Summary:

- Tesla, Inc. delivered stellar financials in 2022 and followed with strong sales in Q1 2023, justifying the 70% rally from the beginning of the year.

- The company’s focus on scale, cost efficiency for its next-generation platforms, and planned spending suggests aggressive growth for more years to come.

- Buying Tesla, you can find yourself riding a prominent valuation reversion angle down to the sector levels on an industry-leading profitability.

Xiaolu Chu

One of the biggest growth stocks Tesla, Inc. (NASDAQ:TSLA) exhibited a strong rally of 70% since early January, thus taking a good run-up from last year’s downtrend, which is justified by the strong Q1 vehicles sales. From a pioneer in the electric vehicle market, Tesla has almost doubled its declared production capacity in a year, and despite a strong gain since early 2023, TSLA stock is trading significantly short relative to historical levels. I am bullish on TSLA stock, as the company is chasing stellar expansion and cost optimization plans, underpinned by price cuts to bolster the demand and control the competitive landscape.

Record Tesla sales, but still not enough

Tesla drove Q4 2022 revenue up by 37% YoY to $24.3 billion thanks to higher car sales (+31% YoY; 405k units). Against the backdrop of macro headwinds, the company is managing the difficulties with demand and is increasing production by launching the Berlin and Texas sites. At the same time, orders uptake remained solid and Q1 2023 deliveries reached 422.9k, which is 36.4% YoY and 4.3% sequentially higher. The latest moves to lower prices could be regarded as strategic in the sense that the company is trying to make sales keep up with production rate, especially ahead of the ramp ups. This would help to unwind the accumulated inventories and reinforce the free cash flow (“FCF”) generation further.

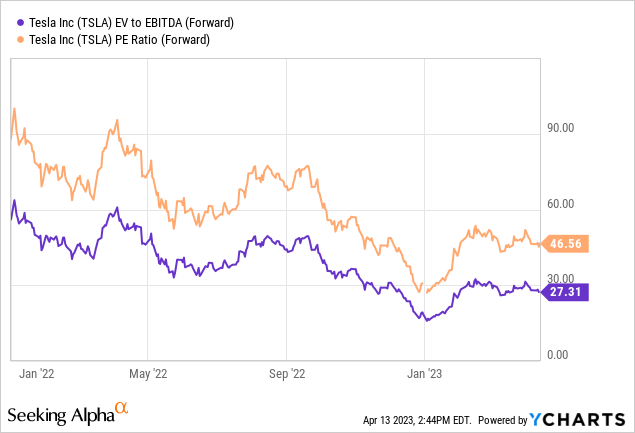

Looking at the valuation, Tesla shares are trading below their historical values, but above their traditional auto industry peers. According to Seeking Alpha, the sector median P/E FWD is 14x, EV/EBITDA is 9.4x, while Tesla is trading at 46x forward annual earnings and 27x EBITDA multiple. However, such values are lower than past figures.

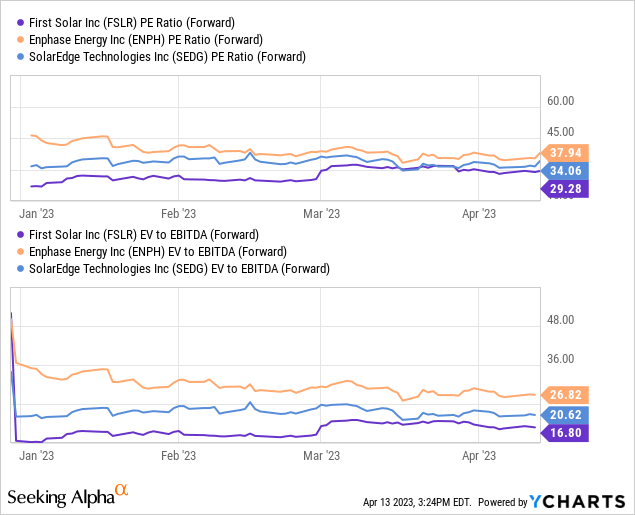

The premium to counterparts could be explained by some factors. Firstly, high growth rates of the environmental-friendly car niche. The global electric vehicle sales are expected to grow by 32% on annum through this decade and surge up to 73 million units in the next decade from 2 million in 2020. In addition, the market values clean energy companies at higher multiples. In particular, some of the largest positions of the iShares Global Clean Energy ETF (ICLN) (which tracks alternative energy companies) are valued by the market as follows:

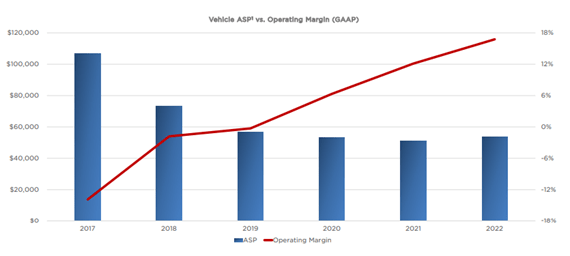

Moving to the point, a key factor is profitability. Tesla posted positive EBIT in 2019, positive net income in 2020, while the largest e-car (including hybrids) peers by market capitalization are still in the process of becoming profitable. Tesla’s market-leading operating margin allows it to price its vehicles competitively. The company is not only ramping up production but also making it cheaper thanks to automatization, vertical integration, and one more feature – Giga Press machines. Tesla orders huge presses that literally stamp parts for new cars. The name here is not an empty phrase. These are gigantic machines that provide high pressure and high-speed filling of molds, which in turn makes the parts much stronger. In Model Y, this allowed to reduce the weight of the car by 10% and speed up the assembly. As a result, Tesla implemented a huge potential for cheaper and faster production, which brought operating margin up to 16.8% on a consistently decreasing average pricing.

ASP and EBIT margin (company presentation)

However, the focus on efficiency and scale is yet to manifest, as the vertical integration efforts pay off in full size at an extraordinarily high manufacturing scale. I believe that achieving 1-2 million units per model could bring the operating margin up to 20-25%.

Giga-growth outlook

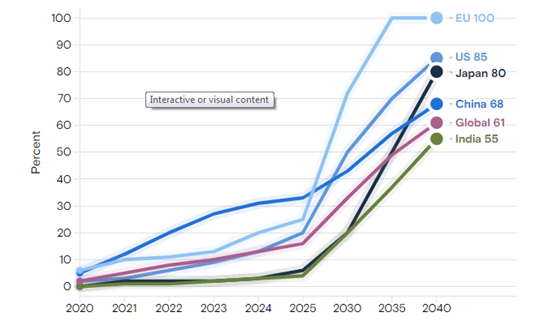

Considering Tesla’s aggressive growth plans of selling 20 million vehicles a year by 2030, the ambition implies a 15-fold increase in sales compared to 2022 and a 10-fold expansion in production capacity. In the meantime, the green agenda provides a solid foundation for further growth in electric vehicle sales worldwide. The governments of the leading economies have set bold targets to increase the share of electric vehicles, which is sharply steepening from 2025, in order to achieve decarbonization plans.

Electric vehicle sales (Goldman Sachs)

Against this backdrop, the company announced a significant investment to expand the Nevada plant and Texas factory. Tesla also plans to extend its manufacturing footprint of four electric vehicle (“EV”) factories with a fifth announced in Mexico. In addition, the company focused on lithium refinery and cathode facility. I wouldn’t be surprised if at some point this will move into upstream. However, the aggressive growth plans may be questionable without entering the <$25k vehicle market (with Tesla Model 2?). The lack of a new model being unveiled during the latest event was a bit disappointing. However, it is not the best strategy to announce a cheaper, with potentially enhanced capabilities model, as it could wipe out some current orders. Still, delivering a lower priced vehicle could be a crucial support to the company’s growth outlook.

Moreover, improvement in operational efficiency could allow Tesla to reduce the cost of its electric vehicles further, which are currently expensive relative to analogues and are considered premium e-cars. For instance, the cost of the old-timer Nissan Leaf starts at $28,000, while Tesla sells from $42,000. Price cuts will increase their economic affordability for buyers, which could support Tesla sales with a strong increase in the vehicles output.

For autonomous driving, Tesla already has a huge amount of data captured through its autopilot. With more data contributed to the neural network, Tesla could enhance its self-driving capabilities, which can be sold to millions of Tesla owners on a high gross margin, thus positively impacting the profitability.

Although Tesla’s share of the electric vehicles segment dropped to about 65% from about 72% in 2021, the company is still a majority owner of the U.S. EV market. And despite the competition hitting the market, Tesla commands a significant moat, which is sufficient for the company to focus on efficiency and scale, bring costs way down for its next-generation platforms and execute the planned spending. With this in mind, the question of how the competition is supposed to keep up remains open.

It’s worth noting the company’s impact on the global battery industry, which may still be underestimated. With around 16GWh of Megapack deployment, Tesla’s energy storage business is growing at a stellar pace. This higher-margin LOB offers a best-in-class energy density, which, along with the ramping up production, could underpin prominently the margin on the company’s operating line.

Valuation

Turning to the valuation screener on Seeking Alpha, Tesla is trading at a significant premium to the sector median levels. On the EV/Sales multiple, Tesla stock is pricing a 5x premium, while the EV/EBIT ratio implies a 3x overvaluation. My point is that Tesla has a significant potential for growth in this valuation, underpinned by superior operating profitability. But it will take time.

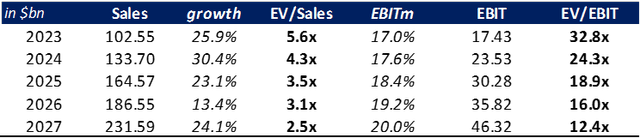

Valuation trend (Seeking Alpha; author’s estimates)

The above table lays out the analyst’s sales outlook on Tesla, suggesting a solid 25% on average growth potential. This could bring the EV/Sales valuation from 5.6x implied for 2023, down to 2.5x through the 5Y period. For reference, this would be significantly below the historical 10.4x levels. However, the company’s cost reduction and higher production roadmap shouldn’t be overlooked, and I expect Tesla to touch the 20% operating margin line by 2027. In this course of events, the premium valuation could be completely wiped out, bringing the EV/EBIT ratio down to 12.4x, in line with the sector levels of around 13x. Moreover, the introduction of new models (Cybertruck, Semi, Model 2?) and faster adoption of FSD puts merely upside pressure on profitability estimates.

The result is, that Tesla’s 25% growth outlook and focus on operating efficiency gains suggests a prominent reversion angle, and in my view, TSLA deserves a Buy rating.

Risk factors

A number of manufacturers are preparing to launch new electric and hybrid vehicles at various price points in the coming years, which will increase Tesla’s competition. The delays in deliveries could dampen consumer demand, while elevated costs could continue to put pressure on the company’s automotive gross margin. In addition, TSLA has historically been significantly more volatile than the broad U.S. stock market and headlines regarding the innovations, such as renewable energy, FSD can cause further volatility. Also, the company’s financial performance depends on the implementation of the ambitious plans to expand the production capacity.

Conclusion

Tesla, Inc. earned a record revenue in 2022 by selling 1.3 million vehicles, achieving substantial growth. The company has an aggressive ambition to dominate the EV market with the expansion of production over the coming years. TSLA is trading at a significant premium to auto sector levels, which could be justified by higher growth prospects of environmentally friendly manufacturers thanks to the green agenda, where the largest economies in the world seek to reduce emissions from ICE vehicles quite rapidly. On the other hand, it’s fair enough to consider the valuation of Tesla compared to clean energy companies, due to the rapidly growing Megapack deployment. However, the point is, that Tesla, Inc. could work out its value through growth potential and profitability down to the sector grades.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.