Summary:

- Tesla stock is surging Thursday after the third quarter earnings call and its best quarter in over a year. We missed the upgrade.

- Tesla surged on second-consecutive gross margin expansion to 19.80%, lower cost of goods sold per vehicle, and Musk’s 20-30% growth outlook for next year.

- We expect to see trouble on the Q4 report as better margins aren’t expected to stick yet and Tesla is unlikely to hit its 2024 vehicle goals.

- We think mid to long-term investors will see better entry points by the end of the year once we get more clarity on how much TSLA will achieve in 2025.

Firehorse/E+ via Getty Images

Tesla, Inc. (NASDAQ:TSLA) reported its third-quarter earnings after the bell on Thursday. We had a great downgrade of the stock back in late September at around $254 per share; our thesis was that expectations for Tesla’s deliveries and the “We, Robot” event would disappoint. Indeed, the stock sold off in the couple of weeks that followed, declining to around $213 per share, ~16%, in late October. Our thesis played out well, but we missed the upgrade on the stock.

We didn’t see any plausible near-term catalyst at play to support outperformance, aside from the expectation reset after the first half of October. What we should’ve paid more attention to was just how low expectations had gotten heading into the report. Tesla stock is surging Thursday after the third quarter earnings call and its best quarter in over a year. The company achieved $25.1B in sales, missing consensus at $25.67B but growing Q/Q and Y/Y while adjusted EPS came in at $0.72, outpacing expectations at $0.60.

CEO Elon Musk finally quenched investor thirst for near-term catalysts or positives; Musk provided a 2025 outlook during the earnings call, expecting “Something like 20% to 30% growth next year is my best guess.” He also added some more flavor to Tesla’s ride-hailing plans, expecting to go public next year in California and Texas; although that news isn’t really new, it was enough to drag Uber (UBER) and Lyft (LYFT) shares down for the day. Musk is also eyeing the launch of new, more affordable models in 1H25, a move that reaffirms our earlier argument that Tesla is transitioning to the mid and low-end market after competition penetrated the EV market.

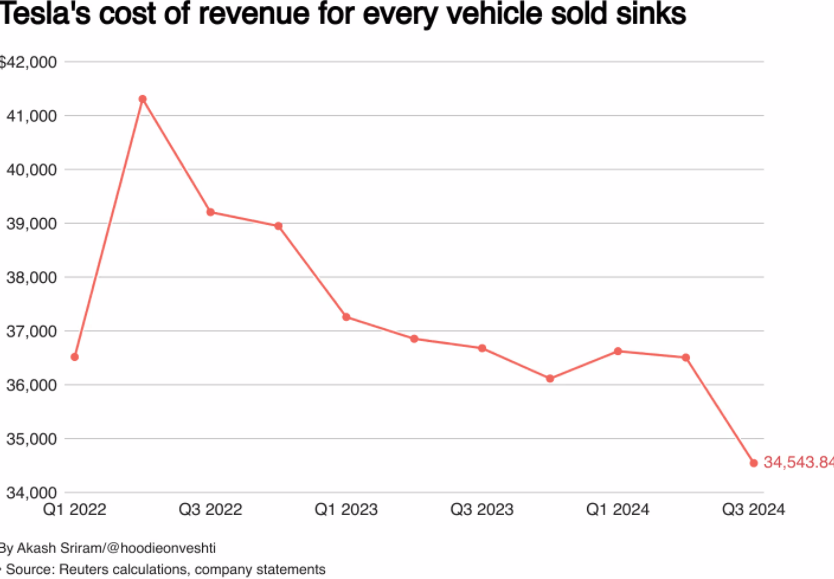

The numbers weren’t so bad in that Tesla showed some hope in reversing its gross margin compression, perhaps sustainably. The company reported the cost of goods sold (COGS) per vehicle down to the lowest level at $35,100, as shown below. The lower cost can be attributed to lower raw materials costs, specific adjustments, and parts dropped from the vehicles. Operating income increased Y/Y to $2.7B, with an operating margin of 10.8%.

Reuters

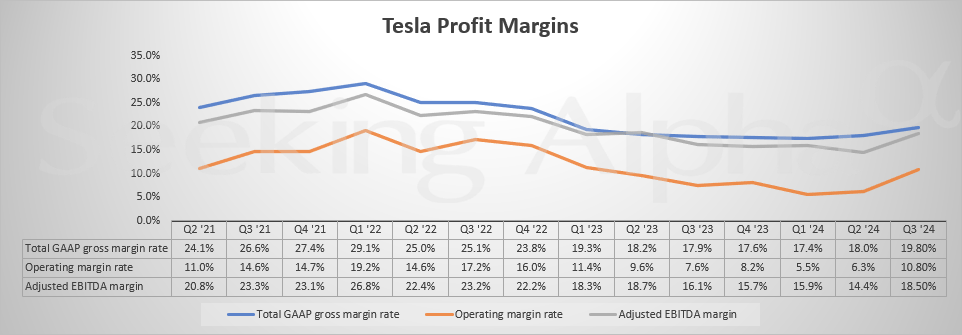

Gross margins were the real highlight for us, though, as we’ve been waiting to see some expansion since we forecasted margin pressure after Musk announced the price cuts in early 2023. This quarter, the gross margin was 19.80%, up Q/Q from 18.0% in 2Q24 and 17.4% in Q1, as shown in the graph. The gross margin also appears significantly better once put against expectations, which were for 16.8%. The better gross margin can in part be attributed to the sequential increase in Cybertruck production, allowing it to reflect positively on the gross margin for the first time.

Seeking Alpha

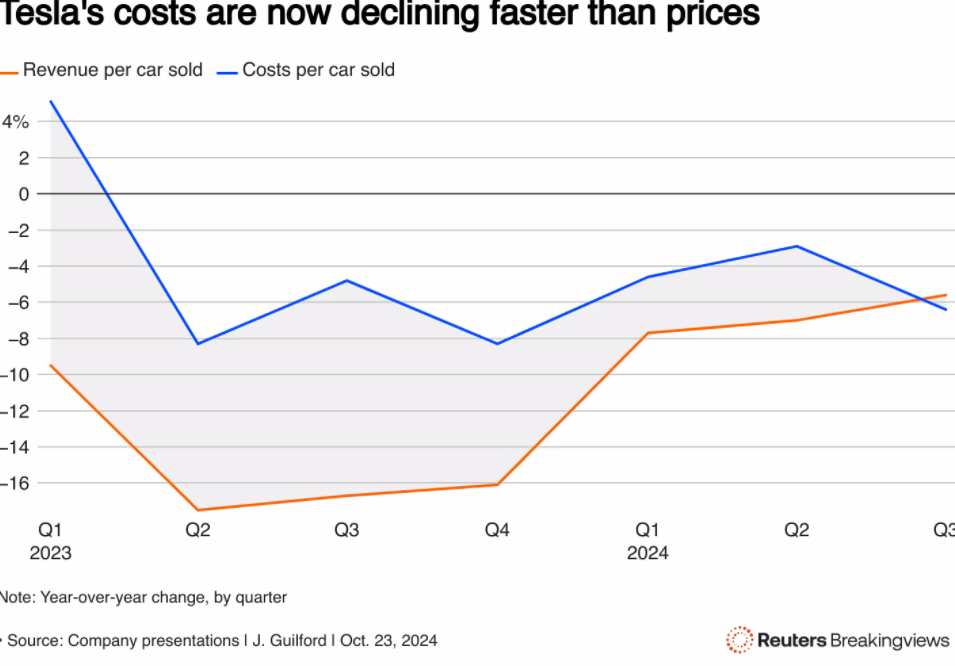

The issue remains that there are no real near-term catalysts at play; yes, the Cybertruck ramp is kicking in, and there are promises of new affordable models in the first half of next year, but the 2024 outlook remains mixed. The positives are the lower costs of production, allowing leeway for Musk’s promise of more affordable vehicles as the cost per car sold dips below revenue per car sold.

Reuters

There’s a blur, in our opinion, about how Tesla will go from the “slight growth” expected for this year to the best guess of “20% or 30%” for next year

Again, with Tesla this year, too much seems contingent on Musk’s vague commentary. This kind of commentary extended to Musk’s vision of Cybercab in particular; Musk noted that it would reach volume production in 2026 rather than start production and aims to manufacture 2M Tesla Cybercabs a year; that is more than the company sells early now, with 1,845,985 vehicles sold at the end of 2023.

Again, there is a disconnect between how Musk will achieve that and within what timeline. The outlook is a big positive, but the concern with Musk is that, more recently, he’s been long on promises and short on results. Tesla continues to be a fundamentally sound company, and as Musk pointed out on the call, it is among the only profitable EVs. Still, market share and profitability are on the decline, big picture wise. The stock could make for a good trade on all this hype for 1H25, but we don’t think now is the moment to jump in.

(Dramatic) market reaction

Tesla added around $150B in market value the day after earnings, with the stock rising +20% since. Plenty of people are calling this a “relief rally,” which is because investors went into the event with floor-low expansions after the deliveries miss and the “We, Robot” event. Then, they were hit with expanding margins for the second quarter in a row and a 20-30% growth outlook for next year, effectively addressing concerns about margins and the pace of growth and causing the surge.

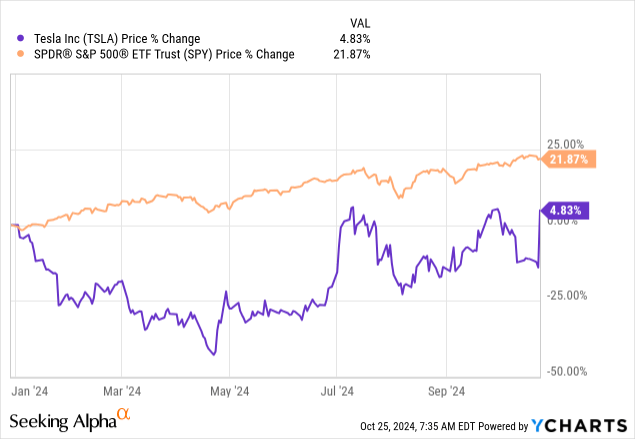

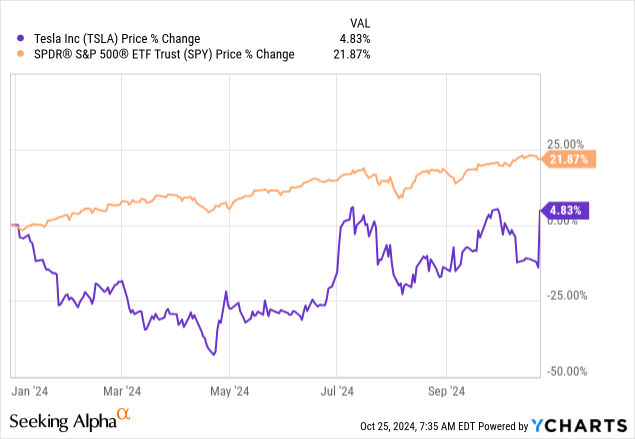

The market was so impressed that Tesla’s EV/Sales went from ~6.8x on Wednesday (the day of earnings) to about 8.1x on Thursday (the day after). RSI also shot up from around 30.83 the day before trading to 68 the day after. Tesla stock is too hot currently because we fear that these could be far-reaching goals with little roadmap clarity, particularly when it comes to regulatory hurdles relating to Cybercab. Elections may play a big role in Musk’s plans for Tesla; he definitely spent a lot of the call on the topic. The following chart outlines Tesla’s YTD performance, up ~5%, versus the S&P 500 (SP500) up ~22%.

YCharts

This chart gives a more zoomed-in perspective of Tesla’s three-month stock price performance, which encompasses the hype leading up to October, the disappointment mid-way through, and the bounce back. Thursday represented Tesla’s biggest gain since May 2013.

YCharts

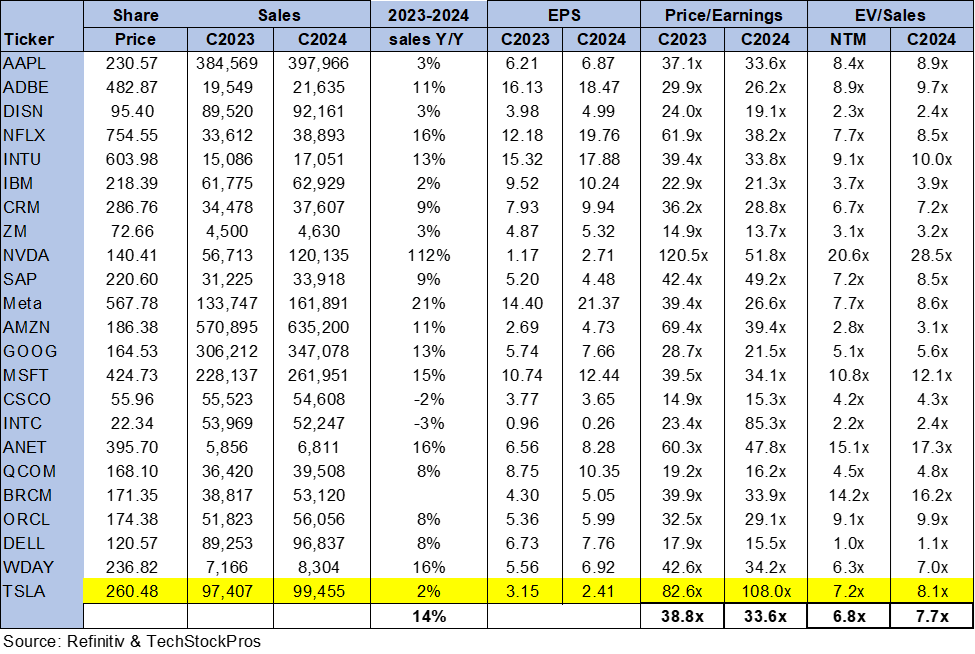

Valuation & Word Wall Street

Tesla’s valuation is up again to above peer group average levels, but still lower than it was at our downgrade in late September. The stock trades at EV/Sale of 8.1x C2024, versus the previous ratio of 9.4 in late September. The following chart outlines Tesla’s valuation against the peer group average.

TechStockPros

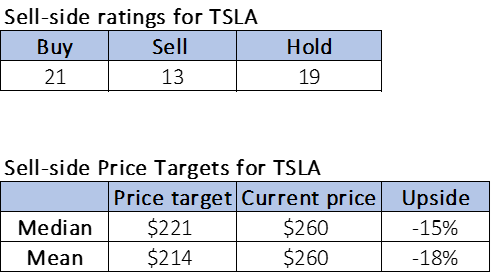

Wall Street is pretty mixed on the stock; of the 53 analysts covering the stock, 21 are buy, 19 are hold, and 13 are sell. The stock price is currently around $260 with a need for price target revision with Tesla’s median currently at $221 and mean at $214 with analysts already raising the mean price target to the $280s range. The following charts outline sell-side ratings and price targets for TSLA.

TechStockPros

What to do with the stock?

We think Tesla makes for a good intra-quarter trade for the brave-hearted, particularly considering the upcoming elections and a special someone whom Musk supports heavily, which might also impact the stock and investor confidence. We think there remains a disconnect between this year and next year in terms of how Musk expects to achieve the forecasted growth.

As we wrap up this article, the stock’s RSI sits at 67, deflating a tiny bit; the RSI is high and a lot of the positives have already been priced in. Having said that, in Tesla’s case specifically, we’ve seen the stock price continue to rise even after the RSI crossed into overbought territory; in fact, in early July when the stock shot up between July 1st and 10th the RSI was in overbought territory, but that didn’t stop the stock from gaining around 30%. We think swing investors could take a look opportunistically, but we recommend mid to long-term investors stay on the sidelines for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.