Summary:

- A significant portion of Tesla, Inc.’s potential lies in self-driving technology, energy, and artificial intelligence, in addition to its core car business and charging network, and I discuss my personal experience with the latest updates.

- Tesla’s valuation range lies between $770 billion to $990 billion when considering all of these factors.

- While Tesla’s market cap has increased significantly, the company’s future prospects have also risen due to improvements in the FSD Beta and the addition of other car manufacturers to Tesla’s charging network. I rate Tesla as a hold.

Xiaolu Chu

Introduction

Tesla, Inc. (NASDAQ:TSLA) full self-driving (“FSD”) Beta developments have continued since the time of my FSD 11.3.6 Beta article in April. There, I described improvements from earlier versions. I upgraded from FSD 11.3.6 Beta to FSD 11.4.2 Beta on June 3rd. There was yet another upgrade from 11.4.2 Beta to 11.4.4 Beta on the morning of June 21st and there have been many noticeable improvements in these versions. My thesis is that Tesla continues to improve protection for drivers as their FSD Beta software keeps getting safer and more practical.

Driving Notes

11.4.2 Beta felt as if a smoother and more confident driver was at the wheel relative to 11.3.6 Beta. 11.4.2 Beta was quicker in terms of making a right turn out of a parking lot and onto a busy street. On 11.4.2 Beta, my car exited the freeway and turned right onto a busy street with a considerable amount of traffic. Once we were in the right lane of the street, my vehicle had to merge at least one lane over to the left so that we could proceed straight instead of being trapped in the right-turn-only lane. My car did a nice job finding a narrow opening between two vehicles. This is a move that my vehicle could not have made on previous versions of FSD Beta.

Going from the Sacramento area to Bend, Oregon in late May, I had one of my last long drives on 11.3.6 Beta and it was pretty smooth, but newer versions are even better. More recently, I used 11.4.2 Beta to drive from the Sacramento area to LA and back. FSD Beta has always been pretty good on freeways, but 11.4.2 Beta seems smoother than previous versions – definitely smoother than 11.3.6 Beta. Using FSD Beta, I enjoy paying more attention to music, sceneries and phone calls than I would be able to without it. There were several times on the Sacramento to LA drive when the traffic slowed down suddenly and FSD Beta was able to apply the brakes early every time. It would be nice to try the “Elon” mode on the freeway where they say the driver is allowed to have more freedom in terms of eye and hand movement.

I was recently hoping to test 11.4.4 Beta on a slow transition from I-5 to I-80, but the opportunity didn’t come up because the traffic was moving too slow. In other words, the car drove too slowly in the past at this location, but I wasn’t able to test it again because the traffic wasn’t moving fast enough. This got me thinking about one of the ways in which FSD Beta is great; the software does a fantastic drive when we’re in slow traffic and we don’t need to change lanes. These are the exact types of tedious and boring situations where humans want to have the machine take a greater role. In other words, I’m sometimes excited about the prospect of doing my own driving when I’m in a sporty car on the open road, but when I’m in traffic, I prefer to have the car drive itself.

Release Notes

I find this section of the 11.4.2 Beta release notes on turns to be consistent with what I experienced behind the wheel:

Improved control through turns, and smoothness in general, by improving geometry, curvature, position, type and topology of lanes, lines, road edges, and restricted space. Among other improvements, the perception of lanes in city streets improved by 36%, forks improved by 44%, merges improved by 27% and turns improved by 16%, due to a bigger and cleaner training set and updated lane-guidance module.

Work is still needed on turns, especially in situations like roundabouts. Having said that, 11.4.2 made progress with turns, forks and merges.

This 11.4.2 Beta release note caught my eye because I’ve noticed improvements with pedestrians:

Improved ego’s assertiveness for crossing pedestrians in cases where ego can easily and safely cross before the pedestrian.

This is consistent with what I’ve seen; FSD Beta was too slow and conservative with pedestrians in past versions such that cars behind me would get annoyed. It became obvious in 11.4.2. Beta that enhancements have been made.

Per 11.4.4 Beta release notes, the software is now better with respect to gap selection:

Improved short-deadline lane changes, to avoid going off-route, through better modeling of target lane vehicles to improve gap selection assertiveness.

Enhancements are continuing for vulnerable road users (“VRUs”) like pedestrians per the 11.4.4 Beta release notes:

Improved handling for VRUs near crosswalks by predicting their future intent more accurately. This was done by leveraging more kinematic data to improve association between crosswalks and VRUs. Improved ego’s behavior near VRUs by tuning their assumed kinematic properties and utilizing available semantic information to classify more accurately their probability of intersecting ego’s path.

Upcoming Improvements

I’m confident FSD Beta will continue to get better as drivers keep giving feedback. As @chazman tweeted, improvements are needed at the beginning and the end of each drive with FSD Beta, but the middle portions of drives are often excellent:

without the nags and actual requirement to pay attention, there is a period of time that on every drive it feels like we are very close to autonomy. This is a bit of a placebo effect right now, but it is in fact real. Ego can do many of the drives we need it to do. We need work on the beginning and end of each drive now but this has come a long way.

One area where 11.4.2 Beta struggled for me is on Sepulveda Boulevard in Manhattan Beach. Ostensibly there are 3 lanes but lane 3 often has parked vehicles such that human drivers know to stay in lane 1 or lane 2. 11.4.2 Beta didn’t figure this out and it regularly tried to get into lane 3 which caused issues when encountering parked cars. In fact, I found it easier to just turn 11.4.2 Beta off while driving on Sepulveda.

Much of what @greentheonly tweeted about on June 16th regarding 11.4.3 Beta resonates with me in 11.4.4 Beta, especially the part about FSD Beta driving too slow:

This also explains the barrage of people that claim the car works very good and they are happy – perhaps they like to drive slow, content with random lane changes and such.

I don’t drive that fast compared to when I was in my 20s, but I do like to use the power of my Tesla when accelerating from 0 to 60. As such, some of the FSD Beta driving is a bit slow for me although it has gotten better from previous versions and I’m sure it will continue to get more practical in this area.

A June 30th blog post by Cruise Director of Public Affairs Mariah Ray discusses ways in which Cruise is partnering up with Mothers Against Drunk Driving (“MADD”) to make our roads safer. I expect Cruise, Tesla and others to continue making improvements such that we’ll have less reliance on human drivers and fewer drunk driving incidents in the future.

Valuation

A June 17th WSJ article by @timkhiggins talks about the way CEO Elson Musk uses first principles which means he envisions the completion of something and then questions assumptions from the ground up. This is a consideration that increases Tesla’s valuation. The article explains that CEO Musk got a casting idea from toy cars such that Tesla vehicles now have reduced costs and complexities:

Another recent example is how Tesla turned to a giant casting machine to create the front third and rear third of the Model Y sport-utility vehicle as single pieces, which replaced scores of different parts of the SUV’s structure, helping reduce cost and complexity in the company’s manufacturing process.

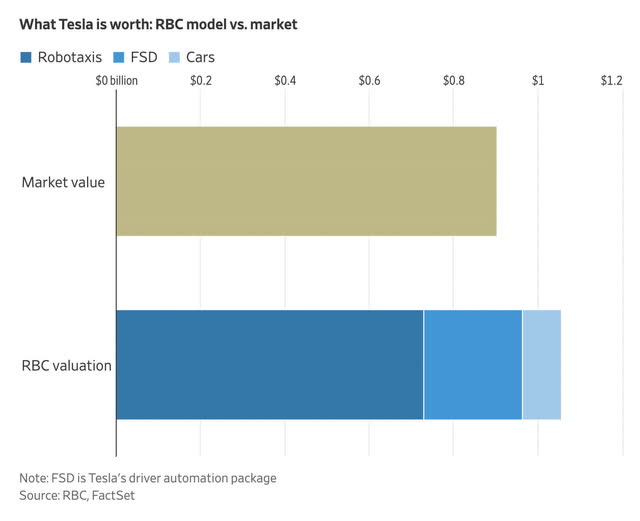

A June 20th WSJ article by @StephenWilmot has an RBC chart showing a huge part of Tesla’s overall valuation being outside the traditional “Cars” segment. The graph shows RBC breaking down the valuation as $0.73 trillion for Robotaxis, $0.24 trillion for FSD and just $0.09 trillion for Cars. The $0 billion label is confusing as I believe it should read $0 trillion:

I agree with RBC that much of Tesla’s valuation range comes from outside the narrowly defined “Cars” segment!

We have to adjust the valuation now that Ford Motor Company (F), General Motors (GM), Rivian (RIVN) and Volvo Car (OTCPK:VLVCY, OTCPK:VLVOF) have joined Tesla’s charging network. This opens the door for these OEMs to use Tesla’s software in order to access the charging network. There are countless possibilities once Ford, GM and others start using Tesla’s software! In addition to using Tesla’s software, customers of other OEMs will start getting used to Tesla’s brand in charging stations; it is effectively a free form of brand awareness and advertising for Tesla. A June 2nd ultra-long range article in the WSJ by @mims explains why a Cybertruck with a 500-mile battery will be desirable. The points in the article make me question why customers in North America would want to buy a BEV from a carmaker outside of Tesla’s charging network.

Rather than using verbiage like robotaxis and full self-driving, I prefer to think in terms of general self-driving. I believe Tesla is close to a version of self-driving where the human in the driver’s seat will be allowed to look away from the road from time to time without all the warnings we see today. It is rumored that this already exists in the “Elon Mode” of self-driving. This will be an inflection point when it is widely rolled out and it is highly likely Tesla will license this tech to other OEMs. This is a huge part of Tesla’s valuation!

In terms of Tesla’s valuation range, I divide things into two buckets. The first bucket is the “Cars” business and charging. The second business is everything else like general self-driving, energy and artificial intelligence.

Trailing twelve month (“TTM”) earnings per share are expected to come close to doubling from $3.36 in June 2023 to $6.40 in June 2025 per the June 20th WSJ article by @StephenWilmot. TTM net earnings are $11.8 billion and much of this is from the core auto business. I am comfortable using a high multiple of 40 to 50x on the core auto business and the charging business now that Tesla is becoming the default network for charging in North America. Rounding to the nearest $5 billion, this implies a valuation range of $470 to $590 billion for the “Cars” business and charging.

Again, I think in terms of general self-driving as opposed to full self-driving and robotaxis. I believe it is a mistake when folks say anything less than full autonomy is a failure. As FSD Beta keeps improving, there will be trips where I’ll opt for driving instead of flying. This is especially true if we can get the nags reduced on the freeway such that we can check our phones more often. I agree with CEO Musk and BYD’s (OTCPK:BYDDY) Chairman and CEO Wang Chuanfu that it is too early for companies to be making major LiDAR investments at this time. Tesla has the right idea in my opinion, which is to get camera-driven technology safer than humans before investing heavily in LiDAR.

The energy possibilities for Tesla are immense. A March 21st Teslarati article by @WilliamWritin explains that Oxnard went with 124 Tesla Megapacks instead of a new natural gas plant:

With a combined capacity of 400MWh, locals now have access to clean energy whenever they need it, not just when the wind blows, or the sun shines. Perhaps an even better example of the successful implementation of the Megapack came from last year when the State of Hawaii ditched coal power after installing a set of Megapack stations. The success of the Tesla Megapack in Oxnard and other locations around the globe is enticing an increasing number of municipalities and corporations alike.

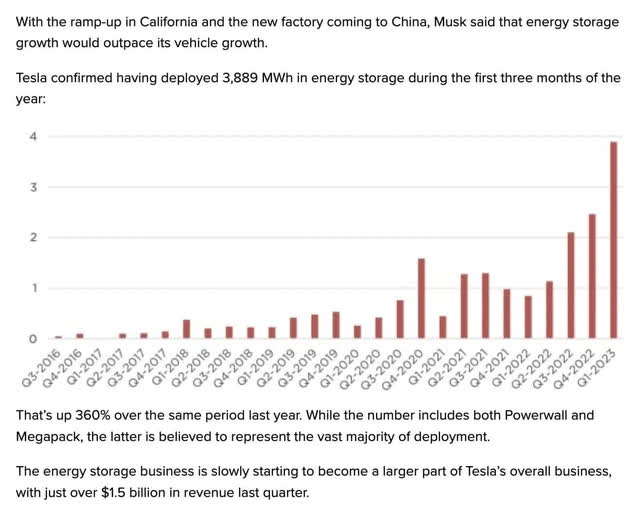

An April 19th Electrek article by @FredericLambert shows the importance of Tesla’s energy business:

We’re not yet seeing major earnings from FSD Beta in the income statement, and I believe the general self-driving business could be worth more than $100 billion. The energy business and AI projects like Optimus could add hundreds of billions of dollars to the valuation on top of that. In summary, I think these considerations outside the narrowly defined car bucket could add $300 to $400 billion to the valuation.

Summing up, my valuation range is as follows:

$470 to $590 billion – “Cars” business and charging.

$300 to $400 billion – self-driving, energy and AI.

—————————————–

$770 to $990 billion

The 1Q23 10-Q shows 3,169,504,301 shares outstanding as of April 17th. Multiplying by the June 30th share price of $261.77 gives us a market cap of $830 billion. The enterprise value is somewhat close to the market cap.

Tesla, Inc.’s market cap has gone up substantially this year, but my estimates for future cash flows have gone up as well. This is because FSD Beta keeps improving and OEMs like Ford, GM and others have joined Tesla’s charging network. I still view Tesla, Inc. stock as a hold, as both the market cap and future prospects have risen dramatically.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, BYDDY, GOOG, GOOGL, VLVCY, VLVOF, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.