Summary:

- Tesla, Inc.’s Cybertruck faces low demand and high costs, risking billions in losses and questioning its long-term viability.

- Consumer interest in Tesla is waning, with EV demand slowing and inventory increasing, challenging growth projections.

- Tesla’s valuation is deemed excessive, with a high P/E ratio and modest vehicle sales growth not justifying its market cap.

- Political pressure for EV adoption remains a potential risk to the bearish TSLA thesis, but current fundamentals suggest Tesla is overvalued.

Brandon Woyshnis

Tesla, Inc. (NASDAQ: NASDAQ:TSLA) is the world’s most valuable carmaker, with a market cap of more than $760 billion. The company announced its pickup truck, the Cybertruck, which originally hit almost 2 million preorders with “off the hook demand.” Yet as we’ll see throughout this article, with the major risks we discussed about Tesla recently, combined with news about the Cybertruck, Tesla faces billions in losses.

Airbus A380

The Airbus A380 is famous as the largest commercial plane in the world with its uniform double-decker design.

A380 Wikipedia

The plane became iconic with its design, luxurious new first classes brought on by some carriers, and more. Yet despite all of that, manufacturing stopped in 2021. The reason? The plane was designed for what was fundamentally a different market. The plane was built for a “hub-and-spoke” model, but when it came down to it, a “point-to-point” model was preferred by consumers.

The net result? A beautiful plane that never broke even on R&D costs in the $10s of billions.

Cybertruck Order Conversion and Costs

So how does this relate to the Cybertruck? The Cybertruck is a car that Tesla was far too ambitious with, it doesn’t seem to meet the needs of consumers changing their minds, and we expect it to never recover R&D costs.

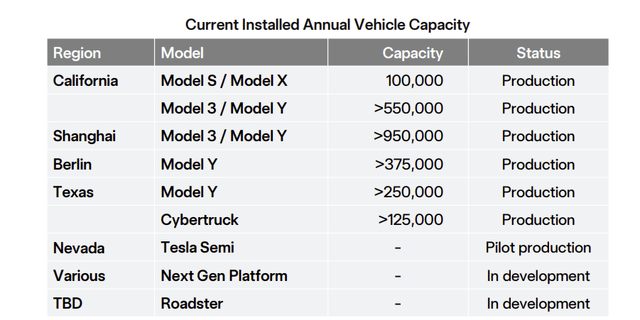

Tesla has built up a massive factory in Texas with capacity for >125k Cybertruck per year. The exact cost remains to be determined, and hasn’t been truly calculated, but Elon Musk has indicated it could be >$10 billion. Again we don’t have an exact breakdown but given that the Cybertruck is larger, more expensive, and lower volume we don’t expect it to be less / unit.

As a result, we can expect the Cybertruck factory construction costs to be at least $3 billion over time.

At the same time, reports are coming out that indicate that Tesla has now exhausted its entire 1 million reservation list, with just 2.5% of consumers converting. Tesla has officially closed its U.S. reservation program, indicating that it has exhausted all of its available reservations and interest from that standpoint.

The current wait time for a base level Cybertruck is $80k is 10-days. That indicates that demand is dropping. Given that vehicle sales tend to be seasonal, we don’t expect things to pick up. However, without speculating on what happens to the production line, two things are clear.

(1) The company’s original backlog for the Cybertruck is much weaker than what was expected.

(2) Margins and ASP for the vehicle are likely to go down given that the company emphasized high-value vehicles first.

It’s a polarizing vehicle. The company has sold ~25k Cybertruck so far, worth ~$3 billion worth of revenue. With the company’s 10% margin, that means the company is billions of dollars away from covering the cost of $3 billion in factory costs. Without the ability to cause a pickup in sales, the company could lose billions from its unique Cybertruck.

Election

Tesla has hit a $1 trillion market capitalization, pushing Tesla CEO Elon Musk’s net worth to >$300 billion. The company’s share price has gone up by more than 30% after Donald Trump won the election for the presidency of the United States. Elon Musk’s support for Trump is clearly resulting in a central position in the administration, as he joined a call with Ukraine’s President Zelensky with the future leader.

We see this as a major downside risk to Tesla for three key reasons.

(1) Elon Musk already has competing interests. Lawsuits have raised questions about company independence before, as have direct actions such as Elon Musk redirecting Nvidia chips meant for Tesla to xAI. With Trump saying that Musk will have important government positions, we expect Musk’s competing interests to grow, which could hurt Tesla further.

(2) Tesla is public, and Elon Musk has a lower equity stake. Elon Musk has had his Tesla pay package nullified by a judge, and he himself has stated he feels he doesn’t have sufficient ownership in Tesla to justify focusing on it. Together with point (1), we feel that Elon Musk will focus even less on Tesla.

(3) Trump has stated repeatedly that he will support additional oil drilling. Given demand is currently weak, major analysts such as Citi are expecting oil prices to decline under Trump. That’s not particularly surprising either, given that Trump has advocated for cheap gas prices.

Given that we already know that falling gas prices slow down EV adoption, and Trump weakened auto emission standards in his last term which decreases manufacturer EV construction appeal, we expect EV demand to be weaker for the next 4-years.

As a result, we see Tesla’s share price improvement as a knee-jerk market reaction to Elon Musk’s improvement in power that will be tangibly worse for investors.

Tesla’s Slowing Consumer Appeal

In general, we see rapidly slowing down consumer appeal for Tesla.

To start with, surveys indicate that consumers are less likely to purchase an EV at all. Tesla’s CEO Elon Musk had previously advertised a multi-year 40-50% growth rate in vehicle sales. The company did incredibly well after the recent quarter’s earnings in the market, when Elon Musk again forecast a 20-30% growth rate for 2025.

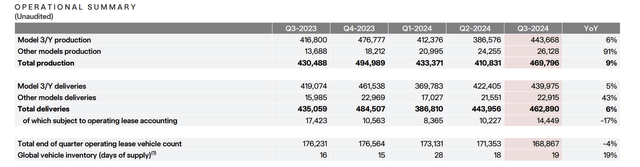

To be honest, we don’t expect the company to get close. The company saw 5% YoY Model 3/Y delivery growth and 43% growth in other models. That pushed total deliveries up 6% as the company was boosted by the launch of the Cybertruck. At the same time, the company has seen vehicle inventory increase YoY for the company.

With Cybertruck demand dying down, as discussed above, and consumers moving away from EVs, we see minimal chance of the company hitting 20-30% growth. The company has missed its growth estimates before, and we don’t see why that would change.

Valuation

Putting this all together, we see Tesla as dramatically overvalued.

The company currently trades at a 0.5% FCF yield for its TTM. That’s several billion in FCF that the company is effectively adding to its cash pile. The company’s cash pile is ~$33 billion, which is ~5% of the company’s market capitalization, not enough to drive substantial returns from its cash pile by itself.

The company’s growth is mid-level single digits in vehicles, below the growth rate of the S&P 500 earnings. Yet, the company’s P/E for TTM is >50x. That’s a lofty valuation that shows, in our view, Tesla should be trading at a fraction of its current value.

Thesis Risk

The largest risk to our thesis is political pressure to move towards EVs. Specifically, climate change is a real risk, and governments are working to avoiding emissions. New governmental policy to force EVs could increase demand for Tesla and put the company much closer to justifying its valuation to investors.

Conclusion

Tesla is a great EV manufacturer that has done an impressive job for itself. At the same time, the company has built up an impressive storage portfolio, selling increased numbers in that emerging field. The company is generating billions of dollars in annual profit, building up an impressive portfolio of cash. However, that doesn’t change the fact that this is a company worth more than $750 billion.

The company doesn’t just need profit, it needs $10s of billions in reliable and growing annual profit. Its vehicle sales are growing at mid-single-digits, and long-term demand for the Cybertruck is questionable. As a result, we expect the company to struggle to generate earnings to justify its valuation, making it a poor investment.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.