Summary:

- Tesla’s Robotaxi event failed to impress the market.

- The company is expected to show a relatively weak performance this year.

- The rising competition and the lack of a major upside make Tesla a SELL for us.

Anna Moneymaker/Getty Images News

Tesla, Inc.’s (NASDAQ:TSLA) stock has dropped after the robotaxi event that took place earlier this month, as the market questioned the ability of the company’s upcoming service to meaningfully impact the business’s financials anytime soon. Despite all the innovative products that Tesla has been revealing recently, the company itself remains an automaker that has been reporting relatively mixed earnings results this year. It has seen its stock depreciate YTD due to the ongoing price war in the electric vehicle sector.

Back in 2021, we already said that the issues that Tesla faces in China are only getting started, and more challenges are ahead. Since that time, the S&P 500 Index (SP500) saw a return of 34%, while Tesla’s stock trades at the same price as it was in 2021 when our last article on the business came out here on Seeking Alpha. Currently, we don’t see any major upside for Tesla and believe that its stock remains a SELL ahead of its Q3 release on October 23rd.

The Upside Is Not There Anymore

There was a lot of skepticism before the beginning of the Robotaxi event that took place earlier this month. That skepticism was more than justified. For a long time, the predictions that Tesla’s CEO Elon Musk was making failed to materialize plenty of times. Elon Musk’s prediction in 2016 that Tesla was less than two years away from complete autonomy didn’t play out. To this day, the company only has Level 2 autonomy. His prediction in 2019 that Tesla will have 1 million robotaxis in 2020 also failed to materialize.

The event that took place this month certainly was interesting, but also disappointed plenty of investors. Major outlets such as Bloomberg and others found out after the event that the Optimus robots were controlled by humans behind the scenes. At the same time, it’s also difficult to imagine that the autonomous FSD will be available in Texas and California next year, given that previous predictions about autonomy did not materialize and Tesla is still on Level 2 autonomy.

It’s also questionable whether it will be possible for Tesla to launch Cybercabs, which were revealed during the event, before 2027 for less than $30,000. We should not forget that while Cybertruck was revealed in 2019, it entered volume production only last year, and it’s expected to be profitable only in 2025. Tesla Semi has a similar story. After the concept for the truck was revealed in 2017, it entered production only in 2022, while the volume production is expected only in 2026. That’s why there’s a risk that the production, and especially the volume production, of Cybercabs is manageable in less than three years from now.

What we can be certain about is that none of the products that were revealed earlier this month will have a meaningful impact on Tesla’s financials anytime soon. In a way, that’s an issue since the company is suffering from the rising competition that is slowly its market share.

Earlier this year, Tesla already executed another round of price cuts across the globe to attract new customers. This has already negatively affected Tesla’s bottom-line performance. The company’s gross profit margins are now below the sector’s median, while the performance in Q1 and Q2 was relatively weak. The company’s stock is also down 11% YTD, while the S&P 500 Index is up over 20% YTD.

The problem is that despite the price cuts, the competition continues to heat up. In Q3, Tesla delivered 462,890 vehicles, which was below the expectations of 463,310 vehicles. A few months ago, CEO Elon Musk himself said that the Chinese EV makers could demolish the competition, while the Chinese EV automaker BYD Company (OTCPK:BYDDF) is now expected to sell more vehicles than Tesla this year.

All of this points to the fact that the upside for Tesla is limited for now. The company is expected to grow its sales barely this year, while earnings are expected to be down Y/Y. That’s why we don’t expect many positives from the upcoming Q3 earnings report that should be out this Wednesday.

The Real Value of Tesla

With the lack of any meaningful upside this year, we believe that Tesla’s stock is an unattractive investment. Below, we present our valuation model, which will show why buying the company’s shares at the current price makes no sense.

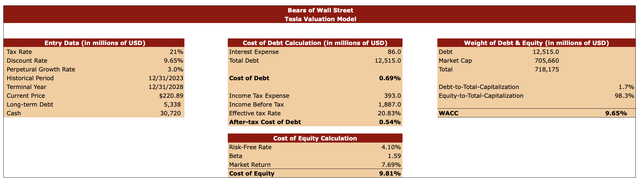

Our valuation model covers the period of the next five years. The effective tax rate in the model is 21%, which is the current corporate standard rate in the United States. The perpetual growth rate is 3%, which is close to the historical GDP growth rate. We made this model when Tesla was trading at $220.89 per share, and the data for the cash reserves and the long-term debt is taken from the latest earnings report for Q2.

The discount rate in the model is 9.65%. We calculated this rate first by figuring out Tesla’s after-tax cost of debt and cost of equity rates. The numbers for the cost of debt calculations were taken from the recent earnings report. To find out the cost of equity we used the risk-free rate of 4.10%, beta of 1.59, and the market return rate of 7.69%. Thereafter, we weighted Tesla’s debt along with equity and found out the discount rate.

Tesla’s Valuation Model (Bears of Wall Street)

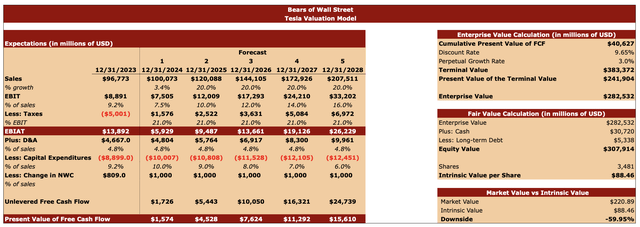

Once we got the initial data needed for our calculations, we then moved on to our forecast. In our model, we assume that Tesla will grow at a single-digit rate this year, which is also what the consensus currently is. In 2025 and beyond, we forecast a sales growth of 20%. This is above the current consensus by a few percentages, but there’s a possibility that analysts will do upward revisions in the future considering that the EV market is expanding, and Tesla’s top line is constantly improving.

The EBIT in 2024 is expected to be down Y/Y. The consensus is similar and a decline in earnings is expected, after which the EBIT is gradually forecasted to improve. We have reflected this in our model as well.

The D&A as a percentage of sales in the model is similar to the historical performance, and the change in net working capital remains positive as it was last year. The CapEx in 2024 is expected to be over $10 billion, which is what the management recently guided.

Once we completed our forecast table, we then moved on to calculating Tesla’s intrinsic value, which is presented on the right side of the screen below. After figuring out Tesla’s enterprise value, we add cash and subtract long-term debt to arrive at the equity value of $307.9 billion. Then we divide the equity value by the number of outstanding shares and find out that Tesla’s intrinsic value is $88.46 per share. This means that the downside is ~60% from the current market price.

Tesla’s Valuation Model (Bears of Wall Street)

While our model shows a significant downside to Tesla’s shares, there are nevertheless price targets that are lower than ours among major Wall Street firms. Even if we decrease the assumptions for the tax rate in the model to ~10%, then the intrinsic value would be around $100 per share, which also represents a significant downside. Since there’s a possibility that corporate taxes in the United States will increase in the coming years to combat the rising budget deficits, we believe that at the very least assuming a 21% rate in the model for the following years makes sense.

Furthermore, by trading close to 100 times its future earnings and significantly above the sector median, it’s difficult to see how Tesla could be considered a safe and attractive investment at the current price.

Risk to Our Bearish Thesis

One of the biggest risks to our bearish thesis is the fact that Tesla has been trading at an exuberant valuation for a long time, and that did not stop its shares from appreciating even further. That’s why the shares could perform well if there are enough positive developments that will keep investors excited about the company’s future.

While the price war within the electric vehicle sector is certainly a big deal, especially for the bottom-line performance, it benefits the top-line performance as cheaper vehicles become more attractive to consumers. We already see an increase in global EV sales, which is certainly a positive development for Tesla and its peers.

There’s also a possibility that 2025 will be a much better year for Tesla since it’s expected to launch a new affordable vehicle, which could drive its sales much higher. That’s the main reason why we slightly increased the sales growth rate in our model above the current expectations in 2025 and beyond. The startup production of the new vehicle is expected in early 2025, and it could certainly have a positive effect on Tesla’s shares. However, having only one major growth catalyst in the foreseeable future is not enough to support the growth story in our opinion.

Final Thoughts

Back in 2021, we saw that the EV environment is changing, and it’s going to be much tougher for Tesla to compete. We turned out to be correct, as Tesla’s stock has greatly underperformed against the S&P 500. Since that time, nothing much has changed, as the company continues to face the same challenges. While it’s able to scale its business and grow sales, the upside for its shares is simply not there, especially at the current market price. That’s why Tesla remains a SELL for us.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.