Summary:

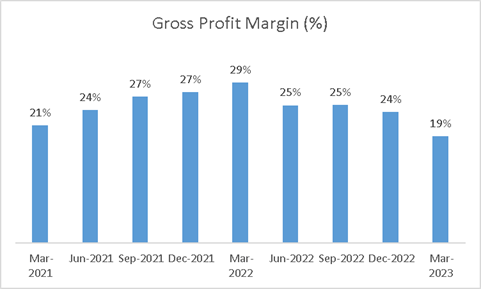

- Tesla, Inc.’s gross profit margin was less than 20% for the first time since 2020.

- Tesla vehicle sales increased 36% year-on-year.

- With its price cutting, Tesla is probably targeting ICE’s customers.

Maja Hitij/Getty Images News

This is my first article about a company already covered by many analysts and that does not need any introduction: Tesla, Inc. (NASDAQ:TSLA). As my usual readers know, I mostly cover stocks in the energy sector (mostly oil and gas companies or oil tankers stocks). However, I have been following Tesla with interest for a while to the point I now want to jump into the discussions.

In this article, I will provide an overview of the Q1 2023 results that Tesla announced a couple of weeks ago, and I will explain the rationale behind my BUY recommendation.

Tesla’s Q1 2023 results were a bit mixed, with some sound demand metrics but softer margins that will make investors raise some questions. The strategy of reducing margins in the short term in exchange for long-term demand growth might be a good strategy, but the gross margin falling below 20% is going to increase investors scrutiny on every action the company will take in the next months.

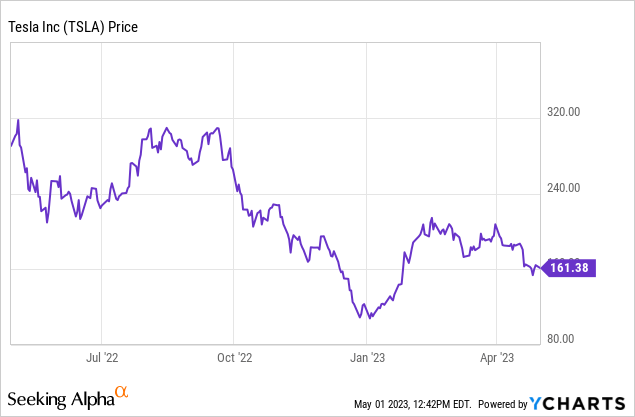

Tesla stock price

The stock is currently trading at $164.3/share, equivalent to a market capitalization of $512 B. The stock is down year-to-year by -44% but has been recovering year-to-date with a +33%. As one would expect, the stock is characterized by strong volatility with the 52-week standard deviation being $51/share, equivalent to almost 30% of the current trading price. The 52-week minimum was $108.1/share, recorded on March 1st, 2023, while the 52-week maximum was $309.5/share, recorded more than eight months ago on August 15th, 2022.

Q1 2023 financial and operating results

Total sales increased 24% year-on-year by $4.5 bn, from $18.7 bn to $23.3 bn. The increase in revenues was driven by the results of the different business units with total automotive revenues increasing 18% y-o-y to $19.9 bn, sales from energy generation and storage increased by 148% to $1.5 bn and service revenues increasing 44% to $1.8 bn.

More in detail:

- Total automotive revenues: automotive sales accounted for 95% ($18.8 bn) of total automotive revenues and increased 22% year-on-year. Tesla also received $521 M in regulatory credits (-23% y-o-y). The leasing of automotive only accounted for $564 M, down 16% year-to-year. Overall, automotive revenues have increased on a yearly basis, but credits and leasing have been performing worse than they could have.

- Energy generation and storage: within this item, Tesla includes sales generated by energy storage products such as the Megapack of the Powerwall. Revenues from this division ($1.5 bn) accounted for 7% of the total Q1-2023 Tesla revenues, up from 3% of the previous year

- Service and other: within this item, Tesla includes sales from services offered either to cars or other products and for Q1-2023 the total revenues accounted for $1.8 bn, almost 8% of total revenues, in line with the year before (7%).

Focusing on the automotive sector, the increase in revenues was mostly driven by two dynamics. On one side, Tesla was able to deliver more vehicles during Q1-2023, with about 108k more Model 3 and Model Y combined deliveries year-on-year. On the other side, the volume increase was partially offset by an average lower selling price since Tesla has been constantly reducing prices in order to increase market penetration.

Regarding Energy generation and storage, revenues have increased mostly due to more installed capacity with a yearly 360% increase to $3.8 GWh of installed capacity.

Moving to the cost side, the total cost of revenues increased by 42% year-on-year with the following breakdown:

- Automotive cost of sales: +39% to $15.8 bn

- Energy generation and storage: + 98% to $1.3 bn

- Service and other +32% to $1.7 bn.

As one can see, the total cost of revenues increased more than revenues leading to a declining gross profit of $4.5 bn (-17% year-on-year) and, above all, declining margins. For the first time since 2020, the gross profit margin was below 20%, a threshold that – considered the previous quarters – came a bit unexpected. Obviously, price reduction played a key role in margin contraction, but yet, investors will start asking questions.

Tesla gross profit margin (Tesla 10K)

Other operating expenses were quite in line with the previous year (-1% at $1.8 bn), leading to an EBIT of $2.6 bn. The final net income for Q1 2023 was $2.5 bn, down 24% year-on-year.

Looking at the cash flows for Q1-2023, one can notice that cash flow from operations was positive at $2.5 bn, while cash flow from investing activities was negative (-$2.4 bn) due to the purchase of property and of investments. At the end of Q1 2023, Tesla had a cash balance of $16.7 bn plus $6.0 bn of short-term investments versus a total debt of $2.6 bn, resulting in a net-cash of about $20.1 bn.

Outlook

There are two main takeaways from the Q1 2023 results: declining margins and – partially connected – declining selling prices. In 2022, Tesla’s Model 3 and Model Y were the first two most-sold BEVs (battery electric vehicles) in the U.S., together selling almost 11 times more than the third most-sold vehicle, the Ford Mustang Mach-E. Considering that today the BEV market accounts for less than 10% of the U.S. car market and that the IEA target is to have 60% of BEV sold by 2030, the question is: why did Tesla cut prices? Tesla’s cars, even without the price reduction, already have better performances than other electric vehicles. Therefore, my guess is that Tesla is cutting prices to try to steal customers from internal combustion engine (“ICE”) manufacturers. It’s for sure a bold move, but the potential reward can really be huge.

Wall Street analyst’s rating

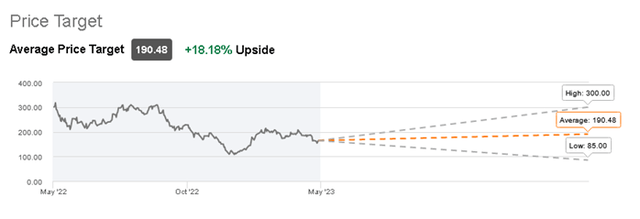

Tesla is currently covered by 37 different analysts that issued equity reports in the last 90 days. 15 of them have assumed a HOLD position while 17 are more bullish, issuing BUY or STRONG BUY advice.

The average target price is $190.5/share, which would represent a +18% versus the current trading price.

Tesla Target Price (Seeking Alpha)

Conclusion

In my view, despite gross profit margins falling below the psychological threshold of 20%, Tesla, Inc. remains a solid company with a very strong balance sheet and a clear strategy ahead. I personally see the price cuts as a tentative attempt to get new customers that otherwise, with higher BEV prices, would not even consider buying an electric vehicle.

Overall, my recommendation for Tesla, Inc. stock is a BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.