Summary:

- I believe Tesla, Inc. stock is currently in a buy zone and investors should consider forming a long position or holding the stock in their long-term portfolio. Read on.

- Tesla’s Q4 2023 gross margin experienced a severe YoY decline, but it’s starting to show some signs of bottoming out.

- I’m bullish on Tesla’s long-term growth prospects due to its leadership in the EV and cleaner energy sectors, with additional potential upside from projects like robotics.

- Today’s Tesla price challenges present a prime opportunity for a long-term position, potentially yielding over 10% annually by 2030, even at current prices, based on my findings.

- I’m therefore rating Tesla, Inc. stock a “Buy” for the first time today.

Leon Neal/Getty Images News

My Investment Thesis

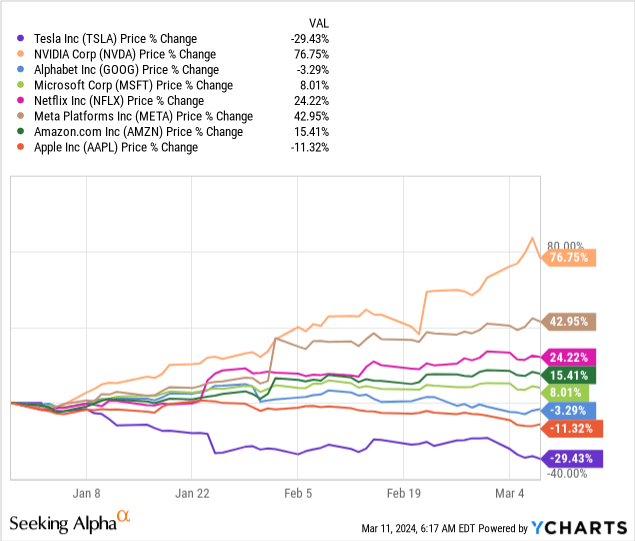

Tesla, Inc. (NASDAQ:TSLA) is one of the largest U.S. companies in terms of stock market capitalization. However, in recent months its share price performance has raised doubts among investors whether it is still reasonable to hold the laggard:

After looking at various sources and doing my analysis, I believe that TSLA stock has already entered a buy zone where its price can be considered reasonable for the potential business growth shareholders are set to receive over the next few years. So, I think investors should gradually start to form a long book in TSLA or hold the stock if it is already in their long-term portfolio.

My Reasoning

First of all, I would like to explain the sources I used for this, my first article about Tesla Inc. They are Goldman Sachs’ November 2023 report, RBC’s February 2024 industry research report, Barclays’ comments on the fourth quarter of FY2023 results, Morgan Stanley’s TSLA stock outlook for FY2024 (December 2023), and Argus Research’s January 2024 report. All these sources are proprietary, which I would like to emphasize right at the beginning – this fact forces me to refer to the analyzed information in a special way, without publishing individual fragments of the reports, in order to avoid copyright infringement. Of course, I use the latest 10-K, press releases, and management comments as well as other publicly available sources. So let me start with the public information first.

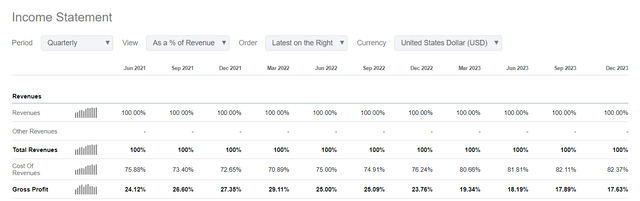

Based on the press release, in Q4 2023 Tesla produced ~495,000 vehicles and delivered ~484.5 thousand vehicles, which is about 12.75% and 19.5% higher than last year, respectively. The company’s revenue increased by 3.49% YoY, and the gross margin – one of the main metrics all investors are keeping a close eye on – experienced a YoY slump of 613 basis points. On a QoQ basis, however, the company’s GP margin only fell by 26 b.p., which can be considered a good result under the current macro conditions and against the backdrop of growing competition in the world of EVs.

Seeking Alpha Premium data, TSLA

According to Barclays’ report, the consensus margin for Q4 2023 was at ~17%, so Tesla’s actual gross margin surpassed the market’s expectations, indicating that the GP margin is past the trough now. So with progress being made in the development of the Model 2 (Tesla’s next-generation vehicle) and a more concrete timeline for the start of production (expected in 2H 2025), excitement in the market could increase, the analysts add.

Indeed, last quarter Tesla saw a 3.4% QoQ reduction in vehicle cost per unit, dropping to around $36,000/unit due to volume growth (i.e., better fixed cost absorption), lower raw material costs, and potentially higher IRA benefits. But Barclays expected an ongoing ASP compression amid tough pricing conditions, with a forecasted 4% QoQ ASP reduction in 1Q FY2025. While Tesla aims to maintain pricing discipline in 2024, competition may force further price cuts. This was said at the end of January, and by mid-February Tesla reduced prices again, making Barclays’ forecast come true:

Seeking Alpha News, Oakoff’s notes

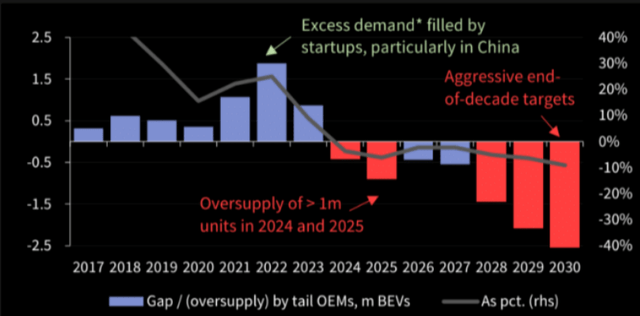

But as far as I can see, this is not unique to Tesla. According to RBC’s report, there’s currently no evidence yet that the EV market slowdown is reaching its nadir. This is evidenced by Ford Motor Company’s (F) worsening EV losses in Q4 FY2023 and its FY2024 guidance, which is worse than expected. General Motors Company (GM) reported modest BEV sales in FY2023 (though beating consensus), selling 170,000 units, with a forecast to sell 250,000 this year. For reference, compare it to Tesla’s 1.8 million deliveries in FY2023 and consensus expectations of 2.1 million for FY2024. We learn even more about the quality of the currently deteriorating EV landscape from Magna International Inc. (MGA), which has moved its breakeven guidance for megatrend investments from 2025 to 2026, citing the ongoing EV slowdown as a major factor. Aptiv PLC (APTV) has also lowered its long-term gross operating margin forecast from 8-10% to 6-8%, citing the decline in the high-voltage business, a segment driven by EVs.

Overall, I don’t expect electric vehicle manufacturing – now TSLA’s biggest revenue pot – to be the company’s main focus going forward. Years of electric vehicle development and the rapid growth of the financials of the pioneers have attracted so many firms and start-ups wanting a piece of the pie that the overall EV market going to get oversupplied very soon (if not already), according to a study by Redburn Atlantic (proprietary source):

Redburn Atlantic (proprietary source), cited by TME newsletter

Elon Musk is, as far as I can tell, a mission-driven person. If many years ago, when he was just starting to build Tesla, he wanted to solve the environmental problems associated with the proliferation of ICE vehicles, then in the current conditions of oversupply that goal seems almost achieved. Next, he’s likely to shift focus to AI, full self-drive (“FSD”), robots, clean energy markets, and improving existing EV software.

Tesla needs a business model change, and I agree with Nick Colas, who said in a recent interview with CNBC that TSLA should consider a $10 billion to $15 billion capital raise to drive its transformation from an automaker to a disruptive technology company. I do not presume to judge the appropriateness of this figure, but according to Nick this should be sufficient, and for a company as large as TSLA such a capital increase is more than possible.

At the same time, Tesla does not have to give up on defending its current market leadership in the EV market when such a transition is imminent. The company has to seek to develop infrastructure, services, and related products and constantly expand its offerings. One of the company’s projects – the Supercharger Network – is expected to become a major revenue driver in the coming years as many automakers, including Ford, GM, Volvo, Mercedes-Benz, and BMW, have agreed to adopt the Supercharger charging standard (NACS) in their electric vehicles by early 2024-2025, according to analysts at Argus Research. This will allow owners of these vehicles to use Tesla’s Superchargers, which are the largest fast-charging network in the world with 5,952 stations at the end of Q4 2023.

So even though the recently reported slower growth in both vehicle deliveries and EPS creates an overhang on the stock in the short term, I believe that Tesla is well positioned for longer-term growth given its leading position in the EV, cleaner energy markets; the tailwinds from other projects like robots add some upside to this story.

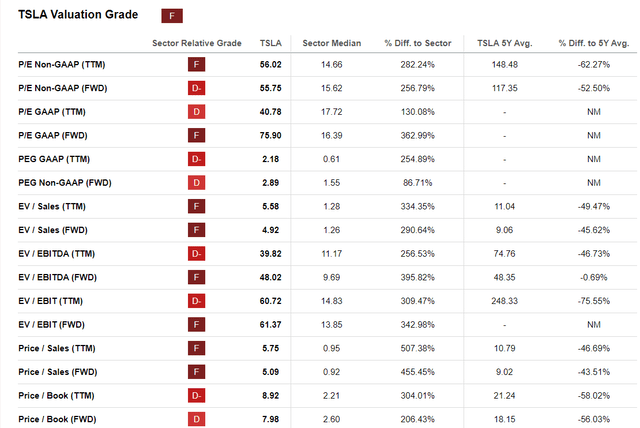

Talking about the company’s valuation today, Tesla’s PEG ratio for next year of 2.89x may seem very high to many – especially compared to the sector median of 1.55x. And in general, we see no signs of undervaluation in the overall picture of Tesla’s valuation multiples:

Seeking Alpha, TSLA’s Valuation

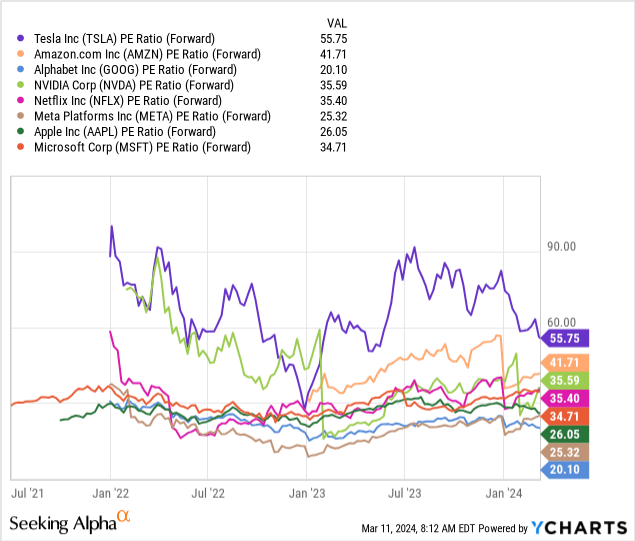

But let’s look at this picture from a slightly different angle. What if we were to look at TSLA as a full-fledged technology company and not just a car company? Then, given its size, we have to compare it to other “Magnificent 7” companies. What do we see? Tesla stock appears to be extremely overvalued on a price-to-earnings ratio basis:

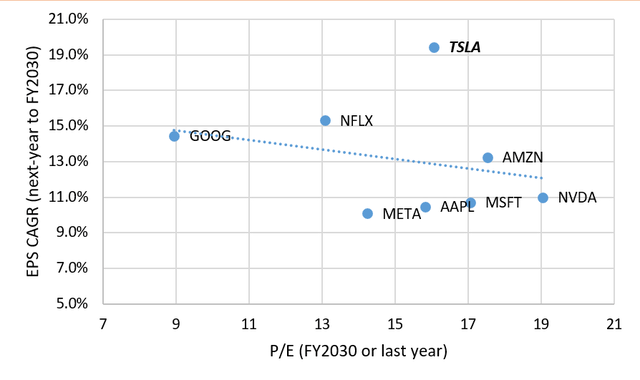

However, if we use the long-term growth potential of the companies as a comparison and then also compare it with the implied P/E ratios, we now see that TSLA is becoming one of the most undervalued stocks in the peer group:

Oakoff’s work, based on Seeking Alpha Premium

In other words, this graph can be described as follows: If an investor chooses between buying TSLA and other mega-caps, buying Tesla stock today will give him/her the highest earnings per share growth rate at a roughly average implied P/E ratio.

Of course, there is a high risk that the market’s current view of EPS will change dramatically in 5-6 years. Therefore, the current growth rate may be a bit too high. But if my assumption about the rapid repositioning of the company from a pure car company to a full-fledged tech giant over the next few years comes true, then by the logic of things we will see a slower contraction of the multiple. This means Tesla is likely to maintain its high multiples for longer than currently expected – which bodes well for good total returns over the next few years.

Speaking of concrete figures: If we assume that Tesla’s P/E ratio is in the 25-30x range by FY2030, then at the current consensus earnings figure of $10.92 per share, the stock should get to the mid-range of ~$300. That equates to a total return of about 71.3%, giving a CAGR of 10.48% over the next 6 years.

Risks To Consider

While I remain optimistic about Tesla’s growth prospects, some risks should be carefully weighed before you make any investment decision.

First, the ongoing slowdown in the electric vehicle market combined with intensifying competition is challenging Tesla’s dominance and market share. So pricing and margin pressures exacerbate these concerns and may impact profitability given competitive pricing dynamics.

Second, the transition to a disruptive technology company poses risks as Tesla will need to make operational adjustments and investments to expand its offering – this is where the execution risks come in. Also, the absolute valuation metrics raise eyebrows about potential overvaluation as the macroeconomic factors add complexity to Tesla’s growth trajectory, killing the valuation premium (i.e., the multiple keeps shrinking faster, which is not good for the stock price).

This is why every existing or potential investor must keep a close eye on industry trends and the dynamics of the competitive landscape. Tesla’s gross margin over the next few quarters must show that it has bottomed out and is ready to stabilize and eventually rise. It’s also important to look at the non-EV segments and their health – from what we’ve seen in Q4 2023, everything is going well so far. But whether this trend will continue in the future is a big question.

Your Takeaway

When you buy a stock like Tesla, you’re buying a ticket to the future, so to speak. It’s very important that this ticket does not expire. From what I see today, Tesla’s “ticket” is still valid: the company continues to develop in different directions and is actively trying to ride several waves at once. I don’t think multitasking will hurt the company in the long run; on the contrary, it’s a great way to expand and diversify the business structure and gain a foothold in new, promising end markets. The most important thing in this case is to have a visionary at the helm who has the ability to take on several tasks at once. Elon Musk’s entire biography shows us that this is just one of those cases.

I see today’s difficulties in TSLA price action as an excellent opportunity to take a long-term position, which may have to be averaged down, but which I calculate should yield more than 10% annually by 2030 even at today’s prices.

I’m therefore rating the stock a “Buy” for the first time today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.