Summary:

- Tesla’s stock has performed exceptionally well in recent months, increasing by over 120% since the first analysis in January. A revision analysis revealed valuation concerns.

- Despite strong delivery numbers and the potential of Full Self-Driving technology, the current optimism and high valuation are not justified by the actual numbers and natural environment.

- Tesla topped expectations with delivery numbers, giving it an edge for a further hike in EPS´s estimates, but the market is pricing in so much hope and promises.

- Fair value is significantly lower than the current price, thus reflecting the sell rating opinion as a follow-up of previous two bullish thesis.

- Almost based on every angle of valuation standpoint, such a screaming Forward P/E as well as a significant discrepancy between EV/EBITDA to EBITDA margin and its peers make it just too expensive.

eric1513

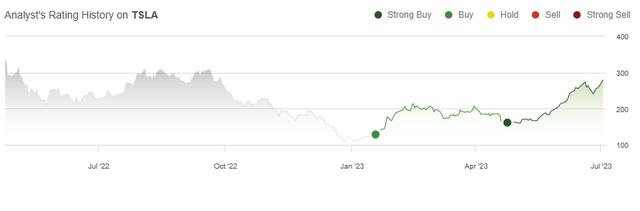

In the past few months, Tesla, Inc. (NASDAQ:TSLA) has performed exceptionally well. While it made sense for my opinion to be bullish close to 2023’s low based on valuation, it also made sense for me to revise my outlook to strong bullish after 1Q 2023 earnings call and drop after earnings. The stock has increased by more than 120% since the first analysis in January (reaction of the price cuts and sparked demand in China) and nearly 70% since the subsequent one in April, discussing the great potential of revenue streams after 1Q 2023. While I consider Tesla to be a fundamentally excellent company with so much to offer and being much more than a car manufacturer, current valuations are a major reason for my bearish outlook. In nearly every stock-picking, the same narratives are observed: frenzy buying sentiment at the top and fear near the bottom. This is how the psychology and sentiment play out. While I began following Tesla publicly in 2023, I had significant concerns about the company’s valuation in 2021 and 2022, as well as its ability to meet such stringent Wall Street standards. Even though I think Elon Musk and his team are doing a fantastic job running Tesla, there is a lot of uncertainty in the medium term regarding the current FSD optimism as a potential high revenue stream being considered by almost every bull. Consequently, AI mania has reached the stock market, and the stock has entered this phase, in my opinion. It is time to depart, as hopes and expectations far exceed actual numbers and the normal surroundings.

Tesla – Rating History (Seeking Alpha)

Let’s start with delivery numbers

Deliveries exceeded expectations

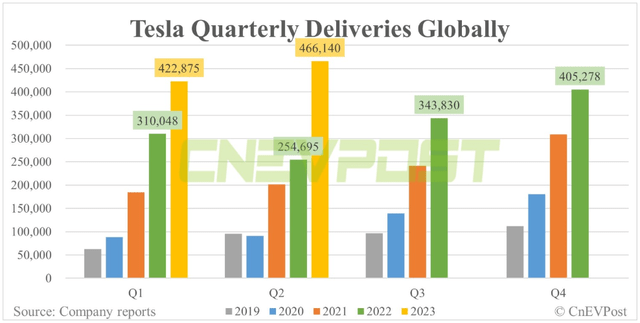

Tesla’s management lowered the prices of cars multiple times in 2023 to attract consumers, but this action is making its competitors do the same, thereby increasing the pressure on their margins. As we will discuss below, this is because Tesla’s EBITDA margin remains superior to its competitors and is in a better shape. However, Tesla could afford it because its margins are higher and it will still be profitable even if additional price cuts occur. There is also a trend in the overall decline in automobile demand globally. In 2023, Tesla will focus on volume rather than profit margin. Obviously, they desire the highest possible profit margin, but they must also adapt to the demand factors. That is fairly obvious. They wish to sell as many automobiles as possible in order to increase its influence and market share in preparation for a future FSD application. Tesla Management is achieving this objective very effectively, as deliveries have not only surpassed Wall Street’s expectations, but also set a new record for overall unit sales.

Tesla Quarterly Deliveries Globally (Company reports via CnEVPost)

In early July, Seeking Alpha reported Tesla´s delivery numbers for the second quarter:

Tesla said Sunday it delivered 466,140 electric vehicles in the second quarter of 2023, easily beating estimates of around 445,000 units. The company produced 479,700 vehicles in the same period. The second quarter numbers represent 83% increase in deliveries compared to the 254,695 reported during the same period a year earlier, and 10% growth in deliveries sequentially compared to the 422,875 the company reported in the first quarter of 2023.

These numbers are astounding, as Tesla surpassed Wall Street’s expectations, indicating strong demand, efficiency, and a possible hike in EPS.

It’s not just a “car-maker”

When trying to compare Tesla to its rivals, one of the most prevalent arguments among analysts is that the rivals are limited to the auto industry and related services. I fully agree with such an approach, as that is the reason why Tesla deserves a better premium. Even if we try to compare it to the auto industry only, in my opinion, the premium valuation should also be justified as it has a significantly higher EBITDA margin than its peers. However, it is always a question of how far we are able to accept such a valuation premium. In my view, it’s currently too high and unacceptable. There may be a slight premium because Tesla carries almost no debt, has a significantly higher operating margin, and its growth in the coming years is anticipated to be substantially greater. These arguments would support a slightly higher valuation than its competitors.

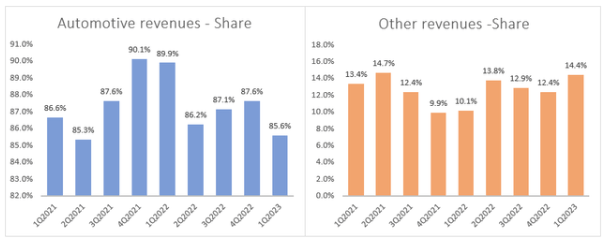

As I mentioned previously, the share of automotive-related revenues has entered a downward trend, and the share of all other services increased since the fourth quarter of 2021. This is extremely important to Tesla. Other sales include revenue from services such as after-sale vehicle services, supercharging, retail merchandise, insurance, FSD and others. While the energy segment will be a significant contributor in the coming years, this also supports the claim that Tesla is not just a “car company.”

Tesla´s revenue share (Author´s calculation (previous thesis))

Full Self-Driving (FSD) numbers

Nevertheless, each bull believes that FSD will present enormous opportunities. Implementing this high-potential revenue stream necessitates the logical decision to prioritize volume over margins. However, we do not currently have any evidence that FSD will be implemented in a version other than beta, but I believe it is only a matter of time. I believe it will be a reliable source of income, but it is unlikely to be implemented globally anytime soon.

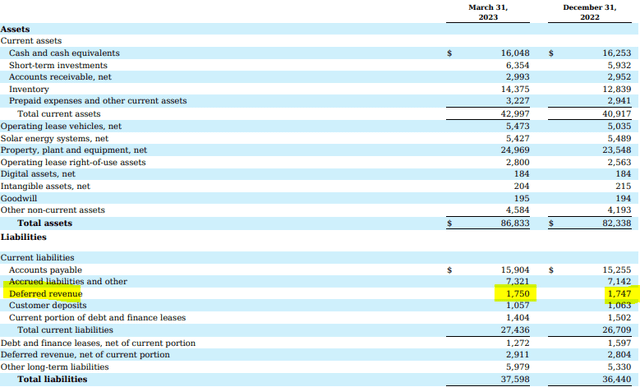

There is only one item in the 10K-Filling that is partially related to the FSD. It is referred to as deferred revenue, which can be recognized as revenue when Tesla delivers the FSD to the customer.

Hidden FSD revenue stream – deferred revenues (Tesla, 10-K Filling, SEC)

According to 10K-Filling for the 1st quarter in 2023:

Deferred revenue is related to the access to our Full Self Driving ((“FSD”)) features and ongoing maintenance, internet connectivity, free Supercharging programs and over-the-air software updates primarily on automotive sales. Deferred revenue is equivalent to the total transaction price allocated to the performance obligations that are unsatisfied, or partially unsatisfied, as of the balance sheet date. Revenue recognized from the deferred revenue balance as of December 31, 2022 and 2021 was $134 million and $66 million for three months ended March 31, 2023 and 2022, respectively. Of the total deferred revenue balance as of March 31, 2023, we expect to recognize $679 million of revenue in the next 12 months. The remaining balance will be recognized at the time of transfer of control of the product or over the performance period.

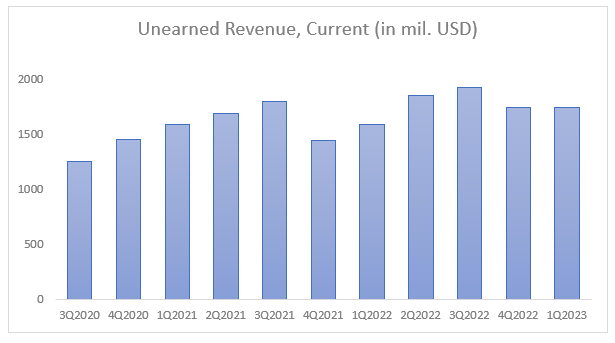

Simply put, deferred revenues are money received in advance for Tesla services or potential features that have not been utilized or realized yet. FSD is part of that. Therefore, we do not have a breakdown, but deferred revenues from customers also relating to FSD services are hidden here – in deferred revenue, or in Seeking Alpha’s case, in unearned current revenue, which is the same thing.

Tesla – Unearned Revenue (Author via Seeking Alpha)

The principle is that these amounts on the chart below represent the total value of selected features or services that have not yet been provided by Tesla. During this time, as Tesla finally provides the FSD or other features to selected customers that were bought by those customers, it will be recognized as revenue, so there will be a transformation from deferred revenue to revenue. However, we do not know any exact breakdown, which belongs to FSD, on ongoing maintenance, internet connectivity, supercharging programs, or another service. There is neither a breakdown of deferred revenues nor a detailed breakdown in the income statement. However, going deeper into the notes in the 10-K, you can find such a statement:

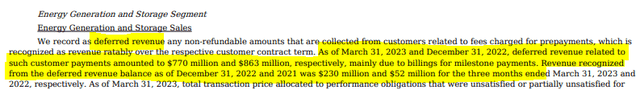

Tesla – Energy generation in deferred revenues (Tesla, 10-K Filling, SEC)

$ 770 million and $ 863 million of the deferred revenues, totaling $ 1.75 billion and $ 1.747 billion for 1Q2023 and 4Q2022, respectively, were clearly attributable to Energy Generation and Storage Sales-related prepayments. In summary, 44% of deferred revenues (DR) for the first quarter of 2023 and 49% of DR for the second quarter of 2023 were attributable to fees associated with the Energy Generation and Storage Segment. The remaining funds, let’s say $980 million and $884 million, can be allocated from FSD and other services. However, that is merely my estimation and not a proven fact. There could be an error or I could be mistaken. However, once FSD is delivered to customers who ordered the service, it could be converted into revenue. Adjusting for other fees included in deferred revenues, this number could be considerably lower.

Valuation from different angles

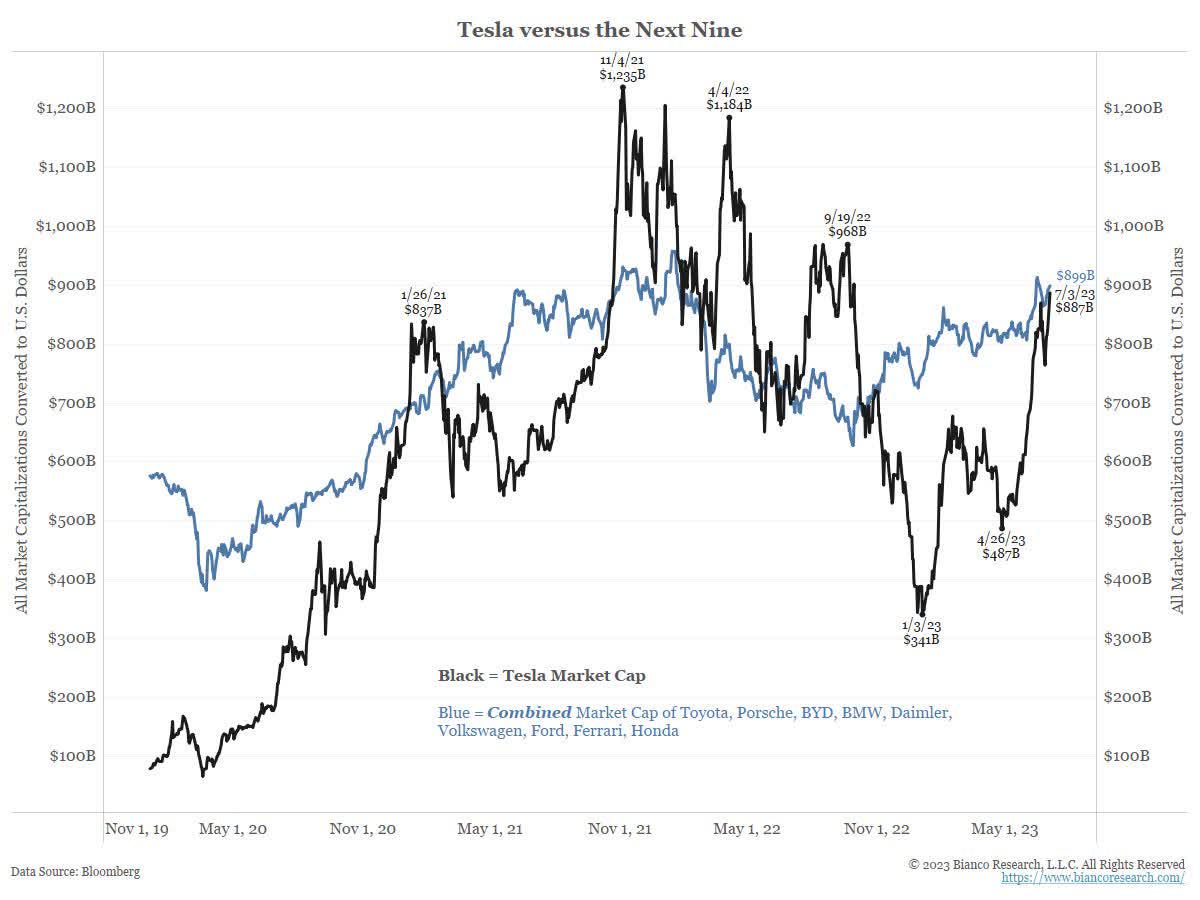

I am aware that we are currently in the testing and utilization, fixing, and other phases. I understand tremendous potential. However, it can be completed within a year or fully implemented within five years. From this perspective, it is completely inappropriate to bet on such a high degree of success, which is exactly what the market is pricing. The market is valuing opportunities and expectations. When valuation made sense to me, I was an aggressive bull. Currently, based on this information, valuation concerns me greatly, and I believe it’s best to leave the market, close long, or simply hold. However, my rating is sell what is meant to close long (and not going short) as a follow-up for previous thesis. The table below shows the combined market capitalization of several of the largest automakers, compared to Tesla.

Market Capitalization – Tesla vs. peers (combined) (Jim Bianco twitter (link in the source), Bianco Research)

Despite the fact that I maintain the same opinion regarding Tesla’s valuation because it is incomparable to other automakers due to its current and potential revenue streams, Tesla’s market capitalization soared when compared to the industry as a whole. It’s a major warning sign.

When evaluating Tesla, we should consider two or three valuation metrics. First two are based on trading multiples, where the combination is appropriate for valuing Tesla:

- It’s Forward Price to Earnings (Forward P/E).

- Then compare EV/EBITDA to its EBITDA margin historically and relative to its competitors. While, as previously stated, Tesla generates the most cash from its automotive sales, we should compare it to the automotive industry, but there should be a significant premium due to the possible surge of other revenue-generating streams.

The third approach is DCF value, which is the most detailed but subjective approach. We will concentrate on the each of them, but rather to multiples which are comparable to both history and peers.

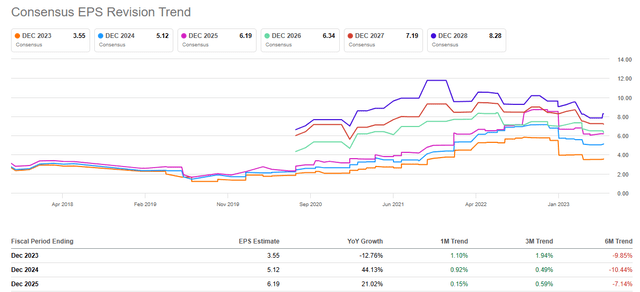

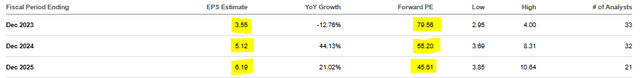

Tesla – Earnings Revision (Seeking Alpha)

First, I believe it is always appropriate to examine the most recent earnings revision and consider what Wall Street has priced in. Despite the fact that earnings for 2023 and 2024 have only bottomed out and risen marginally, there is the possibility of upward revisions, which could be influenced by robust deliveries despite still-lower prices. It would be a thesis threat, but keep in mind that it could occur. I would also support this proposal because it would demonstrate that Tesla is on the right track. Nonetheless, the macroeconomic conditions are continuing to deteriorate, as I discussed in my previous article, and so is the risk – higher interest rates, declining sales, etc. Despite all of this information, Tesla delivered a larger quantity than anticipated, but this is partially due to the reduced prices compared to a few months ago. However, tight conditions could be advantageous from a different perspective due to decreased prices of commodities and other services.

Returning to the thesis, the earnings estimates table generated by Seeking Alpha’s tracker indicates that the Forward P/E for December 2023 through December 2025 is 79.56x, 55.2x, and 45.50x, respectively. There is no way I could be comfortable with that, and I believe this view is shared by many investors.

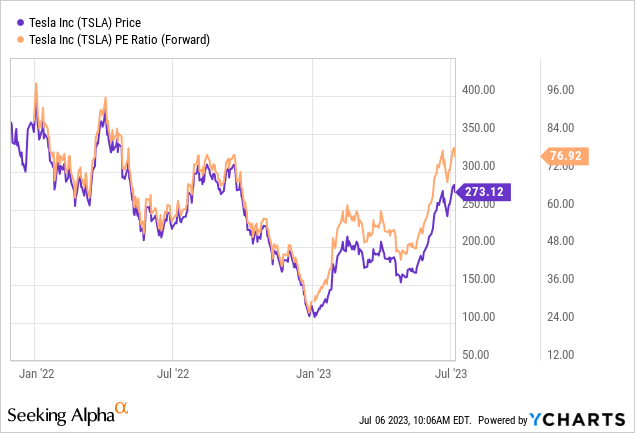

Tesla – Forward P/E (Seeking Alpha)

The only reason to hold a stock with such a high valuation is if investors and other market participants are extremely confident that earnings will explode higher from other segments or services, such as the Energy and storage segment and FSD. As I attempted to explain previously, we do not currently see large numbers from FSD, but I believe Tesla is well on its way to achieving this. However, it can last a year or five years after being successfully implemented globally. In this case, the premium should be significantly higher. In my opinion, there is still a great deal of uncertainty surrounding that path, and it is not always appropriate to focus on hopes and promises. Forward P/E ratios reach similar levels near the first quarter of 2022.

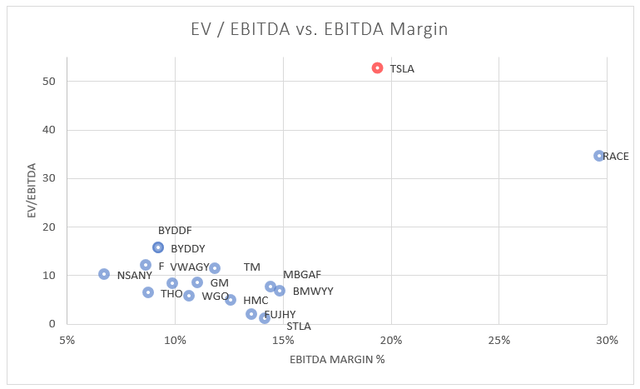

When I was writing a bullish thesis in January, the Forward P/E for December 2023 was a very attractive 26.7x based on previous estimates. Compare these figures to the current total of 70.56x. Despite being a fundamental bull for all of Tesla’s products, efficiency, and growth, I now consider the company to be overvalued based on its historical valuation, which is a major reason for this rating. Below is a comparison of Tesla and its peer’s EV/EBITDA and EBITDA margins.

Tesla and peers – EV/EBITDA vs. EBITDA Margin (Author´s calculation. Data from Seeking Alpha)

Comparison to its peers with this type of metric is even absurd. Despite this, the market continues to price Tesla as a start-up when you consider trading multiples. However, I compare EV/EBITDA to EBITDA margins to determine if there is a premium due to a higher margin. In the case of Ferrari N.V. (RACE), it also applies to Tesla. The growth and margins of Ferrari are also substantial. Based on the growth, I would estimate Tesla to be in this the surrounding area, but with a lower margin than RACE. At this price, the overvaluation is once again present from this point .

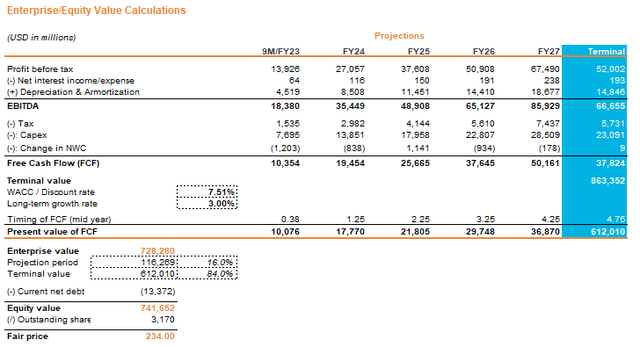

To determine how far we are from Tesla’s fair value, I’ve estimated the company’s valuation despite the extreme optimism. When examining the revenue projections for the following years, I anticipated much higher revenue growth rates (from 35% to 25%), which significantly differ from the revenue projections in the Earnings revision section. In addition, I increased the profit margin to a range of 16% to 21%, which is significantly higher than the current situation (net profit margin TTM of 13.66%), with a WACC of 7.50%. This template is from valueinvesting.io, but the values have been modified to accommodate my calculations.

Tesla: Best-case DCF valuation (Author via valueinvesting.io)

This is not a comprehensive DCF valuation, but I was significantly more optimistic than the current consensus to examine how far to fair value we are, even considering best-case scenarios. Based on such high revenue and margin assumptions, it may also be affected by FSD and significant growth in other segments. In conclusion, I calculated a fair value of $ 234 (based on this very optimistic scenario), whereas the current stock price is $ 280.

Summary and risks

Risks associated with the thesis should include the possibility of FOMO, because Tesla’s momentum is strong and could drive the price even higher. Nonetheless, this thesis is a follow-up of my previous thesis, with a strong bullish outlook. After this price increase, it would be prudent to reduce risk and rebalance. From this perspective, selling the previous long position would be the best course of action. While I am a strong believer and supporter of Tesla’s story, the FSD is currently based on hopes rather than numbers and logical assumptions. Despite my long-term optimism regarding this revenue stream, it is currently surrounded by great uncertainty. I believe that Tesla is succeeding and will continue to succeed due to its strong revenue streams and enormous potential, and it should be valued at a premium. However, from a valuation standpoint, there is no margin of safety based on nearly every valuation we wish to conceal ourselves from.

After examining the Forward P/E approach, I determined that the company was significantly overvalued, even if EPS estimates were to increase by 20-30%. Tesla was significantly less expensive in January, ranging between $ 110 and $ 120, and even after the next swing low, near $ 160. Based on the EV/EBITDA and EBITDA Margin metrics, which should also account for the margin premium, Tesla is also clearly overvalued. Despite not reaching RACE margin levels, the growth potential and enormous opportunity in other revenue streams would justify a valuation comparable to RACE (despite a significantly lower EBITDA margin) based on this approach. In my opinion, Tesla cannot be fully compared to other automobile manufacturers, and a premium should be added to its valuation.

Nonetheless, after DCF valuation based on Enterprise/Equity value and significant optimism, or the best-case scenario, I calculated a fair value of $234, which is significantly lower than the current stock price of approximately $ 280, thus reflecting no margin of safety. In conclusion, Tesla is a fundamentally strong company with great efficiency, growth, and vision, but based on current revenue and EPS projections, it is, in my opinion, fundamentally overvalued, even considering a 20% upside earnings revision. Based on the current situation and outlook, Tesla could once again be attractive in the 200 to 220 dollar range. In my opinion, there are much better opportunities in terms of a balanced combination of growth and a cheap valuation, such as PayPal (PYPL) in my most recent analysis, or in the bleeding banking sector based on a strict combination of risk profile, adjusted valuation, and earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.