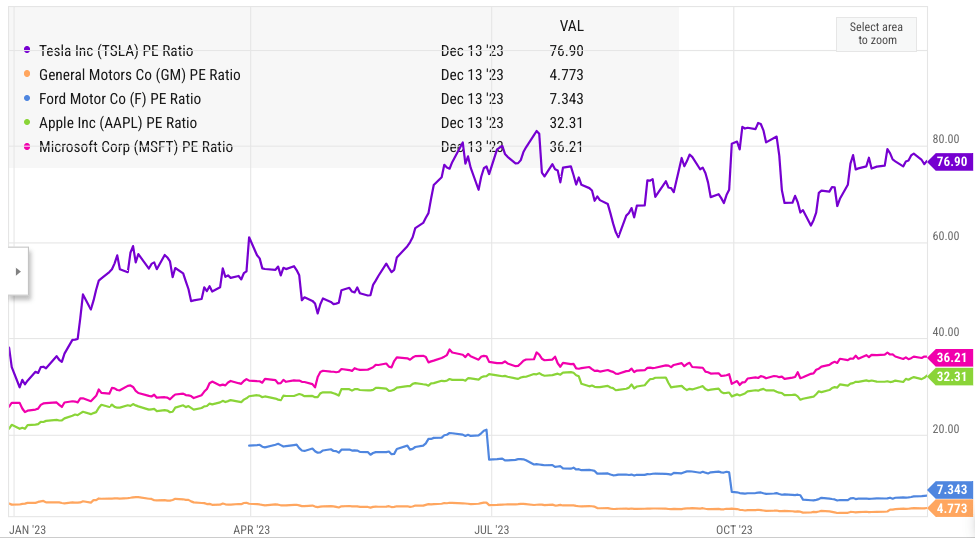

- Despite the cost pressure, Tesla has received greater flexibility from Wall Street which gives the company a competitive advantage against traditional automakers.

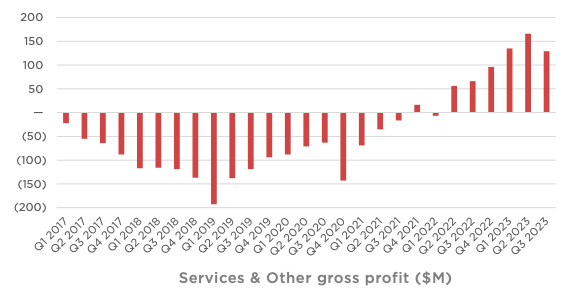

- Rapid growth in high margin service business will be the key in improving the profitability trajectory for Tesla.

Xiaolu Chu

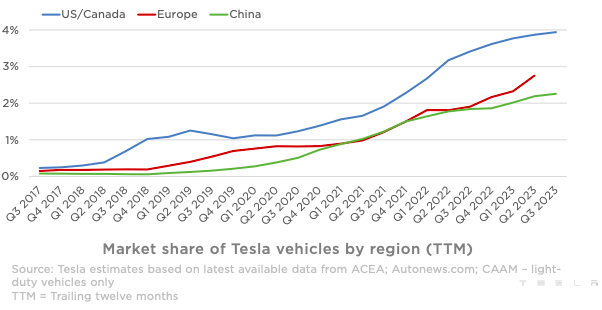

Tesla, Inc. (NASDAQ:TSLA) is facing headwinds due to recent cost-cutting pressures in the electric vehicle (“EV”) industry, an ominous sign of future trajectory. CEO Elon Musk and many other executives in the auto industry have blamed high interest rates and macroeconomic headwinds for a reduction in prices and a fall in margins. However, there is a bigger trend which is building within the EV industry. There is a massive overcapacity within China’s auto industry. The European Union has opened an anti-subsidy investigation against Chinese EVs and blames it for “flooding” the market in the EU. Chinese EVs have an 8% share of the EVs sold in the EU, and it is estimated that this number can jump to 15% by 2025. In a previous article, it was mentioned that Tesla is facing margin pressures.

The domestic market in the U.S. is safe due to growing geopolitical tensions between China and the U.S. However, we could see cost pressure intensify for EVs in the U.S. and other regions as there is a ripple effect across the entire supply chain. Tesla’s operating margin has shrunk from 17.2% in Q3 2022 to 7.5% in Q3 2023. It is certainly possible that Tesla again dips into negative territory as it is forced to keep up with the cost cuts in other EV models. The only long-term solution for Tesla is to build its own ecosystem similar to the App Store in Apple Inc.’s (AAPL) iPhones. The self-driving service being built by Tesla should also improve the product differentiation for Tesla and give greater pricing leverage.

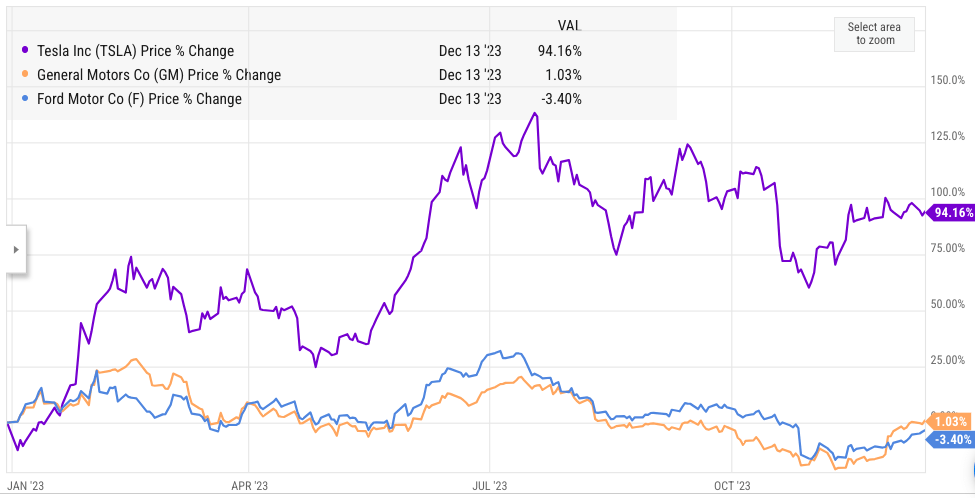

Tesla has a big advantage compared to other automakers, as Wall Street is ready to give greater flexibility to the company in terms of margin and revenue growth. Despite near-term challenges, we could see Tesla build a better growth trajectory with good margins over the next 3-5 years.

Cost pressures are here to stay

Elon Musk has regularly mentioned about the headwinds due to high interest rates, inflation, and other macroeconomic issues. These factors are short-term, and it is expected that once their negative impact reduces, we could see better margin and revenue growth. However, there is a much bigger long-term trend which is quite negative for Tesla and other EV manufacturers. There has been massive overproduction of EVs and battery capacity in China as the government gave more lucrative policies to manufacturers.

The Chinese EV makers have saturated the domestic demand and are now looking for international markets. One of the key regions is the European Union, which has the advantage of huge demand as well as relatively normal geopolitical relations with China. This has allowed the Chinese EV companies to rapidly expand their presence in the EU in the last few quarters. A recent report in Reuters mentions that Chinese EVs have cornered 8% of the total EV share in the EU, and this ratio is likely to increase to 15% by 2025. In Southeast Asia, another key market, the Chinese automakers have cornered a staggering three-quarters of the total EVs sold.

Company Filings

Figure 1: Market share of Tesla in different regions. Source: Company Filings.

This trend can be compared to the 1970s, when Japanese cars started increasing their market share in the U.S. Despite the oil shock of the 1970s eventually ending, the market share of Japanese cars continued to be high. Similarly, we will see better macroeconomic conditions in the next few quarters, but it is very likely that the cost pressure due to overproduction in China will continue to have a long-term impact on Tesla and other EV manufacturers.

Tesla needs its App Store moment

Apple has been able to build a strong ecosystem around its devices which gives it greater pricing leverage. The growth of other Chinese OEMs did not affect Apple significantly, as it had a better branding perception and a strong ecosystem of its App Store. Tesla would also need to add new services and build its own App Store which can increase customer loyalty towards its products. In 2023, Tesla made several price cuts in order to remain competitive. This race to the bottom is not sustainable in the long run, and we have already seen a big drop in operating margins for Tesla.

Company Filings

Figure 2: Increase in Services gross profit. Source: Company Filings.

The strong growth of full self-driving (“FSD”) is a key service that should allow Tesla to differentiate itself from other competitors. The recent failure of General Motors Company (GM)-backed Cruise and the earlier shutdown of Ford Motor Company’s (F)-backed Argo shows that it is very difficult to build a self-driving business that can get regulatory approvals. Both GM and Ford have spent billions of dollars in their self-driving ventures, but they did not reach the monetization stage. This will be a warning for future companies who might be interested to enter this industry. Even Apple has delayed its self-driving operations despite having massive resources to ramp up this capability. It is highly likely that most of the market share will be cornered by three big tech companies – Tesla, Google’s (GOOG) (GOOGL) Waymo and Amazon.com Inc.’s (AMZN) Zoox. This should allow Tesla greater monetization ability and better margins.

Besides FSD, Tesla needs a wide range of services to build its ecosystem. It will be important to gauge the efforts made by the management to improve this ecosystem over the next few quarters.

Tesla’s advantage under cost pressure

Tesla has always received significant leeway from Wall Street when it comes to margins. The company has been able to grow its revenue base from less than $2 billion in 2013 to $95 billion in the trailing twelve months. This is close to 50% CAGR. The management has announced that they are aiming for a similar 50% CAGR revenue growth till 2030. A short-term dip in operating margin is unlikely to cause a major setback for the stock. This gives the management a lot of wiggle room when it comes to pricing.

Other traditional automakers do not have a similar leverage, and they are more focused on profitability. This will make it harder for them to absorb the massive price cuts due to increases in EV production in China.

Ycharts

Figure: YTD performance by Tesla, GM, and Ford. Source: YCharts.

Both GM and Ford have maintained their operating margin in the last few quarters, but their stock has performed poorly. On the other hand, Tesla has seen a massive dip in operating margin in the last few quarters, and yet the stock has seen close to a 100% jump in 2023.

We could see a further dip in operating margin in the next few quarters from Tesla. However, the bigger factor affecting its stock price trajectory will be the reception of new models like Cybertruck and its ability to successfully monetize FSD and other services.

Future trajectory in Tesla stock

Tesla stock has become more expensive after the massive bullish run in 2023 and also due to a dip in profitability. The valuation gap between Tesla and other Big Tech companies has increased significantly in 2023. It is unlikely that Tesla will be able to change its margin trend significantly in 2024 or even 2025. However, the long-term ability to monetize FSD and other services should help in giving Tesla a better profitability roadmap.

Ycharts

Figure: P/E ratio of Tesla in comparison to Apple, Microsoft, Ford, and GM. Source: YCharts.

Wall Street will closely look at the business model and profitability of the autonomous driving industry after the failure of Cruise and Argo. Google’s Waymo has already started increasing its paid trips in several cities. CNBC made a back-of-the-envelope calculation estimating that it would take 5,000 robotaxis to reach $1 billion in annualized revenue rate. This is certainly possible for Tesla in the next few quarters as it increases the cumulative miles driven with FSD technology.

The current cost pressures faced by Tesla are likely to remain even if the macroeconomic situation improves dramatically. The future service ecosystem of Tesla will be the key factor in building greater pricing leverage and better monetization of its customers.

Investor Takeaway

Tesla is facing strong headwinds due to cost cuts in the EV industry. There is a massive amount of overproduction of EVs and battery capacity in China. This will have a ripple effect in all regions over the next few quarters. EU is already showing a surge in Chinese EV market share which is putting pressure on pricing for Tesla in that region.

Tesla needs its own App Store to build a better ecosystem, customer loyalty, and higher monetization options. Recently, Tesla has shown an increase in gross profit for services while the overall operating margin declined. Wall Street has overlooked the margin decline and slower revenue growth and focused on the Services growth. This trend should continue in the near term, as the margins on auto sales will be under pressure while Services revenue will grow.

Despite the bull run, high valuation multiple, and short-term headwinds, Tesla stock is a Buy. The company is in a good position to build its Services business while showing a strong CAGR in revenue metrics due to a good product pipeline.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.