Summary:

- Automaker cuts prices across the board in US and Europe.

- So far, demand indicators are not as impressive as hoped.

- Analysts are starting to cut 2023 estimates for top and bottom lines.

Xiaolu Chu

Last week, I detailed how I thought the major theme for Tesla (NASDAQ:TSLA) this year would be prioritizing volume over margins. The electric vehicle maker’s goal has been to achieve 50% delivery growth per year over the long run, and plenty of new factory capacity has recently come online. Recent quarterly delivery numbers have shown that demand wasn’t where it needed to be to achieve this dramatic unit growth, so last week we saw major price cuts announced. Today, I’d like to look at some of the initial reactions to these moves across a variety of data points.

Tesla first started the month by announcing its second major round of price cuts in China since the beginning of Q4. Between the Berlin factory ramp taking some export volume away, economic troubles due to Covid in China, and a very competitive EV market there, demand was not looking good. Similar thoughts had been building in the US as it appeared the introduction of new tax credits had not really bolstered sales in early January. Last week, Tesla announced major price cuts in the US as well as in Europe.

These price cuts varied significantly by vehicle and country, from the low single digits percentage wise in some cases to one Model Y variant in Norway coming down by more than 23%. While even some of the biggest Tesla bulls were expecting some price reductions this year to drive added volume, some of these cuts were a bit larger than most were expecting. In the US, some of the price reductions made certain vehicles eligible for tax credits under the new Inflation Reduction Act, but the cuts weren’t limited to just the Model 3 and Y. Tesla’s two luxury vehicles, the S and X, also received cuts in the 9% to 15% range in the US.

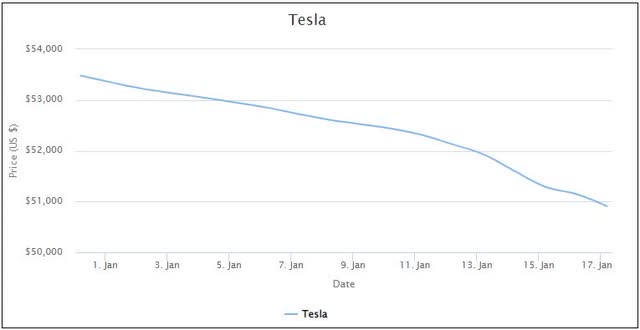

Perhaps the most notable impact so far is on used Tesla vehicle prices. Like most used vehicles out there, the Tesla line has been declining in value since late July, although at a rate significantly more than that of the overall index. The price cuts last week really accelerated those declines, as you can see in the CarGurus overall Tesla index below. For example, the Model Y index that had declined at an average of $65 per day in the first 12 days of January has dipped by $336 per day in the five days since the price cuts.

Used Tesla Price Index (CarGurus)

The decline in used Tesla values won’t kill the company, but it is something to keep an eye on. We are now starting to see more Model 3 and Y leases finish up each quarter, meaning the company could have more used vehicle inventory on the books. Also, used Tesla sales that had boomed last year and helped the Services / Other segment get into profitability will likely see their margins slashed. Tesla could also take losses on any residual value guarantees it promised customers or fleet buyers in the past, if it has to buy back those vehicles at higher prices that it now can sell them for.

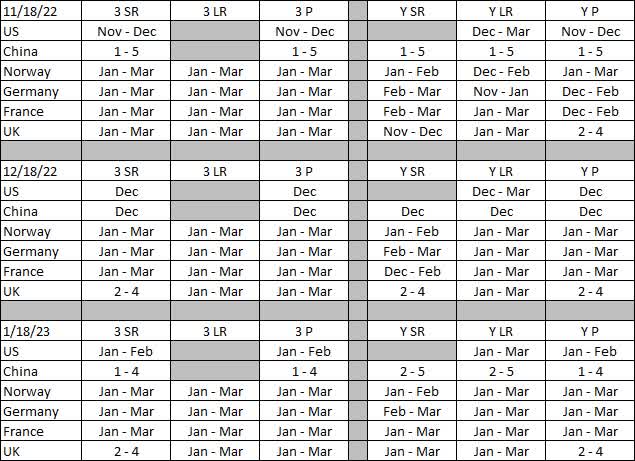

Another item to really watch in the short term is any potential demand data. One Tesla tracking site has estimated the company’s US inventory levels during the past few months. After last week’s cuts, that site’s estimated inventory figure dropped quite a bit, but the total number has now leveled off, and it actually is starting to tick up slightly again. The other item to look at here is estimated delivery times, which for the Model 3 and Y have not really increased as you might expect if demand is really surging. The following table shows key country delivery estimate timelines for the two mass market vehicles. A numerical range shown here represents number of weeks.

Tesla Delivery Estimates (Company Order Pages)

A lot of the European delivery estimate timelines continue to show January to March availability, which is what they were back in November. The Berlin factory ramp is helping a little, but that also means that Shanghai will export less and thus Tesla needs more demand out of China. The rather low delivery estimate timelines in China are also a bit worrisome when you consider that the Shanghai factory will be down a good portion in late January for that country’s New Year Holiday break.

In the US, a good portion of the above delivery estimates are current month or next month as they were over the past couple of months. If demand doesn’t pick up in a material way, another round of US price cuts may be needed, especially if one or more vehicle variants lose any credits once the Inflation Reduction Act language is finalized. Even if some of these dates move forward a little in the coming weeks, key Tesla trackers are showing that the backlog is nowhere near where it used to be.

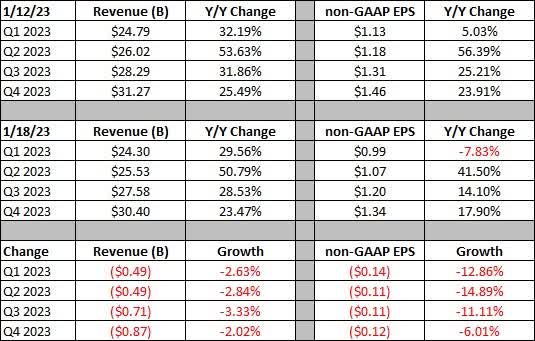

So what does this all mean for Tesla as a whole? Well, we’ve seen a number of analysts come out and cut their revenue and non-GAAP EPS estimates for this year already. In the table below, you can see where the average estimate for each period in 2023 was on January 12th, before the cuts, and where current estimates are now. The percentage change in growth is the actual numerical change, so for example a decline from 10% to 8% would be shown as minus 2%, and not a 20% drop. For the Q4 2023 year over year changes, that percentage is based off the current estimate for Q4 2022, which is still changing a little as we move closer to the quarterly report.

Tesla 2023 Estimates (Seeking Alpha)

At the same time, many of these analysts have come out and reduced their price targets on Tesla shares. The current average of $197.65 represents about 50% upside from current levels. However, the street average has dropped by $18 since the price cuts were announced, and this target average stood at more than $300 a share just three months ago. Unfortunately for investors, many of these analysts’ valuation reductions came only after Tesla shares plunged.

In the end, Tesla’s decision to cut prices to drive delivery growth this year came rather quickly. We’ve now prices reduced across the board in many countries around the globe, and not just on the company’s cheapest vehicles. It remains to be seen how much volume this will drive in the short term, but analysts all seem to agree that margins will be impacted quite negatively. Tesla shares have held up pretty well so far, but the key test will likely come next week when the company reports its Q4 results.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.