Summary:

- Tesla, Inc. FSD 12 supervised improves acceleration, turn signal usage, and the use of the left lane, making it more human-like.

- Tesla needs to move quickly on Level 3 tech, as Mercedes has already received limited authorization in California and Nevada.

- If Tesla can license Level 3 tech in the near future, then the earnings could be substantial.

benedek

Introduction

Per my July 2023 Tesla, Inc. (NASDAQ:TSLA) article, Full Self-Drive aka FSD 11.4.4 Beta was a step up from FSD 11.3.6 Beta. I updated my Tesla software to 2023.44.30.25 or FSD Beta v12.3 on March 25th. Among other things, this version replaced over 300k lines of explicit C++ code. My vehicle had yet another update to 2024.3.10 or FSD (Supervised) v12.3.3 on April 4th. Throughout this article, I’ll refer to these as FSD 12 beta and FSD 12 supervised, respectively.

My thesis is that FSD 12 supervised has a smooth, human-like feeling relative to older FSD versions, and Tesla’s immediate focus should be on Level 3 licensing.

Improvements With FSD 12 Supervised

Acceleration has improved dramatically! One of the reasons I bought my Model Y is because it can get up to speed quickly. Previous versions of FSD underutilized the car’s acceleration. FSD 12 beta changed that; the car doesn’t waste time getting up to speed when going straight. FSD 12 beta remained slow regarding acceleration when turning right after stopping at a red light, but FSD 12 supervised seems much better.

The use of turn signals is now better. Before FSD 12 beta, turn signals seemed abrupt, and they weren’t always used as far in advance as I preferred. Both FSD 12 beta and FSD 12 supervised are smoother and more human-like with turn signals, notifying other vehicles of intentions well in advance.

We now have a version of FSD which isn’t hesitant when we need to use the left lane. I’m guessing some of the 300 thousand lines of explicit C++ code in older FSD versions were involved in terms of making my vehicle avoid the #1 lane. It was stressful whenever the navigation route had left turns because my vehicle would often stay in the right lane until the last minute. Sometimes there would be traffic near the intersection such that we would miss the left turn altogether. This issue has been solved with FSD 12 supervised. My vehicle now drives more like a human in terms of smoothly using the left lane whenever it is appropriate.

Immediate Focus On Level 3 Licensing

In an April 3rd X post, CEO Musk confirmed Tesla will license FSD tech to other car companies:

More lives can be saved in the next few years from Level 3 licensing than from robotaxis. Fehr & Peers have an August 2019 paper which says Transportation Network Companies (“TNCs”) like Uber (UBER) and Lyft (LYFT) were only responsible for a small percentage of vehicle miles traveled (“VMT”) in a study across six urban areas:

TNCs account for an estimated range of 1.0- 2.9 percent of total VMT for the six metropolitan regions, while all other vehicle activity accounts for approximately 97 to 99 percent of total VMT.

Per a March article from Newsweek magazine, Mercedes-Benz (OTCPK:MBGAF) is now authorized for Level 3 Drive Pilot technology use in parts of California and Nevada. Additionally, Drive Pilot has been available in Europe for a year. This means some human Mercedes drivers are now allowed to take their eyes off the road in certain situations (emphasis added):

When Drive Pilot is activated and operational, a series of turquoise lights illuminate on the exterior of the vehicle. They serve as a signal to passersby, including emergency responders, that the vehicle is piloting itself and therefore the driver may be occupied with activities other than watching the roadway, including activities otherwise prohibited by law such as watching videos on a smartphone.

I believe other car companies will be limited in their enthusiasm for licensing from Tesla until Tesla has some Level 3 functionality like Mercedes. As such, I think it is key for Tesla to focus on Level 3 tech at this time. I’m optimistic that Tesla is close, such that drivers will soon be able to take their eyes off the road to do things like check screen settings, check text messages, read books or watch videos. Like Mercedes, I think it is likely that Tesla will first get this authorization on major freeways where there are no intersections and no red lights. Additionally, I’m guessing it will start in stretches of navigation routes where no lane changes are required.

It is hard to say how much of this is up to Tesla and how much of this is up to regulators. Tesla has reached 1 billion FSD miles driven in the U.S. and Canada. Recently, Tesla began giving a free one-month trial of FSD to all vehicles in the U.S., so the number of FSD miles driven is climbing faster than ever. CEO Elon Musk wrote the following back in July 2016 (emphasis added):

Even once the software is highly refined and far better than the average human driver, there will still be a significant time gap, varying widely by jurisdiction, before true self-driving is approved by regulators. We expect that worldwide regulatory approval will require something on the order of 6 billion miles (10 billion km).

The number of vehicles able to license FSD tech at this time is limited. This is partially because autonomous vehicles require substantial battery power, which internal combustion engine (“ICE”) vehicles don’t have. More battery EVs, or BEVs, from various car companies will be hitting our roads soon and Tesla should be working with BEV makers to make sure new BEVs have 8 cameras in the right locations.

FSD is only available in the U.S. and Canada right now, but it isn’t too early to start planning licensing efforts in other parts of the world, like China. Primarily selling in China, BYD Company (OTCPK:BYDDY) makes more non-ICE vehicles than anyone, and they have shown a reluctance to invest in autonomy. Tesla should convince them to put 8 cameras in the right locations such that they have the option of licensing FSD tech from Tesla down the road. Ford (F) was the first major automaker in North America to join Tesla’s NACS supercharger system. Ford could also be among the first OEMs to license Tesla FSD. The Cybertruck isn’t for everyone, and I always see Rivian (RIVN) trucks in the Lake Tahoe area. It would be excellent if Rivian owners could license Tesla FSD. Autonomy solutions from other car companies relying on expensive and complicated components such as HD maps, excessive sensors, and Lidar may be out of the race right now:

The part above about the only solution being end to end NN is key, and Tesla gives some specifics about neural networks on their website (emphasis added):

Our per-camera networks analyze raw images to perform semantic segmentation, object detection and monocular depth estimation. Our birds-eye-view networks take video from all cameras to output the road layout, static infrastructure and 3D objects directly in the top-down view. Our networks learn from the most complicated and diverse scenarios in the world, iteratively sourced from our fleet of millions of vehicles in real time. A full build of Autopilot neural networks involves 48 networks that take 70,000 GPU hours to train. Together, they output 1,000 distinct tensors (predictions) at each timestep.

Valuation

Tesla had a rough time in 1Q24, with deliveries of 386,810 units, down 20.2% Q/Q from 484,507 units in 4Q23 and down 8.5% Y/Y from 422,875 units in 1Q23. Tesla wasn’t alone in terms of struggling during the 1Q24 period; it was a tough quarter for new energy vehicle (“NEV”) maker BYD. They sold 626,263 NEV units including both BEVs and Plug-in hybrid electric vehicles (“PHEVs”) in 1Q24, down 33.7% Q/Q from 944,779 units in 4Q23 but up 13.4% Y/Y from 552,076 units in 1Q23. Looking at passenger BEVs by themselves, BYD sold 300,114 units in 1Q24, down 43% Q/Q from 526,409 units in 4Q23.

There is a January 2024 discussion on X about Morgan Stanley’s sum of the parts (“SOTP”) valuation and the share price target they had at that time, which was $380 including $86 per share for the core auto business. Things have changed since January, and most investors agree $380 per share is a bit rich right now. Reuters came out with a story on April 5th saying Tesla was scrapping the Model 2 program. Morgan Stanley then responded, saying the auto business is worth $62 per share, which is down from the $86 per share from their January 2024 valuation.

Much of Tesla’s overall free cash flow (“FCF”) is from the auto business. CEO Musk said the following about FCF in the 4Q24 call (emphasis added):

Free cash flow remained strong at $4.4 billion in 2023 in spite of record spending on future projects. So we had record CapEx expenses as well as record R&D.

FCF was $5 billion in 2021, $7.6 billion in 2022 and $4.4 billion in 2023. I treat stock-based compensation (“SBC”) like a cash expense, and it was $2.1 billion, $1.6 billion and $1.8 billion, respectively, for these years. However, I believe the SBC was more than offset by capex spending on future projects (growth capex).

Looking at other considerations for 2021 to 2023, the above FCF compares to operating income of $6.5 billion, $13.7 billion and $8.9 billion, respectively. Gross profit for those years was $13.6 billion, $20.9 billion and $17.7 billion, respectively, on respective revenue of $53.8 billion, $81.5 billion and $96.8 billion.

The decline of gross profit margin for the automotive side is disturbing. In 2022, we had automotive gross profit of $20.4 billion on automotive revenue of $71.5 billion, for a gross margin of 28.5%. In 2023, we had automotive gross profit of $16 billion on automotive revenue of $82.4 billion, for a gross margin of just 19.4%. Tesla would be able to increase both gross profit and volume growth in a perfect world, but it appears they are using price cuts to sacrifice the former for the latter. There is merit to this strategy if we think about the value of putting extra cars on the road with the right hardware for FSD.

Here is a breakdown of gross profit and revenue by segment. Paid supercharging falls under the “services and other” segment, which we’ve shortened as “services” below ($ in millions):

|

auto gross profit |

auto gross margin |

auto revenue |

energy gross profit |

energy gross margin |

energy revenue |

services gross profit |

services gross margin |

services revenue |

|

|

2021 |

$13,839 |

29.3% |

$47,232 |

-$129 |

$2,789 |

-$104 |

$3,802 |

||

|

2022 |

$20,354 |

28.5% |

$71,462 |

$288 |

7.4% |

$3,909 |

$211 |

3.5% |

$6,091 |

|

2023 |

$16,030 |

19.4% |

$82,419 |

$1,141 |

18.9% |

$6,035 |

$489 |

5.9% |

$8,319 |

FSD falls under the auto segment above, and it is only available in North America at this time.

I like to break the valuation up, with the auto business in one bucket and everything else in another bucket. Investments in R&D for future projects obfuscate the economics showing in the operating income. FCF is even more confusing given all the growth capex. I like to look at the gross profit of the auto business and make projections from there. I think the auto business and charging could be worth 10 to 15x the 2022 gross profit of $20.4 billion, which is about $200 to $300 billion if we round down a little bit. This valuation is significantly less than the estimate in my last Tesla article, but I did not expect the auto gross profit to fall 21.6% from $20.4 billion in 2022 down to $16 billion in 2023.

Beyond the core auto business, I like to look at licensing next because Level 3 tech is closer than robotaxi tech and licensing demand should be substantial once a Level 3 solution is available. X posts on licensing say earnings in this area could be substantial:

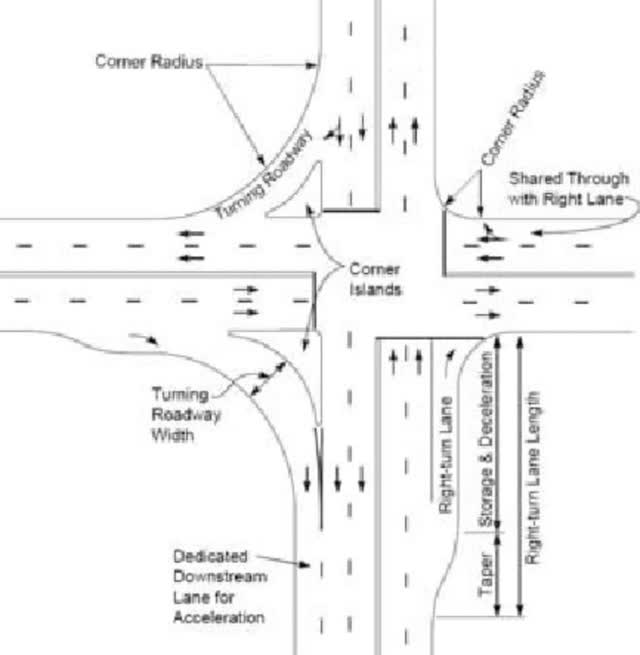

Forward-looking investors should keep tabs on FSD areas which need further refinements. FSD 12 supervised can be a bit conservative for me in the early portions of channelized right-turn lanes. It doesn’t seem to be an issue when we have a green light, but when we have a red light combined with vehicles behind us, then I feel like my vehicle could drive more efficiently, especially when no cars are coming towards the “dedicated downstream lane.” In other words, suppose the top part of this Semantic Scholar image is the northern part, and we are driving east and turning right such that we’ll be heading south (down):

Channelized Right Turn (Semantic Scholar)

If no other vehicles are coming south, then we should be able to get through the turn in a timely manner such that vehicles behind us can also make the turn while we have a clear window. Even if there is moderate traffic heading south, I like to move through the early parts of the turn in a timely fashion and merge during the latter portions of the downstream lane. However, FSD 12 supervised sometimes stops near the early parts of the turn, which can frustrate vehicles behind us.

FSD progress isn’t always linear. One example of this is the top speed. It wasn’t bad in previous versions, but it got too conservative in the FSD 12 beta version. This was partially corrected in the FSD 12 supervised versions. The top speed is good enough for licensing, but a robotaxi would have to be faster – especially if customers are getting a ride to the airport. When a road only has one lane in each direction, then the top speed can be especially important. If our car goes slower than the speed of traffic, then we get unhappy drivers piling up behind us. At some point, it makes sense to drive faster or pull over and let the vehicles behind us get by. I’ve also seen FSD 12 supervised slow down too much when exiting the freeway; it got down to 15 mph for me exiting I-80 recently.

In the past, it didn’t take much rain for FSD to give control back to the driver. Now FSD 12 supervised keeps working in light and moderate rain, but it sends a beep saying FSD may be degraded. This can be repetitive and annoying, and the degradation message needs to be done in a better way for both licensing and robotaxis.

If Tesla can have an FSD subscription on 10 million vehicles with each vehicle paying $1 thousand per year, then we have revenue of $10 billion per year. Hopefully, the bulk of this revenue will make its way to the bottom line – perhaps as much as $7.5 billion. Valuing this business at 20x the yearly bottom line would put it at $150 billion. I can see other segments like energy, Optimus, and DOJO combining for another $150 billion in valuation, such that we have up to $300 billion in valuation outside the core auto segment. As such, my total valuation is $400 to $600 billion.

The 2023 10-K shows 3,184,790,415 shares outstanding as of January 22nd. Multiplying by the April 8th share price of $172.98 gives us a market cap of $551 billion. The current market cap is within my valuation range, and I think Tesla, Inc. stock is a hold.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, BYDDY, RIVN, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.