Summary:

- Tesla, Inc. stock remains under pressure due to a worse-than-anticipated production and delivery report.

- Despite temporary setbacks, Tesla is still the market leader in the EV industry and has long-term growth potential in FSD, robotics, AI, and other segments.

- Tesla stock is undervalued relative to its long-term profitability prospects, and it presents a considerable buying opportunity with substantial upside potential.

Bill Pugliano

The last time I wrote about Tesla, Inc. (NASDAQ:TSLA), the stock was around $180-$190. Tesla’s previous decline primarily occurred because Tesla missed its Q4 earnings estimates. Revenues and EPS were lower than expected due to Tesla temporarily lowering vehicle prices and a likely transitory decrease in demand due to a relatively slow economy and high-interest rates.

Tesla’s Stock – Now Dropping Again

Tesla’s stock remains under pressure, dropping again recently due to a worse-than-anticipated production and delivery report. Of course, it’s not just Tesla, as the broad electric vehicle, or EV, industry is going through a slowdown phase because of temporary market oversaturation, a relatively slow economy, high-interest rates, and other transitory factors.

However, despite the temporary setbacks in the EV market, market participants should keep a long-term perspective regarding Tesla. Tesla remains the market leader spearheading the EV industry. We should not expect constant exponential growth. There will be troughs and temporary challenges.

Nonetheless, you can’t argue with the future. EVs are cleaner and more energy-efficient than their internal combustion engine, or ICE, counterparts. Moreover, many countries plan to phase out ICE cars in the future, enabling EVs to continue gaining market share in the global car market.

Therefore, Tesla’s temporary slowdown is not a significant issue, as we are still early in the EV ballgame (around the third or fourth inning here), in my view. Additionally, we have Cybertruck and Tesla Semi sales to look forward to in the coming quarters. Furthermore, Tesla’s Model 2 project, “Redwood,” will likely be released in H2 2025.

In addition to Tesla’s dominant presence and massive potential in the expanding EV industry, Tesla is a global leader in AI, robotics, FSD, neural networks, and other technologies that should power its growth and profitability in the coming years.

Despite the short-term turbulence, Tesla’s stock is considerably undervalued relative to its long-term growth and profitability potential and should move much higher as we advance.

Tesla’s Golden Long-Term Buying Opportunity

Tesla’s stock has declined by about 47% since its 2023 high of around $300. The stock is approaching $160-145 (the critical support zone), and the downside potential is likely minimal. The crucial support zone around $150 coincides with the unfilled gap from the run-up in early 2023. We also see higher lows in the RSI, implying potential for improving technical momentum soon. While there may be a minor downside in the short term, there is likely considerable intermediate and long-term potential in Tesla’s stock, and the risk/reward appears favorable here.

Why Tesla’s Stock Is Down

Tesla delivered “only” about 387,000 vehicles in the first quarter. While this number is a decline of about 8% year-over-year, several elements must be considered. The decrease in sales was partially due to the early phase of the updated Model 3’s production ramp, factory shutdowns due to shipping diversions from the Red Sea conflict, and an arson attack at Gigafactory Berlin. These factors contributed to the worse-than-expected delivery data.

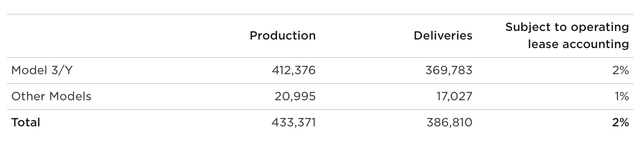

Q1 Production and Delivery Data

Production and delivery data (ir.tesla.com)

On the bright side, Q2 sales could increase more than anticipated due to the “hangover effect” from Q1. Tesla produced 433,371 vehicles in the quarter, which is only a 1.6% decline from last year. This dynamic implies that deliveries/sales would have been considerably higher without disruption events.

Q1 Sales Estimates Based On Delivery Data

Due to recent price cuts, Tesla’s ASP for the Model 3/Y segment was around $40,000 in Q4 (based on my latest estimates). The ASP for the “other models” segment, primarily Model S/X (very few Cybertrucks so far), was likely around $110,000 in Q4.

However, Tesla has returned to raising prices, and ASPs were likely higher in Q1 than the previous quarter. Moreover, Tesla’s ASPs should continue increasing in Q2, which should be constructive for the company’s top and bottom lines as it advances. I will use slightly higher ASP figures (than last quarter’s) to derive Q1 revenue estimates, as Tesla is set to report earnings on April 23rd.

369,783 Model 3/Y vehicles, minus 2% for lease accounting, comes to around 362,388 Model 3/Y sales. With an ASP of about $42,000, Tesla likely made around $15.2 billion from the Model 3/Y segment in Q1

17,027 other vehicles, minus 1% for lease accounting, equates to about 16,857 other cars sold in Q1. Using an ASP of around $118,000 suggests Tesla could have derived approximately $2 billion in revenues from the “other” car segment in the first quarter.

Q1 2024 Sales Estimates

- Model 3/Y segment: $15.2B

- Other Model segment: $2B

- Regulatory credit revenues: $600M

- Automotive leasing revenues: $600M

- Energy generation and storage sales: $1.6B

- Services and other revenues: $2.3B

Q1 Total Revenue Estimate: $22.3 billion

Tesla’s gross margin was around 18.3% in 2023. However, due to recent price drops and other transitory factors, it hit a low of 17.6% in Q4 2023. Q4 was likely the rock bottom quarter relative to gross margin. Due to the rebound in pricing and other factors, Tesla could post a gross margin of about 17.9% in Q1.

- 17.9% gross margin equates to a gross profit of roughly $4B

- Estimated R&D expenses: $900M

- Estimated SG&A costs: $1.1B

- Q1 estimated operating income: $2B

- Estimated tax/other: $300M

- Q1 estimated net income: $1.7 billion.

2024 Q1 EPS estimate: $0.54

Here’s What Consensus Estimates Say

EPS estimates (seekingalpha.com )

Q1 EPS estimates are for $0.57, slightly above my $0.54 estimate. However, if Tesla earns a few cents fewer than expected, it should not make a huge difference for the stock, especially in the long run. We should also consider the long-term perspective, and EPS should improve considerably in future quarters.

Q1 Revenue Could Also Be Slightly Lower Than Expected

Revenue estimates (seekingalpha.com)

Given the recent delivery figures, the consensus sales estimate is around $23.3B, which seems a tad high. My estimate is around $22.3B. The lower-than-anticipated sales figure could be factored into Tesla’s stock price. Moreover, we could see higher-than-anticipated sales in Q2 as some of the lost sales figures from Q1 transfer to Q2. Also, Tesla’s improving margins could limit the “damage,” and the stock’s downside could be minimal.

The Bottom Line: Keep A Long-Term Perspective

Market participants should keep a long-term perspective on Tesla’s potential and stock. The EV slowdown is likely transitory, and demand should improve as global growth increases and the Fed drops interest rates. This dynamic should ease lending standards, unlocking more financing options for consumers. Also, higher oil prices should lead to improved EV demand.

Furthermore, Tesla is far more than just a car company. Tesla is a leading energy generation and storage business with enormous potential in FSD, robotics, and AI. The current challenging phase is transitory, and Tesla’s revenue and EPS growth should recover as we advance.

Therefore, the recent dip is a buying opportunity, and I will increase my Tesla position if there is more downside after the company reports Q1 results on April 23rd. My optimal near-term buy-in range is around the $160-145 level, and Tesla’s stock has a high probability of moving much higher as we advance.

Where Tesla’s price could be in future years:

| The Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $122 | $160 | $193 | $235 | $285 | $342 | $410 |

| Revenue growth | 25% | 31% | 21% | 22% | 21% | 20% | 20% |

| EPS | $3.75 | $7.70 | $10 | $12.8 | $16.3 | $20.3 | $25.2 |

| EPS growth | -8% | 105% | 30% | 28% | 27% | 25% | 24% |

| Forward P/E | 32 | 34 | 35 | 36 | 35 | 34 | 33 |

| Stock price | $250 | $340 | $450 | $588 | $710 | $860 | $980 |

Source: The Financial Prophet.

Due to the recent declines in deliveries and other transitory factors, I’ve adjusted my near-term EPS and revenue estimates lower than my prior analysis regarding Tesla’s projections. However, many of the issues currently plaguing Tesla are short-term challenges that should be resolved within the next 6-12 months, in my view. Despite the difficulties, Tesla’s stock should be considerably higher several years from now.

Risks To Tesla

Tesla faces various risks, especially in the near term. We see decreased growth in EV demand for Tesla and other EV makers. Increased competition in the EV space could impact Tesla’s demand, margins, and future profitability. Tesla also faces the risk of a slower-than-anticipated economy with a higher rate for longer regime. There is also the risk of the Cybertruck and other Tesla production resulting in higher-than-expected costs. Investors should consider these and other risks before establishing a position in Tesla.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!