Summary:

- My previous sell view on Tesla, Inc. has been playing out.

- Management’s margin outlook is unreliable.

- Recent price hikes in the premium models don’t offset continued price cuts overall.

- The energy business will grow exponentially.

- I believe materially visible traction in Tesla’s energy business increases the chance of a re-rating; changing my stance from a “sell” to a “hold.”

RoschetzkyIstockPhoto

Introduction

A few weeks ago, before the Tesla, Inc. (NASDAQ:TSLA) Q1 FY23 results, I published a sell note on the stock. I viewed its price cuts as a move toward loss of differentiation vs other automotive competitors. Since then, TSLA stock has fallen 8.73% vs the S&P 500 (SP500) fall of 0.03%; an alpha move of 8.7%.

I believe the Q1 FY23 earnings update continues to paint a bleak picture on margins. I think Tesla’s recent roll-backs of price increases in some of its models improve the scenario somewhat, but not nearly enough. All in all, I still don’t like what is happening to Tesla’s automotive margins. However, strong traction in the energy generation business is a saving grace; enough to change my stance from a “sell” to a “neutral/hold.”

Thesis summary

My neutral stance on Tesla is due to 3 key views:

- Management’s margin outlook is unreliable

- Recent price hikes in the premium models don’t offset continued price cuts overall

- The energy business will grow exponentially

Management’s margin outlook is unreliable

During the Q4 FY22 earnings call, in response to a question on the effects of pricing cuts, CFO Zachary Kirkhorn commented:

we believe that we’ll be above both of the metrics that are stated in the question, so 20% automotive gross margin, excluding leases and credits, and then $47,000 ASP across all models.

– Author’s bolded highlights.

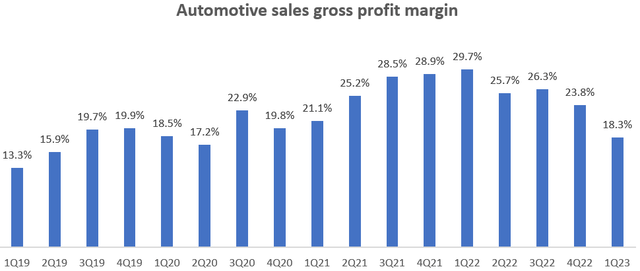

The company has already missed this expectation in Q1 FY23, as it printed 18.3% in automotive sales’ gross profit margins; continuing the margin bleed since peak levels of 29.7% in Q1 FY22:

Automotive Sales Gross Profit Margin (Company Filings, Author’s Analysis)

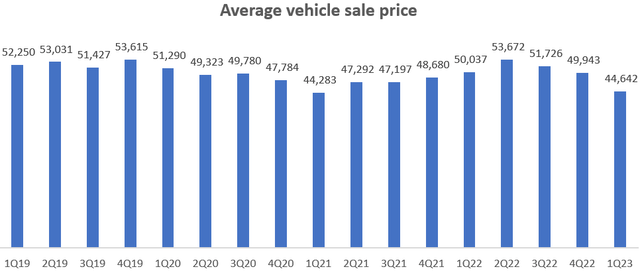

On the average selling price front, we saw a 10.6% QoQ decline to $44,642; the steepest QoQ fall in 4 years:

Average Vehicle Sales Price (Company Filings, Author’s Analysis)

In the Q1 FY23 earnings call, Elon Musk frequently referred to Tesla’s ability to sell at 0 profit, to later recoup via monetization of future autonomous software developments. This may very well be true, however, without tangible signs of visibility and traction, it hardly meets the risk appetites of even growth investors.

Ultimately, for my medium-term time horizon of investing, market developments that occur 6-9 months from now matter most. I acknowledge that Musk said full autonomy will happen this year in the earnings call. However, I do not view this statement as reliable, as he was hesitant to make that claim and, more importantly, there is a track record of this being a postponed promise since at least 2019.

Recent price hikes in the premium models don’t offset continued price cuts overall

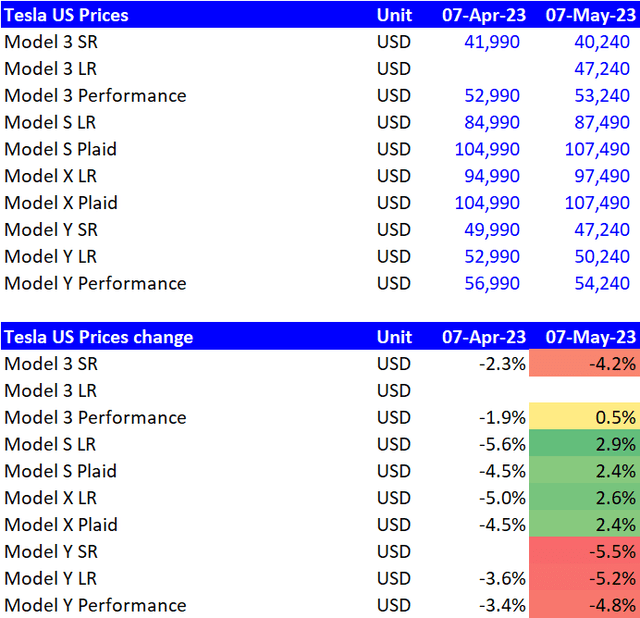

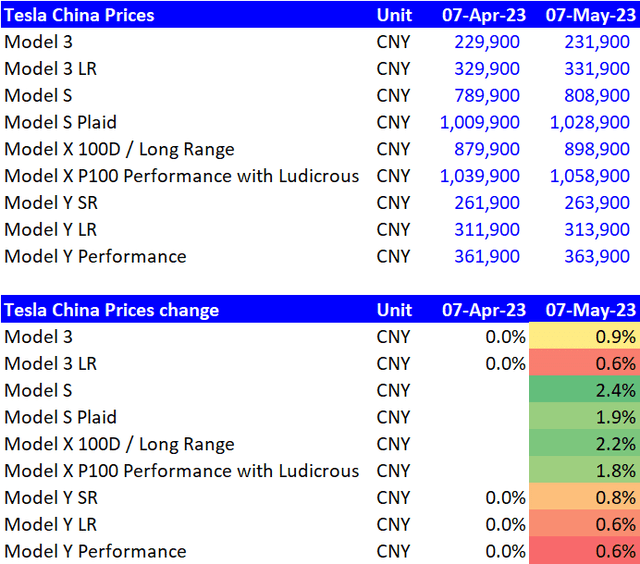

Tesla recently implemented some price hikes in some of its models across geographies. Here is the summary of the changes in the United States (48.2% of overall revenues) and China (21% of overall revenues):

Tesla US Price Changes (Company Website, Author’s Analysis) Tesla China Price Changes (Company Website, Author’s Analysis)

All the price-hikes are in Tesla’s premium models; Model S and Model X. These models make up only 2.5% of the overall deliveries mix as of Q1 FY23. Therefore, they have little impact on the overall margins. In fact, over the last month, there have been more than 5% price reductions in the U.S. prices for the Model 3 and Model Y. Thus, the overall price and margin cut woes continue.

The energy business will grow exponentially

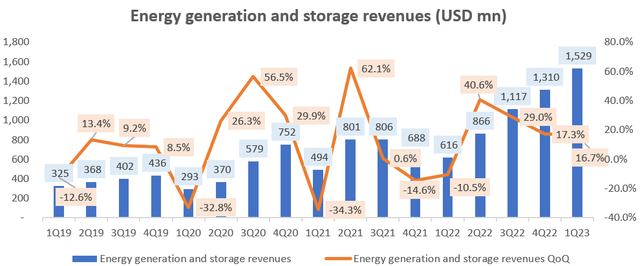

Energy Generation and Storage Revenues (Company Filings, Author’s Analysis)

The last 12 months have led to a 148% increase in the size of Tesla’s energy generation and storage business. The quarterly growth trends for the past 4 quarters are also posting more consistent growth than before. The overall contribution of the energy generation and storage business to overall revenues has jumped 120bps from 5.4% in Q4 FY22 to 6.6% in Q1 FY23.

Management attributes this to the scale-up of the large-scale Megapack battery, driven by utilization ramp-up in its 40GWh Lathrop Megafactory.

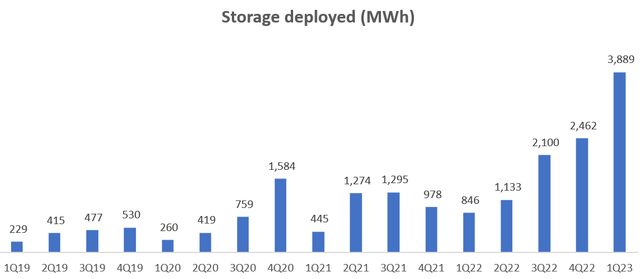

Storage Deployed (MWh) (Company Filings, Author’s Analysis)

The current scale is almost 3.9GWh, which corresponds to a 360% YoY increase. This is enough to power almost 80,000 Model 3’s for one round of charging. A continued ramp-up of production capacity and the addition of another 40GWh Megapack factory in Shanghai is expected to continue the strong growth traction in this business.

Importantly, the growth is expected to occur at healthy, profitable margins; CFO Kirkhorn noted that they are working toward mid-20% gross margins. Currently, Tesla’s energy business has 11% gross margins. This implies margin expansion potential to accompany the growth prospects.

Hence, with meaningful exponential and profitable growth starting to meaningfully materialize in the numbers, I think the battery storage business is something that can post positive surprises going forward.

A change in stance

In my last article on Tesla, I made a strong claim that Tesla was grossly overvalued vs. automotive competitors. Now, as I notice materially visible traction in Tesla’s energy business, I believe the chances of re-rating are elevated. On a valuation basis, the stock seems expensive at a 1-yr forward P/E of 55.22x. However, note that promising growth option values often justify these kinds of multiples. For example, Amazon.com, Inc. (AMZN) was consistently trading at a >50x P/E in 2006 when Amazon Web Services (AWS) was still in its infancy. Perhaps Tesla is at a similar stage now…

So, I am changing my stance on Tesla, Inc. stock from a “sell” to a “neutral/hold.” I do not have the confidence in Tesla stock to buy yet; for that, I would need to see some stabilization in the automotive price cuts and margins.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.