Summary:

- Tesla, Inc.’s 20% post-earnings surge has recovered most losses incurred after its underwhelming Robotaxi event.

- Tesla’s solid Q3 earnings release supports the thesis that the worst is likely behind the EV leader.

- However, the market isn’t dumb, given Tesla’s sky-high valuation amid EV growth challenges.

- Tesla’s fast-growing energy storage business might not be sufficient to justify the optimism baked into its autonomous driving ambitions.

- I argue why betting against TSLA isn’t wise. However, going long on the stock seems too aggressive at the current levels.

Michael Swensen/Getty Images News

Tesla: 20% Post-Earnings Surge Recovered Most Of Recent Losses

Tesla, Inc. (NASDAQ:TSLA) investors cheered the EV leader’s Q3 earnings release as TSLA surged more than 20% on October 24. As a result, it has recovered most of the losses since its relatively underwhelming Robotaxi Day in early October. The significant volatility in the stock has likely stunned inexperienced TSLA holders as the market reassesses the Elon Musk-led company’s EV growth profile.

Doubts about Tesla’s launch of “more affordable” vehicles dominated the narrative at its Robotaxi event. Reports about human-controlled Optimus robots made the news in the financial media, as investors were concerned about the company’s autonomous ambitions. Hence, questions from bearish investors about what has changed over the past two weeks that led to yesterday’s surge are justified.

Management remains optimistic about scaling Tesla’s autonomous aspirations over the next two years. However, I assess that the de-rating that followed its Robotaxi event in early October suggests the market is increasingly focused on the company’s near-term growth prospects. Therefore, Tesla’s ability to deliver a growth inflection in its financial performance could indicate the worst is likely over.

There were already green shoots of a recovery in early October when Tesla posted delivery growth in Q3, outperforming Wall Street’s estimates. In my previous TSLA article, I urged investors to remain cautious, as Tesla could disappoint at its Robotaxi event. My thesis panned out as the market digested the overstated hype, although this week’s spectacular post-earnings surge has reversed the initial decline.

Tesla’s Q3 Earnings Suggests The Worst Is Likely Behind Us

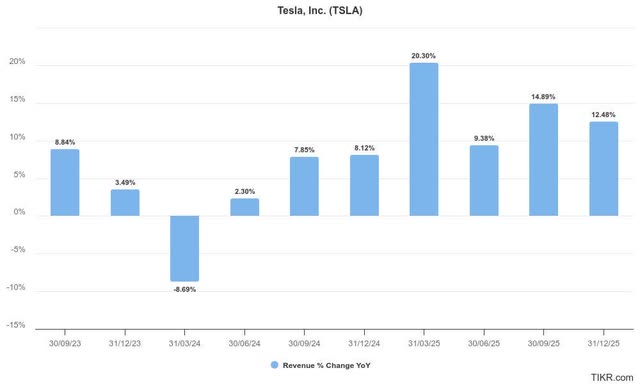

Tesla revenue estimates (TIKR)

Tesla’s performance in Q3 underscores its pre-eminent position as the world’s leading EV maker. As seen above, it recorded a 7.8% YoY increase in revenue in Q3, corroborating the recovery momentum it posted in Q2. Tesla has continued to manage its pricing levers to improve its competitiveness. The intense competition in the EV industry has hampered the company’s ability to drive a more robust topline growth profile. The high-interest rate environment has continued to affect affordability, although the headwinds have likely peaked. Despite that, Tesla’s ability to navigate these challenges and achieve a revenue growth inflection is a testament to its market leadership, scale, branding, and customer confidence.

Notably, Tesla notched solid results with its Cybertruck, becoming the “third best-selling EV in Q3 in the US.” Therefore, the market is likely increasingly confident in its growth prospects through 2025, corroborating the EV leader’s market dominance.

Tesla’s Scale Could Lift Its Margins Further

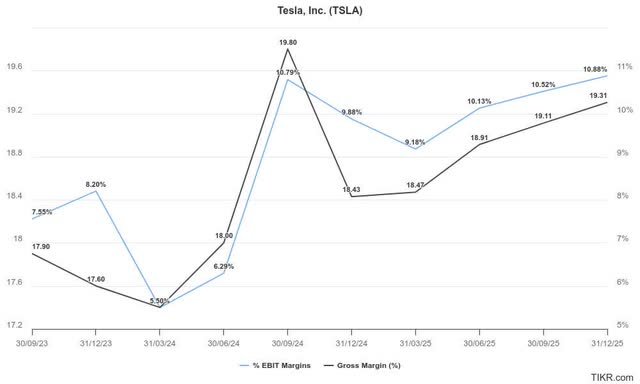

Tesla profitability estimates (TIKR)

Management indicates macroeconomic challenges in Q4 could hamper its robust automotive gross margin recovery. However, its ability to post a solid corporate gross margin of almost 20% demonstrates the sustainability of Tesla’s scale.

In addition, Elon Musk telegraphed his confidence in achieving 20% to 30% in vehicle growth rates next year, justifying the recent optimism. As a result, Tesla’s increasing scale should position the EV leader well into potential delivery estimates of above 2M for 2025.

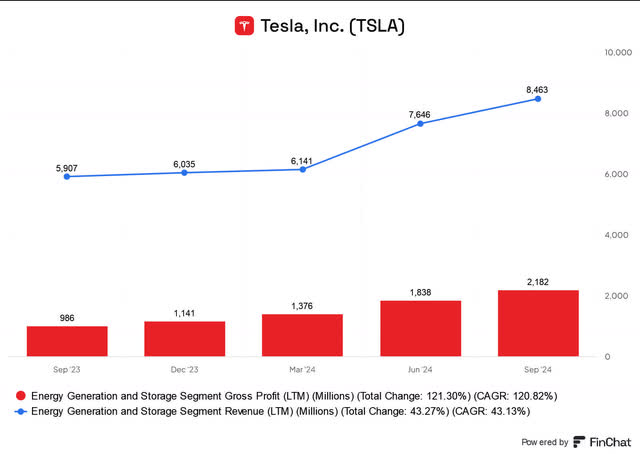

Tesla energy generation and storage metrics (FinChat)

Coupled with the continued growth in its energy generation and storage business, I assess that the market has turned more constructive with the recent proof points. As seen above, Tesla’s energy business has continued to do well, posting a topline growth of more than 40% on a trailing twelve-month basis. Given its improved scale, its gross profitability has also been lifted markedly, reaching nearly 26% in Q3 (trailing twelve months basis).

As a result, Tesla has demonstrated its ability to chart a significant growth vector through its energy business, even as its EV growth has decelerated. Although its energy business remains nascent (relative to its automotive business), it’s expected to play an increasingly critical role moving ahead.

Solar energy capacity has surged to new highs, gaining significant influence in the renewable energy industry. Hence, I assess that cautious or bearish investors (including myself) have likely understated Tesla’s capabilities to expand its growth drivers, notwithstanding the slowdown in its core EV business.

TSLA Stock: But, Hasn’t The Market Priced Them In?

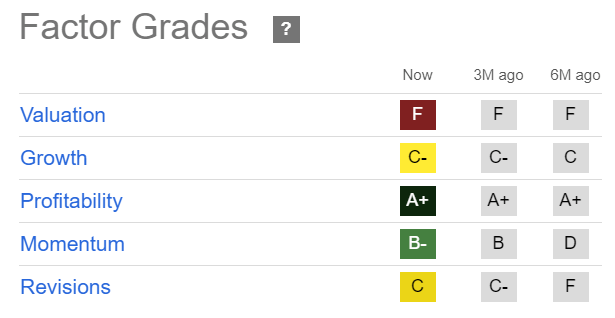

TSLA Quant Grades (Seeking Alpha)

Despite that, TSLA’s “F” valuation grade corroborates my cautious thesis that the market has likely overstated its relatively tepid “C-” growth grade. In other words, it’s increasingly challenging for TSLA investors to justify its growth premium based on its fast-growing energy storage business. Accordingly, it hasn’t been able to mitigate the slowdown in its main EV business.

Tesla has committed to driving near- and medium-term growth through its Robotaxi business and autonomous driving software. However, these optionalities are still mired in significant uncertainties. Although management telegraphed its confidence in the volume production for Cybercab in 2026, investors must be cautious in potentially overstating them.

Regulatory hurdles, deployment challenges, and capacity constraints could hamper management’s optimism. In addition, the actualization of Tesla’s autonomous driving ambitions isn’t expected to be close to fruition yet. Hence, there seems to be too much hype baked into TSLA’s arguably unjustified valuation metrics at the current levels.

Is TSLA Stock A Buy, Sell, Or Hold?

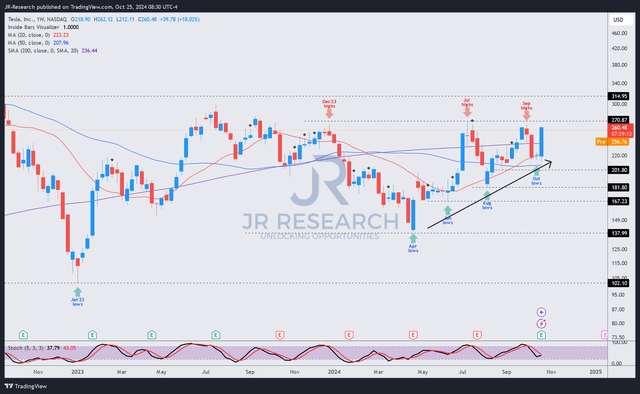

TSLA price chart (weekly, medium-term) (TradingView)

TSLA’s forward adjusted EPS multiple of 105x is substantially above its consumer discretionary (XLY) sector median of 17x. It’s also markedly above its automotive peers’ median of 3.6x (according to S&P Cap IQ data). Furthermore, investors should consider the relative underperformance of its solar energy peers listed in the Invesco Solar ETF (TAN), as it fell to new recent lows in October 2024. Therefore, anticipating a significant valuation re-rating based on its core EV or solar energy business could be increasingly challenging unless Tesla makes a substantial breakthrough in actualizing its autonomous ambitions.

Despite that, its price action highlights the robustness of its dip-buying sentiments. TSLA’s “A” momentum grade has been upgraded from “D” over the past six months, corroborating the stock’s markedly improved buying momentum. Therefore, bearish investors must be cautious about trying to bet against the market, as these bets could be eviscerated, given the potentially high volatility and robustness in TSLA’s underlying momentum.

TSLA’s price action has inched closer to a critical resistance zone under the $270 level. That level has resisted buying advances since December 2023, which justifies increased caution. Therefore, I assess that the market seems to have baked in steep optimism on Tesla, Inc.’s ability to actualize and monetize its autonomous driving and Robotaxi ambitions over the coming years.

Hence, I urge investors to remain cautious about the stock, as profit-taking could also set in as it inches closer to the $270 zone.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!