Summary:

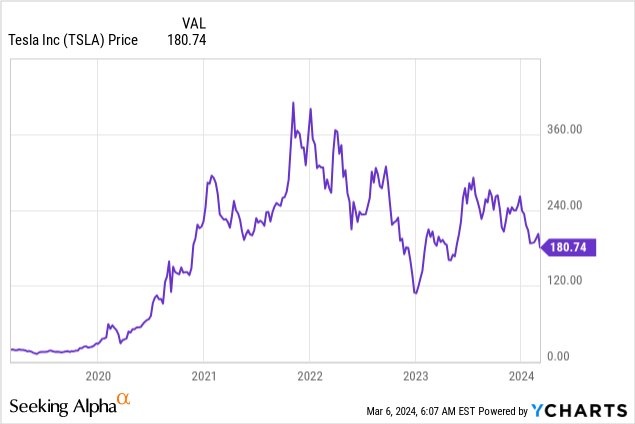

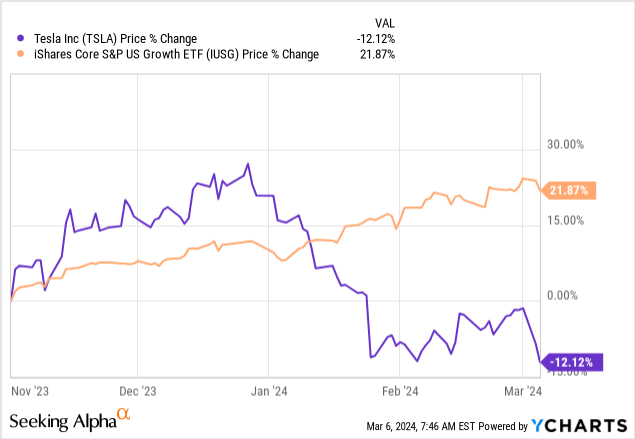

- After disappointing investors over the past few years, Tesla, Inc. share price continues to underperform.

- Deteriorating business fundamentals are largely at the mercy of outside factors.

- At the same time, Tesla stock no longer participates in growth stocks rallies, which makes the company unattractive from a risk-reward perspective.

Xiaolu Chu

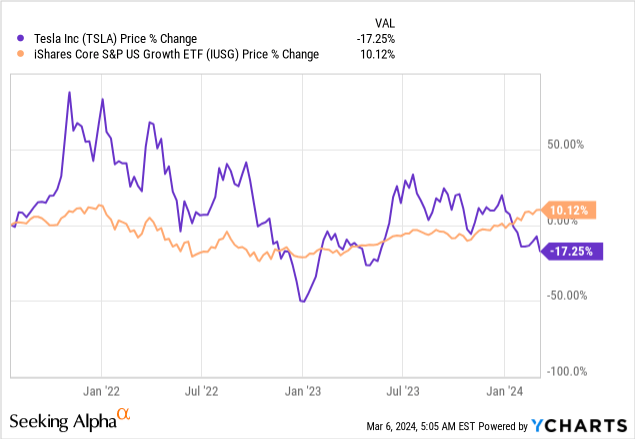

For the past two years or so, Tesla, Inc. (NASDAQ:TSLA) stock has failed to live up to investor expectations. While the business continued to expand, shareholders have not only underperformed the broader equity market since July of 2021, but have also lost roughly 17% on their investment.

The reason why I use July of 2021 as a reference point is because this is when I published my first negative review on the stock (Hold rating) and warned that investors are being exposed to significant risks associated with the momentum trade.

Although all growth stocks are exposed to such risks to a certain extent, the case of Tesla was rather unique given its size and share price exposure to overall liquidity within the market. I won’t go into all the details of that here, but for anyone who is interested to read more on the topic, you can read my last two analyses on the stock (see here and here).

Now that TSLA trades at levels from late 2020, the stock could be easily perceived as a bargain. Especially, if one uses a forward looking valuation model with too optimistic assumptions about the future, discount rates, etc., something that we have seen time and time again over the years when in fact it was market liquidity that has been in the driving seat of Tesla’s share price.

Instead, I will show why Tesla remains a high-risk stock with a limited upside in the current environment, even if the underlying business continues to grow.

A Radical Change For The Business

While Tesla’s growth was accelerating and profitability was gradually improving, the stock was among the most popular names in the market and was experiencing extremely high momentum.

This is what ultimately caused the stock price to become so detached from current business fundamentals as growth expectations were improving consistently year over year with little regard to potential risks.

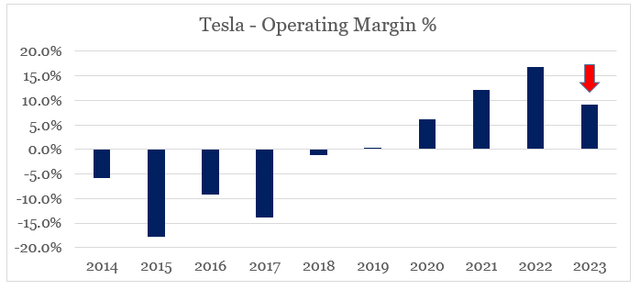

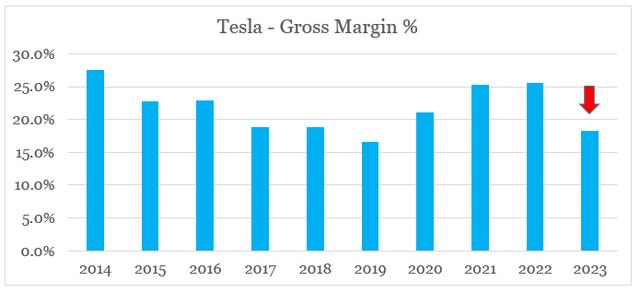

But in 2023, something unexpected happened – Tesla’s operating margin fell dramatically after years of consistent improvements.

prepared by the author, using data from Seeking Alpha

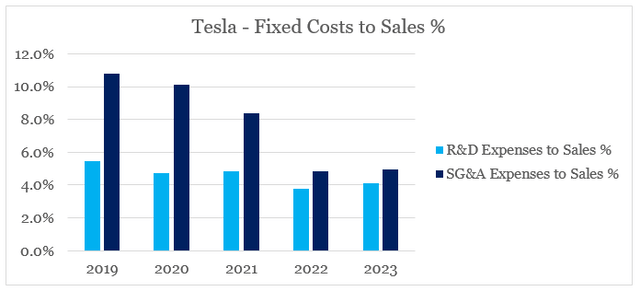

This wasn’t caused by a massive jump in fixed costs relative to sales in neither selling, general & administrative (SG&A) nor in research & development (R&D) expenses. Both of these expense categories actually stood relatively flat as a share of revenue, which is a strong indication that economies of scale are fading.

prepared by the author, using data from Seeking Alpha

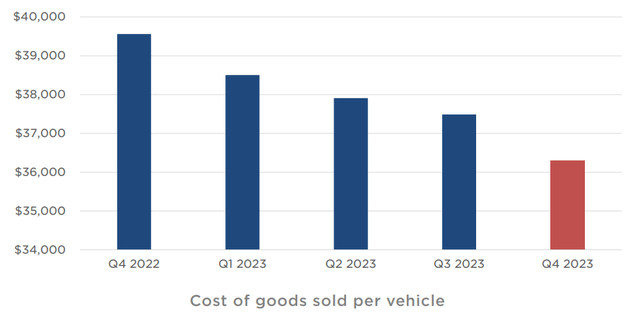

The key factor behind the large drop in the company’s operating margin was gross profitability, which noted a sharp drop to levels last seen in 2019.

prepared by the author, using data from Seeking Alpha

This wasn’t the first time that this has happened to Tesla and is not unusual for cyclical automotive stocks, but in the past Tesla has managed to offset any drops in gross margin through higher realized economies of scale, or in other words falling fixed costs as a share of total revenue. Something that did not happen in 2023, as Tesla is now behaving more like a mature business as opposed to a high growth stock.

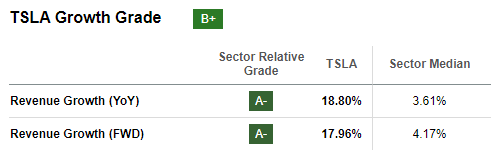

On top of all that, expected revenue growth has slowed down and is now standing below the company’s realized year-on-year growth (see below). Yet another radical change for the business which has caused market participants to reconsider their view on the stock, but more on that later.

Seeking Alpha

As far as the sharp drop in gross margins is concerned, the CEO Elon Musk was very direct during the latest earnings call on what analysts could expect from the future.

Martin Viecha

Thank you. The next question is, what is your expectation for automotive gross margin ex-regulatory credits for the full year?

Elon Musk

We don’t know. We don’t have a crystal ball, so it’s difficult for us to predict this with precision. If the interest rates come down quickly, I think margins will be good. And if they don’t come down quickly, they won’t be that good. Yeah. It’s always important to remember that the vast majority of people buying a car is about the monthly payment. It’s not that people don’t want. We have tons of — we have lots of people who want to buy our car but simply cannot afford it. And as interest rates drop and that monthly payment drops, then they’re able to afford it and they buy the car. It’s pretty straightforward and there are no tricks around to get around this.

Source: Tesla Q4 2023 Earnings Transcript.

Thus, even as the cost of goods sold per vehicle continued to decline each quarter in 2023, Tesla’s gross margin fell.

The statement above also clearly indicates the extent to which Tesla’s stock depends on changes in interest rates and the amount of liquidity within the markets. Thus, the success of the company is heavily dependent on outside factors, but to make matters worse, Tesla’s share price no longer seems to benefit from any upside in momentum trade.

All About Outside Factors

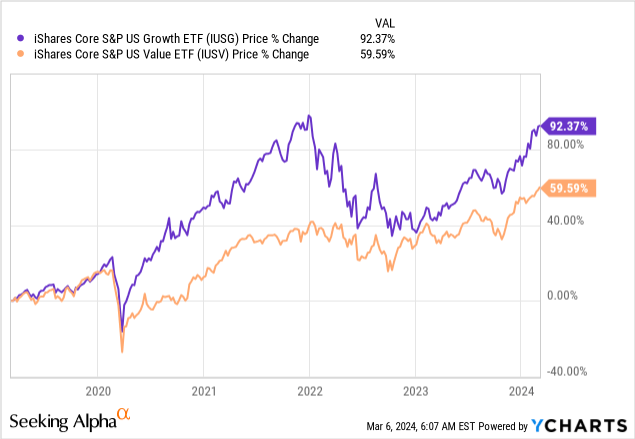

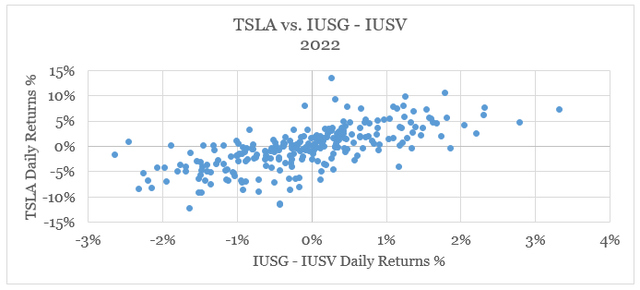

As I have shown in my previous analyses, Tesla share price used to outperform strongly during periods when growth stocks, as measured by the iShares Core S&P U.S. Growth ETF (IUSG), outperform value stocks, as measured by the iShares Core S&P U.S. Value ETF (IUSV).

From the graph below, we can see that the 2020-21 period was a good example of growth outperforming value by a very wide margin. After the sharp contraction of the performance gap between the two in 2022, last year was yet another period when growth did much better than value. This trend also seems to be continuing in early 2024.

Consistent with the growth vs. value performance we saw above, TSLA did extremely well both in 2020 and 2021 – largely driven by the strong demand for growth stocks. As expected, in 2022 the stock fell sharply – consistent with the dynamic we saw above, and then somehow recovered in 2023 as growth stocks once again outperformed value.

The interesting part here is that Tesla continued falling in recent months even as the performance gap between growth and value has widened once again since the beginning of November last year. The reason why 1st of November is such an important date is because that was when the quarterly refunding announcement by the U.S. Treasury was published and the term premium of equities has fallen dramatically since then (for more information on this, follow this link).

Thus, Tesla share price does not seem to benefit anymore from any upside in growth stocks more broadly.

At the same time, when growth stocks fell dramatically in 2022, TSLA share price was also severely punished, without any deterioration in the company’s business fundamentals at that time. We could see that by plotting the daily returns of the ISUG less the daily returns of the IUSV on the x-axis and TSLA daily returns on the y-axis on the graph below.

prepared by the author, using data from Seeking Alpha

We could clearly see the strong positive relationship between the two variables, which has been a major risk that I have been warning about since 2021.

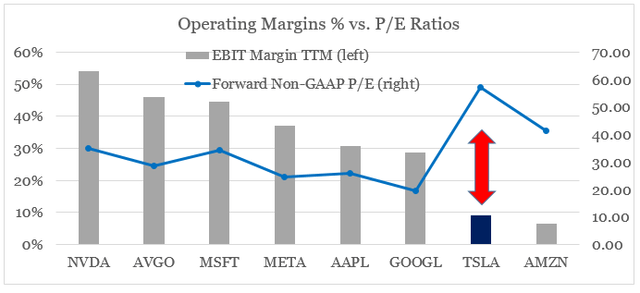

Even if one refuses to compare TSLA to legacy auto OEMs, the stock does not appear attractive when compared to the largest tech stocks within the S&P 500. On the graph below, we could see that TSLA still trades at one of the highest forward Non-GAAP P/E ratios while having the second lowest operating margin.

prepared by the author, using data from Seeking Alpha

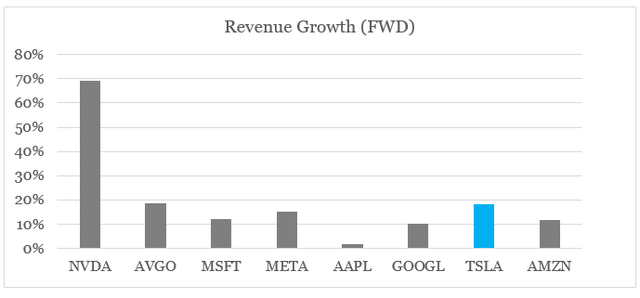

Expected revenue growth of TSLA is also no longer a unique feature of the company when compared to the other tech giants, with the market now having a new darling (Nvidia) that could soon follow on the steps of Tesla as far as share price performance is concerned.

prepared by the author, using data from Seeking Alpha

Conclusion

Even after very disappointing performances over the past couple of years, Tesla, Inc. stock does not look like a bargain at this point in time. The stock may now seem less risky than it was back in 2021, but that does make it a “buy” in my opinion. Tesla shareholders were first punished in 2022 due to outside risk factors related to growth stocks, and are now once again being punished by the company’s deteriorating fundamentals at a time when growth stocks are once again on an uptrend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the technology space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.