Summary:

- Tesla, Inc. reported tough Q2 earnings with declining margins and profits, struggling with weak vehicle demand.

- The company’s hubris is evident in overinvestment in capacity and side projects, such as AI, with uncertain returns.

- Tesla’s valuation is not justified by its financial performance, market potential, or competition in the self-driving industry, making it a poor investment choice.

Richard Drury

Tesla, Inc. (NASDAQ:TSLA) recently reported tough Q2 earnings, which put strong pressure on the company’s share price. The timeline of the company’s earnings lined up with CEO Elon Musk kicking off a poll on X about whether Tesla should invest $5 billion in xAI. Of course, the platform for the poll, Tesla, and xAI are all Elon Musk companies.

As we’ll see throughout this article, the company’s tough earnings combine with a management that cannot focus on the company’s vehicle business, which makes the company a poor investment.

Tesla Financial Summary

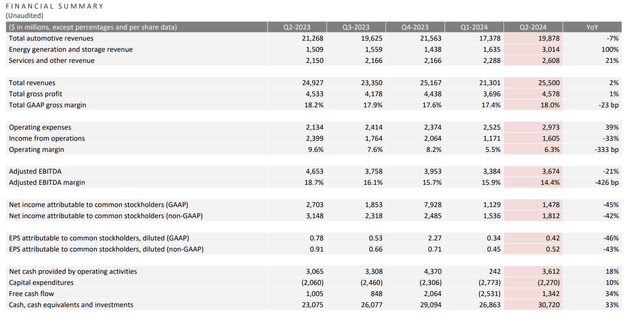

Tesla had a tough quarter financially as revenues increased by less than inflation in relation to a lofty valuation.

The company’s quarterly revenue was just over $25 billion, with GAAP gross margins decreasing by 0.23% annually. The company is struggling to continue increasing its margins, not surprising given the tough nature of the vehicle industry. The company’s operating margin declined by a much more significant 3% to just over 6% and its EBITDA margin declined by more than 4%.

At the end of the day, the company’s EPS, both GAAP and non-GAAP, declined by more than 40%. The company’s revenue continues to be supported by businesses such as energy generation and storage, which doubled over the past year. This is a reasonable business and one of the company’s more exciting, but it won’t dwarf the company’s automotive business.

The company’s FCF was positive, but relatively weak, at more than $5 billion annualized. That gives the company a FCF yield of ~0.8%. The company needs to increase FCF by an order of magnitude to justify its valuation, something that 2% annual YoY revenue growth as margins decline won’t justify.

Tesla Operational Results

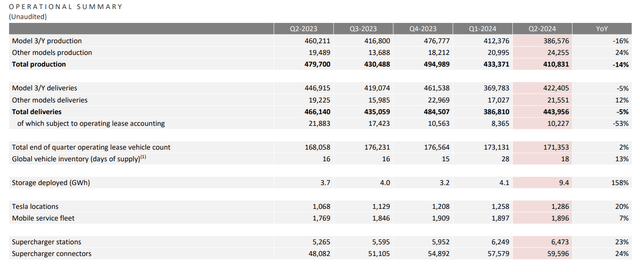

From an operational perspective, the company has continued to struggle with weak demand for its vehicles.

The company’s production has now declined for 2 quarters in a row, and its Model 3 production has gone down by 16% YoY. The company has seen some strength in its other models, supported by Cyber Truck deliveries ramping up, but quarterly Cyber Truck sales now seem to be ~10k. The company’s deliveries remain higher than production but also down YoY.

Overall, the company’s total deliveries YoY are down 5%, a massive hit for a company where lofty growth expectations are 40-50% annual vehicle sale growth. The company is also seeing lease vehicle counts remain fairly hefty with global inventory, as days of supply are also up YoY for the company.

The company has continued to deploy large amounts of storage, which is a bright spot for its portfolio. However, there’s a cap to the market potential here. The company deployed 9.4 GWh in storage, earning ~$300 million / GWh in deployment. It’s worth noting that this is also a sign of weak vehicle demand, given the company deploys battery capacity to vehicles preferentially.

Energy storage remains a growing market, however, total added demand is expected to be roughly 1 TWh going into 2030. The company’s current production rate will be ~250 GWh of that, indicating that even if it takes over the entire market, there is a limit to revenue growth. That’s not enough to justify a $700+ billion valuation.

Tesla’s Hubris

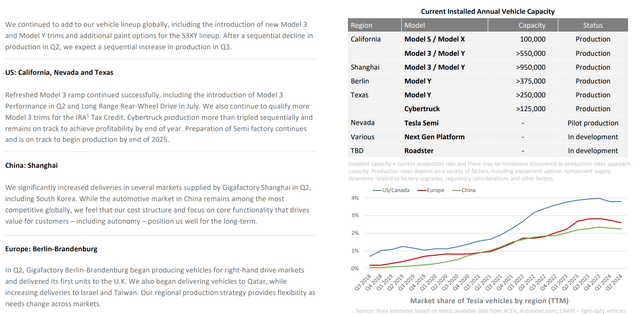

Tesla’s hubris is evidenced through its continued building of capacity as the company expands its lineup and spends large amounts of capital.

By the company’s own admission, its annual capacity is roughly 2.4 million vehicles annually. However, the company’s deliveries have been trending down, and demand for its vehicles is roughly 1.8 million vehicles annually. That’s only 75% of its vehicle capacity. The company’s market share in numerous key markets seems to be flattening out.

The issue for the company is continuing massive investments that might not see the demand for the long term. The company said it expects an increase, but without growth in market share, that remains to be seen. That’s especially true given that EV buyers around the world want to return to gas vehicles. EV demand remains weak across all markets by most estimations, and ASP continues to decline.

All of these things are signs of Tesla’s continued over-confidence and overinvestment in relation to its valuation.

Tesla Overspending

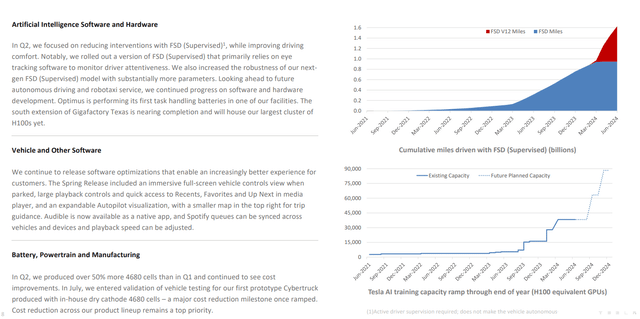

Tesla at the same time, is chasing various side pursuits, with massive spending that might not pan out.

The company is planning to add roughly 60k H100 equivalent GPUs by year-end. At roughly $25k per GPU, that’s roughly $1.5 billion in new GPUs that the company is adding by year-end. This is on a business that’s driving no profits at all to the company’s bottom line. The company is not an AI player but is arbitrarily attempting to be one.

That’s versus multi-trillion companies such as Google, Meta, and Amazon that have much more capacity than Tesla to invest and compete. That’s tough given that Tesla’s FSD is still nowhere near its goal to build a self-driving taxi fleet. The self-driving fleet is a key part of investors, such as Cathie Wood’s thesis.

However, even in its home base of the Bay Area, Tesla is being outcompeted by Waymo, backed by Google, which is actually earning revenue. We’ve taken a ride on Waymo in San Francisco, and it’s a phenomenal experience. However, it’s worth noting that leader Waymo’s valuation is ~$30 billion, meaning that the entire business is <5% of Tesla’s market cap even if it has an equivalent valuation.

Thesis Risk

The largest risk to our thesis is that Tesla is effectively a company filled with moonshot investments. Any of these investments could hypothetically pan out tomorrow. While we don’t see a path to that happening, betting against a company is risky, and could hurt the ability to generate shareholder returns in your portfolio.

Conclusion

Tesla recently announced tough earnings, as the company that’s supposed to have double-digit growth to justify its valuation saw revenue grow less than inflation. That was combined with a massive impact on profits as the company’s profit margins continued to face strong pressure. The company’s core vehicle demand remains weak.

There are some bright spots in the company’s portfolio. These include areas such as energy storage. However, the market isn’t big enough to justify Tesla’s valuation, and the company has previously said it’d redirect battery capacity here from cars when the market is weak since cars are more profitable.

All this combines with Tesla losing the self-driving race to Waymo and a distracted management spending billions on artificial intelligence. Elon Musk, the CEO, is using Tesla billions to invest in other hobbies and projects. Putting this all together, Tesla is an overvalued company that can’t justify its valuation, making it a poor investment.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.