Summary:

- I downgrade Tesla stock from ‘Sell’ to ‘Strong Sell’ due to severe overvaluation and emerging industry challenges impacting its fundamental business.

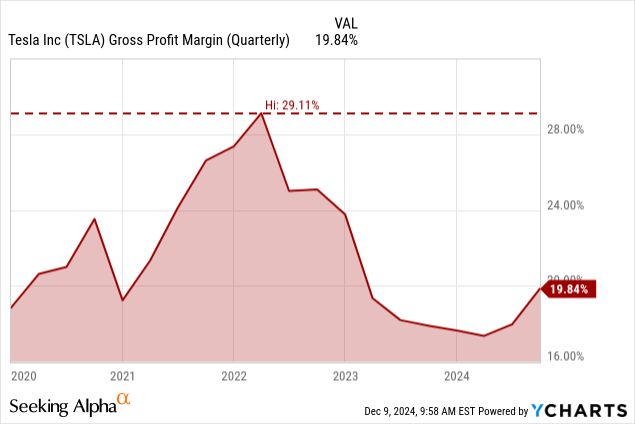

- Tesla’s Q3 2024 revenue growth decelerated to 8% YoY, with automotive gross margins dropping to 20.1% from 29% in 2022.

- Market saturation, reduced government incentives, and intensifying competition from Chinese manufacturers and new entrants threaten Tesla’s margins and market share.

- Cybertruck production issues and potential demand shortfall highlight broader market challenges, suggesting significant downside risk despite Tesla’s technological and brand advantages.

sefa ozel

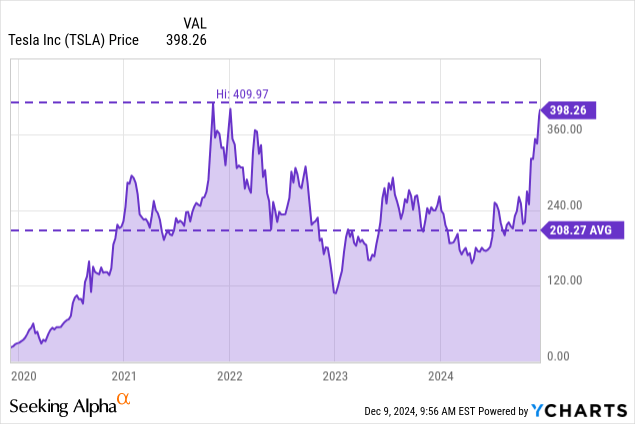

Tesla (NASDAQ:TSLA) is approaching its all-time highs, and I am downgrading my rating from ‘Sell’ to ‘Strong Sell’ due to its severe overvaluation relative to its fundamental business, particularly in light of emerging industry challenges and operational headwinds.

The stock’s recent 54% rally following Trump’s electoral victory was driven primarily by investor optimism about potential regulatory relief due to Elon Musk’s alliance with Trump. However, Tesla’s Q3 2024 financial results paint a more sobering picture. The company’s revenue growth has decelerated significantly, with total revenue increasing just 8% YoY to $25.18 billion. This dramatic slowdown from Tesla’s historical growth rates suggests the company is entering a stagnation or deceleration phase of its business cycle.

The most concerning is the state of Tesla’s core automotive business. The segment’s gross margin of 20.1% in Q3 2024, while showing a slight sequential improvement, remains well below the 29% achieved in 2022. This compression is mainly because of intensifying competitive pressures and the impact of multiple price reductions throughout 2023 and early 2024. The margin trajectory becomes even more worrying when considering the broader context of the EV market.

According to the McKenzie Center for Future Mobility’s latest survey, 46% of current EV owners are considering switching back to internal combustion engine vehicles for their next purchase. This is particularly alarming as it suggests that even early adopters that are typically the most committed segment of any new technology market are now experiencing sufficient pain points to consider abandoning the technology.

Competition from Chinese manufacturers creates another mounting challenge. While Tesla’s China deliveries fell 4.3% YoY to 78,856 units in November domestic competitor BYD (OTCPK:BYDDF) achieved remarkable growth of 67.87% during the same period. This shift in market share dynamics is especially significant given China’s importance as both a production hub and key market for Tesla.

Looking ahead to 2025, I anticipate these challenges will intensify. The combination of market saturation, reduced government incentives, and increasing competition from both traditional automakers and new entrants like Xiaomi’s SU7 threatens to further pressure Tesla’s margins and market share. While Tesla maintains significant advantages in technology and brand recognition, I believe the risk-reward profile at current prices is unfavorable.

Market Saturation and Industry Headwinds

There are several concerning trends that point to a fundamental shift in the industry’s trajectory.

First, we’re seeing a systematic reduction in government support. The tax credits that previously offset the price premium of electric vehicles are being scaled back in many markets. This is particularly impactful because these incentives were masking the true cost differential between EVs and traditional vehicles. The average new car price of $50,000 becomes even more challenging for consumers in an environment of high interest rates and inflation making the premium pricing of EVs increasingly difficult to afford.

Second, Chinese manufacturers have achieved remarkable scale and efficiency, as evidenced by BYD’s 67.87% YoY growth. However, this success has triggered protectionist responses in key markets. The implementation of tariffs targeting Chinese EVs has created a complex dynamic where manufacturers must choose between maintaining competitive pricing and preserving margins.

The impact is already visible in Tesla’s numbers. The broader market implications become even more concerning when considering that new competitors like Xiaomi are entering the market with sophisticated offerings like the SU7 which directly targets Tesla’s premium positioning.

These interconnected challenges paint a concerning picture for Tesla and the broader EV industry. While Tesla maintains significant advantages in technology and brand recognition, I believe the combination of market saturation, reducing government incentives, increasing competition and changing consumer preferences will create substantial headwinds for growth and profitability in the coming years.

Revenue Growth Deceleration

In my last article about Tesla I discuss in detailed about Tesla’s overvaluation

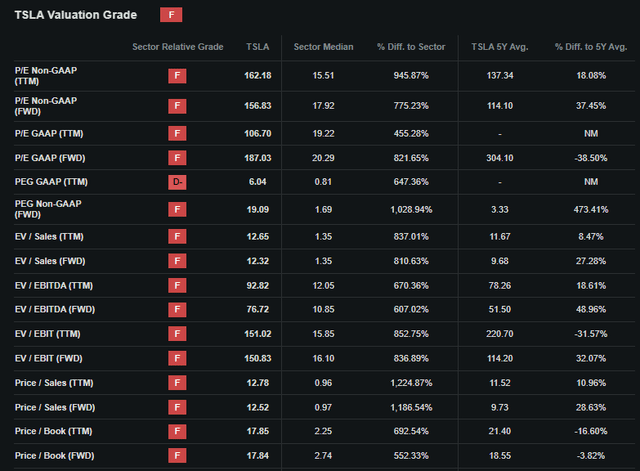

This picture speaks for itself:

Currently, Tesla trades at a forward P/E ratio GAAP of 127.26 compared to the sector median of just 17.18, reflecting a massive 588% premium. This disconnect is alarming to me because Tesla’s growth rate does not justify such a high multiple when revenue growth YoY has slowed down to just 1.28% and its EBITDA growth has contracted by 12.38%.

Some people might argue that Tesla is not a car company, it’s an AI and tech company Okay, For instance, Alphabet’s Waymo and GM’s Cruise both have operational robotaxi services, yet they don’t face the same level of stock price inflation. Alphabet’s (GOOG), (GOOGL) P/E forward ratio is around 21.27, a far more reasonable figure given its autonomous driving progress. Similarly, NVIDIA Corporation (NVDA), which provides Operational Systems and GPUs autonomous vehicle technology, has a forward P/E ratio of 51.75 which is still expensive but more justifiable considering its outsized revenue growth of 194.69% YoY. Tesla’s 1.28% revenue growth pales in comparison. Tesla is trading at an EV/EBITDA (TTM) of 61.39 compared to the sector median of 11.28. Additionally, Tesla’s P/S ratio of 8.52 is 803% higher than the sector median. – Read the Article In Detail

In Q3 2024 while total revenue reached $25.18 billion, the 8% YoY growth rate represents a dramatic deceleration from Tesla’s historical performance. This slowdown is even more significant when examining the core automotive business where sales revenue grew a mere 1% YoY to $18.83 billion.

While the Q3 2024 automotive gross margin of 20.1% showed a modest sequential improvement, this figure must be viewed in context. The current margin levels represent a significant deterioration from the 29% achieved in 2022, and my analysis suggests this compression is likely to continue.

Manufacturing efficiency also presents challenges. The company is experiencing higher costs during new model ramps, particularly evident in the Cybertruck production process. The recent production pause in December 2024 points to potential issues with manufacturing optimization and capacity constraints. These operational challenges are reflected in the company’s overall gross margin of 19.8% in Q3 2024 and I believe will face further pressure as competition intensifies.

Cybertruck Production Issues

Tesla notified workers at the Austin factory to take three days off from the Cybertruck production line, with workers still receiving eight hours of pay for each scheduled workday. Factory workers have reported inconsistent scheduling patterns since late October with multiple instances of workers either being sent home upon arrival or being reassigned to training exercises and cleaning duties to fill their scheduled hours.

The timing of these production issues is especially problematic given Tesla’s ambitious plans for the Cybertruck. While the company recorded over 2 million reservations, the conversion rate from reservations to actual orders appears concerning. This becomes more significant when considering that these reservations required only a $100 deposit, a small commitment that may not accurately reflect genuine purchase intent. The contrast between the high reservation numbers and the current production challenges suggests a potential mismatch between anticipated and actual demand.

One particularly telling comment from a Cybertruck line worker with several years of experience at Tesla highlights the severity of the situation:

“When I started at Tesla you could expect to get overtime pay, now I feel lucky to get 40 hours.”

Typically, automotive companies see their highest sales in spring months when consumers receive tax refunds and driving conditions improve. Therefore, if Tesla were anticipating strong Cybertruck demand in the coming months the factory should be operating at full capacity now to build inventory. Instead, the apparent inventory backup suggests a potential demand shortfall that could impact Tesla’s 2025 revenue projections.

These production challenges also need to be viewed in the broader context of Tesla’s market position. While the company sold approximately 28,000 Cybertrucks in the first three quarters of 2024, falling short of analysts’ expectations of 48,500 units for the year, competitors like Rivian (RIVN) and Ford (F) are also struggling with their electric truck offerings. This suggests that the issues might extend beyond Tesla-specific problems to indicate broader market challenges in the electric truck segment.

To Sum Up,

The challenges I’m seeing aren’t just temporary speed bumps, they’re fundamental shifts in the market that, I believe, will reshape Tesla’s future. I keep coming back to one simple truth: Tesla’s current valuation of $1.25 Trillion assumes everything will go right, when I’m seeing multiple signs that things are going wrong.

But don’t get me wrong. Yes, Tesla still leads in EV technology and brand value. Yes, they could surprise us with robotaxis or some new innovation. But at these prices, I believe the risks far outweigh the potential rewards.

So here’s my bottom line: The market’s enthusiasm about Trump and regulatory relief is masking deteriorating fundamentals that, I believe, will become impossible to ignore in 2025. I don’t expect Tesla to collapse, but I do see significant downside risk from current levels. I believe Tesla is at that inflection point now. Better to acknowledge it early than wait for the market to force the issue.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.