Summary:

- Comparing Tesla’s gross margin to other automakers is not an accurate comparison.

- The profits generated from traditional automakers on a per vehicle basis are equal to or greater than Tesla.

- Tesla’s competitors are more capable of handling a price war than they appear to be.

ljubaphoto/E+ via Getty Images

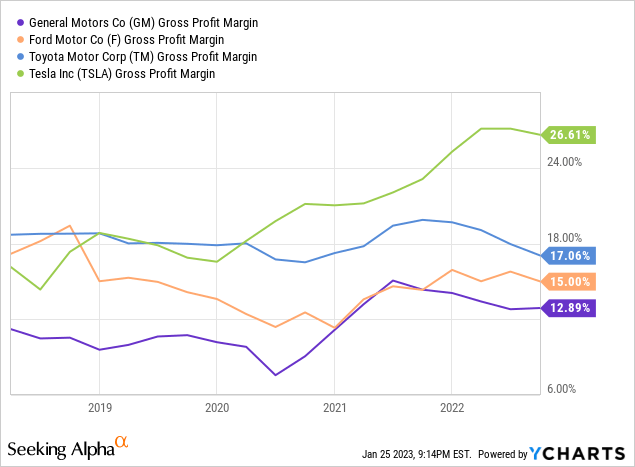

It is well known that Tesla’s (NASDAQ:TSLA) margins are significantly higher than other automakers, as shown in the chart below. However, the reason is not well understood among analysts, investors, and the media. This is problematic as it can draw false hope for the stock as they often credit Tesla with superior margins that can be used to provide exceptional pricing power. In reality, traditional automakers possess more pricing power than what’s suggested and furthermore, unlike Tesla, they are not subject to the same margin contractions from price cuts that Tesla will likely undergo as the result of its recent price cuts.

The Gross Margin Misconception

When it comes to electric vehicles, it is clear that Tesla has a substantial cost advantage over its competitors due to its scale within the sector. Tesla has also made significant investments to streamline production and lower costs, including implementing techniques such as large castings, advanced software, and clever infotainment systems that remove buttons, knobs and switches. This can physically be observed by comparing a Model Y to a Model 3, which not only look similar but share a proportionally large percentage of their components when compared to the sedans and crossovers of other brands.

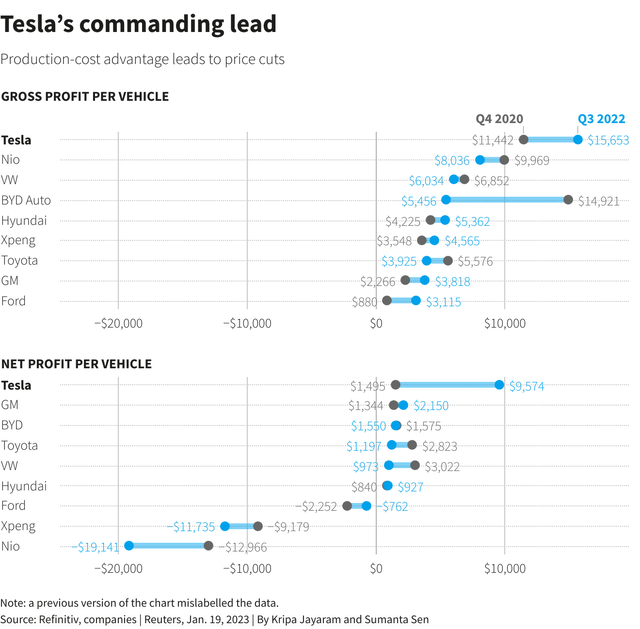

However, in the chart below by Reuters, Tesla has a significant profit advantage over its competitors between Q4 2020 and Q3 2022. Notice how Tesla’s net profit per vehicle increased more than sixfold while much of the competition saw decreases. The data is accurate, but any individual who looks at this data alone will be misled into thinking that the competition is in big trouble following Tesla’s price cuts.

While the chart contains the label “Production-cost advantage leads to price cuts”, Tesla’s profit advantage over the OEMs has almost nothing to do with manufacturing. Based on the chart above, manufacturers would have to take on substantial losses or see profits evaporate to respond to Tesla’s latest price cuts, right? Not at all. In fact, we will see significant price decreases from vehicles across the board and the net profits of traditional automakers will likely be unaffected. It’s possible that profits could increase while their customers pay thousands less to purchase their cars.

To understand how this is possible, we first need to know how car sales differ between Tesla and traditional automakers. To purchase a Tesla, a shopper places an order on their website and goes through the necessary steps to secure their vehicle such as financing and registration through Tesla. When their vehicle is ready, they may pick up their order at a delivery center or have it delivered to them.

Purchasing a car from a traditional automaker involves dealing with a third party, a car dealership. In the US and other countries, purchasing a car through a dealership is the law as there is no option of buying a vehicle directly from the manufacturer. Unlike your local McDonald’s or UPS Store, which may be brand-owned or franchised, car dealerships all operate independently from manufacturers, and naturally, they take a cut from the sale.

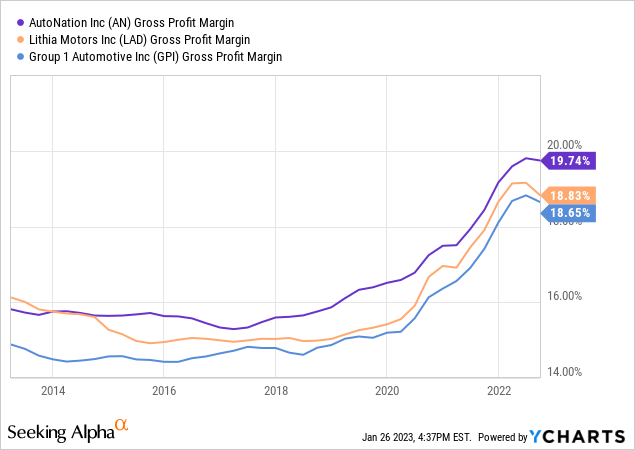

This cut has been significant over the past few years as vehicle shortages have led to dealerships charging in excess of MSRP. Note that the average selling price for a vehicle is greater than the average MSRP of a vehicle, and has been for over a year. Below, you can see the rapid rise of margins from publicly traded dealer groups that each manage hundreds of dealerships.

Hold on. Have we just discovered profit margins worth thousands of dollars?

For Q3, 2022, AutoNation (AN) reported a gross profit of $5,934 per new car sold at an average revenue of $51,541. That’s an 11.5% gross profit margin on the sales of cars alone. Additionally, AutoNation averaged $2,755 in revenue from Finance and Insurance, which is additional earnings from sales that includes profits selling financing, maintenance contracts, warranties, and other items. Note that the F&I figure includes averages from the sale of used cars, which may or may not be higher. Regardless, we’re discussing gross profits of more than $8,000 that have nothing to do with manufacturer gross margins.

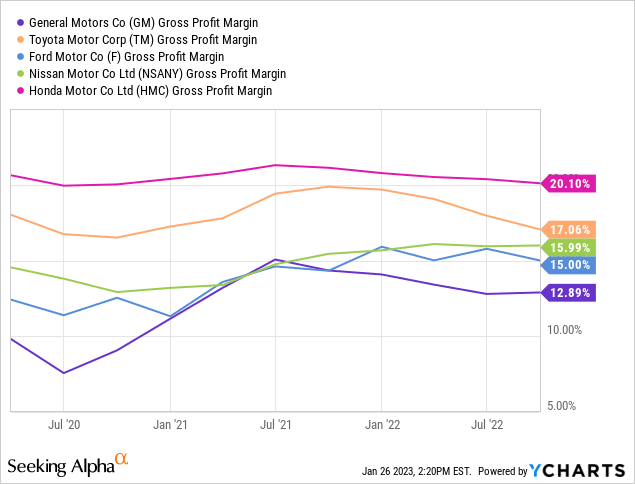

If the law didn’t disallow manufacturers from selling vehicles directly to the consumer, dealer profits would be in the hands of manufacturers and would completely erase Tesla’s gross margin advantage. Unfortunately, this isn’t the case so despite skyrocketing vehicle prices, you can see that manufacturer margins have remained flat over the years as shown below.

If you combine the gross margin of the dealers, many automakers would have greater margins than Tesla. Tesla’s ownership of the retail and service network allowed it to claim the benefits of higher prices that dealers have been taking from traditional automakers. Now, of course, dealership profits do not belong to the automaker but they play a critical role in understanding why Tesla’s price cuts can easily be matched.

As a side note, dealers can certainly frustrate manufacturers, but on the bright side, they do not need to invest in new stores and service centers as Tesla will need to as it grows sales.

Prices Will Come Down

The high prices within the auto industry are unusual and unsustainable. It was merely a coincidence that carmakers were facing production challenges from supply chain issues while, at the same time, pent-up demand from lockdowns and low interest rates resulted in a surge in demand. Since the automakers cannot control the price of its cars sold by dealerships, dealers exploited the supply-demand disparity to make thousands of dollars more per vehicle sold when compared to just a few years ago.

Historically, dealerships made very little from the sale of new vehicles. For the same quarter of 2018, AutoNation made just $1,583 in gross profit compared to $5,934 from Q3 2022. As manufacturers resolve their production constraints, and as demand for vehicles falters in the face of higher interest rates, prices will inevitably come down.

While prices hit record levels in December yet again, the market is starting to show signs of recovery in some areas. Used car prices are down, and some brands are starting to introduce discounts, but other brands like Honda and Toyota remain tight on inventory. According to KBB, the microchip shortage will be resolved this year, resulting in a higher supply that will lower prices.

As prices come down, the gross margin of traditional automakers will likely not be affected, especially while the average selling price is above MSRP. Price cuts will primarily occur at dealerships in the form of reduced markups or discounts to spur demand. If necessary, manufacturers may chip in and offer incentives to further drive down prices, but the vast majority of price reductions from current levels will come on the dealer’s end.

Conclusion

It’s important not to assume that Tesla has a significant advantage over the competition when it comes to pricing simply due to its higher gross margins. When the profits of dealers are combined with those of manufacturers, the overall profit margins are comparable to or greater than those of Tesla. Over the past two years, the significant increases in vehicle prices can be attributed to dealerships using their free will to charge well in excess of MSRP. AutoNation was averaging north of $8,000 in gross profit per new car sold on average, which is roughly $5,000 more than prior to COVID and well more than most automakers are making on their own cars.

For more than two years, Tesla’s Model Y and Model 3 have had the advantage of avoiding unequal competition from popular alternatives such as the RAV4, Camry, CR-V, and Accord. Many used 2022 RAV4s are still listed well above the MSRP of a new one, and some versions of the RAV4 sell for more than $50,000. At that point, why buy a Toyota when you can buy a Tesla, right? Production constraints continue to make it difficult to obtain such cars at fair prices, if at all, but only for now.

With the chip shortage estimated to end this year, vehicle supply will return to normal and Tesla will inevitably face a wave of price reductions from its strongest competitors (Cars like the RAV4, not the Mach-E, yet). Furthermore, since these cuts will come from dealers ending markups and providing discounts, manufacturer gross margins will be largely unaffected.

Tesla stock is up more than 70% from its lows this month as investors found relief from the fear of slowing demand for their vehicles. If investors were worried about demand last month, wait until we finally witness the delayed effects of higher interest rates on the economy as well as lower vehicle prices from the competition.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.