Summary:

- Tesla, Inc.’s stock surged over 25% post-3Q FY2024 earnings, driven by early signs of inflections in margins, EPS growth, and delivery growth.

- Tesla’s Q3 revenue fell short of consensus expectations, driven by disappointing deliveries, despite achieving its second-highest regulatory credit revenue.

- The company achieved 105% QoQ in FCF in 3Q despite a significant increase in capex.

- CEO Elon Musk’s “best guess” suggests 20%-30% YoY growth in vehicle deliveries for FY2025, driven by the rollout of affordable models in 1H CY2025.

- The stock is trading at 85x non-GAAP P/E for FY2025, more than double Nvidia’s multiple, indicating downside risk if the inflection points achieved in 3Q prove to be unsustainable.

wellesenterprises

What Happened

Tesla, Inc.’s (NASDAQ:TSLA) stock rallied over 25% following mixed Q3 FY2024 earnings. Non-GAAP EPS significantly exceeded estimates; however, revenue fell short of consensus despite achieving the “second-highest quarter of regulatory credit revenue,” suggesting normalized revenue would have been even weaker.

TSLA showed early signs of inflection in margins, reversing its previous downtrend. Additionally, EPS YoY growth was positive in 3Q, marking a reacceleration milestone. This reflects the company’s commitment to optimizing its cost structure. Therefore, TSLA’s FCF in 3Q FY2024 more than doubled compared to the previous quarter, marking its best rally since 2019.

In my recent article, I maintained a strong sell rating on TSLA ahead of the Robotaxi event, as disappointing Q3 deliveries likely contributed to weaker revenue growth. The stock dropped over 10% due to a lack of detail from the Robotaxi event.

However, the post-3Q rally enabled TSLA to break through its previous resistance level, signaling a potential bullish trend from a technical standpoint. Nonetheless, its lofty valuation makes a bullish stance difficult to justify, and I believe the recent rally largely priced in optimism around these inflection points.

From a fundamental perspective, I changed the rating to “sell,” as margin expansion may be unsustainable, and I’m skeptical that TSLA will achieve a “best guess” of 20% to 30% YoY growth in deliveries next year.

Can Tesla Achieve a 30% YoY Deliveries growth Next Year?

The company model

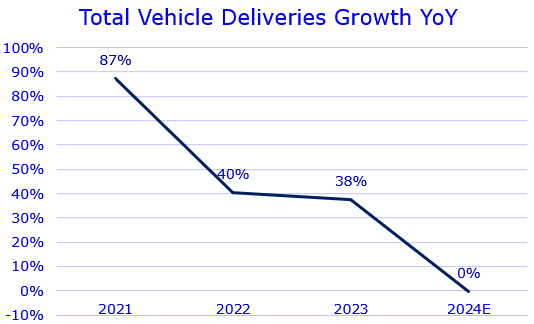

TSLA’s revenue grew 8% in 3Q FY2024, missing consensus and continuing to decelerate from 9% YoY growth in Q3 FY2023, primarily due to slower vehicle deliveries. Despite Elon Musk’s long-term goal of 50% YoY growth in deliveries, I expect TSLA will see 0% YoY growth in FY2024, assuming a similar 6% YoY growth in deliveries in 4Q FY2024 as seen in 3Q. However, TSLA has expressed confidence in achieving 25% to 30% YoY growth in FY2025, as the company plans to deliver more affordable models in 1H CY2025.

Moreover, Elon stated that Cybercab could reach volume production in CY2026, targeting at least 2 million units annually with an ultimate goal of 4 million. However, I am discounting these projections due to his previous credibility issues.

Early Sign of Margin Inflection

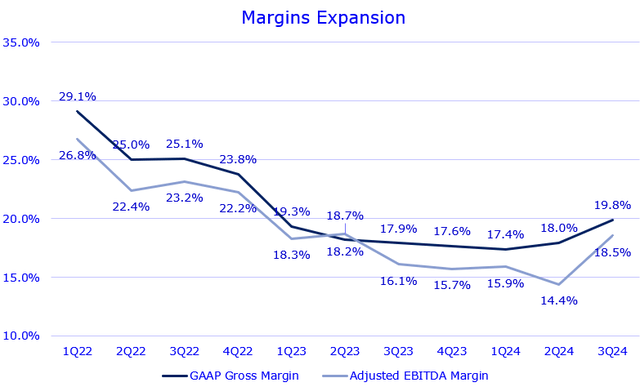

Despite weaker-than-expected 3Q revenue, I believe TSLA has reached a turning point in its margins. As shown in the chart, its GAAP gross margin rose significantly in 3Q FY2024 to 19.8%, expanding by 180 bps sequentially, following a 60 bps increase in 2Q FY2024. During the 3Q earnings call, the CFO indicated that the cost per vehicle reached the lowest level last quarter, reducing Cost of Revenue. Additionally, adjusted EBITDA margin saw a strong expansion of nearly 410 bps in 3Q, reversing the downtrend that stated in 1Q FY2022.

It’s important to note that its R&D and SG&A expenses declined YoY by 10.5% and 5.3%, respectively, which likely reflected a normalization of operating costs after significant growth in FY2023. However, management attributed the cost reduction to prior restructuring efforts, offset by increased AI-related expenses.

In the call, the management also mentioned that the current margins seen in 3Q may not be sustainable in 4Q due to a challenging economic environment, implying a potential sequential decline in margins. While I believe the worst margin contraction is behind us, the forward path for margin expansion may still be bumpy.

EPS Growth Inflection Has Triggered

The company model

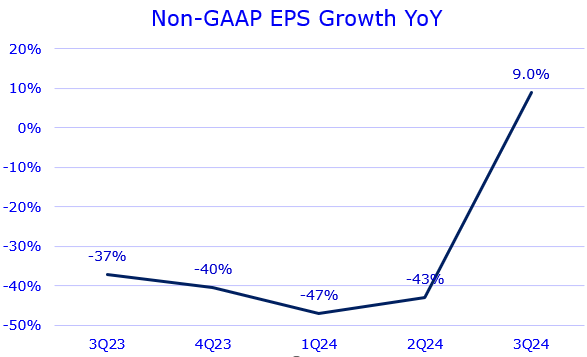

Due to strong margins expansion, TSLA’s non-GAAP EPS an inflection point in Q3 FY2024, achieving a 9% YoY increase and significantly beating market expectations, which forecasted a -9% YoY decline. I believe this sends a bullish signal to investors that TSLA is set for growth acceleration in the coming quarters, despite its lofty valuation. We should be mindful that TSLA has often traded on sentiment, with investors eager to overprice any early signs of growth acceleration. Its premium valuation may also reflect TSLA’s consistent profitability despite a significant growth slowdown over the past two years. As Elon Musk argued, “If you look at EV companies worldwide, to the best of my knowledge, no EV company is even profitable.”

FCF Grew over 100% Sequentially in 3Q

The company model

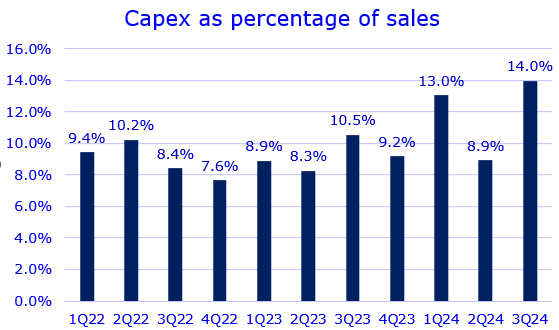

Despite a 55% sequential increase in capex, TSLA generated $2.7 billion of FCF in 3Q, up 105% QoQ compared to 2Q. This bolstered its cash and cash equivalents by nearly $2.9 billion. As shown in the chart, TSLA’s capex as a percentage of sales increased significantly in 3Q, reaching 14%, with most of the increase due to AI compute investments, especially for FSD. Despite progress on FSD, my primary concern remains obtaining regulatory approval for unsupervised FSD in major states like California and Texas, although Elon is optimistic about securing approval next year.

Additionally, TSLA projects FY2024 capex to exceed $11 billion, implying around $2.5 billion in capex for Q4 FY2024. It’s encouraging to see the company strengthening its FCF profile amid a potential economic slowdown.

A “Meme” Stock?

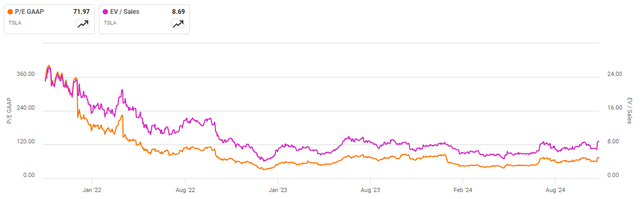

TSLA’s lofty valuation is very well-known to investors. In the short term, valuation may not dampen the stock’s bullish sentiment, as the market has long been accustomed to TSLA’s high multiples. As shown in the chart, investors poured into TSLA stock in FY2022, pushing its valuation to elevated levels, anticipating robust growth materializing in the coming years. Indeed, TSLA’s growth and profitability remain impressive compared to other EV peers, warranting a higher valuation.

However, the stock’s current GAAP P/E TTM of 72x surpasses even Nvidia’s (NVDA) 66x, despite NVDA quadrupling its EPS over the past 12 months compared to TSLA’s 33.4% YoY decline. Looking ahead, TSLA’s non-GAAP P/E fwd in FY2025 is projected at 85x, more than double NVDA’s 38x. Additionally, its EV/sales TTM traded around 8x in 2022, when Elon projected a multi-year 50% YoY growth in deliveries. Today, that multiple has remained unchanged, despite a significant growth slowdown and the potential for 0% growth in FY2024, which has weighed on revenue growth.

While we can see some early signs of growth turnaround and margin improvement, I believe the recent rally has priced in these optimistic signals too soon and too aggressively. Therefore, I still maintain a bearish view on TSLA.

Conclusion

While TSLA’s 3Q FY2024 results indicate a promising inflection in margins and EPS growth, the sustainability of these improvements remains uncertain, although I believe the worst is behind us. I think the initial 25% reaction following the earnings report has priced in this optimism in the near term, especially with the stock trading at a 85x non-GAAP P/E for FY2025.

The market also anticipates a growth inflection in vehicle deliveries based on Elon’s 20%-30% outlook for FY2025, but I do not believe this target will be easy to achieve. Additionally, uncertainty around regulatory approval for unsupervised FSD could significantly impact the debut of Robotaxi in 2026.

Given these factors, I maintain a sell rating on TSLA, as its valuation appears stretched relative to the fundamentals, even though momentum factors may still push the stock higher in the short term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.