Summary:

- Tesla, Inc.’s growth strategy shifted due to competitive pressure from Chinese EV automakers, prompting reevaluation.

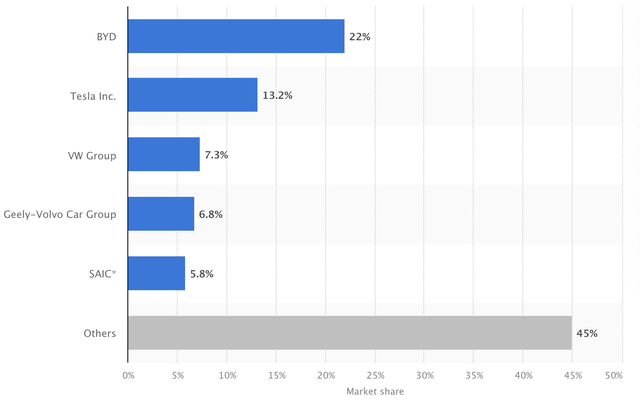

- Despite competition, Tesla maintains a notable market share compared to peers like BYD Company and Volkswagen.

- The electric vehicle market is projected to grow significantly, offering expansion opportunities.

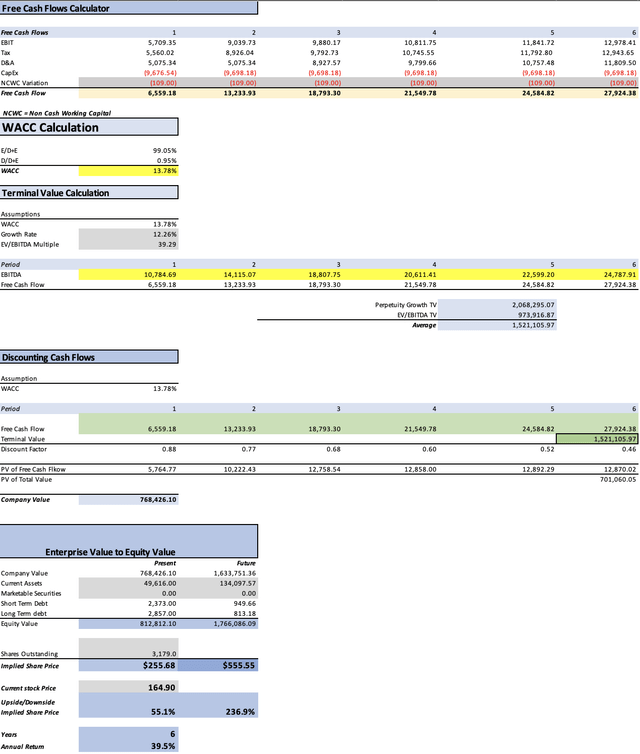

- Through a discounted cash flow model, Tesla’s fair price estimate is $255.68, with a future projection of $555.55 by 2029.

- Risks include concerns over Tesla’s luxury brand image and competition, but the outlook remains positive, supporting a strong buy recommendation.

MikeMareen

Thesis

In my previous article Tesla, Inc. (NASDAQ:TSLA), I explained that Tesla could achieve my target of 14.3M vehicles by 2030. This prompted a fair price of $358.89 and a future price of $766.68.

However, many reports indicated that Tesla has scrapped its plan for its entry-level EV at $25K, codenamed Redwood. This has been caused by the competition from Chinese EV automakers which have been in a suicidal pricing war with Tesla.

This prompts a reevaluation of the situation that Tesla is standing on, what targets can the company now achieve, and at what price it should maintain its units.

After the valuation process, I arrived at a fair price estimate for Tesla stock of $255.68 (55.1% above the current stock price of $164.90) and a future price for 2029 of $555.55 (which implies 39.5% annual returns throughout 2029). For these reasons, I reiterate my strong buy rating on Tesla.

Overview

Growth Plan

Tesla’s main objective has been to release an entry-level EV, the Model 2, at a price of $25K. This, according to the company, would help them achieve their 2030 target of selling 20M cars.

However, now that the plans have been allegedly scrapped, the company is supposedly going to focus on robotaxis, and Musk said that same day, that they are planning to release it by August 8.

How does Tesla Compare against peers?

In what concerns the plug-in EV market, the leader is BYD Company Limited (OTCPK:BYDDF) with a market share of around 22%, meanwhile, Tesla has around 13.2%. In third place comes Volkswagen AG (OTCPK:VWAGY) with 7.3%, which is already very far from BYD and Tesla. Overall, the market is very fragmented, with other manufacturers aside from the displayed in the graph below, holding around 45%.

Industry Outlook

The electric vehicle market is expected to reach a market volume of $623.3B in 2024. Then it will grow at a CAGR of 9.82% throughout 2028 when it’s expected to reach a market volume of $906.7B.

Then, the worldwide car insurance market is expected to grow at a CAGR of 7.38% for 2024-2031. In that period, the market should pass from a valuation of $910.90B in 2023 to the $1.6T in 2031. Other estimates indicate for CAGRs of 8.17% or 6%.

Lastly, the global solar power market was valued at $234.86B in 2022 and it expected to reach $373.83B by 2029. This translates into an annual growth rate of 6.9%.

Valuation

I will value Tesla through a discounted cash flow, or DCF, model. In the table below, you will find all the financial data necessary for doing so. The WACC was calculated with the already-known formula, which in the case of Tesla, the result came out at 13.78%. For a more detailed process, you can observe the section labeled “WACC calculation” in the DCF model.

Since the aggressive expansion to achieve 20M in sales for 2030 would not be necessary now that the plans are allegedly scrapped, CapEx will remain constant at $9.67B throughout the entire projection.

D&A will be projected with a margin tied to revenue, which in this case came out at 4.82%. Interest expenses will decrease at an annual pace of 20.3% because that’s the evolution that total debt displayed in 2020-2023.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Market Value | 544,950.00 |

| Debt Value | 5,230.00 |

| Cost of Debt | 2.98% |

| Tax Rate | -50.03% |

| 10y Treasury | 4.345% |

| Beta | 1.55 |

| Market Return | 10.50% |

| Cost of Equity | 13.89% |

| Assumptions Part 2 | |

| CapEx | 8,898.00 |

| Capex Margin | 9.19% |

| Net Income | 14,997.00 |

| Interest | 156.00 |

| Tax | -5,001.00 |

| D&A | 4,667.00 |

| Ebitda | 14,819.00 |

| D&A Margin | 4.82% |

| Interest Expense Margin | 0.16% |

| Revenue | 96,773.0 |

Before starting, I need to clarify that I’m very skeptical about robotaxis. Therefore, I will focus on knowing where Tesla sales go if the average price stays at $58K.

I think that if Tesla really scrapped the model 2, it was a good choice, since now, Tesla owners will not see the resale price of their cars decrease dramatically year-over-year. If Tesla achieves to maintain its “luxury” image, that will help the company achieve its sales targets.

The first thing I will assume is that Tesla will stop with the suicidal price cuts and will remain constant at 58K on average per vehicle. Then, unit sales will increase by 10% annually, which is almost in line with the overall worldwide EV market. This would cut Tesla’s 2030 original target of 20M cars to 4.28M, which is 78.6% less.

| Average Price (In USD) | Units Sold (Thousands of cars) | |

| 2019 | 55.0 | 367.2 |

| 2020 | 48.0 | 499.0 |

| 2021 | 61.0 | 935.5 |

| 2022 | 58.0 | 1,313.86 |

| 2023 | 40.2 | 1,800.00 |

| 2024 | 38.0 | 2,421.00 |

| 2025 | 58.0 | 2,663.10 |

| 2026 | 58.0 | 2,929.41 |

| 2027 | 58.0 | 3,222.35 |

| 2028 | 58.0 | 3,544.59 |

| 2029 | 58.0 | 3,899.04 |

| 2030 | 58.0 | 4,288.95 |

Then, service & other, which include various diverse sectors such as insurance and car leasing, will grow at a pace of 7.38% in line with the worldwide car insurance market. Meanwhile, solar will grow by 6.9%, again in line with the worldwide market.

| Sales of Vehicles | Service & Other | Solar | |

| 2023 | $72,432.0 | $7,243.0 | $5,112.0 |

| 2024 | $91,998.0 | $7,777.5 | $5,464.7 |

| 2025 | $154,459.8 | $8,351.5 | $5,841.8 |

| 2026 | $169,905.8 | $8,967.9 | $6,244.9 |

| 2027 | $186,896.4 | $9,629.7 | $6,675.8 |

| 2028 | $205,586.0 | $10,340.4 | $7,136.4 |

| 2029 | $226,144.6 | $11,103.5 | $7,628.8 |

| 85% of Revenues | 8.5% of Revenues | 6% of Revenues |

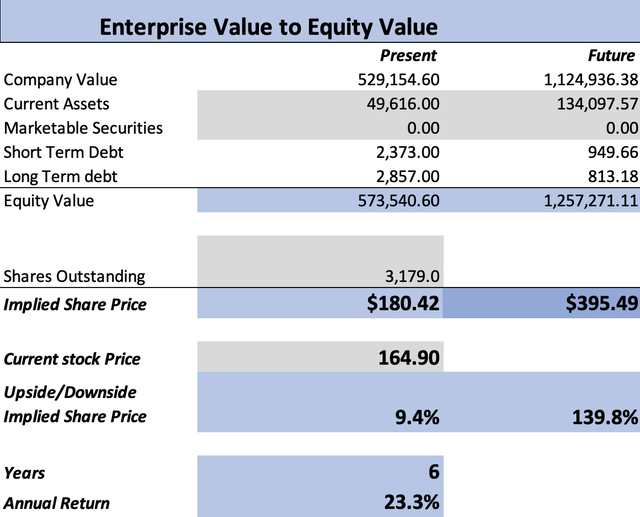

Lastly, the model will also suggest which could be the fair price of the stock for the year 2029. To do this I assumed that every element of equity will display the same trend showcased in the period 2020-2023. This means that short-term debt would decrease by 16.7% annually, long-term debt by 22.2%, marketable securities would remain at $0, and current assets would grow by 22% annually.

As you can see, Tesla’s fair price with these estimates would stand around $255.68, which is 55.1% above the current stock price of $164.90. Then, the projected future price stands at $555.55 which implies very high 39.5% annual returns throughout 2029.

As could have been expected, the high volume / low price strategy was replaced with a mid-price / lower volume strategy. Tesla will continue to be alive under this scenario, nevertheless, the implied fair price has fallen from $358.89 to the current $255.69, a 28% decrease.

If Tesla wants to recover the optimism it had before, it would need to make sure the robotaxi idea rolls out as soon as possible. The only problem is that riding on a robottaxi is expensive, and the only way to make it cheaper is by volume, since there is no way a few robot taxis will be able to compete in pricing with an Uber (UBER) driver earning $15-$25 per hour.

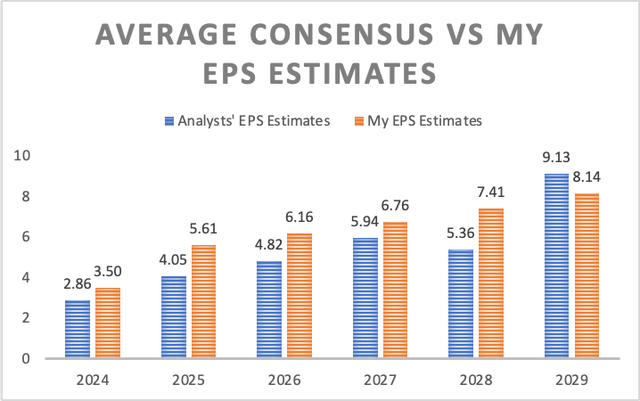

How do My Estimates Compare with the average consensus?

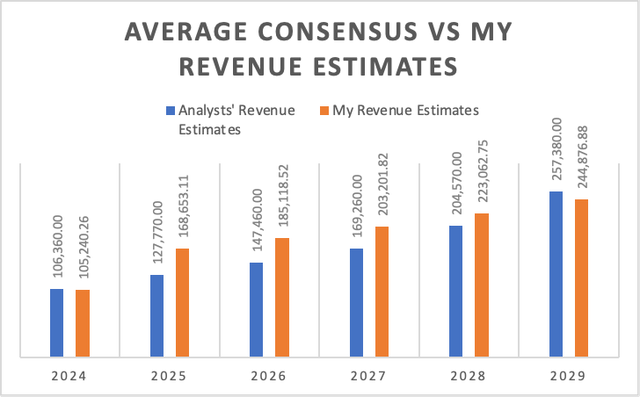

If I did a model completely based on available analysts’ estimates, I would get an estimated fair price of $180.42 and a future price of $395.49. At the current stock price of $164.90, this future price implies annual returns of 23.3% throughout 2029.

As you can see in the table below, my EPS targets are higher than the average estimates by an average of 21.63%, which is very high. The reason for this is that my revenue estimates are on average 13.45% higher and because my net income margins are also higher.

Author’s Calculations Author’s Calculations

Risks to Thesis

The main risk to my thesis is currently optimism, since the debate of whether Tesla should be valued as a technology company or as a car company is not new. Nevertheless, that’s in a multiples valuation. In reality, since the value of a company must be what it earns, Tesla would be valued more since it generates more free cash flow than the traditional car manufacturers such as Ford Motor Company (F). Tesla’s stock price is currently fueled by sentiment regardless of whether I say it’s fairly valued or not.

Then, there is the risk that Tesla loses its appeal as a luxury brand in many countries due to its low pricing, which could cause its Chinese rivals to completely eat into Tesla’s market share. For this reason, Tesla shouldn’t pursue any more aggressive price-cutting strategies unless it achieves enough margin to do it. Nevertheless, I think that if the traditional auto segment is divided into many companies, then this is unlikely to happen in the EV market, which, at some point, becomes the new “traditional auto market.”

Conclusion

In conclusion, Tesla’s stock price has increased by insane percentages after 2020, and that increase is there to stay. Tesla does not need to sell 20M cars by 2030 to justify its current valuation.

After slashing Tesla’s 20M original target for 2030 to 4.28M units at an average price of $58K, I arrived at a fair stock price of $255.68 and a future price for 2029 of $555.55.

Furthermore, even with the average analysts’ estimates, annual returns remain around 23.3%, which is superior to the market average annual return.

For these reasons, I reiterate my strong buy rating on Tesla. For the future what I would monitor would be Tesla’s image, pricing, and if car sales increase to the levels I am projecting.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.