Summary:

- Despite Tesla, Inc.’s premium multiples, the higher-than-peers’ valuation can be justified by Tesla’s high growth potential and margin expansion in the past 4 years.

- It’s prudent to be cautious on high valuation after Q1 results due to the demand slowdown and deterioration in auto gross margin, resulting in a sharp decline in free cash flow.

- Macro headwinds and looming recession risk further intensify the existing uncertainties.

- I’m neutral on Tesla stock as growth slowdown and high valuation can’t coexist, despite secular growth in the long run.

Dimitrios Kambouris

Investment Thesis

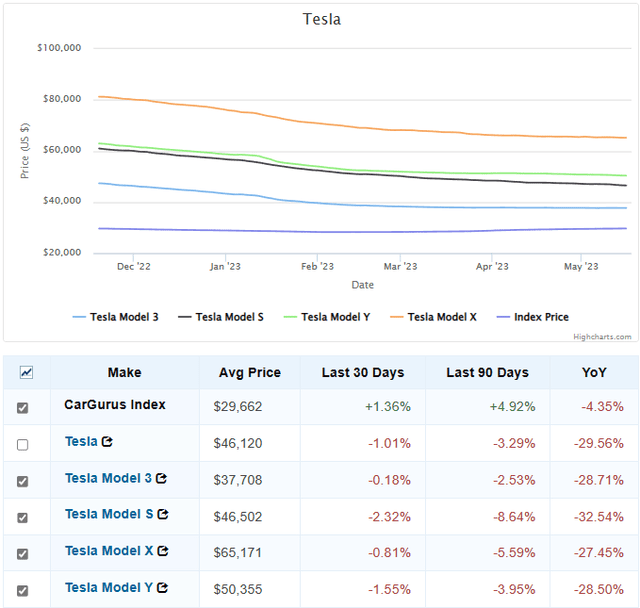

Tesla, Inc. (NASDAQ:TSLA) shares dropped by more than 10% after its Q1 results due to weak revenue growth and margins contraction caused by the company’s ongoing vehicle price reductions. However, the stock has largely recovered and is currently range-bound. Investing in Tesla presents a dilemma for many investors. While they are concerned about its valuation multiple (currently trading at 49x P/E TTM) despite a more than 50% drawdown from its 52-week high, they believe that TSLA’s secular growth tailwinds remain intact. Additionally, they don’t want to miss out on any significant rebound like the one seen in 2021.

There are two important factors to consider. Firstly, despite the highly competitive EV industry, Tesla’s growth potential and margins are currently higher than its peers, which can justify higher-than-peers valuation multiples. Secondly, given the concerns about growth deceleration and margins contraction in the face of a demand slowdown and further price reductions, it’s necessary to discount its valuation accordingly. Therefore, I maintain a neutral view on Tesla stock and wait for a consolidation to occur that balances the potential growth slowdown with the high valuation.

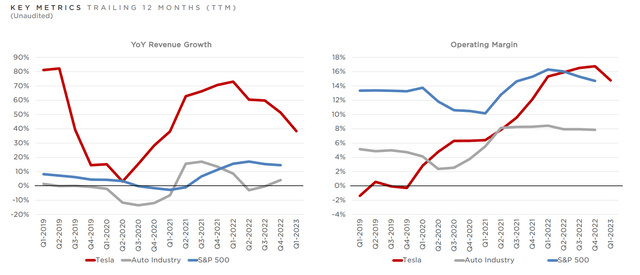

Cautiously Optimistic

Despite disappointing Q1 results, the company’s auto gross margin has shown significant improvement, rising from 21.2% in FY 2019 to 28.5% in FY 2022, surpassing General Motors’ (GM) 18.9% and Ford’s (F) 16.2%. TSLA’s revenue has achieved a CAGR of 5.1% from FY 2019 to FY 2022, significantly higher than GM’s 5.5% and F’s 1.2%. Additionally, TSLA’s strong cash flow and negative net debt on the balance sheet are positive indicators of the company’s financial health. Its free cash flow (“FCF”) per share increased from $0.4 in FY 2019 to $2.18 in FY 2022. While TSLA continues to trade at a premium multiple, its impressive track record supports its valuation.

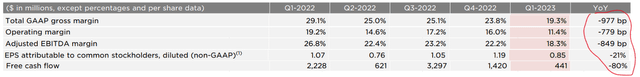

However, we need to be cautious on its near-term volatility, as the company showed signs of a demand slowdown in Q1, which could potentially cause further decline in revenue growth and margins compression in the coming quarters. As indicated in the table, during Q1 FY2023, both the gross margin and adjusted EBITDA margin contracted below the threshold of 20%. Due to the ongoing uncertainty around TSLA’s near-term earnings outlook, I believe the stock will continue to face pressure in the current macro environment.

Contradicted Statements

During the Q4 FY2022 earnings call in January this year, Tesla dismissed the idea of having a demand problem and emphasized that demand exceeded supply. When analysts asked if auto margin will drop below 20% after price cut, the CFO replied:

“So based upon these metrics here, we believe that we’ll be above both of the metrics that are stated in the question, so 20% automotive gross margin, excluding leases and rent credits and then $47,000 ASP across all models.”

However, in Q1 FY2023, the auto gross margin decelerated to 19% (excluding credit), which fell below the street consensus of 20%. This led to a FCF of $521m, below the street consensus. It’s worth noting that the FCF figure would be negative if excluding regulatory credits.

Moreover, the management reported a new order intake rate almost twice the rate of production and expressed the potential to beat their 2023 deliveries target of 1,800k vehicles, if production capacity allowed. At the time, market consensus projected more than 1,900k deliveries in 2023 at higher prices. the company indicated they were selectively raising prices on certain models to address the supply and demand imbalance. Particularly, Elon Musk said:

“We currently are seeing orders at almost twice the rate of production. So it’s hard to say that will continue twice the rate of production, but the orders are high. And we’ve actually raised the Model Y price a little bit in response to that.”

However, the subsequent price cuts in Q1, which impacted margins more than anticipated, and the ongoing price reductions in Q2 without a corresponding increase in the 2023 deliveries target, contradict their earlier statements.

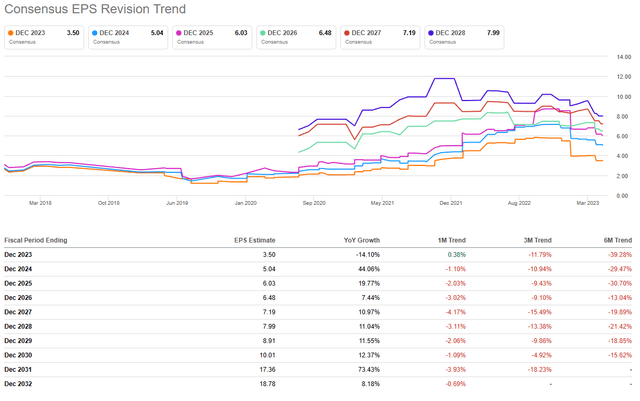

Significant Downward Revisions

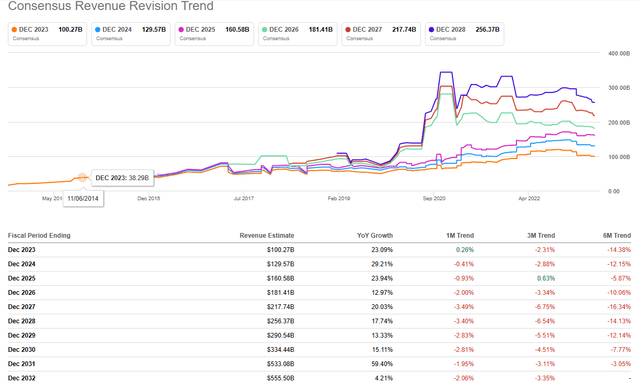

As previously mentioned, there has been a downward trend in TSLA’s revenue estimates throughout this year, reflecting concerns regarding demand slowdown and macro headwinds. This is evident in the substantial downward revisions in TSLA’s revenue consensus for the upcoming years, as shown in the table. Consequently, the P/E ratio has experienced a nearly 50% decrease from its previous high.

It’s worth noting that the revenue consensus has not only been reduced in the near term but also in the mid and long term. This may suggest a concern regarding a structural demand headwind resulting from increased competition within the EV industry. Therefore, I believe that investors should wait for an acceleration in top line growth before expecting significant upside momentum in the near term.

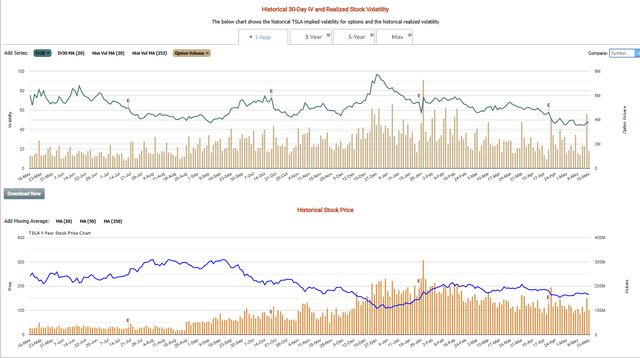

On the other hand, since the beginning of the year, the analysts have been slashing earnings estimates due to margins compression resulting from ongoing price cuts. As shown in the table, the EPS estimates for FY2023 and FY2024 have been reduced by 40% and 30%, respectively, over the past six months. These reductions signify significant near-term headwinds for the company. As a result, investors may consider hedging against a potential downside using options, given that TSLA’s implied volatility is currently at a one-year low.

Lower Implied Volatility

Due to a near-tern concern on TSLA’s volatility, it’s a good idea to implement a protective put hedging strategy, which can be cost-efficient when buying options at a bargain, similar to buying a stock with a low P/E. It can offer unlimited upside potential while providing some downside protections or lowering the volatility. Readers can test the strategies using option profit calculator. Keep in mind that the optimal strategies vary based on an investor’s risk tolerance and investment horizons.

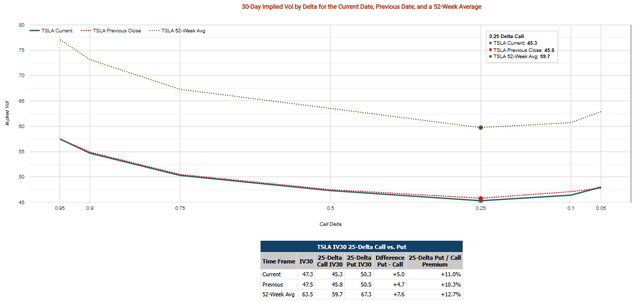

It’s worth noting that TSLA’s IV30 is currently at 47.3, near its one-year low, indicating a good time to buy options at a lower price. However, determining the appropriate strike price for put options requires consideration of the delta. A delta of 0.5 means an at-the-money (ATM) option, while a delta below 0.5 means an out-of-the-money (OTM) option.

Based on the chart, the IV30 is at its lowest point for the 0.25 delta. Additionally, the table below indicates that the IV30 for 25-delta put options is more expensive than for call options (50.4 is greater than 45.6), suggesting a higher demand for downside protection. Consequently, buying put options requires an 11% premium compared to call options.

Therefore, one strategy to consider is implementing a rolling hedge every 30 days by buying put options with a delta of 0.25, which translates to a strike price near $150. This level also aligns to a technical resistance level, as the price rebounded from around $153 after the Q1 earnings. Thus, investors concerned about potential near-term pullbacks or valuation concerns may consider a rolling hedge by purchasing one-month $150 put options. Again, this is just an example to demonstrate the logic behind it. This is not a strategy suitable for all investors and the risks of options should be studied and understood before trading them.

Conclusion

In sum, Tesla, Inc. demonstrates higher margins and revenue growth compared to its peers, justifying its premium valuation. The company also exhibits strong cash flow and carries negative net debt, supporting its impressive track record.

However, it’s prudent to be cautious due to the potential near-term volatility caused by a demand slowdown. As Tesla, Inc.’s IV is currently at a one year low, hedging strategies, such as purchasing options at a lower IV can provide downside protection while allowing for potential upside capture. It is crucial to note that investment strategies should be tied to individual risk tolerance and investment horizons.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.