Summary:

- Tesla Energy’s comprehensive strategy includes energy storage, electricity sales, and trading, presenting lucrative opportunities for investors.

- The demand for Tesla’s energy products, such as Megapacks and Powerwalls, is surging, with the potential for significant revenue growth.

- Tesla’s virtual power plant concept and real-time wholesale trading platform, Autobidder, position the company as a major player in the global energy market.

onurdongel

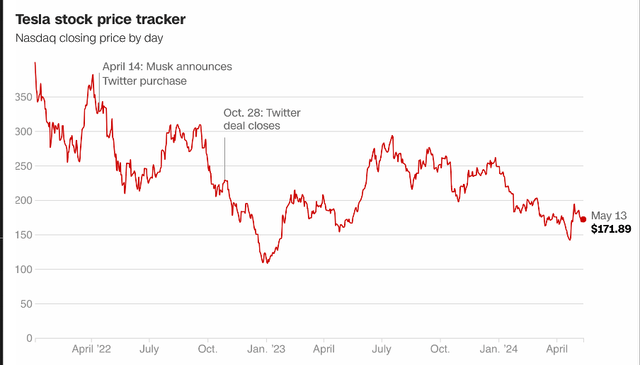

Tesla, Inc. (NASDAQ:TSLA), the renowned electric vehicle (“EV”) giant, is currently in the midst of a subtle transformation. Despite the dominance of its Model Y in car sales during 2023, the competitive landscape in the EV market has somewhat tempered the enthusiasm for Tesla’s stock, resulting in a notable 30% decline since 2024. But it is not all doom and gloom for Tesla shareholders. Within this context, Tesla Energy emerges as a beacon of potential, indicating lucrative opportunities for astute investors.

This article delves into Tesla Energy’s comprehensive strategy, encompassing energy storage, electricity sales and trading. It underscores Tesla’s integrated approach to the energy market and examines the progress and challenges encountered in each domain.

Demand for Energy Products Surges

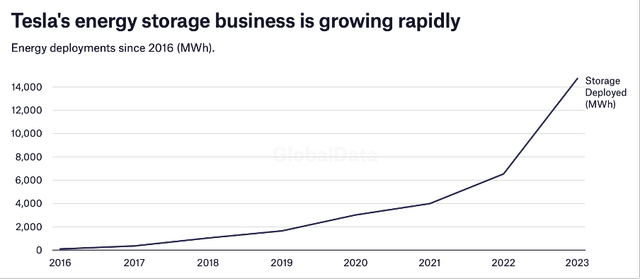

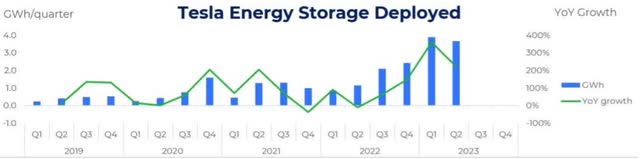

Tesla CEO Elon Musk has long predicted robust growth for energy storage, driven by the imperative to integrate variable renewable energy sources into the grid and to manage the supply demand dynamics arising from electrification, including Tesla’s own EVs. The growth trajectory of Tesla’s energy storage division mirrors a global trend towards renewable energy. At the end of last year, Tesla’s energy storage deployments reached 14.7 GWh. Total installations for 2023 were more than double than in 2022, up by 125%. The division’s profit nearly quadrupled.

Both commercial and residential customers are increasingly turning to Tesla for sustainable energy solutions, outstripping the company’s manufacturing capacity. This heightened demand marks a significant shift in Tesla’s revenue dynamics, with energy storage poised to assume a more substantial role.

Currently, Tesla energy only accounts for 9.4% of its overall revenue. But with the year-over-year growth of Tesla’s energy revenue averaging 62% each quarter since 1Q 2023, Tesla’s energy profits could exceed its automotive business by 2026 based on such growth trajectory.

Leg #1: Storage strategy

Tesla is seeing a lot of traction in the energy storage space. The company has an edge in storage, given that batteries are the heart of EVs, with Tesla seen as a leader of sorts in terms of performance, energy density, and longevity. Tesla’s large-scale battery-storage solutions targeted at commercial installations are called “Megapacks,” while its smaller “Powerwall” storage device is intended for home use.

Following the commissioning of a new Gigafactory dedicated to Megapacks in Lathrop, California, sales of these massive grid-level storage systems have taken off. Tesla offers the domestic Powerwall systems for homes, while the Megapack is designed to be a component of large grid-level storage farms. The great advantage that Tesla has over other electricity storage vendors is that it designs and manufacturers its own batteries, using the same low-cost lithium iron phosphate batteries as its EV cars, providing valuable manufacturing flexibility.

Megapack: A Revenue Powerhouse

Tesla’s Megapack initiative stands out as a significant revenue driver. With planned capacities reaching up to 40GWh in California and similar-sized factories in Shanghai, Tesla’s revenue potential from Megapacks is substantial. Bloomberg estimates indicate a potential 15-fold market size increase by 2024, further solidifying Tesla’s position as a market leader in energy storage solutions.

With Tesla already building its second dedicated Gigafactory for Megapacks in China, it is clearly heading to be a major player in the energy storage market. The latest Megapack battery design is selling at $2.6m each and grid-level storage farms need 100 or more of these batteries, so it’s not surprising that CEO Musk claims that sales of energy systems could eventually be greater than those of its EVs.

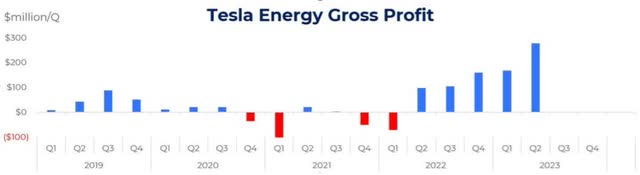

Interestingly, industry experts estimate that the margins on the Megapack from Tesla’s new Lathrop plant are running at 50%. This potentially gives the company major financial competitive flexibility in how it prices these systems and the opportunity to balance its margins across its combined operations of Tesla Auto and Tesla Energy, or within Tesla Energy’s storage and solar product lines. Such strategic options seem to be quickly becoming a reality if we look at Tesla’s Energy group’s reported gross profit, illustrated in the above graph, and the significant increase in its gross profits over the past 12 months.

Currently, many of its Megapack farms are being sold as replacements to expensive, polluting natural gas peaker plants, or storage systems for renewable wind and solar power generating projects. As Tesla’s storage takes off, it is possible that the company could use its growing profits from Megapack to help subsidize sales of associated solar farms. This could lead to Tesla becoming a major player in integrated grid-level electricity production and storage itself, not just storage systems.

Impressive Growth Trajectory

Tesla currently commands approximately 30% of the global Battery Energy Storage System (“BESS”) market, a figure set to expand as the market grows. CEO Elon Musk’s vision of capturing 15% of the total energy market with “Megapacks” may seem ambitious, but even 5% could translate into astonishing revenues of $4.2 trillion eventually.

In 2022, Tesla’s auto revenues grew by 40% to $81 billion, while energy storage revenues surged by 64% to $3.9 billion. The gap between the two has widened in 2023, and this trend is expected to continue. During the Q2 2023 earnings call, energy generation and storage revenues soared by 74% year-on-year, comprising 6% of total company revenues.

If Tesla has even just a 15% share of a potential $600 billion battery storage market, sales from this business could reach $90 billion. That would almost match Tesla’s total revenue from last year. Based on those estimates, the energy generation and storage business is worth $120 billion to Tesla in 2024 dollars. That’s over 20% of Tesla’s current market cap for a segment that isn’t yet priced into the company’s valuation. This is considered a conservative estimate considering Tesla’s cost advantages that could allow it to take outsized market share. While the introduction of a lower priced EV might be the next major catalyst for Tesla stock, its energy business could be the longer-term value driver for an investor buying shares today.

Leg #2: Sales strategy

So, what about the second leg of the company’s energy strategy – deployment and sales of electricity?

This leg is potentially the most interesting, as it is even further from Tesla’s base of making electric vehicles and potentially the most disruptive to the global energy market. This could make Tesla a global utility, taking over the role of the primary global energy supplier held by the major oil companies for the past century.

Tesla is developing different but similar approaches to the domestic and industrial energy markets. In the domestic sector, it is developing the concept of the “Virtual Power Plant” or VPP. This concept links Tesla’s domestic power storage systems – Powerwalls – into a distributed power network. Owners of Powerwalls have to agree to be connected, then they become a component of a network of storage systems. Tesla can then simultaneously switch hundreds if not thousands of separate domestic storage units into a short-term, single, large grid-level power source. This would allow it to provide short-term grid support, for example if a hurricane takes out part of the local grid or a heatwave suddenly drives up demand to unexpected levels.

This concept of a large, distributed battery system providing clean back-up energy has a lot of appeal in today’s renewables market. All that individual domestic participants need is to link their Tesla Powerwall into the VPP, via their Tesla app. Tesla then provides the sophisticated software to manage the thousands of individual Powerwalls in real-time through the Cloud, linking them together to create a single distributed energy source.

Tesla’s current network of VPPs already spans the U.S., Europe and the Far East

- USA

- Vermont: Launched in 2017 through the local electric utility, Green Mountain Power, expanded in 2022 from 30 MW to 55 MW of grid-connected battery storage

- Massachusetts & Rhode Island: From June 2021, participants in National Grid’s ConnectedSolutions program could be part of Tesla’s VPP to support the grid

- California: From July 2021, owners of Powerwalls could “opt in” to Tesla’s VPP, a partnership with PG&E

- Texas: In December 2022, Tesla was approved as a utility power supplier in Texas and is planning to launch a VVP by 2023 year-end.

- Puerto Rico: Tesla is planning to launch a VPP by the end of summer 2023

- Australia – Announced as early as 2018, South Australia’s Virtual Power Plant (SA VPP) plans to deliver 250 MW of solar energy and 650 MWh of battery storage capacity through 50,000 domestic partners. It launched in 2020 with 1,000 Powerwalls, by May 2023, 4,100 had linked in to the VPP, and there are firm plans to install another 3,000 in low-income family homes, funded by Tesla.

- UK – In October 2020, approved as a retail electricity provider and launched the Tesla Energy Plan in conjunction with Octopus Energy. Octopus will provide all the electricity retail services, including account management and customer support, while Tesla will supply the Powerwalls and networking, following Tesla’s approval as a UK electric utility in June 2020

- Japan – In July 2021, Tesla launched a VPP on the island Miyakojima with plans to install 600 Powerwall batteries in homes by the end of 2023, and to expand across the whole of Okinawa Prefecture

- Germany – in October 2021 the German subsidiary of UK-based Octopus launched a VPP service similar to its UK Tesla Energy Plan

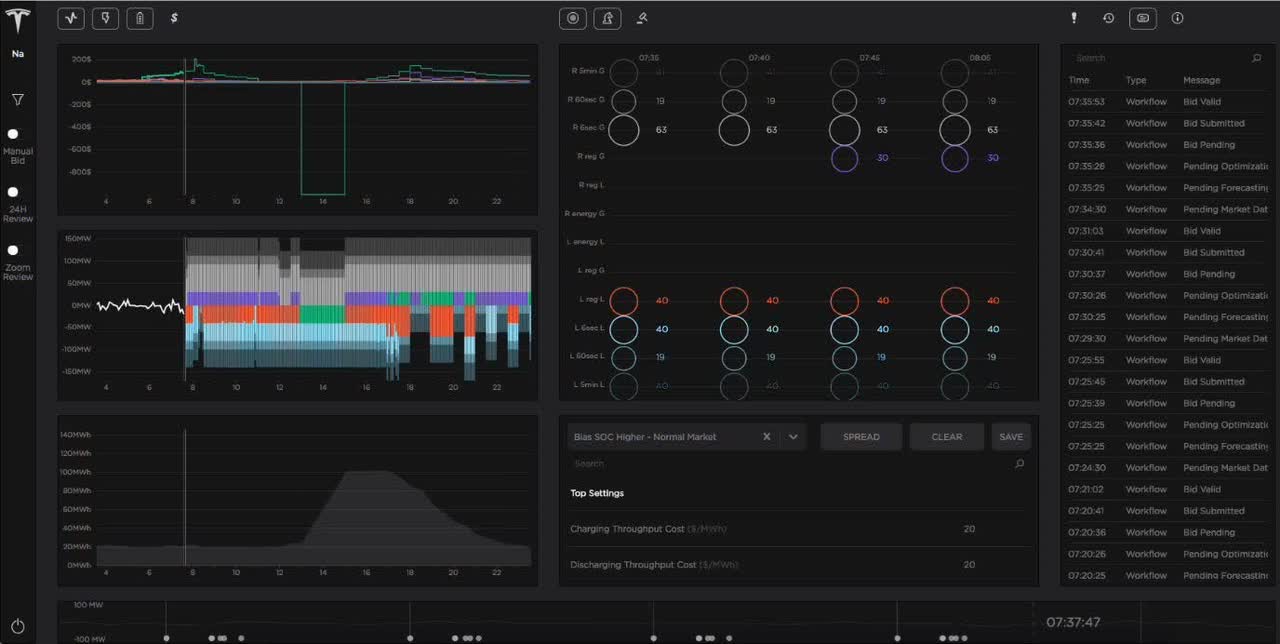

Tesla provides Cloud-based Opticaster software, which manages the real-time charging and discharging of the battery farm to optimize the savings against predefined goals. Tesla can layer its real time Cloud-based trading platform, Autobidder, on top of this.

Autobidder operates in multiple real-time wholesale trading markets. It was first used commercially in 2018 at the Hornsdale Power Reserve (“HPR”) just outside Adelaide in Southeast Australia. Today, this project is referred to as the “Big Tesla Battery” and has 150 MW of storage connected to French energy company Neoen’s Hornsdale Wind Farm. It has proven itself on multiple occasions, supporting the local grid when there were issues and providing significant cost savings by managing the use of its stored power. In its first year of operation, Autobidder more than doubled the total energy traded in the region, which included hydro, coal and natural gas-generated power, reflecting Autobidder’s ability to rapidly react to changing external factors and make near-instantaneous trades.

Tesla’s Real-time Wholesale Trading Platform – Autobidder

The Big Battery project, Australia’s largest battery with 300 MW of power stored in 212 Megapacks, had to go through an initial approval phase, which it passed and is now officially live. In December 2021, a second big battery system was brought online in Geelong just outside Melbourne, by Neoen, with twice the capacity of HPR at 300 MW. It is also planning 200 MW farms in Blyth near Adelaide and Western Downs near Brisbane, making Tesla by far the dominant utility battery owner/operator in Australia.

In addition to these multiple Autobidder projects in Australia, Tesla is also involved in major renewables projects around the UK with Harmony Energy Income Trust (“HEIT”). The first of nine planned projects was officially brought online at Pillswood, Yorkshire by Tesla in November 2022, six months early. This 98 MW system with 78 Megapacks is linked to the Dogger Bank offshore wind farm and is currently the largest BESS in Europe. In May this year, HEIT then brought online its second UK BESS project at Broadditch, Kent. All nine of these projects, totaling 0.5 GW of Megapack storage, will be linked to either solar or wind production and added to Tesla’s Autobidder fleet.

The regulatory framework is evolving to support VPPs, with examples like Colorado’s Xcel Energy (XEL) opening VPP schemes. Tesla is helping to build a number of grid-level Megapack farms in both Northern and Southern California, but perhaps the most interesting U.S. development is in Texas, where in late 2022, Tesla was approved as a retail electricity provider through a new subsidiary, Tesla Energy Ventures. This will give it the capability to be a fully integrated producer, storer, and trader of its own energy as a retail energy supplier.

Tesla’s VPPs are expanding worldwide, constrained only by production capacity. As Tesla ramps up its capacity, revenue figures are poised for rapid growth. As Tesla expands its production capacity, revenue figures from Powerwall installations and VPPs are poised for exponential growth.

Future Strategy

We can now start to see the full strategy of Tesla and Tesla Energy. This is far from being just a supplier of small, medium and large battery systems. Tesla is already trading electricity on a small scale through its various VPPs, and increasingly at a grid-level through Megapacks and Autobidder. Added to this, since 2021 it has been actively building a team of engineers, economists and energy traders located in California, Texas and the Netherlands, to continue to develop Autobidder and its other sophisticated AI power management systems.

If we look at the full extent of what Elon has put together today, we can see that Tesla has the very real potential to become a major player in the renewables value chain through both storage and trading, and a major global, green distributed energy supplier. This was the role of the major oil companies like BP, ExxonMobil, Chevron, Shell and TotalEnergies throughout most of the last century. They have all put their toes in the renewables market, but recently all seem to be moving back into oil and gas. One wonders if they fully grasp Tesla’s energy strategy and the potential impact of the explosive demand for Megapacks. This may well be the driving force that rapidly propels Tesla to become a major green energy competitor

It has already become a major disruptor to the global auto market, so why not next the global energy market?

Risks and Downsides

Before delving into the risks within the energy sector, it’s prudent to examine the risks inherent in its automotive division. Numerous investors are apprehensive about dwindling sales, apprehensive of the waning enthusiasm for electric vehicles. Their concerns are valid, as EV sales saw a mere 1.3% increase in the last quarter. Compounding the issue, several European nations have reduced subsidies for EVs, rendering Tesla’s flagship model less accessible to prospective buyers. Projections indicate a decline in Tesla’s vehicle sales for the upcoming quarter, adding to investors’ jitters.

Nevertheless, this does not hinder the inevitable shift towards vehicles that produce zero emissions. Automakers in Europe are subject to more rigorous government regulations concerning EVs, with a current target to phase out sales of conventional, fossil-fueled vehicles by 2035. Tesla remains the leading EV manufacturer, boasting a 52.4% market share in the United States. While Tesla managed to push 50,000 new EVs into the market, Ford (F) struggled to reach 10,000 EV sales, securing the second position. Following Ford, Hyundai and BMW trailed with 5,686 and 4,246 electric vehicles sold in March, respectively.

Tesla’s commanding 80% market share in 2020 was clearly unsustainable, and we forecast its share to level off in the higher 40% range. The surge in EV demand seen in 2021 and 2022 was a momentary market peak, and we’re now experiencing a sort of EV winter as the consumer trend fades. However, we anticipate a fresh wave of demand as charging infrastructure becomes more widespread.

The partnership between Tesla and Panasonic (OTCPK:PCRFF) has grown in significance over the years as the electric vehicle become increasingly competitive. Cracks in their relationship emerged in 2018 when rumors abounded that Tesla was speaking with Chinese Lishen Battery, and in 2019, when Panasonic formed a joint venture with Toyota to produce prismatic batteries.

Despite the challenges coming from the strain of soaring demand in the past few years, their partnership has endured. The strategic alliance between Tesla and Panasonic has been pivotal, enabling Tesla to implement price reductions and solidify its position as the leading BEV seller globally. Together, Panasonic and Tesla are working on the production of the new 4680 battery cells, which promise substantial advancements in capacity. Following the joint development of the 4680 technology, Panasonic intends to roll out an enhanced version of the 2170 battery cells for the Tesla Model 3 and Model Y in either 2024 or 2025.

Bloomberg reports that the Japanese electronics giant is poised to increase battery capacity and enhance productivity without the need for significant new infrastructure investment. The goal is to quadruple production capacity by 2030, a move that stands to greatly benefit Tesla.

On the energy front, we see risks coming from CATL, a leading Chinese battery manufacturer. In April 2024, it launched a new energy storage system, TENER, claiming zero degradation in the first five years of use. This beats the Tesla Megapack as the first energy storage system with a zero-degradation guarantee, but there’s no word on how it compares on price — a single Megapack unit costs about $1.2 million, but CATL hasn’t released pricing details for TENER yet.

However, the collaboration between Tesla and CATL adds another layer of complexity to the situation. While on one hand, it suggests recognition of CATL’s expertise and technology by a prominent player like Tesla, on the other hand, it raises questions about how this partnership might impact the competitive landscape. It could lead to synergies in technology development and production, potentially accelerating innovation in the energy storage sector. This alliance could indeed be a “game changer,” shaping the future trajectory of the industry.

Conclusion: A Promising Investment Opportunity

Tesla’s energy storage division represents a compelling investment opportunity amidst a rapidly evolving global energy landscape. With the potential to match auto revenues in the medium term, Tesla’s stock presents an attractive proposition for investors seeking exposure to the renewable energy sector. Despite inherent uncertainties, Tesla’s energy division stands poised to lead the charge, offering investors a promising avenue for long-term growth and profitability.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.