Summary:

- Like Maximus in the Gladiator, Tesla was leading the EVs charge. But it is losing that position of power as it enters the gladiator’s arena, full of intense competition.

- Tesla’s volume growth is slowing.

- Lack of new model launches undermines Tesla’s first-mover advantage.

- Price cuts signal a dive into an intense competitive arena.

- Tesla is grossly overvalued even relative to its direct EV comparable and competitor.

Gladiators fighting on the arena of the Colosseum

slavazyryanov/iStock via Getty Images

Thesis

Tesla (NASDAQ:TSLA) was a Maximus Decimus Meridius, leading the EVs charge. But it is quickly losing that position of power as it is forced into the common gladiator’s arena, full of intense competition with bloody price wars. I am bearish on Tesla due to 4 key reasons:

- Tesla’s volume growth is slowing

- Lack of new model launches undermines Tesla’s first-mover advantage

- Price cuts signal a dive into an intense competitive arena

- Tesla is grossly overvalued even relative to its direct EV comparable and competitor

Note: The volume analysis in this article is mostly focused on the US; the geography that makes up almost half of total revenues. The purpose of the volumes analysis is to glean insights about Tesla’s strategy and competitive positioning.

Tesla’s volume growth is slowing

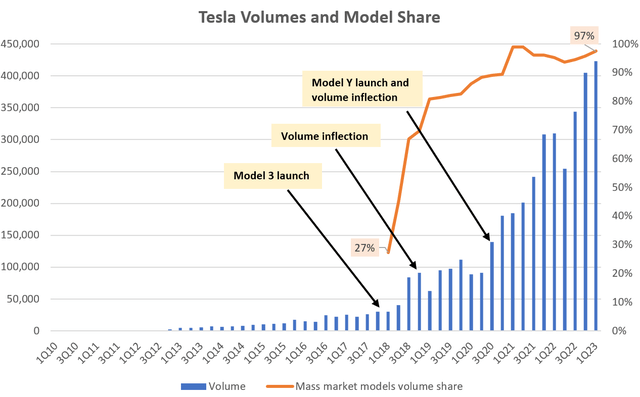

As is common with first-movers, over its journey, Tesla has evolved from initial premium market offerings via the Model X and Model S to more mass-premium models via the launches of the Model 3 and Model Y. The launch of these models have coincided with sales volume inflections:

Tesla Volumes and Market Share (Company Filings, Author’s Analysis)

Over a span of 5 years, the volume share of Tesla’s mass market models have expanded from 27% to 97%.

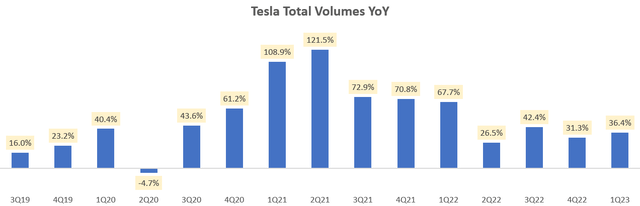

The problem now is that Tesla’s volumes growth is slowing down:

Tesla Total Volumes YoY (Company Filings, Author’s Analysis)

36.4% YoY growth in Q1 FY23 seems high but to put it into context, note that Ford (F) has EV volumes growing at 41% YoY. So the specialist EV maker Tesla is growing volumes slower than a traditional automotive company’s EV volumes. Not a good sign.

Lack of new model launches undermines Tesla’s first-mover advantage

Tesla has not had a new car model launch since 2020. Yes; it has been upgrading the technology and making incremental updates but the outer look and feel of the vehicle remains the same. The expected launch for a new Tesla model (Model 3 Generation 2) is in 2024. This is before accounting for potential production delays, which Tesla has often experienced.

Low volumes growth without a new model launch in the interim paints a bleak volumes picture for Tesla since new models are what lead to a new leg of volume growth. This problem is compounded by increasing competitive intensity as traditional auto makers aggressively invest to gain EV share. According to lead automotive analyst at Bank of America Merrill Lynch (BAC) John Murphy, who has published an annual “Car Wars” study for the past 25 years, Tesla is en-route to lose significant market share from ~70% to under 11% by 2026.

Even though it has transformed the automotive market, Tesla has not moved quickly enough to shut out competitors who will be able to offer a variety of newer models.

– John Murphy, lead automotive analyst at Bank of America Merrill Lynch

Ultimately, I think this is a signal that Tesla’s first-mover advantage in EVs is eroding away. This is worsened by the following:

Price cuts signal a dive into an intense competitive arena

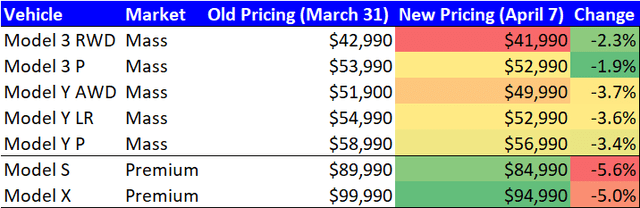

Tesla has announced broad-based price cuts for the 5th time this year across all its models:

Tesla Model Price Cuts (Tesla, Guggenheim Securities, Author’s Analysis)

For perspective, the average new car price in the United States is $49,388. This figure has been increasing over the last 10 years, and especially over the last 2 years as inflation has climbed up. Yet, Tesla is dropping prices. Most of its mass market models are now barely above the average new car prices.

Since there is no new model launch to boost volumes this time, it is clear that Tesla is implementing these price cuts to boost demand and re-ignite volumes growth. But more important is what implies strategically; I believe Tesla is becoming just like any other automotive player as it loses the allure of the EV novelty feature and engages in the typical pricing, production and marketing battles with the rest of the automotive OEMs.

This is a whole new game for Tesla – one that it is not used to playing. And I am not sure if they are capable and ready. For example, sales and marketing will become more important now. This is something in which Tesla lacks experience. Indeed, even in their FY22 10-K, it was written that management continues to believe they will be able to continue generating significant media coverage without traditional advertising and marketing spends:

Historically, we have been able to generate significant media coverage of our company and our products, and we believe we will continue to do so. Such media coverage and word of mouth are the current primary drivers of our sales leads and have helped us achieve sales without traditional advertising and at relatively low marketing costs.

– Tesla’s FY22 10-K, author’s bolded emphasis

I disagree with this belief. As Tesla enters more into the mass market with price cuts, as other automotive OEMs launch their own EV models, differentiation will be much tougher making sales and marketing critical. This is not only another skill that Tesla has to master, but also another cost that the company has to bear, thus creating further margin pressures.

Tesla is grossly overvalued even relative to its direct EV comparable and competitor

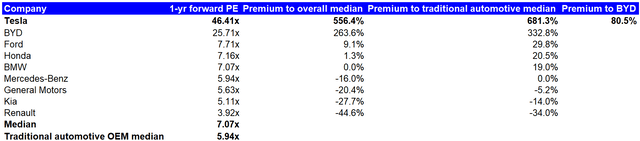

Tesla Valuation Comps (Capital IQ, Author’s Analysis)

Peer-set includes BYD (OTCPK:BYDDF), Ford (F), Honda (HMC) (OTCPK:HNDAF), BMW (OTCPK:BMWYY), Mercedes-Benz (OTCPK:MBGAF) (OTCPK:MBGYY), General Motors (GM), Kia (OTCPK:KIMTF), Renault (OTCPK:RNSDF) (OTCPK:RNLSY)

On a 1-yr forward PE basis, Tesla is trading at a 556.4% premium to the overall median, 681.3% premium to the traditional automotive companies and a 80.5% premium to EV competitor BYD.

Is this reasonable and justified?

I say absolutely not. As Tesla becomes just like the other automotive OEMs, I expect this premium to shrink. Even compared to BYD, Tesla is overvalued as BYD is winning the battle in China. For example, Tesla reduced its prices twice in China in 2022 whilst BYD increased its prices. Yet, BYD may be en-route to overtaking Tesla in terms of scale this year. Charlie Munger also agrees on BYD’s superiority:

BYD is so far ahead of Tesla in China ‘it’s almost ridiculous’

– Charlie Munger at the Daily Journal’s (DJCO) annual meeting

Even then, Berkshire Hathaway (BRK.B) (BRK.A) has been trimming its BYD position due to pricey valuations.

I believe it doesn’t matter how you split it; Tesla still seems grossly overvalued.

Overall View

Tesla started out as a disruptor and beacon for new-age EV vehicles. Its initial models catered to the premium and luxury segments as that is what made sense economically. Over time, it expanded into the mass-premium and broader mass markets, which allowed its sales volumes to explode.

But now, its sales volume growth is declining, even below that of traditional automotive OEMs’ EV volumes. It has no new model launch in the near term horizon to ignite a new leg up in volume expansion. And competitors are rapidly catching up on the transition to EVs. Its direct competitor in China [BYD] is already taking the lead both in terms of price hikes and volume growth.

This has led Tesla to aggressively engage in price cuts to stimulate demand and continue volume growth. However, this strategic change signals a new Tesla; one which is entering the intense competitive arena wherein pricing, efficient production, and effective sales and marketing are the key success parameters. This is a game Tesla is unused to playing. And I am doubtful about whether it has what it takes to succeed.

I believe valuations are not reflecting this new reality for Tesla. I believe it is grossly overvalued, even when compared to its direct EV competitor in China. Thus, I rate Tesla a ‘sell’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.