Summary:

- Tesla reports their 3rd quarter, ’24 financial results after the closing bell on Wednesday, October 23.

- Consensus analyst expectations are looking for $0.58 in EPS, $25.37 billion in revenue, for expected y-o-y growth of -12% for EPS and +9% revenue growth.

- What’s worrisome about that is that the FSD division still accounts for the lion’s share of Tesla’s valuation, and reading the commentary following RoboDay, analysts and investors seemed rather underwhelmed.

- One positive that came out this weekend was the news on Cybertruck sales, which were stronger than expected, with an average ASP of $115,000 per truck.

AdrianHancu

Tesla (NASDAQ:TSLA, NEOE:TSLA:CA) reports their 3rd quarter, ’24 financial results after the closing bell on Wednesday, October 23rd, ’24, with consensus analyst expectations looking for $0.58 in EPS, on $25.37 billion in revenue, for expected y-o-y growth of -12% for EPS and +9% revenue growth. Operating income is expected at $1.9 billion and is expected to grow +8% y-o-y.

The stock fell after the 2nd quarter results were announced as revenue grew 5% y-o-y, while operating income fell 33% and EPS fell 43% y-o-y.

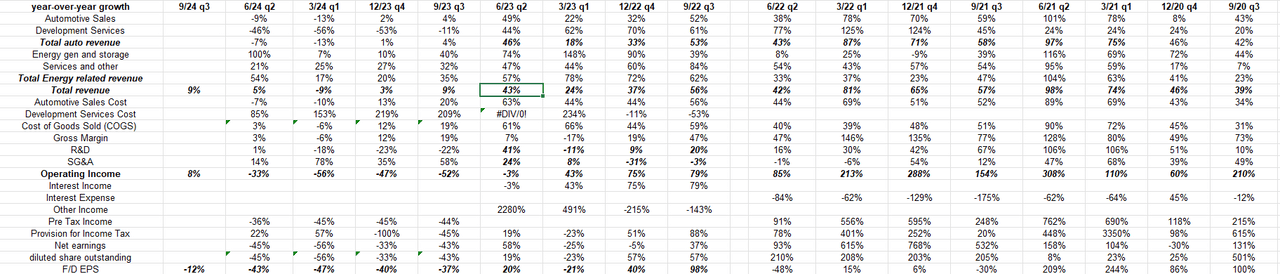

Income Statement: y-o-y growth by line item

year-over-year growth of Tesla’s revenue, operating income and EPS since Covid.

If the consensus operating income number is met, Tesla will see the first y-o-y operating income growth in 6 quarters.

Peak auto revenue for Tesla was $21.56 billion in December ’23, the best energy storage revenue was last quarter – Q2 ’24 – at $5.6 billion – the best auto gross margin, which is correlated with operating income, was at 26.3% in Q3 ’22, and highest operating income was $3.9 billion in Q4 ’22. Peak free cash flow was in June ’22 at $6.9 billion on a trailing twelve month (TTM) basis, while the same TTM FCF is at $1.7 billion as of the June ’22 quarter.

Tesla actually delivered more vehicles in Q2 and Q3 ’24, but ASP’s (average selling prices) were lower, hence the drop in revenue, operating income and margins.

It’s clear the momentum is gone from the stock: even RoboDay was a bit of a bust for Tesla. What’s worrisome about that is that the FSD (full self driving) division still accounts for the lion’s share of Tesla’s valuation, and reading the commentary following RoboDay, analysts and investors seemed rather underwhelmed.

Tesla mentioned on the July ’24 call that their lower-end, mass-market model will be out – or more information will be forthcoming on the mass-market model, in the first half of ’25.

One positive that came out this weekend was the news on Cybertruck sales, which were stronger than expected, with an average ASP of $115,000 per truck. As readers will see in a second, the Cybertruck results actually caused a little increase in the expected full-year 2024 revenue estimate for Tesla.

In early September ’24, Tesla announced a 37% sequential jump in China deliveries. (The recent jump in China on the stimulus package was short-lived. If it continues though, and the Chinese consumer can be reinvigorated, it’s likely only a plus for Tesla.)

Another positive for the stock was the growth in energy storage, which Tesla specifically noted and highlighted after the 2nd quarter results. Energy storage revenue has doubled to $5.6 billion since December ’22 and is now 22% of total Tesla revenue.

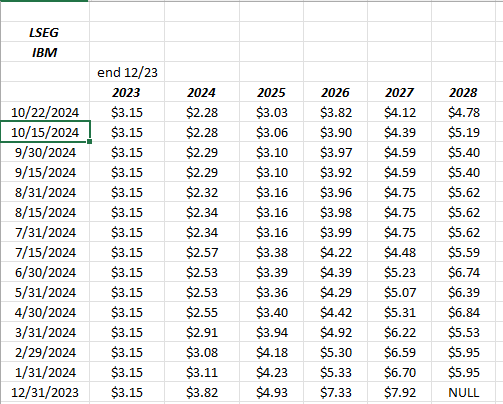

Tesla’s EPS and estimate revisions:

Data source: LSEG

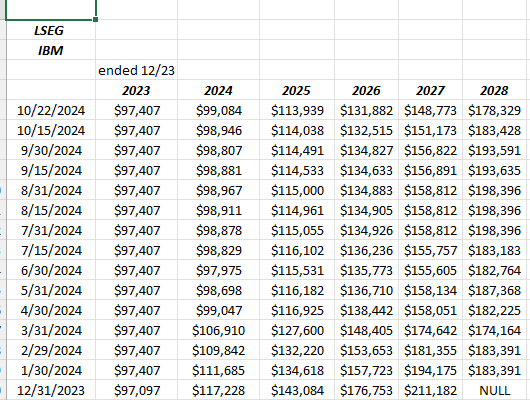

Data source: LSEG

Excuse the wayward cursor, but there is nothing in the above table that would excite an investor, looking at the above negative revisions in these Tesla EPS and revenue estimate trends as of 10/22/24.

Note the little bump in the full-year 2024 expected revenue estimate (2nd table), which, I assume, is due to the cyber-truck disclosure this weekend.

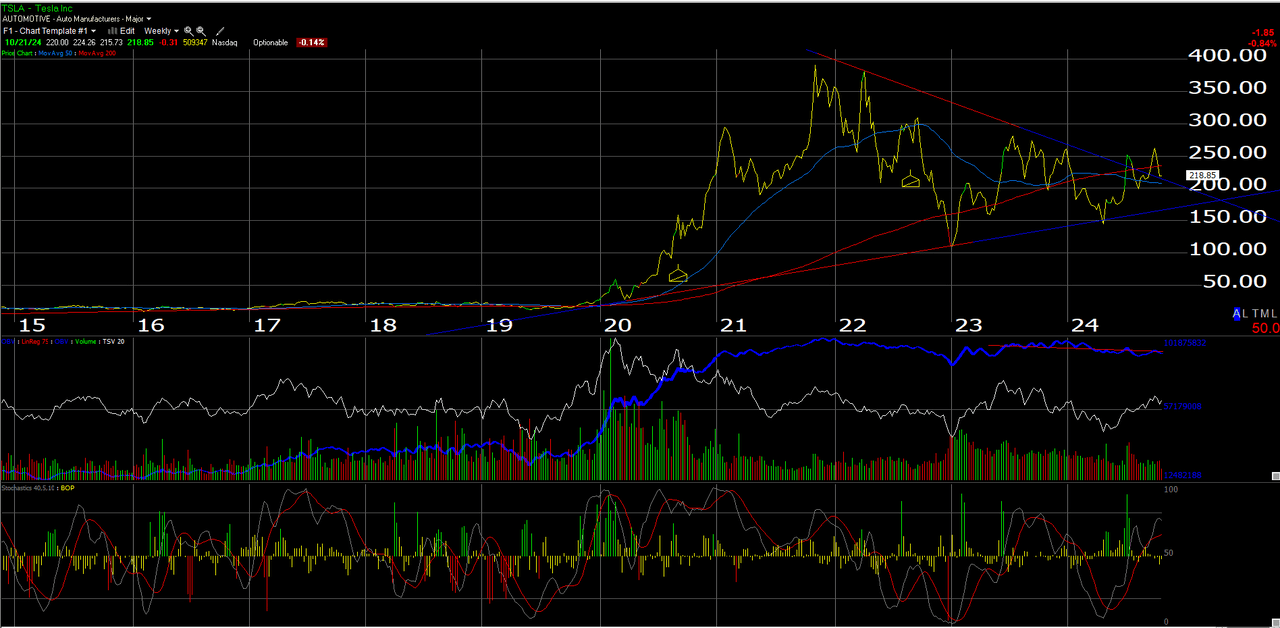

A look at the chart:

The upward-sloping trendline off the ’20 and ’22 lows is still intact, and doesn’t look like it would be violated until $170 – $175 is taken out, on heavy volume. $138 is the 2024 lows, so that’s the definite line in the sand.

Summary/conclusion:

The very bullish sentiment that surrounded much of the stock market in late ’21, early ’22 has now evaporated, and that includes the sentiment around Tesla. Sentiment around Tesla seems almost apathetic, and if Elon gets pulled into the US government after the President election in two weeks, I wouldn’t consider that a plus for the stock, although I’d definitely consider it a plus for the US government.

The trend in EPS and revenue estimates has to change, i.e. turn positive. After following the stock since 2014 – 2015, and reading all the research about Tesla back then, it was surprising to read back then that FSD was the larger proportion of the valuation of the stock, and while that hasn’t changed, Tesla’s progress on Robo seems to have stalled, and Waymo seems to be in the lead.

Morningstar has a $200 valuation on the stock, so Tesla is just slightly overvalued on that one estimate.

Trading at 100x EPS today, and 60x cash flow, the few positive developments seem to have been overwhelmed with the stagnant robocar division and the delayed rollout of the lower-end model, but Tesla has much easier compares ahead. (Note Q4 ’23’s growth numbers on the above y-o-y growth from PL.)

My biggest concern is that when looking back to the middle of the last decade when Tesla wasn’t yet free-cash-flow positive, and the auto giant was still a concept company, is that battery technology still has not developed to the point where Tesla owners don’t have to spend 30 – 45 minutes on a recharge. Just think, if it took that long to put gas in your car.

The other major concern I have is that Elon is spread too thin. Tesla, SpaceX, Starlink, and whatever else he has under the hood, truly prove his genius as an entrepreneur and a wealth-creator, but maybe he’s less great at being a custodian of Tesla shareholders’ wealth. Only he knows if he can do it all, and the Tesla numbers will bear that out.

It’s tempting to add some small share amounts to accounts who own the stock already, given the poor sentiment around the stock and the expectation of blah earnings.

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can and does involve the loss of principal, even for short periods of time. Any reference to EPS and revenue estimates is data sourced from LSEG.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.