Summary:

- Tesla, Inc. heavily relies on China for its future growth and manufacturing, with the Chinese market accounting for a significant portion of its sales and production.

- The potential economic slowdown in China, particularly in the real estate industry, could lead to a decline in car sales and negatively impact Tesla’s growth.

- The current valuation of Tesla stock may not be justified given the rising risks and potential slowdown in growth.

DKart

I have been hesitant to write about Tesla, Inc. (NASDAQ:TSLA), as a lot of other analysts have already written about the matter. Regarding the endless debate of whether Tesla is a car company or a tech company, in my view both sides have presented a convincing case. With the recent issues facing China, though, I have noticed that the company is facing a disproportionate amount of risk. A lot of Tesla’s future growth is staked on China, which is starting to face significant headwinds.

China is an Important Market and Hub for Tesla

China has been a growing market for electric vehicles and Tesla has been in a prime position to capture that market share. According to a news article by Seeking Alpha, China delivered a record number of cars in August, 2.24 million in total. From this total number, roughly 32% were EVs and plug-in hybrids, an increase of 35% year-over-year. This figure shows how widespread EVs and plug-ins are becoming in China as well as how much of their manufacturing base has shifted to accommodate EVs for the export market.

The Chinese domestic market has been doing well as total Car sales increased by 2.2% to 1.94 units in August. As proof of Tesla’s strong brand even in the notoriously difficult-to-crack Chinese domestic market, Tesla’s share of the EV market nearly doubled in August. According to Reuters calculation, Tesla now holds a 13.2% market share in the Chinese EV market up from 7.5% from last month. Tesla sold 84,159 EVs in August compared to 64,285 units in July. On a YTD basis, Tesla sold 624,983 China-made vehicles, an increase of 56.3% from last year.

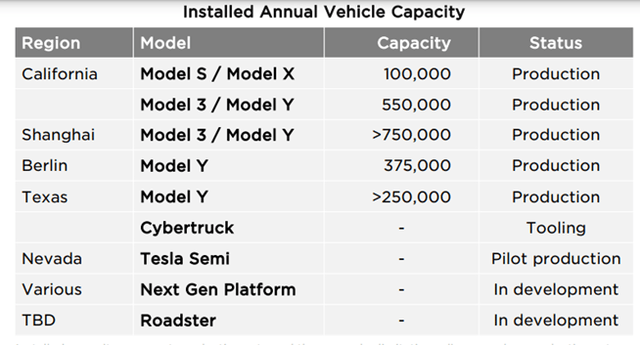

From these figures, it’s clear to me that Tesla is becoming increasingly reliant on China. In fact, the company relies on China not only for access to its domestic market but also for its manufacturing. The Shanghai “Gigafactory” is the company’s current main export Hub. Based on my quick calculations, the Shanghai factory accounts for 25% of Tesla’s installed annual vehicle capacity. This calculation is already taking into account Tesla’s production expansion of its “Gigafactory” in Berlin from 500,000 units to 1 million units.

Vehicle Capacity (Tesla Presentation)

Basically, this means a lot of Tesla’s forward growth prospects are based on two broad assumptions: 1) selling a lot of cars in China; and 2) making a lot of cars in China.

Car Sales Could Stall, Affecting Tesla’s Growth

The latest data for U.S. Car Sales have held steady despite the multiple headwinds of inflation, a high-interest rate environment, and a slowing U.S. economy. S&P Global Mobility has projected August car sales would be up 18% year-over-year. However, growth has been slowing down as projections are pointing to a 3% month-over-month increase.

These projections are not too bad, yet there are signs of future deterioration in demand. The daily selling rate peaked at 54,500 sales per day in April and is on a downward trajectory. August is expected to come in at less than 50,000 sales per day. It’s in my view, that there is a risk of new car sales declining in the US which would be bad for Tesla.

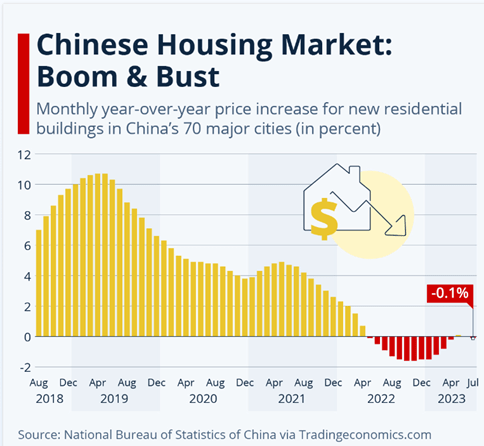

I believe the economic situation in China is potentially worse as the country seems to be headed to a 2008 / 2009 style Housing / Financial crisis. The slowing Chinese economy, leftover effects of a draconian COVID-19 response, and years of poor regulation and oversight have left the Real Estate industry on the precipice of collapse. Country Garden, which is China’s largest homebuilder, has twice nearly defaulted on its debt.

The homebuilder has about $3.7 billion in bonds that are potentially due through 2024. While Country Garden can continue scraping by with whatever small amount of liquidity and cash flow it has, the company’s total liabilities are massive at close to $200 billion.

Unlike in other places in the world where banks would pay the developers in full once an apartment is completed or turned over, in China developers are paid in full during the construction phase. This means that when developers default, buildings/homes go unfinished. And yet the poor Chinese consumer is left holding the bag.

Remember the damage done in 2008 /2009 in the US when real estate prices dipped, thus wiping out consumer equity? Now imagine the potential damage to the Chinese consumer having an unfinished building/home that has no value and still having to pay it in full. Chinese consumers would have less money, thus resulting in much slower car sales.

China housing prices (Statista)

A Chinese recession would no doubt severely impact Tesla’s car sales. This could be bad for TSLA stock as the recent rally was built around the narrative of the company seeing massive growth in China. If China heads into a recession, combined with the slowdown we are beginning to see in the U.S., it is difficult to imagine how the company can achieve its long-term target CAGR of 50%.

Tesla has been very aggressively cutting the prices of its cars in China. The Model S and Model X are nearly 7% cheaper post-price cuts. This may be pure speculation, but I wonder if these price cuts are a result of the company not wanting to have inventory as China goes into a recession. It does make sense though, given the unprecedented nature of these cuts and the fact that these cuts would not happen if the company were certain of future demand.

Note: This doesn’t even include the political risk of having significant operations in China. Recently, the ruling CCP has banned government officials from owning iPhones (AAPL). As geopolitical tensions rise between China and the West, this form of tit-for-tat retaliation could potentially become increasingly common.

Valuation and Conclusion

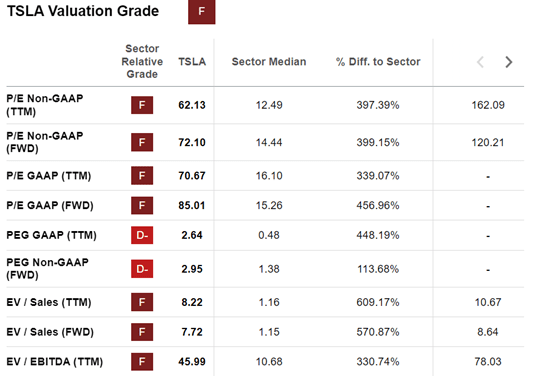

In terms of valuation, Tesla as a hyper-growth company has always defied conventional measures. Tesla unsurprisingly has an “F” valuation score in Seeking Alpha’s Quant rantings. No doubt, this score has been low for a long time. Currently, the company has a P/E ratio of 62x to 72x TTM and forward respectively. The company also has a forward Price to Sales ratio of 7.8x which is similar to a high-growth tech start-up.

Valuation Ratings (Seeking Alpha)

The stock’s run-up has been justified, though, given that Tesla was able to deliver on top-line growth of 48.5% for the past 5 years. However, given the risk of growth slowing down (and margin compression), is the company’s $788 billion market cap justified? From a risk-to-reward ratio, given the rising and obvious risk, I don’t think TSLA stock could be a 5-bagger from these levels.

I think the long-term buy-and-hold money on Tesla stock has already been made, given that it is now among the world’s largest companies. China hitting a particularly hard economic slowdown has the potential to send Tesla stock crashing to earth given the company’s vast exposure not just on its projected revenue growth but also its manufacturing base. It is for this reason, that I believe Tesla is more of a “Sell.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.