Summary:

- Tesla, Inc. stock has been sitting this year’s stock market rally out.

- I discuss one key reason for the underperformance.

- Automotive margins should remain pressured in the coming quarters.

MicroStockHub

Tesla, Inc. (NASDAQ:TSLA) bulls are in a world of hurt. On Monday, March 4, the Tesla stock sank 7 percent, and year-to-date, the stock price is down 24 percent whereas the NASDAQ (QQQ) is up 10 percent, Met Platforms (META) is up a whopping 41 percent, and Nvidia (NVDA), hold on to your seats, is up 77 percent.

Nvidia Bulls have a reservation at Eleven Madison Park, while Tesla Bulls are fine-dining at the local Popeyes.

So, what gives? What happened to THE stock of 2020?

Appreciating Asset Is Depreciating

In 2019, Elon Musk infamously said:

If you buy a Tesla today, I believe you are buying an appreciating asset, not a depreciating asset.

To be fair, I said it too, many times. I thought that the fact that Tesla does not allow purchase options at the end of leases would restrict the supply of used Teslas in the secondary market and that the Full Self-Driving (“FSD”) software would drive demand for used Teslas higher than supply for many years to come.

There were two material flaws with my line of reasoning:

- Tesla would take another five years, and counting, to develop FSD; and

- The Fed would hike interest rates to the highest levels in decades.

And here’s the result that Tesla bulls did not foresee:

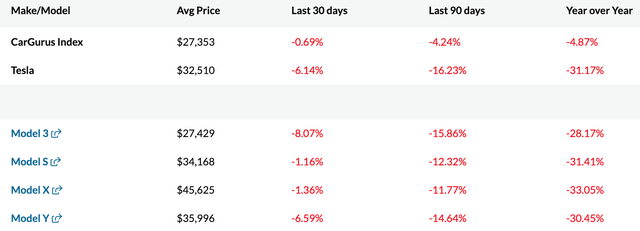

Used Teslas are depreciating faster than candy after Halloween: The resale values of the Model 3 and the Model Y, Tesla’s two top-selling models, dropped by 8.1 percent and 6.6 percent in the last 30 days alone.

In the same period, the CarGurus Index inched down just 0.7 percent, meaning Teslas depreciated an order of magnitude faster than the average used car listed up for resale in the United States.

Why?

The following are three potential reasons that I could muster up:

-

Concerns about battery degradation and replacement: Though uncommon, battery replacements can be expensive, leading some buyers to be cautious about purchasing used Teslas, especially older models nearing the battery’s typical lifespan. While Tesla batteries are designed to last for many years, consumers still have some uncertainty about how long they will last and how much it will cost to replace them if needed. This uncertainty could be leading to lower resale values for used Teslas.

-

Rapidly evolving technology: The EV market is still relatively young and the technology is constantly improving. This means that newer Tesla models may have significantly more range, features, or capabilities than older models, making older models less attractive to used car buyers and potentially causing their value to depreciate faster.

-

Price fluctuations: Tesla is known for occasionally making significant price adjustments to its models. This can create uncertainty in the used car market, as potential buyers may wait for a price drop on a new model rather than purchase a used one.

If you can think of any other reasons, please let me know in the comments below this article. I’d love to learn from you, and I try to reply to everyone.

Austin, We Have A Problem

I can almost hear Tesla’s CFO telling Elon in the voice of Tom Hanks that resale values are plunging and that even more margin-killer price cuts are needed.

This makes sense because used cars offer an alternative to new cars for value-conscious buyers, especially in the current period of high interest rates, and this is one reason why Tesla is currently offering its cars at the lowest prices ever combined with the highest incentives ever in its two-decade history.

Here’s a list of incentives that Tesla is currently offering potential buyers:

- Up to $5,000 off on demo cars that have typically been used for test drives and may have a few miles on the odometer as well as new inventory cars;

- $1000 off a new Model Y, Model S, or Model X for Cybertruck reservation holders because Tesla would rather convert those potential buyers today instead of having them wait another year for a Cybertruck;

- Three months of free Full Self-Driving subscription with a referral link;

- 5,000 free Supercharging miles for buyers in the U.S. or Canada who trade in a vehicle and take delivery by March 31, 2024;

- Lower lease rates starting from $329 a month before gas savings; and

- Tesla China is offering incentives for in-stock Model 3 and Model Y units purchased before the end of March, including discounted car insurance options, a 10,000 yuan deduction for paint customization (approximately $1,400), and low-interest financing alternatives with rates as low as 1.99 percent.

I estimate that the monetary value of Tesla’s historic incentives amounts to about $10,000 or 10% to 20% off the list prices displayed on the order design page, depending on the specific model and the geography, and although such deals are attractive for potential buyers of the vehicles, they also pressure Tesla Automotive margins for at least the first quarter of 2024 and possibly for the coming quarters, especially if Fed Funds Rate and loan rates remain high.

Long-Term Story Is Intact

Despite the near-term headwinds for Tesla Automotive, other parts of the company are set to do well for investors throughout the coming years:

- Tesla Energy’s growth rate and profit margins exceed Tesla Automotive’s;

- Early feedback from beta testers on FSD V12 has been generally positive; and

- Tesla’s Optimus humanoid project offers a valuable carrot for very long-term investors who are willing to wait in the stock for the next decade.

Conclusion

With the bleak outlook for Automotive margins, there’s little hope for the Tesla, Inc. stock to join this year’s stock market rally, unless FSD suddenly becomes materially better, so I guess Tesla Bulls will be holding their noses for the next few quarters while they enjoy their Chicken Sandwiches at the local Popeyes. Pass the barbeque sauce, will you?

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.