Summary:

- Tesla, Inc.’s Q3 deliveries showed 6% YoY growth but must post a record Q4 to outperform its 2023 full-year performance.

- Intense competition from BYD Company and other EV makers could worsen matters for Elon Musk and his team.

- Tesla’s Robotaxi event shouldn’t be considered the holy grail, behooving caution as its valuation has surged to frothy levels.

- Investors chasing its recent buying optimism could see their hopes crushed if Tesla doesn’t deliver the hype necessary to sustain its momentum.

- I explain why investors should continue staying on the sidelines, as Tesla’s best (high-growth) days could be over.

Apu Gomes

Tesla: Q3 Deliveries Shows Growth. Is It Enough?

Tesla, Inc. (NASDAQ:TSLA) investors anticipating a more robust performance from the Elon Musk-led company were likely disappointed with TSLA’s third-quarter deliveries update this week. EV investors were likely buoyed by the solid deliveries metrics posted by Tesla’s Chinese EV peers, coinciding with the massive “bazooka” stimulus measures promulgated by the Chinese authorities.

As a result, TSLA investors likely headed into its Q3 deliveries update expecting the leading EV maker to outperform the Street’s “whisper numbers” with ease. Notwithstanding the company’s return to YoY growth on its deliveries metrics, it’s increasingly clear that its high-growth bullish thesis is predicated on an increasingly tenuous foundation. In addition, BYD Company (OTCPK:BYDDF) and its smaller EV peers have been gaining ground (whether in BEV or PHEV). Hence, I assess the intense competition by the leading Chinese EV makers as likely catching up with Tesla in its most significant and critical ex-US market.

In my previous TSLA article, I urged caution in the expensively rated EV growth play. I highlighted the Robotaxi-driven hype cycle likely lifted investor sentiments as bullish TSLA investors returned to bolster its buying momentum. Nevertheless, investors are reminded not to throw caution to the wind, as the EV makers operate in a highly cyclical industry. In addition, CEO Elon Musk is not close to solving the full autonomy conundrum. Hence, it seems premature to bake in significant optimism in its Robotaxi business and full self-driving proposition, even as its leading competitors have continued to make headway in demonstrating their full autonomy ambitions.

Tesla’s High-Growth Thesis Demands A More Robust Performance

As a reminder, Tesla posted 462.9K in deliveries in Q3, representing a 6% YoY uptick. It also marked the EV maker’s first quarterly deliveries increase in FY2024. Hence, I assess TSLA’s recovery from its April 2024 lows as appropriate, as investors correctly anticipated that its deliveries performance should improve further. Tesla’s more robust performance in China also aligns with the record performance of BYD and its Chinese EV peers. Coupled with the more dovish Fed as it seeks to lower interest rates through 2025, I assess the most intense macroeconomic headwinds in Tesla’s US and Chinese markets have likely peaked.

Notwithstanding Tesla’s improved deliveries performance in Q3, the company must post a record Q4 to outperform its 2023 full-year deliveries metric of 1.81M. Therefore, I assess that this week’s selloff corroborates more cautious sentiments as TSLA investors reconsider whether continued optimism is justified. However, the lack of a steeper selloff suggests a palpable lack of selling intensity. Hence, I assess that the market has likely baked in more robust expectations for Tesla’s upcoming Robotaxi event scheduled on October 10. Given the growth premium baked into TSLA’s valuation, the market seems increasingly confident about its ability to outperform its peers.

Notwithstanding the progress made by its leading self-driving competitors, investors should consider it noteworthy that Tesla is expected to launch FSD in Europe and China in early 2025. Hence, Tesla seems to have made regulatory progress in its most critical markets, potentially lifting its software monetization opportunities. I urge investors to scrutinize management’s commentary regarding its FSD attach rates in these markets through 2025 to assess the speed of its adoption curve.

In addition, Tesla’s massive global scale could give it a significant competitive advantage over its self-driving peers. Therefore, I believe the market is likely increasingly optimistic that Tesla should have the capabilities to solve the software challenges that have hampered its ability to actualize its FSD potential. However, TSLA’s expensive growth premium suggests a more robust FSD take-up rate has likely been factored into its buying sentiments. Hence, investors could be disappointed if Elon Musk and his team fail to meet the market’s expectations at its upcoming Robotaxi event.

Investors looking for the $25K car to mitigate the headwinds for its 2025 deliveries outlook are urged to reconsider their optimism. Deepwater Asset Management highlighted that Tesla’s outlook next year could be hampered by a delayed response, given the anticipated production and launch timeline of its cheaper “mass market” version. Hence, a more robust growth inflection in its bottom line could arrive only from 2026, potentially curtailing the market’s enthusiasm for its shares over the next year.

TSLA Stock: Befuddling Optimism Amid Recent Surge

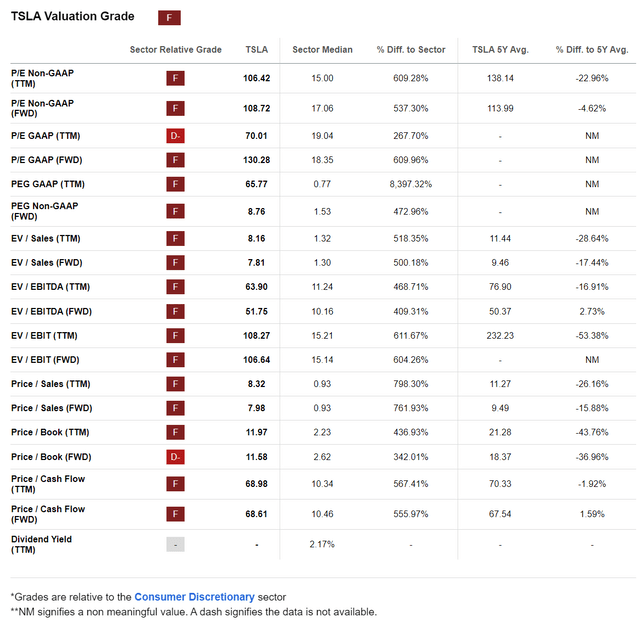

TSLA Quant Grades (Seeking Alpha)

TSLA’s forward adjusted EPS multiple of more than 100x has likely reflected significant optimism on its growth prospects. Not only is its valuation more than 500% above its sector median, but it’s also well above the tech sector median of 24x.

Despite that, TSLA’s impressive “B” rated momentum grade underscores the market’s optimism in its bullish proposition. It has improved significantly from a “D” momentum grade over the past six months, befuddling bearish TSLA prognosticators. Consequently, it doesn’t seem wise to try to bet against the market, but I’ve not assessed an increasingly enticing thesis for investors to consider buying into the EV maker.

Is TSLA Stock A Buy, Sell, Or Hold?

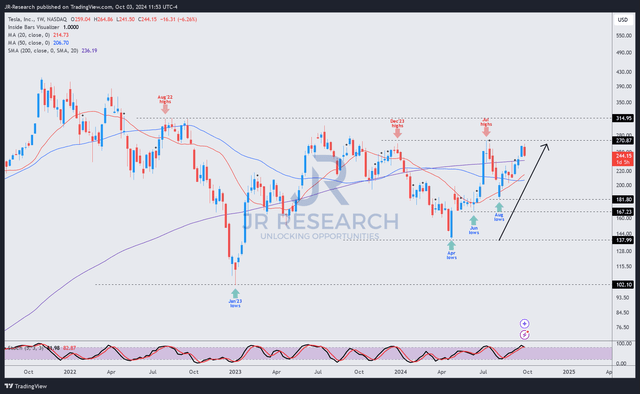

TSLA price chart (weekly, medium-term) (TradingView)

As seen above, TSLA’s price action corroborates the market’s improved buying sentiments. Since the stock bottomed in April 2024, I’ve gleaned several higher-low price structures.

However, a potentially stiff resistance zone under the $270 level could deter a more aggressive response from breakout investors, given its recent disappointing Q3 deliveries update.

Moreover, the surge from its April 2024 lows has likely reflected the optimism for its upcoming Robotaxi event. Hence, I assess that Tesla, Inc. investors banking on Elon Musk to deliver the holy grail at the forthcoming event are likely asking for too much, given its highly expensive growth premium in its valuation.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!