Summary:

- Downgrading Tesla to hold from buy, following a 38% gain in 9 weeks. T.

- This was a “rental” for me from the start, but more importantly, it is a good case for how I use charting and risk-management to approach volatile stocks.

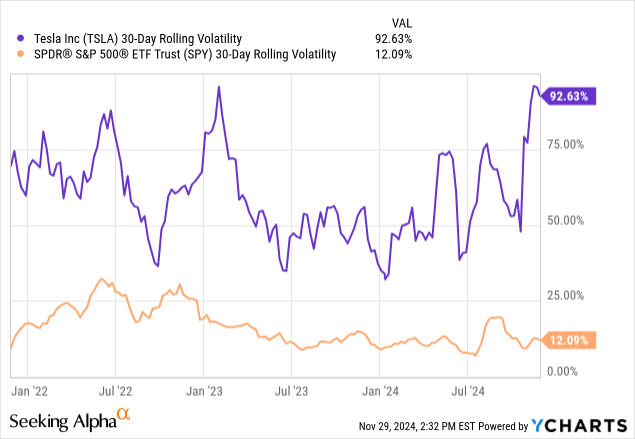

- Tesla’s rolling volatility is extremely high, and despite the big move recently, it is still below where the stock peaked 3 years ago.

jetcityimage

Tesla: maybe you’ve heard of it. Of course I’m kidding. Elon Musk’s creation is not only tied to the next generation of driving, but to at least the next 4 years of the U.S. political scene. To think there was a time in the 1980s (my college disc jockey days) when “Tesla Girls” was a song by a then-popular alternative band Orchestral Maneuvers in the Dark (OMD) about excitement and risk. Critics referred to it as everything from “witty and clever” to “inane and monotonous.” The song, like the company, refer back to the Serbian-American engineer and inventor of the 19th and early 20th centuries.

In an article that, even to my surprise, was published here just 2 months ago, I tried to contain my enthusiasm for a stock I don’t often get involved with, since dividend investing is my primary pursuit. I trade around a lot of names, including this one, and as I explained then, but when I see 3 charts like these below, the technician in me stops…cold. Even when it is TSLA.

And this:

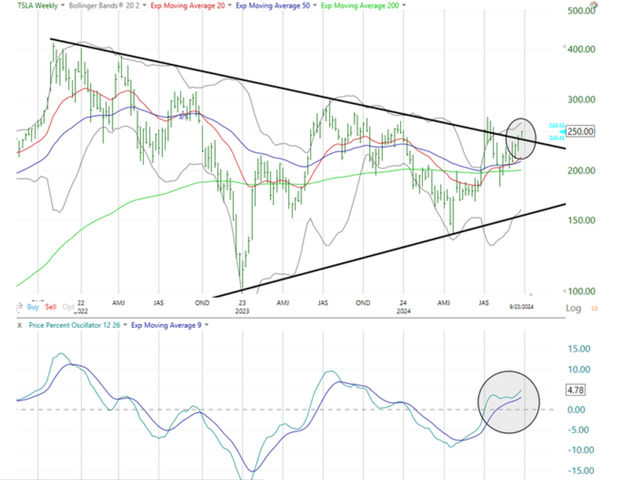

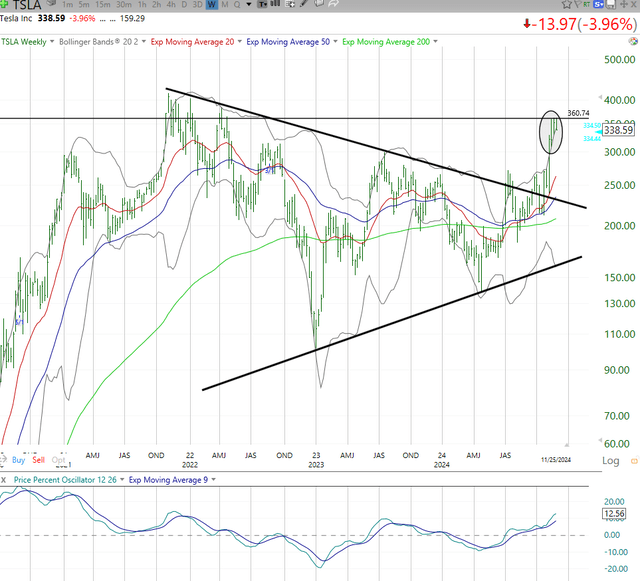

My interest in the stock as at least a short-to-intermediate term situation is compounded by what I see here in the weekly price chart (versus the daily chart). I see the same breakout from that narrowing volatility period. However, my focus is on the lower part of the chart. I’ve put a big circle around what my son and I (he’s a 3rd generation Isbitts chartist, you might say) affectionately call a “dolphin’s mouth.” Because that’s what it looks like to us. More importantly, while nothing in the stock market is a sure thing, that action on a weekly basis in the “PPO” (Price Percent Oscillator) indicator I use as a staple in my work, is very encouraging.

Here’s what it looked like as of late 9/24/24), 2 months ago:

TC2000

And here it is as of Friday’s close (11/29/24):

An $95 up move on a $250 stock. 38% in 2 months. That baby dolphin is now all grown up. But before this is taken as some sort of “victory lap,” it isn’t. I’ve had plenty situations where the chart turned out like this one…except upside down. And they were not inverse ETFs or something I own a put option on!

TC2000

What is the next move in a situation like this? I’ve had several this year, in utilities, REITs, industrials and other sectors. But unlike many investors in this giant circle of Seeking Alpha, I tend to look at a 20% gain or more as close to mandate to either reduce my position, or come up with a good reason not to. Position size equal risk management to me, or at least a key part of it.

This article is about facing the realities of how modern markets work

I believe an investor can own (or “rent”) virtually any stock or ETF, or pursue upside with limited capital outlay using options. So in a case like Tesla, with the stock notoriously volatile and, let’s face it, a glamour stock, a sharp move like that calls for action. At least for me.

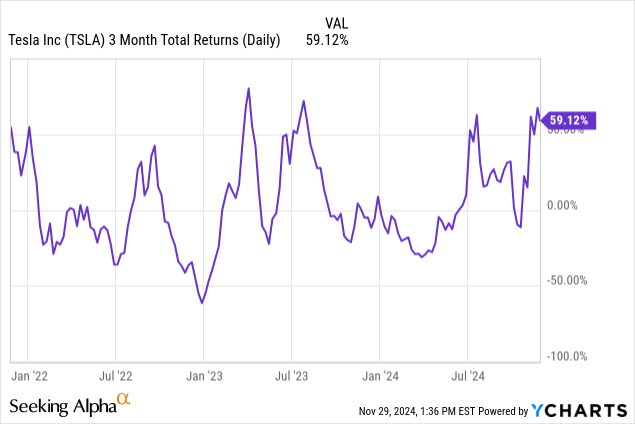

Here’s why. Below, I’ve charted Tesla’s rolling 3 month returns the past 3 years. This most recent 3 month period produced a 59% gain, of which I captured the majority. But just look at the ups and downs here. There are 20% moves routinely in both directions over that short time frame. And occasionally, it move 50% in either direction. So the more I see what I’m dealing with here, the more I use what I consider to be my own version of free lunch. Not diversification, which is the typical Wall Street answer, but position sizing.

That is, putting plenty of effort into right-sizing what you own, instead of just what you own, is as significant an alpha-driver in 2024 and beyond as any other aspect of investing. I constantly see this misinterpreted by commenters. If something is held at, say, 1% of a portfolio instead of 5%, it has 1/5 the impact in either direction. This is really the basis for how many investors use options and even leveraged ETFs now. Yet for some reason, when we talk about individual stock and ETF holdings, that understanding skips a beat. I don’t get it, but my approach is what works for me. And that’s all any investor should really aim for.

This next chart confirms my thinking above. Specifically, that Tesla is a stock that for a conservative investor like me, should be treated primarily as a rental. Just look at that 30-day rolling volatility, which is essentially a VIX for an individual stock. This is something I’ll be writing a lot more on, as I find it really helps me understand the market as it currently functions.

The S&P 500 has has a volatility range in the 15-20% area for the past few years, with some spikes higher. Now look at Tesla in purple on top. It is always spiked! 5030-90% is the range, and it is near the top of that now. The stock fell 25% the last time it hit this level. But I don’t use this indicator as a bottom-line decision-tool. It is primarily part of my work to characterize a stock or ETF. In the case of this stock, it is more like buying a long-term option than a typical stock, given the sustained high volatility.

Put it all together: it calls for a lower Tesla position, and an eye toward the exit door

So my exposure is now more limited, thus the hold rating. But to be clear: I have a faster “trigger finger” than a buy and hold investor would. I AM a buy and hold investor, when the opportunity comes up. But in my dividend income world, the longest-tenured holdings the past couple of years were ETFs that own T-bills, or direct ownership of T-bills themselves. Nearly everything else in my primary stock and ETF universe has been a better reward/risk tradeoff as closer to a 3-6 month hold, or a bit longer or shorter.

I’ll note that if Tesla can survive this topping picture in the $350 area as shown in the detailed chart above, the old high from 3 years ago is up around $410, a nice move from here. And knowing Telsa’s volatility, if it got there, it might take weeks and not months.

So my TSLA position is quite small now. And since we don’t write about the same stocks constantly, if that chart peels another few percentage points off that current topping area, I will be out of TSLA directly. That said, I could trade around it at any time. Or have exposure to it via call options on an S&P 500 security, where it is currently the seventh largest holding. It is also now 4% of the Nasdaq 100 ETF (QQQ).

So that’s my updated technical take on Tesla. I own a lot less than before, and it is a trading position, not an investment, at this stage. I have used ETFs from YieldMax as a way to use the volatility and upside potential in the Magnificent 7 stocks to pursue my priorities, yield and risk management, with recent success, as I’ve written about here recently. However, the YieldMax TSLA Option Income Strategy ETF (TSLY) is not one I’m currently considering, given the risk I see in the underlying stock.

Finally, with the key technical path to my updated view on Tesla above, I’ll finish with just a bit on some non-technical aspects of the story here. To be clear, these are always to me things that are bottom-lined for me in the chart as I read it. Importantly, my charting is about risk management first, not simply to try to find “flyers.” It just so happened that Tesla looked like a high reward/low risk situation 9 weeks ago, and it worked out.

Tesla: needs no introduction?

I am with the section of market participants who, while acknowledging the potential of this first-mover, multi-application, brand-loyal business, does not see a $3 Trillion stock here. But frankly, where it ultimately goes means relatively little to me. Because I classify any stock or ETF into one of two main categories:

1. I would like to own it “at a price,” whether that price is here now, or if I’d like to own it after it gets taken down a notch.

2. I don’t consider it something I want to “own,” but I’ll rent anything!

I’m thrilled to let others grapple over popular debate topics such as:

- Whether it is a car company or a technology company

- If it would thrive without government subsidies

- If it will directly or indirectly benefit from Mr. Musk’s suddenly-pivotal but unofficial cabinet position in the Trump Administration

- It it will “grow into its valuation” or if it has pulled forward its stock price on a fundamental basis

- Whether cyber-cab and other innovations are game-changers soon, not so soon, or destined to disappoint

The anticipated elimination of the $7,500 consumer tax credit for electric vehicles likely impacts TSLA’s U.S. peers more directly, since TSLA has greater market position and a competitive advantage when it comes to modern auto transportation. And if there was ever a stock moved by sentiment, particularly bullish sentiment, this is it.

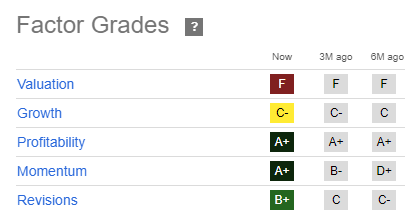

As an admitted non-fundamental analyst (though there are 16 investing groups covering TSLA and 33 Seeking Alpha analysts have written on it in just the past 30 days), I’ll instead comment next on the quant grades I use as key inputs in my own process.

Seeking Alpha

Valuation on TSLA is largely in the eye of the beholder, and sentiment (excitement?) has been a gap-closer in that regard over the years. Growth is mediocre, strictly speaking. But with TSLA, there is so much out there to “move the needle” suddenly, based on political developments or accelerated pace of getting new products to market, this is one stock that anyone can make a bull or bear case, and have a decent shot at being right over a multi-year time frame.

TSLA has the number one thing I look for in a stock outside of its chart. Profitability. So that gets it “in the game” with me. But again, it is with the objective of income, trading profits or both, not buy-and-hold. Not in the case of this stock.

The good news on TSLA: it has more than doubled since last spring. The bad news on TSLA: that giant move brought it back to where it traded about 3 years ago. I’m no fan of “dead money (old Wall Street term)” especially when it comes in the form of a political football which was halfway to a meme stock even before the founder ended up in a potentially influential quasi-government position.

TC2000

Tesla: final thoughts for now

There’s a lot to consider here, and this story is much more complex than a lot of places I can decide to put my money. The chart shows a nice breakout, but it might already be getting tired. That’s not a coincidence, given how much of the recent move has been attributed by many to things other than what is going on directly at Tesla, the company.

I’m keeping my exposure to Tesla limited to small size and opportunistic trading (if any) unless and until something on the technical or quantitative/valuation front creates a significant long-term opportunity with clarity. In other words, like Warren Buffett, I’ll let others mess with this as buy and hold investors. I’ll try anything as a trade, but frankly the constant attention from media and investors on this stock is not my preferred use of time as an investor.

I will assign a “hold” rating simply because I do not currently see a “table-pounding” buy or sell currently, based on my technical and quantitative assessment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

By Rob Isbitts and Sungarden Investment Publishing

A community dedicated to navigating modern markets with consistency, discipline and humility

Full Access $1,500/year

Legacy pricing of $975 for first 35 subscribers, a savings of 35%

-

Direct access to Rob and his live YARP portfolio, featuring a trademarked stock selection process he developed as a private portfolio and fund manager, and his decades of technical analysis experience.

-

24/7 access to Sungarden’s investment research deck

-

Bottom-line analysis of stocks, ETFs, and option strategies

-

Trade alerts and rationale, delivered in real-time

-

Proprietary educational content

-

You won’t get: sales pitches, outlandish claims, greed-driven speculation