Summary:

- I believe Tesla, Inc. will continue to dominate the EV market in the coming years due to its first-mover advantage, economies of scale, and potential full self-driving technology.

- Despite increasing competition and potential commoditization of EVs, Tesla’s strategy to maximize volume and capitalize on FSD and other services is expected to drive growth.

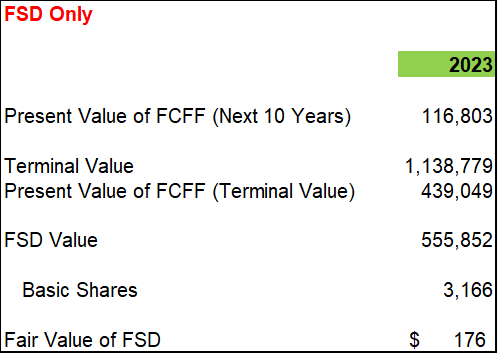

- I value Tesla’s automotive business at $218 per share and FSD at $176 per share, contributing to a total fair market cap of $1.25 trillion.

solarseven

I think Tesla, Inc. (NASDAQ:TSLA) will continue to dominate the electric vehicle (“EV”) market in the coming years. However, the EV market is increasingly competitive, and I believe EVs will become commoditized over time. I agree with Tesla’s strategy to maximize volume by cutting costs and prices, increasing the size of their fleet as quickly as possible, and then capitalizing on full self-driving (FSD) and other services throughout the vehicle’s lifespan. I value Tesla’s automotive business at $218 per share and FSD at $176 per share. Therefore, I believe that FSD contributes to almost half of TSLA stock valuation and will play a critical role in Tesla’s future success.

Growth Drivers

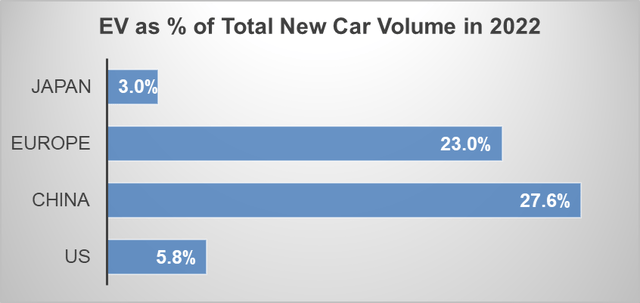

Low Penetration: A total of 14% of all new cars sold were electric in 2022, which is an increase from approximately 9% in 2021 and less than 5% in 2020. The penetration of EVs is still in the early stages. According to the IEA Global EV Outlook 2023, China led the way, accounting for around 60% of global electric car sales.

IEA Global EV Outlook 2023, Author’s Calculation

In addition, the three major EV markets ((China, US, and EU)) have all enacted legislation to align with their electric targets. The Inflation Reduction Act in the U.S., new CO2 standards for cars in the EU, and a $72.3 billion package of tax breaks for EVs over the next four years in China are expected to boost EV adoption. In my opinion, these initiatives will contribute to the EV penetration reaching at least 50% globally by 2030. Consequently, I estimate that the market size of EVs in 2030 will be 3-4 times larger than the current size, allowing ample room for growth for all EV players, including Tesla.

First-Mover Advantage and Economies of scale: I think it is obvious that Tesla has the first-mover advantage and is currently scaling. The traditional auto OEMs are just trying to catch up in the EV game. For example, Ford Motor Company (F) only aims to achieve 1.5 million EV sales by 2030; General Motors (GM) has set an annual target of 1 million EV sales by the mid-2020s; and Volkswagen (OTCPK:VWAGY) aims for 80% of its sales, or 5-6 million cars, to be all-electric models by 2030.

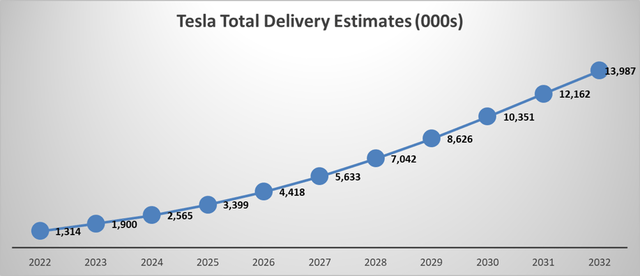

Based on my estimate, Tesla could deliver over 10 million EVs by 2030. I have no doubt that Tesla will continue to dominate the EV space, at least in the coming years.

Full Self-Driving (FSD): I agree with the point that Tesla is not just an automaker but also a software company. They have made early investments in full self-driving technologies. Elon Musk mentioned during the recent World Artificial Intelligence Conference that he believes Tesla is very close to achieving full self-driving without human supervision, and he predicts that this technology (L4 and L5) will be incorporated into production vehicles before the end of the year.

However, it’s important to note that Elon Musk’s predictions should be taken with caution, as his previous timelines for full self-driving have been repeatedly delayed. Furthermore, California has passed a new bill that prohibits Tesla from advertising its cars as fully self-driving, which came into effect earlier this year. The previous release of Tesla’s FSD beta in North America was more like a Level 2 driving assistant system rather than a fully self-driving system. Therefore, it remains uncertain if Tesla can truly achieve L4 or L5 capabilities in the near future.

Additionally, it’s worth noting that a fully self-driving system differs from a driving assistant system. Tesla currently relies solely on cameras for its sensor suite, while other companies incorporate radar and lidar. Tesla’s Dojo, a supercomputer designed for AI training, has the capability to handle vast amounts of data, which is beneficial for AI learning. If Tesla’s algorithm, along with their supported Hardware 3 or 4, can efficiently handle massive data points, Tesla’s low-cost cameras approach may prove to be superior compared to others.

Regarding the future of Tesla’s full self-driving capabilities, it is unclear when they will achieve true FSD. However, I believe the add-on FSD package could be a significant growth driver for Tesla even if Tesla cannot achieve the full L5 capability. Since FSD is primarily a software business, the incremental cost is almost negligible. This means that a majority of the revenue generated from add-on FSD purchases could flow directly to the bottom line as profits.

In my model, I estimate that Tesla can deliver 10.35 million EVs in 2030. Assuming a 34% take rate and $14,785 per car, the FSD package could contribute $39 billion in profits after tax. A more detailed calculation can be founded in the valuation section later.

Efficient Cost Management: I agree that Tesla operates as a very lean and efficient company under Elon Musk’s mission-driven approach. Tesla’s achievement of a 16.8% operating margin and $7.5 billion in free cash flow is indeed remarkable, particularly for an automotive company. Prior to the emergence of electric vehicles, traditional internal combustion engine automakers struggled to reach operating margins of 10%.

To provide a comparison, Ford had an operating margin of only 6.6% in 2022 and has set a target of achieving 14% by 2026. This demonstrates that Tesla is currently the most efficient company in the industry, surpassing the margins of its traditional counterparts.

Elon Musk’s focus on efficiency, continuous improvement, and cost optimization has played a significant role in Tesla’s success in achieving higher operating margins and generating substantial free cash flow within the automotive sector.

Key Risks

The EV market is increasingly competitive, and I think EVs will be getting commoditized over time: It is true that there is a growing number of new entrants, particularly from China, offering more affordable EV models. Furthermore, incumbent carmakers like Volkswagen and GM have ambitious expansion plans for the EV market. Volkswagen, for example, plans to invest EUR 180 billion in R&D and capital expenditure over 2023-2027, with 68% of these budgets dedicated to EV and battery development, according to Volkswagen’s disclosure. Similarly, GM announced an increase in its investments from 2020 through 2025 to $35 billion, representing a 75% increase from its initial commitment announced prior to the pandemic.

Regarding the competition from Chinese EV players, it is reasonable to expect that they will primarily compete in their domestic market, similar to what we have seen with the internal combustion engine (“ICE”) market in China. The larger concern, in my opinion, lies in the competition posed by incumbent carmakers. These established manufacturers have no choice but to invest heavily in EV technology in order to stay relevant in the evolving market. Eventually, I think EVs may become commoditized, similar to what occurred in the ICE market.

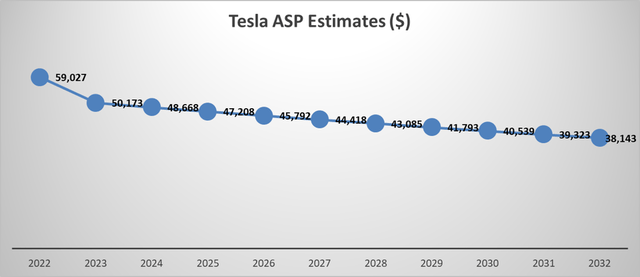

While it is uncertain when the supply of EVs will surpass demand, I believe it is a matter of time before it happens. However, I think Elon Musk’s strategy is well-suited to tackle this situation. He apparently recognizes that maximizing volume by cutting costs and prices, rapidly increasing the size of the fleet, and subsequently monetizing full self-driving and services over the vehicle’s life cycle are key to success. I anticipate that Tesla will continue to reduce selling prices to make EVs more affordable and adapt to the increasing competition.

High Interest Rate: Elon Musk’s concerns regarding high interest rates and their impact on car affordability are valid. When the Federal Reserve raises interest rates, it effectively increases the cost of borrowing, making cars less affordable for consumers who base their purchasing decisions on monthly affordability.

It is true that weak macroeconomics can lead to reduced consumption of automobiles, as they are considered big-ticket purchases. In response to this, Tesla’s price cuts could help offset some of the negative impact on demand caused by the weak macroeconomic conditions. However, it’s important to note that such price cuts may put pressure on Tesla’s gross margin.

Poor Corporate Governance: I admire Elon Musk in many ways, and I have read most of the books about him. I cannot wait to read the biography book written by Walter Isaacson later this year. However, I have to say Tesla has very poor corporate governance as a public company. For example, in FY22, they recorded $204 million of impairment losses resulting from changes to the carrying value of Bitcoin (BTC-USD). I have always viewed Bitcoin as an investment scam, a toy for rich people, and a vehicle for money laundering. Additionally, Elon Musk’s tweets have occasionally influenced Tesla’s stock price to some extents, which I consider to be somewhat unprofessional.

Increasing Competition in Europe: In 2022, China accounted for almost half of Tesla’s total production, but I estimate that more than half of the vehicles were exported to Europe. Furthermore, Tesla opened an assembly plant in Berlin last year with plans to manufacture 500,000 electric vehicles per year. I must acknowledge that Tesla has achieved considerable success in Europe, particularly as traditional automakers have been slower to enter the EV market. However, as I mentioned earlier, Volkswagen has set ambitious expansion plans for the European market following the emissions scandal. It’s also worth noting that the U.S. internal combustion engine auto industry has had minimal presence in Europe. Therefore, I believe that local European automakers will eventually dominate the EV market in the region.

Outlook and Valuation

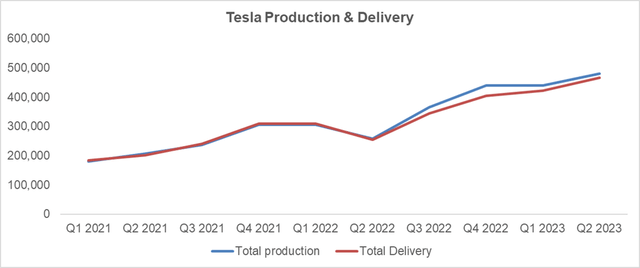

Tesla has already announced their Q2 delivery and production data. Tesla continues to demonstrate strong delivery and production performance, with a year-over-year growth rate of 83% for deliveries and 85% for production.

Tesla Quarterly Results, Author’s Calculation

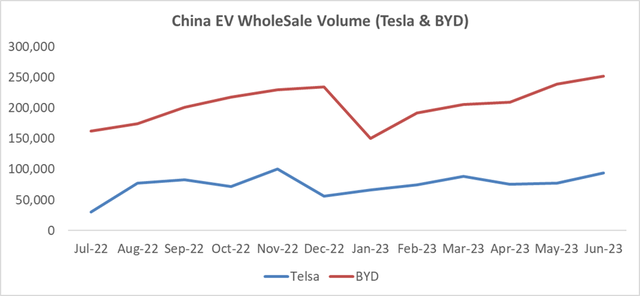

In addition, the China Passenger Car Association (CPCA) recently released the latest auto sales data for June in China. According to the CPCA data, Tesla China recorded a wholesale volume of 247,000 units in Q2 FY23, compared to 112,000 units in Q2 FY22. This represents a year-over-year growth rate of 120%. However, it’s important to note that Tesla’s performance last year was affected by the impact of COVID-19 in China, resulting in a weaker comparison. Taking all the available data into consideration, it is reasonable to anticipate that Tesla will have a strong Q2 FY23 performance.

The China Passenger Car Association, Author’s Calculation

Tesla’s valuation is indeed a topic of debate, and valuations can vary significantly. As I mentioned earlier, Tesla is often viewed not only as an automaker but also as a software company. It is reasonable to consider valuing these two aspects separately in a discounted cash flow (“DCF”) analysis, including the automotive business and FSD technology as distinct components.

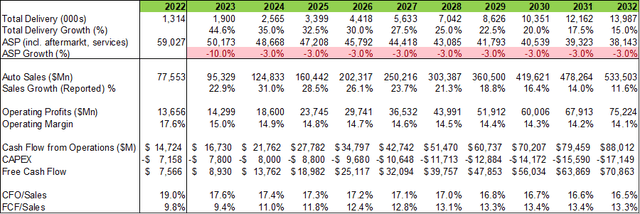

Automotive Part including aftermarket and services: I assume Tesla will continue to grow its volume rapidly in the next 10 years, with a declining average selling price. Worldwide car sales grew to around 67.2 million automobiles in 2022. If EV penetration reaches 50% by 2030, that indicates more than 30 million EV sales in 2030. In my model, I estimate Tesla can deliver 10.3 million EVs in 2030, representing one-third of the global EV market share. I think it is realistic.

Tesla DCF Model-Author’s Calculation

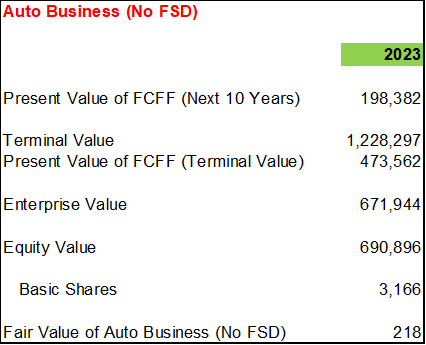

For the operating margin, I think the 17.6% in 2022 is not a sustainable figure. Along with the price cut, Tesla’s operating margin will continue to shrink to 14% over the next decade. Don’t forget 14% of operating margin is not a small figure for the ICE industry. My DCF model also assume 10% of WACC and 4% of terminal growth rate. With all these assumptions, the fair value of auto business without FSD is estimated to be $218 per share in my model.

Tesla DCF Model-Author’s Calculation

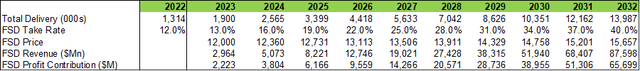

FSD: FSD is basically a software business. In the model, I assume the take rate can reach 40% in FY32, and the average FSD price will be $15,657 in FY32. Using the same volume assumption and 25% of normalized tax rate, I estimate the profit contributions from FSD as below.

Tesla DCF Model-Author’s Calculation

Again, my DCF model also assume 10% of WACC and 4% of terminal growth rate. The fair value of FSD is estimated to be $176 per share in my model.

Tesla DCF Model-Author’s Calculation

To put both parts together, I estimate Tesla’s fair value is $394 per share, or $1.25 trillion equity value (market cap).

End Note

All in all, I believe Tesla’s dominance in the EV market will continue in the next several years, and the entire EV market will become increasingly commoditized over time. Tesla has the first-mover advantage and benefits from economies of scale. However, Tesla shareholders should also keep an eye on Volkswagen, which has ambitious plans in the BEV sector. I think Full Self-Driving technology is a significant driver of Tesla’s current stock price, and it will be mission-critical for the company. I estimate that Tesla’s fair market cap should be $1.25 trillion. Therefore, I recommend a “Buy” rating for Tesla, Inc. stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.