Summary:

- The fundamental growth story of Tesla, Inc. is expanding the total addressable market by driving costs down.

- Robotaxis, next-gen insurance, and a product ecosystem are driving my future growth expectations for Tesla.

- The underlying economics of Tesla are strong, but it looks overvalued at current levels.

- The winner of a Bertrand game is the one with the lowest marginal cost.

- Tesla’s intense focus on cost reduction means the EV price wars should actually benefit Tesla in the long run despite short-term margin compression.

Sean Gallup/Getty Images News

“It is the constant leadership in engineering, not patents, that is the fundamental source of protection.”

– Philip Fisher, Common Stocks and Uncommon Profits.

Investment Outlook and Valuation

An investment in Tesla, Inc. (NASDAQ:TSLA) carries immense risk at current valuations. With a market value of nearly $700B, investors today buy Tesla with grandiose expectations for the future. Although it’s not risky in the “loss of principal” sense, it is risky in the sense of opportunity cost.

It will be difficult for Tesla to continue compounding shareholder value at the rate it has in the past, and there are probably better options for long-term multi-baggers available right now. But Tesla’s growth story is real and should still benefit the long-term investor. At first glance, Tesla seems to be the antithesis of a business that a value investor would consider. But the electrification of the future is profitable and buying Tesla at an appropriate price will make any investor very happy in the long run.

I have used what I believe to be brutally conservative estimates for Tesla’s future prospects. Based on this analysis, I estimate the following equity values:

| Margin of Safety Price (Strong Buy price) | Fair Value Estimate |

| $142.35 | $412.20 |

The margin of safety price assumes a growth rate at nearly half of the historical average and a price/free cash flow multiple at half of the current level. With free cash flow at roughly $4.2B, Tesla’s organic rate of growth is likely to slow in the future. However, Tesla reinvests heavily in R&D and new products drive new growth. Tesla has a robust pipeline of growth opportunities including Cybertruck, Tesla Semi, Robotaxis, a home-solar ecosystem, and commercial energy storage. Tesla is also expanding its production capabilities with a new Gigafactory in Mexico, and has recently broken ground on a lithium refinery. It’s likely I’m being too conservative in my growth estimates, but I am very comfortable that my valuation represents a margin of safety for all investors with a long time horizon.

For risk lovers interested in more ambitious estimates, I estimate a current fair market value of $412.20 and a market cap of $1.3T based on net income and expected growth rates. This assumes net income is more reflective of Tesla’s intrinsic value than free cash flow because of the heavy R&D investment (which exceeded $3B in 2022). For ambitious long-term investors, Tesla is a screaming buy. Being a more conservative value investor, I’m willing to wait and see if volatility is my friend and if I can initiate a position at a much lower price than current levels. Tesla is riddled with speculative investors, but someone that enjoys the process of compounding over time will profit from the failures of speculators if they enter at the right price.

Fifteen years ago, few people saw the future that Elon Musk was creating. Electric Vehicles did not start with Elon, but he heralded the next generation of the auto industry as he built Tesla into the mega-corporation it is today. Constant innovation is required to stay ahead in a tech-driven world and past success is not a guarantee of future performance. It’s hard to think of companies that have achieved the engineering success that Tesla has in the past 10 years. Elon is an engineer, and engineering excellence is the center of every decision Tesla makes. When coupled with industry-leading and scalable manufacturing capabilities, the roadmap for Tesla becoming the world’s most valuable company is clear, but will not be easy.

The success of the past is of no concern to today’s investor, so let’s discuss some key innovations and developments in Tesla’s business that I believe will drive future growth.

Robotaxis and humanoid robots:

We intend to establish in the future an autonomous Tesla ride-hailing network, which we expect would also allow us to access a new customer base even as modes of transportation evolve.

We are also applying our artificial intelligence learnings from self-driving technology to the field of robotics. For example, in 2022 we previewed Optimus, a robotic humanoid which is controlled by the same AI system.

-2022 Tesla Annual Report.

The ride-hailing network is an interesting business idea. In what could be a mortal wound for Uber Technologies, Inc. (UBER), Lyft, Inc. (LYFT), or other similar services (DoorDash, Instacart), Tesla is hoping to allow owners to utilize full-self driving (FSD) capabilities to generate income. From an economic point of view, it’s a win-win-win if successfully implemented. There’s a value-add from this service for all involved parties: the owner makes some money, Tesla gathers more FSD data, and ride-sharing services become cheaper for consumers. This also reduces the real cost of owning a Tesla, which expands Tesla’s addressable market to lower-income families.

In artificial intelligence (AI), usage is key. The more FSD is used, the more data will be collected and the smarter, better, and safer the AI will become. Martin Viecha, Tesla’s Head of Investor Relations, recently said this about FSD: “we profoundly believe mass collection of data and AI is only way to solve generalized autonomy, that’s the path we’re taking.” As FSD safety and reliability increases, it will allow further adoption of FSD capabilities and generate more data to further enhance FSD safety and dependability. It’s a classic virtuous cycle but is not devoid of risk. The proposed Robotaxi ecosystem is entirely dependent on the widespread adoption of FSD capabilities, which is in no way a certainty. Tesla is navigating ongoing regulatory pressure and consumer preferences have not yet shifted sufficiently for FSD, or any autonomous driving product, to be considered a viable or profitable standalone business. As of today, neither governments nor consumers are ready to adopt autonomous driving in full force.

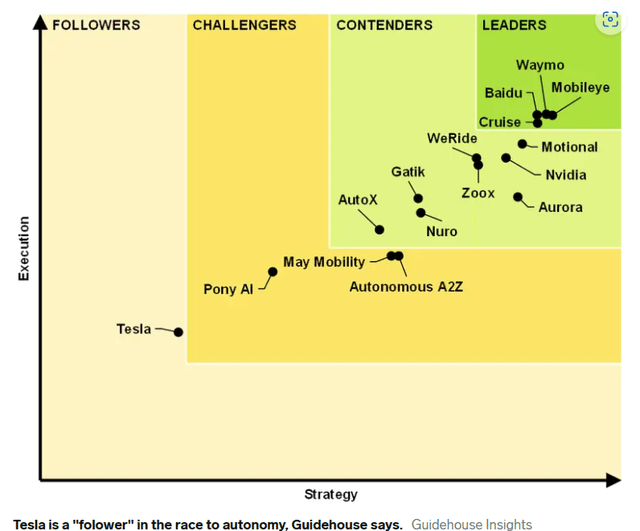

Guidehouse Insights ranks Tesla last of 16 major autonomous driving developers, giving them the rank of “Follower.” But is it so bad to be considered a follower? Autonomous driving is certain to encounter obstacles and controversy along its path to widespread adoption. Tesla doesn’t need to be at the forefront of this fight, it just needs to build a reliable product and implement its strategy. Even in the case that FSD is an utter failure, Tesla has the financial firepower to pursue acquisitions. Aurora, a “Contender,” has already indicated the potential for acquisition by Apple Inc. (AAPL) or Microsoft Corporation (MSFT). Although it’s unlikely Tesla will scrap FSD altogether or pursue an acquisition, they have options to expedite the time to market for robotaxis.

Elon has been talking about this for years, and we’ve already missed his goal of a fleet of robotaxis by 2020. If FSD becomes more widely available and used, this is a very legitimate and lucrative business opportunity because it will greatly expand the total addressable market for Tesla vehicles.

Tesla is also expanding on its AI-fueled innovation with the humanoid robot Optimus, which shares the same AI system as FSD. Elon has stated that there’s no intent to use the robot in the Tesla manufacturing process, which is definitely a viable use case (and likely one of the only realistic roadmaps for this to become a successful product), so it’s a bit disheartening to hear that is not in the plan. As of now, there are too many uncertainties to glean any sort of useful future expectation from this announcement. However, Elon did mention in the recent Investor Day that he believes, between FSD and Optimus, that Tesla is the clear leader in “Real AI.” Meaning, real-world implementations of AI capabilities. Whether or not this is true, it signals the focus of Tesla which is to build profitable products out of innovative technology.

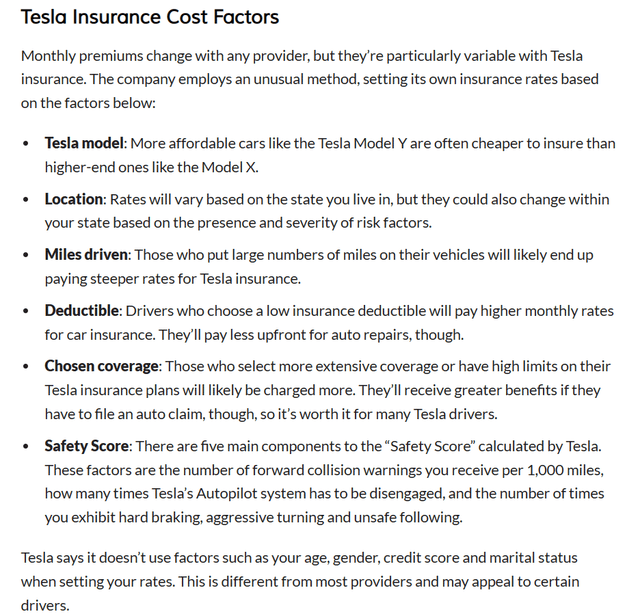

Insurance

In a discussion of next-gen tech, you probably weren’t expecting to read about insurance. The boring and archaic insurance industry can be revolutionized by one thing: data. Predictive analytics mixed with an abundance of real-time data has and will continue to revolutionize auto insurance. Connecting with the previous discussion, the usage and safety of FSD will drive down insurance costs for customers (and further decrease the total cost of ownership, expanding the total addressable market), but real-time non-FSD driving data makes it easier for Tesla to write data-driven insurance policies that are directly influenced by how safe an owner drives. Tesla’s insurance business will scale with its abundance of data and geographic reach. It’s currently only available in 12 states, but there’s a clear value added here. Further, Tesla claims it doesn’t use factors like age, gender, credit score, and marital status in its cost determination, which can increase the competitiveness of policies.

Data empowers better insurance policies, and Tesla is hitting the nail on the head by attempting to leverage their driving data to write cheaper yet more profitable auto insurance policies. Of course, the risk with insurance is one of risk miscalculations. If Tesla writes too many policies that are over-optimistic about FSD capabilities or driver safety, it could bite them when claims come in.

Insurance is a business of trust. If clients don’t trust Tesla to foot the bill when claims come in, there’s little hope for long-term success in this business. Tesla has received negative feedback on the customer service of its insurance operation (per the MarketWatch article linked above), which erodes trust and will challenge scalability. Regardless, if Tesla can leverage its driving data and AI to write policies with better rates and higher profitability expectations, it could become a serious contender in the auto insurance industry. The goal is likely not to become a full-scale insurance provider though, but to decrease the total cost of ownership of a Tesla by offering cheaper insurance on Teslas than the competition.

There’s also a question about liability when FSD is used – will Tesla accept full responsibility and liability for damages caused by FSD accidents? The entire premise of autonomous vehicles is that AI-operated vehicles will be safer than human-operated vehicles. Accidents are accidents though and they will still happen, especially as the software is being tested and improved, but overall safety should increase over time. If there are major defects or cybersecurity concerns in the FSD software, Tesla may end up being liable for far more FSD-related accidents than expected, which could make the insurance business a cash-burning facility.

Government Programs

On page 9 of the 2022 annual report, there’s a brief discussion of the various government programs Tesla benefits from. Government incentives decrease the cost of ownership and expedite the adoption of sustainable energy solutions, which is a significant tailwind for EV manufacturers and sustainable energy providers. The recent passing of the Inflation Reduction Act provides a $7,500 incentive through the year 2032 for EV purchases, which expands Tesla’s addressable market by decreasing the cost of owning a Tesla. Tesla vehicles are considered zero-emission vehicles (ZEVs). Many companies that offer combustion-engine vehicles will face an increasing number of headwinds related to emission standard compliance, which will likely become more strict over time. The sale of tradeable credits can provide a steady and lucrative revenue stream for Tesla and will generate continued earnings growth. Further, Tesla and its customers enjoy tax benefits with solar energy production and storage systems. As more governments adopt pro-renewable policies, Tesla is well-positioned to reap plentiful rewards from its ecosystem of sustainable energy products and services.

Net metering is also a major tailwind for Tesla’s future growth expectations. Net metering allows owners of solar panels to sell excess energy back to their local energy grid. Further, the Powerwall product enhances the profitability of net metering by opening up the possibility of arbitrage. Owners can store energy in Powerwall when energy demand and prices are low, and sell the energy when demand and prices increase. Energy use is cyclical in many places, as either extreme heat or cold increase energy demand, which means price arbitrage is a reliable option for Powerwall owners. The annual report mentions the risk of pushback from local utility companies or regulators, but this is one of the primary benefits of going solar and can turn solar panel ownership into a profitable enterprise for owners, so I do not believe the risk will materialize in a significant way. By not allowing owners to participate in net metering, regulators would cause a drastic slowdown in the adoption of solar energy production and would make it more difficult to hit increasingly ambitious sustainable energy goals set by local, state, and federal governments worldwide.

The Value of an Ecosystem

A recent and rapid development in economics is the concept of a product ecosystem. Businesses like Apple, Microsoft, Meta Platforms, Inc. (META), and Google (GOOG) have robust product ecosystems that combine hardware and software into a “whole is greater than the sum of its parts” type product and service offering spectrum. A product ecosystem is the concept of a business offering many interconnected products, in which owning some or all of the products greatly enhances the marginal benefit of owning each individual product. For example, Apple offers a cell phone, headphones, and a smartwatch, among other hardware products. The ownership of an iPhone greatly enhances the value of owning AirPods and the Apple Watch, and vice versa. Further, the consistency of the experience across the different systems, since they all run on Apple software, is a net benefit for the consumer. Apple has amplified the value-add of its offerings and has developed a seriously wide moat as a result.

Tesla can do the same thing. They are attempting to replicate this concept with an ecosystem of energy products, which will provide a number of benefits for customers. The Tesla ecosystem makes possible energy production (solar panels or roof), energy storage (Powerwall), transportation with an electric vehicle, at-home charging capabilities, and income opportunities with net metering and vehicle-sharing. As customers buy more products and utilize more services the marginal utility of each individual product or service increases, and Tesla generates more earnings and widens its moat. The value of a business is a function of the value it provides to society, and Tesla’s ecosystem is innovative and, quite frankly could revolutionize life as we know it.

It’s not a certainty that this will be successful. Tesla’s ecosystem is subject to a number of regulatory concerns and implementation challenges. Business investments involve risk, and Elon Musk is not known to shy away from risk. If successful, the investment in the development of the Tesla ecosystem will be hugely profitable and beneficial for the company, but it’s far from certain.

Economies of Scale

Auto manufacturing is a famously difficult process to scale. What began with Ford Motor Company’s (F) assembly line has evolved immensely and is now almost entirely automated. Tesla’s factories are among the largest in the world, which introduces the benefits of scale and expertise in future projects. Gigafactory Berlin is the powerhouse of production that will allow Tesla to continue to grow at pace and scale their business globally and also provides a blueprint for future facilities. Tesla can leverage lessons learned and expertise gained to drive efficiency and avoid costly mistakes. The use of robots greatly increases the overhead cost of these facilities, but greatly amplifies the long-run sustainable profitability. Gigafactory Berlin features one of the world’s largest robots.

Tesla will also need smaller and more localized manufacturing capabilities, and the knowledge and expertise gained through previous factory openings will drive more efficient use of resources. Tesla believes its heralding in the 3rd auto production revolution:

In 2017, it cost Tesla $84,000 to make each car. That’s down to $36,000 per vehicle in recent quarters, the VP noted. Almost none of those savings came from cheaper battery costs. Instead, Tesla benefitted from better vehicle design to make manufacturing as easy as possible, and new factory design.

Tesla’s first factory in Fremont, California, near Silicon Valley, is not a great place to build cars, Viecha added, noting that there are cheaper places including Shanghai and Berlin. Tesla has 2 new factories in those locations, along with another in Austin, Texas.

The company wants to continue this trajectory, pushing the boundaries of how much it costs to produce an electric vehicle.

The Fremont factory accounts for about half of Tesla’s production. As new facilities produce more cars, they will be able to manufacture each vehicle for less than $36,000, which should be good for Tesla’s profitability, Viecha said.

During 120 years of the automotive industry, he argued there’s only been 2 major revolutions in manufacturing. One was the Ford Model T and the other was Toyota’s cheaper production approach in the 1970s, he explained.

“EV architecture is so different from internal combustion engine, it allows for a third revolution in automotive manufacturing,” Viecha said.

The elephant in the room here is Gigafactory Shanghai. Although this is a hub of productivity and value creation today, the ongoing east-west tensions and China’s affinity for ‘China-first’ policies make the outlook for Gigafactory Shanghai uncertain. This is a considerable risk to Tesla’s pursuit of scale, and the exit of this market or sale of this factory would be a major setback in Tesla’s journey.

Even without a full-scale exit from the Chinese market, Tesla faces considerable competition from the growing Chinese EV industry, so consistent growth in the Chinese market is very uncertain. Companies like BYD Company Limited (OTCPK:BYDDF) and NIO Inc. (NIO) present material risks to Tesla’s profitability in its Chinese operations. Renowned Berkshire Hathaway vice-chair Charlie Munger recently said that BYD is killing Tesla in the Chinese market, and when Charlie speaks it’s wise to listen.

However, in the Q&A section on Investor day, there was a question on this exact topic (at 12:12 in the video). Tom Zhu, who is responsible for global production and sales & delivery services (and also played a key role in the opening and scaling of Gigafactory Shanghai), said he is not too worried about geopolitical risk in China. He noted that Tesla cars create value for China and that the Tesla factory has created many jobs and has been an engine of economic productivity. It’s unlikely Xi Jinping and the Chinese Communist Party will seriously challenge Tesla’s operations, but no one really knows with any certainty what the future will hold in Gigafactory Shanghai.

Tesla is also leveraging its manufacturing scale and expertise to greatly reduce the marginal cost of commercializing new products. Cybertruck and Tesla Semi are two greatly anticipated products, which open Tesla up to entirely new markets and greatly expand their total addressable market.

In the recent investor day, Tesla unveiled ‘Master Plan 3’ which laid out a clear and understandable roadmap to electrifying the Earth. Zachary Kirkhorn, the CFO, had the most important contribution in my opinion, which was the highlight of cost reductions widening the total addressable market of Tesla. This has been the key focus of my article because this is the key to Tesla’s long term success and long-term value creation ability. What I believe is the most important piece of this event was the contributions of the variety of managers that participated.

The message is clear: Tesla is bigger than Elon Musk. Key-man risk is a very important aspect to my considerations of the investability of Tesla, so it’s very promising to see that Elon is backed up by a team of highly capable and driven individuals. In the Q&A section, Elon made a comment I was very pleased with. He started the Q&A session by urging participants to focus their questions on Tesla’s long-term value creation ability. Long-term value creation and earnings growth is what makes a stock compound. Even at a market value of $700B, Elon and Tesla’s management team remains hyper-focused on long-term growth. There is no resting on the laurels here, and that should give any investor comfort.

Conclusion

Overall, Tesla, Inc.’s strategy to expedite the adoption of sustainable energy solutions has a singular focus right now: decrease the total cost of ownership to expand the total addressable market. This is precisely what the focus should be. Without low-cost options, Tesla will have trouble driving further growth and adoption of its product ecosystem. Further, the EV market is experiencing a Bertrand-esque price war. In the Bertrand model, companies undercut each other’s prices to gain market share. The winner of a Bertrand game is the company with the lowest marginal cost.

As mentioned earlier, Tesla’s economies of scale and expertise have driven average unit costs down from $84,000 in 2017 to $36,000 in recent quarters. This is a promising trend and coupled with Tesla’s intense focus on decreasing the total cost of ownership, the EV price wars could actually benefit Tesla in the long run, as it will parse out less-focused/higher-cost competitors. A Bertrand game cuts out less focused competitors and rewards those with scale and lower marginal cost. Although the EV prices wars will compress Tesla’s margins in the short run, they will also drive out a lot of competition in the long run, which Tesla will benefit from.

Barring immense scandals or accounting fraud, Tesla, Inc. is here to stay. By leveraging natural economic tailwinds, namely shifts in consumer sentiment and government incentive programs, Tesla should be able to drive strong and sustainable growth. Combining economic tailwinds with constant innovation, engineering excellence, and increasingly efficient commercialization of new products yields an extremely lucrative and attractive investment opportunity. The requirement for success in a Tesla investment is to wait for the right price and then tune out the noise and hang on for a while.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.