Summary:

- Tesla, Inc. disappoints with its Q1 results, but there is more than meets the eye.

- We believe that CEO, Elon Musk, is playing the long game and that involves selling more cars for less.

- The difference should be made up through the company’s autonomous driving technology.

Theo Wargo

Thesis Summary

Tesla, Inc. (NASDAQ:TSLA) has disappointed investors with its latest results as profit margins have eroded. Investors are concerned that Tesla could become just another car manufacturer destined to have low margins and high fixed expenses.

However, upon reviewing the Q1 earnings call, it becomes clear to us that the recent margin contraction has been a very deliberate effort by management to increase market share.

Why do this? Because the true value of the company lies in its software, not its cars, and the more cars on the street, the more value this software can leverage.

Elon Musk is playing the long game, and if you believe he can pull autonomous driving off, then today’s price is well worth it.

Quick Overview

Tesla’s recent earnings report has disappointed investors, leading to a +10% sell-off as the market opened.

The “problem” so to speak, has been the sharp contraction in profit margins, which has resulted primarily from numerous price cuts in the last 12 months.

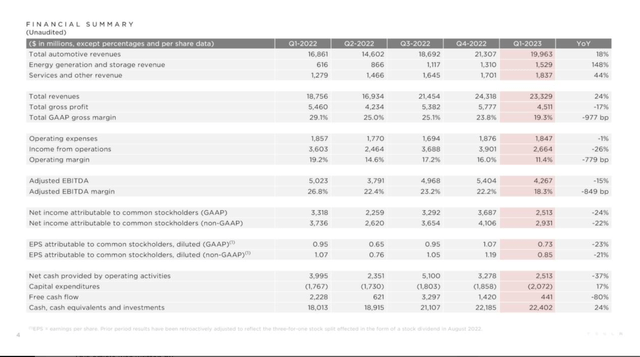

Tesla Financials (Investor Slides)

As we can see, gross margin contracted by 977 bps YoY. This time last year, Tesla’s margin was 29.1%. EPS was positive, but still down 21% YoY and 28.5% sequentially.

Tesla performed reasonably well, but the issue is that the price cuts and lower margins are interfering with the narrative that has allowed Tesla to maintain such a lofty valuation. The “Tesla is not like other car makers” story is losing traction. Or is it?

With that said, I believe a lot more can be learned from listening to the earning call, rather than focusing on the more superficial financial metrics.

So, what do Elon Musk and Tesla’s management make out of this recent quarter, and what are they expecting moving forward?

Tesla Is Still Not Like Other Car Manufacturers

Let’s begin by analyzing a very important part of Musk’s opening statement:

We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin. However, we expect our vehicles, over time, will be able to generate significant profit through autonomy. So, we do believe we’re like laying the groundwork here, and then it’s better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future as we perfect autonomy. This is an extremely important point.

Source: Elon Musk, Q1 Earnings Call.

That is an extremely important point indeed. At this point, a lot of investors may think that the lower margin was a temporary headwind resulting from the fact that the global economy is weakening. Musk does, in fact, mention this in the beginning but then goes on to say that pursuing higher volume and lower margins has been a deliberate action.

Why would Tesla do this? The company plans to bring in more revenues through “autonomy.” What does this mean exactly?

As we well know, Tesla has been working on Full-Self-Driving Technology (FSD) for some time. Right now, this feature is being beta-tested in beta mode and is limited to assisting the driver in steering and certain breaking/accelerating situations.

Now, the idea is that once this feature is enabled, Tesla’s cars will be worth a lot more. It’s easy to see how a car with autonomous capabilities is more valuable than one without, but how exactly would Tesla monetize this feature? Would users pay a monthly fee?

Musk was asked precisely this by Emmanuel Rosner from Deutsche Bank, but the answer wasn’t very precise.

…. So, I guess in which ways would you monetize it?

…So, we internally call it robotaxi. But really, all of the vehicles that have Hardware 3, which is the vast majority of our fleet, we believe will achieve full autonomy. So, there will be like a Model 3 or Model Y would be a robotaxi, a robotic taxi. So, yes, that’s — to the best of my knowledge that we believe the current hardware can achieve full autonomy.

Source: Q1 Earnings Call.

Robotaxi seems to be the name of the game. In the past, Musk has talked about the creation of a Tesla network of Robotaxis. The idea behind this would be to use both company cars and idle customer cars to provide taxi services.

So, you are gone for the week, your Tesla’s in the driveway, and you can simply press a button to send it off to work. It seems far-fetched, but I guess it could work. Tesla has also talked before about creating a dedicated car for this purpose, but this would not fit in with what Musk is saying here about having the most vehicles out on the road.

While I still struggle to see how monetization will happen, the concept put forth by Elon Musk is sound. Tesla is relentlessly working on a software update, autonomous driving, that would greatly increase the value of its assets, its cars on the road. Therefore, it makes sense to maximize the number of Teslas out on the street, even if this means lowering prices and

In Musk’s own words:

But actually, we do have this unique strategic advantage that we have — we’re making a car that if autonomy pans out and we think it will, where that asset is actually will be worth a hell a lot more in the future than it is now. So, it is taking to be possible to sell it at zero profit, but still have the net present value of future cash flows associated with that asset very significant.

Source: Q1 Earnings Call.

Emphasis on the “if” here. Indeed, this plan works out if, and only if, Tesla pulls off autonomous driving well before anyone else.

Can Tesla Pull It Off?

My short answer here, is Yes.

Once again, Tesla’s most valuable asset is the cars it has on the road. These cars are providing Tesla with an enormous amount of data, which is then being used to develop self-driving technology that will change the name of the game.

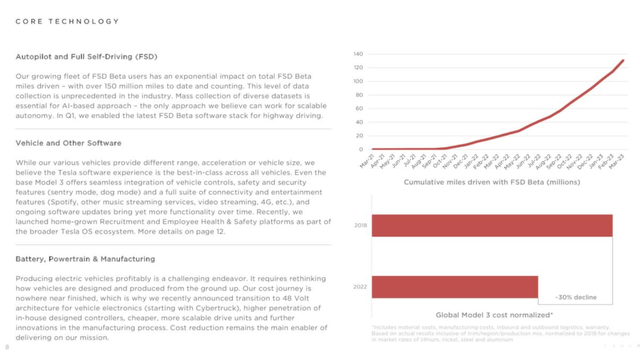

Tesla Core Technology (Investor Presentation)

This slide taken from the recent earnings presentation shows exactly what I’m talking about. On the right, we can see the cumulative miles driven with the FSD Beta. In other words, we can see how much data Tesla is receiving from its cars to enhance its driverless technology.

This is now getting to 120 million miles, and the curve is increasing. With every Tesla sold, more data is obtained through the FSD, and the more data, the more sophisticated a system Tesla can develop.

When it comes to this kind of technology, it’s not enough to program sophisticated software. Real life data is what is needed, and Tesla is leading the pack in this regard.

So, ultimately, I do think Tesla could be the first to commercialize this kind of technology.

Just for fun, let’s crunch some numbers on what it could look like if Tesla pulls it off. If Tesla can create a network of robotaxis using its autonomous driving technology, how much in revenue could they pull in?

The closest thing we have to a comp is Uber Technologies, Inc. (UBER). This company essentially provides a technology, its app, which enables it to profit from offering taxi services.

In 2022, the company made $31.877B in revenue, with an estimated fleet of 3.9 million drivers working perhaps 30 hours on average. Elon Musk is on record as stating that, by 2030, the company could have 20 million units sold. This is a very optimistic number but let’s believe Musk for a second.

Now, not all of these will be eligible for robotaxiing, so let’s exclude some of the earlier models. Let’s say there are 15 million cars available. How many could really be working at any given time? This is very hard to say. It’s true that most of the time, you are using your car, but how many people would actually be willing to put it out as a robotaxi? This would depend on the revenue distribution.

Let’s say that half of these cars opt out of this service, while the other half logs on an average of 8 hours per day. That would mean 15 million cars offering rides for 8 hours a day, meaning 120 million hours of rides.

Uber made $31.877B with 16.7 million hours of driving (3.9 million drivers working 30 hours per week).

So, if we multiply 31,877 billion x 7.18 (120/16.7), that would give us revenues of $229 billion. Of course, that’s far from pure profit for Tesla, but it’s a very handsome chunk of change.

Final Thoughts

The above forecast can give us a notional idea of what kind of revenues Tesla, Inc. could pull if its plan comes to fruition. The main takeaway for investors here is that looking at the Tesla, Inc. margin is not the right metric. The value is in the technology, and if you believe in Tesla’s ability to become the leader in self-driving cars, then today’s price is well founded.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is just one of many exciting tech stocks you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the tech space. Learn the ins and outs of innovative technology and how you can profit from them.

– Access to our Portfolio

– Deep dive reports on select tech stocks.

– Regular news updates

Technology is changing the future, don’t just watch it, be a part of it!