Summary:

- Tesla, Inc. stock has regained some of its bullish after the recent earnings despite having a modest performance in the robotaxi event.

- Musk’s prediction of showing “20% to 30%” vehicle delivery is highly unlikely as the company faces massive challenges in China and Europe.

- Waymo is building a gold standard for robotaxi service, and Tesla is significantly behind Waymo in terms of human intervention required.

- 2025 will be particularly tough for Tesla, and any failure to meet the lofty expectations could cause a big correction in the stock.

- Tesla has a forward P/E multiple of 87 for the fiscal year ending Dec 2026, making it very expensive given the challenges faced by the company.

Sven Piper

Tesla, Inc. (NASDAQ:TSLA) stock bounced back after the recent earnings beat. The election result has also helped the stock due to the close relation with the next White House administration. CEO Elon Musk has announced some lofty targets for Tesla in 2025, and it is very unlikely that the company would be able to meet these targets.

One of the most interesting predictions during the earnings was about showing vehicle growth of “20% to 30%” in 2025 fueled by cheaper vehicles. The competitive environment is changing rapidly for Tesla, especially in China and Europe, where Chinese automakers are rapidly gaining market share. This will make it more difficult for Tesla to reach a strong vehicle decline target in 2025. In the previous article, I mentioned that Tesla would not be able to live up to Cyber Day expectations. We did see a big correction after that event, but the stock has gained some bullish momentum in the last few weeks.

Tesla is also falling behind the autonomous driving segment. Waymo has created a gold standard with its service over the last few quarters. Waymo has recently raised $5.6 billion in additional funding and is rapidly expanding its service. Tesla is also far behind Waymo when we look at the number of human interventions required in autopilot. This would make it difficult for the company to launch a commercial robotaxi.

The EPS estimate for 2 fiscal years ahead is 87, which is significantly higher than any other Magnificent 7 stock. If the company misses the lofty expectations for 2025, we could see a big correction in the stock.

Vehicle growth will be difficult to achieve

Musk is known for setting ambitious goals, but his prediction of “20% to 30%” vehicle growth for 2025 is highly unlikely. Most of the analysts are predicting between 10% to 15% growth. However, even this lower growth might be difficult due to the rapidly changing competitive environment in key international markets.

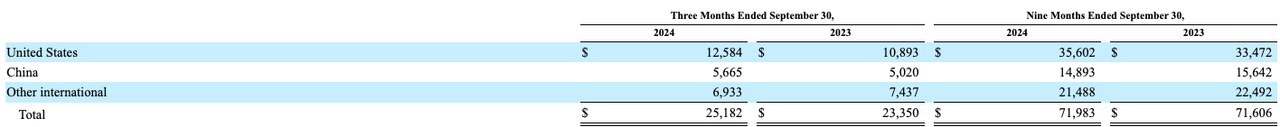

Figure: Tesla’s revenue in different geographies. Source: Tesla filings.

Tesla Filings

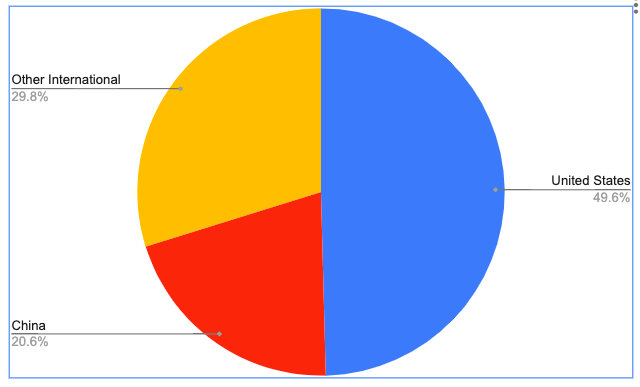

Figure: Geographic distribution of Tesla’s revenue in the past nine months. Source: Tesla filings.

In the above chart, we can see the geographic distribution of Tesla’s revenue in the past nine months. In the first nine months, Tesla received $35.6 billion revenue from the United States, which is less than 50% of total revenue. Over the last nine months, Tesla has reported a 4%-5% YoY revenue decline in China and “Other International” region, which mostly makes up Europe. Both China and Europe are seeing a massive increase in competitive pressure as Chinese automakers continue to launch new models at aggressive prices. After a year of anti-subsidy probe, the European Commission will announce a 7.8% extra tariff on Tesla cars on top of the 10% standard import tariff for all cars. According to estimates by the European Commission, Chinese automakers could gain 15% market share in 2025.

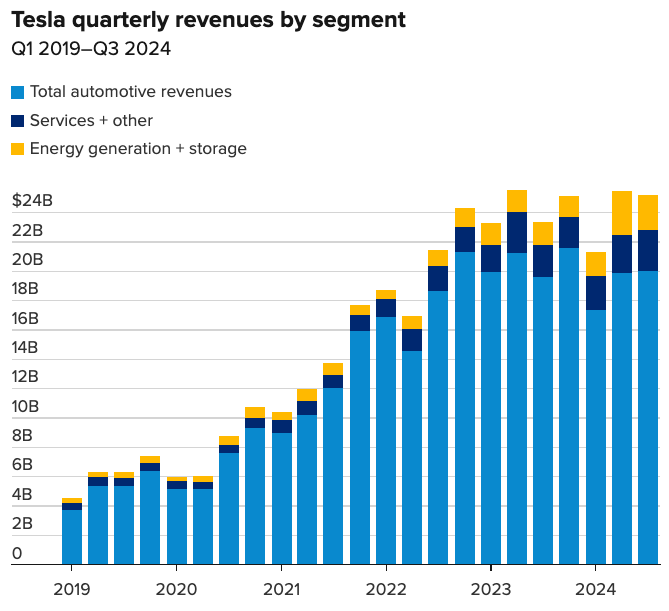

Tesla Filings, CNBC

Figure: Tesla’s stagnant automotive revenue for the past few quarters. Source: Tesla Filings, CNBC.

Tesla will certainly face a headwind due to these extra tariffs. There is additional pressure in China, where Chinese automakers continue to give massive discounts to increase their market share. Even affordable cars from Tesla will not be able to match the rock-bottom prices by some Chinese automakers. BYD (OTCPK:BYDDF) reported a whopping 30% YoY growth in August as it takes market share from Tesla. It is on pace to sell over 400,000 vehicles in international markets in 2024, which is more than 60% YoY growth from last year. It is difficult to see Tesla achieving massive vehicle growth with this product lineup, even if it decides to give massive discounts.

Tesla is falling behind in autonomous driving

Waymo has built a gold standard in its autonomous driving service. It has recently raised another $5.6 billion in a funding round, and Alphabet had earlier promised $5 billion for the service. Hence, Waymo has more than enough resources to roll out the service. Another important factor is gaining the trust of customers and regulators. The incremental approach of Waymo is suitable for this, and we have seen good reviews from the service over the last few quarters.

In the last announcement, Waymo was averaging over 100,000 paid weekly trips. They have already announced expanding the service beyond the sun belt. It is possible that by the end of 2025 Waymo could reach close to 1 million paid weekly trips. Earlier, we have seen the challenges faced by General Motors’ (GM) Cruise. Even a single accident can lead to strong pushback from customers and regulators.

There are already multiple investigations against Tesla’s full self-drive (“FSD”). In a commercial taxi operation, Tesla will have to bear the entire legal responsibility for any crash. If we see any major accident similar to GM’s Cruise, it could delay the successful expansion of Tesla’s service.

Regulatory credits and other issues

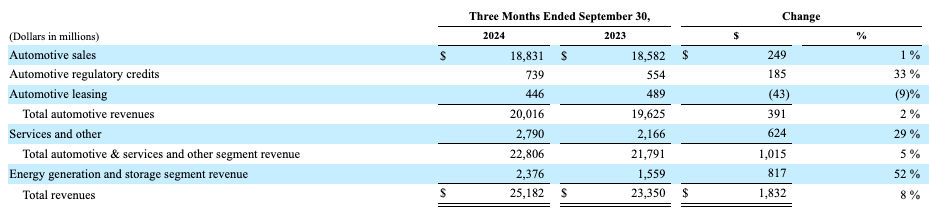

In the recent earnings, Tesla reported 33% YoY growth in automotive regulatory credits. This was a close to $200 million increase from the year-ago quarter. This segment has improved the overall margins for Tesla, but it does not affect the core products of the company. The automotive sales YoY growth was only 1% compared to total revenue growth of 8%. Most of the growth came from Services and Energy generation segment.

Tesla Filings

Figure: Tesla’s recent revenue from different segments. Source: Tesla filings.

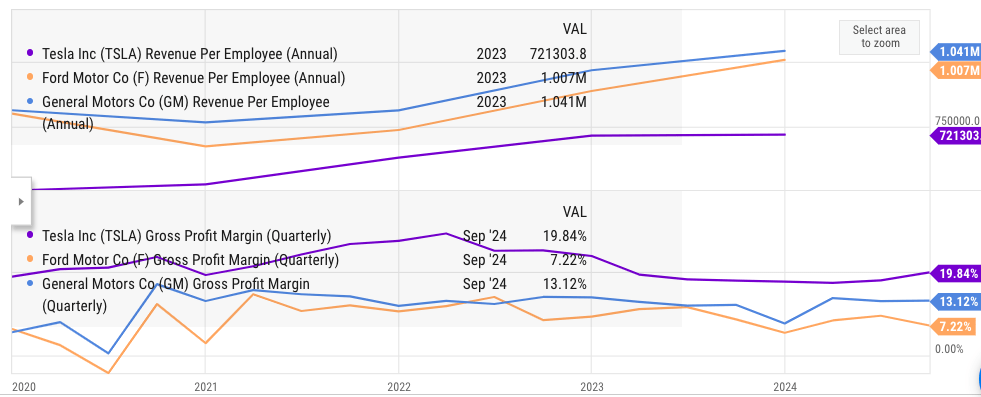

Tesla has also received a tailwind due to recent layoffs. Musk had earlier announced that the company would be cutting 10% of the total workforce, and CNBC reported that Tesla has likely laid off 14% of its workforce. This certainly helps the operational efficiency of the company, but it is not a long-term strategy to improve the earnings. Tesla’s revenue per employee is still higher than traditional automakers like Ford and GM. Tesla’s margins are strong, but there is a strong headwind due to intense competition.

YCharts

Figure: Comparison of revenue per employee and gross margin. Source: YCharts.

Pricey stock

The significant correction after the robotaxi event shows that the stock could decline rapidly if the expectations are not met. Musk has raised the expectations significantly by announcing a likely “20% to 30%” vehicle growth in 2025. Any earnings miss can cause a big correction in the stock from the current point. The consensus EPS estimate for the fiscal year ending Dec 2026 is $4.07 and the forward PE valuation of Tesla is 87. This makes it one of the most pricey stocks among the magnificent 7 stocks. Even Nvidia is selling at less than 30 times the EPS estimate of 2 fiscal years ahead.

Figure: Forward EPS estimate of Tesla. Source: Seeking Alpha.

The product lineup of Tesla is looking a bit stale and mere discounts will not help in improving the attraction of these vehicles. The recent robotaxi event has also been modest and did not show a great improvement in this product lineup.

Investor Takeaway

Tesla, Inc.’s forward vehicle growth projections look highly unlikely as the competition from Chinese automakers intensifies in China and Europe. Additional tariffs on Tesla vehicles in the EU are also a headwind for the company. BYD is reporting 30% YoY growth in China, while Tesla has been reporting revenue decline of 5%. This dynamic is unlikely to change in the near term, causing a further decline in Tesla’s market share.

Waymo is investing heavily in expanding the service. Waymo may reach over 1 million paid weekly rides by the end of 2025. This will set a very high bar for Tesla over the coming quarters. Tesla’s commercial taxi service will also need enough time to gain the trust of customers and regulators. If the company misses any earnings expectations, we could see a massive correction in the stock due to the current pricey valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.