Summary:

- Tesla, Inc.’s Q2 earnings beat estimates, but concerns over declining margins, due to aggressive price cuts, caused shares to drop 10% after earnings.

- Despite record deliveries and 47% Y/Y revenue growth in Q2, Tesla’s gross margin declined to 18.2%, leading to concerns about long-term profitability.

- Tesla’s operating margin is now in the single digits and at its lowest since Q1’21.

- Tesla’s positive free cash flow and industry leadership position are positives, but weakening margins and potential delays in Cybertruck production are risk factors.

- Investors may want to wait for re-engagement until the correction has been completed and a bottom been formed.

Xiaolu Chu

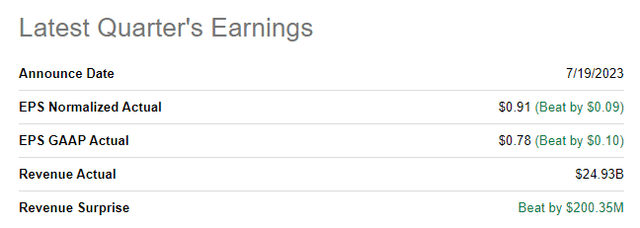

Tesla, Inc. (NASDAQ:TSLA) submitted its second quarter earnings card on July 19, 2023, and it showed that the company beat both top line and bottom line estimates. However, the electric vehicle (“EV”) company also reported concerning developments in terms of its operating margins. These margins have come under pressure lately on Tesla’s aggressive price cuts which Tesla strategically used to spur demand and inflict costs on the EV competition.

Shares of Tesla declined 10% on the day after the release and continue to be at risk in the short term, in my opinion. Since shares are highly rated and valued based off of earnings, I believe investors should wait for a consolidation to play out before establishing a new position.

Previous rating

I rated Tesla a sell in June — Tesla: This Is The Time To Get Out — which was maybe a bit early, but I had already voiced my concerns about the rapid (and unsustainable) increase in Tesla’s valuation. Now, investors have one more aspect to worry about: the company’s falling operating margins. For those reasons, valuation and margins, I reiterate my sell rating on the EV manufacturer.

Strong Q2 earnings release with both a top and a bottom line beat

Tesla reported strong second-quarter results, with both the top and bottom lines beating consensus expectations. Tesla generated $24.93B in revenues, which beat the estimate by a little more than $200M. Tesla reported $0.91 per-share in adjusted earnings, beating the consensus estimate by $0.09 per-share. Although Tesla reported strong year-over-year growth in revenues and net income, the market is starting to be concerned about Tesla’s margin trend… which has emerged as a fear factor for investors.

Second quarter delivery accomplishments

Before I get into the discussion of Tesla’s margins, which I consider to be a key factor behind Tesla’s share price weakness that could last a lot longer, in my opinion, I want to touch quickly on Tesla’s record deliveries, which made Tesla’s strong Q2’23 revenues possible.

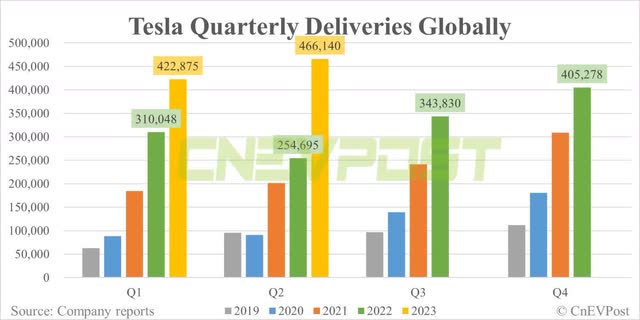

From a delivery point of view, Tesla had an excellent second quarter, as it delivered 466,140 electric vehicles, an all-time delivery record as well. Total deliveries soared 83% year-over-year and approximately 10% quarter-over-quarter. Tesla’s achievements in deliveries have been aided by production ramp ups in Tesla’s Gigafactories in Texas and Berlin as well as higher electric vehicle demand spurred by price cuts.

Due to strong delivery performance and record sales for Tesla’s most popular Model Y, Tesla generated 47% revenue growth in Q2 ’23. Tesla expects to keep this momentum going and projected a total delivery volume of 1.8M electric vehicles in FY 2023… although the company did say that it expects production to fall in Q3 as Tesla does upgrade work on some of its factories. The 1.8M delivery outlook implies 37% year-over-year growth.

Tesla’s got a revenue boost earlier this year after the EV company embarked on an aggressive price cutting policy in order to kickstart faltering demand. This strategy has been a double-edged sword, however, since Tesla has not only reaccelerated its top line growth, but on the other hand the EV company has seen a rather steep decline in its margins.

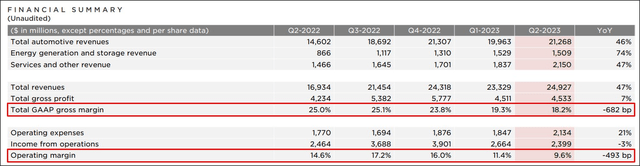

Tesla’s gross margins declined significantly Y/Y in the second-quarter, a result of the firm’s price cuts for popular models, including the best-selling Model Y, reflecting a strategy of purchasing top line growth by accepting lower profitability per-vehicle sold. The firm’s gross margin declined to 18.2%, showing a decline of 6.82 PP Y/Y in Q2’23 while operating margins dropped below 10%: Tesla’s Q2’23 operating margin was 9.6%, showing a decline of 4.93 PP Y/Y. It was the third straight quarter of margin erosion (which coincides with Tesla’s pricing offensive), and operating margins haven’t been this low since Q1 ’21.

The decline in margins is worrisome chiefly because it directly translates to lower bottom line profitability. Although Tesla is widely profitable — it achieved $2.7B in net income in the second-quarter — investors are rightly worried about what these margin trends mean for net income as well as the company’s valuation in the longer term.

A company that is cutting prices does not only acknowledge that it is getting tougher to achieve sales in a crowded market, but also that margin pressures are likely to persist, meaning Tesla’s net income growth may be suppressed for more than just a few quarters.

Tesla’s free cash flow

Nonetheless, the second quarter was a good one regarding free cash flow for Tesla as the company generated $1.0B in free cash flow with a margin of 4.0% compared to a 2% FCF margin in the previous quarter.

Tesla is one of the only electric vehicle company that already achieves free cash flow profitability which is being derived chiefly from the company’s massive global delivery and sales volume. Going forward, I would expect operating income margin pressures to negatively weigh on Tesla’s free cash flow margins as well.

|

$ in millions |

Q2’22 |

Q3’22 |

Q4’22 |

Q1’23 |

Q2’23 |

Y/Y Growth |

|

Total revenues |

$16,934 |

$21,454 |

$24,318 |

$23,329 |

$24,927 |

47.2% |

|

Net cash from operating activities |

$2,351 |

$5,100 |

$3,278 |

$2,513 |

$3,065 |

30.4% |

|

Capital expenditures |

($1,730) |

($1,803) |

($1,858) |

($2,072) |

($2,060) |

19.1% |

|

Free cash flow |

$621 |

$3,297 |

$1,420 |

$441 |

$1,005 |

61.8% |

|

Free cash flow margin |

3.7% |

15.4% |

5.8% |

1.9% |

4.0% |

9.9% |

(Source: Author from Tesla data.)

Tesla’s valuation and a potential re-entry

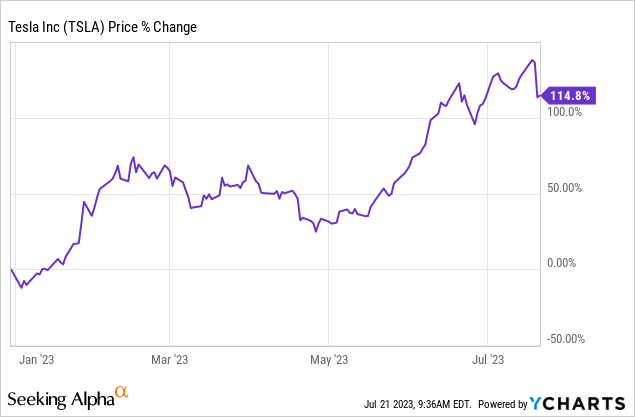

Therefore, the decline in margins can largely be blamed for Tesla shares dropping 10% yesterday. Since Tesla also had an extremely strong run since the start of the year (it more than doubled in price), I believe shares are ripe for a correction and may go into a new down-leg.

Tesla, for me, was always a good buy when the market was very bearish on the EV company — like in December 2022 or in April 2023 — but not when investors are extremely bullish, like they were in February 2023 or are now.

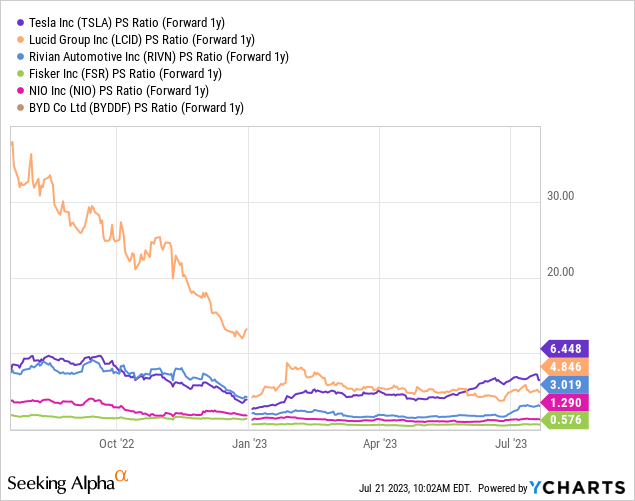

Despite yesterday’s 10% correction, shares of Tesla still have a very high valuation based off of FWD P/S. Shares are trading at a FWD revenue multiplier factor of 6.5X which makes Tesla by far the most expensive EV manufacturer in the market.

To some extent, Tesla’s higher-than-average valuation is justified as the EV company is the leader of the entire industry and many legacy auto companies recently agreed to adopt Tesla’s North American Charging Standard which will harmonizing the EV industry charging infrastructure. Tesla is also delivering by far the most electric vehicles and generates positive free cash flow… something all the companies below don’t. However, shares do seem a bit on the expensive side, and I believe investors may be able to buy into Tesla at a much lower valuation if the correction plays out. Personally, I would look to re-establish a long position closer to the $200-220 price range which implies a P/E ratio of 40X, compared to a P/E ratio of 53X today.

Risks with Tesla

There are a number of key short-term risk factors that I see with Tesla that could impact how the stock will perform over the next 6 to 12 months. One risk factor is the margin trend, as discussed: weakening margins directly imply that Tesla will make less money per car sold, which could weigh on the market’s earnings expectations and Tesla’s valuation factor. A second risk factor relates to the Cybertruck, which is slated for delivery this year, with mass production now expected to kick off in FY 2024, potentially delaying a positive stock catalyst.

Closing thoughts

Tesla had a decent quarter: it beat revenues and earnings, deliveries reached an all-time record in Q2, and the firm continued to see positive free cash flow in the second-quarter as well as an improving FCF margin. However, declining operating margins are now a fear factor for investors and they are to blame for Tesla’s 10% price correction yesterday. Considering that Tesla is still very highly valued based off of P/S, I believe that the current change in investor sentiment will last a while longer. My recommendation would be to stay on the sidelines until a bottom is emerging and bearish sentiment has peaked!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.