Summary:

- The company’s financial history shows consistent revenue growth and positive free cash flow, with a focus on raising capital through new shares.

- Tesla’s value is heavily tied to its progress in autonomous driving technology, with potential for a Robotaxi business in the entire fleet.

- Yet, this remains speculative, and TSLA’s market cap is already a premium to its current cash flows, making it best to wait and see if more progress is made first.

Justin Sullivan

Tesla (NASDAQ:TSLA) is a favorite among the investing community for its unique product and even more unique founder in Elon Musk, particularly since 2020.

TSLA 5Y Price History (Seeking Alpha)

This is more than 10x within five years, despite being down from its all-time highs. The share price appreciation elevated Elon Musk into being the wealthiest person in world.

In my view, however, this $670 billion market cap values the company for a hypothetical that hasn’t begun to materialize. As I think the company does have some strengths, however, I’m going to argue that it is a Hold until more progress is made on its vehicle autonomy.

Financial History

Over the past decade, Tesla has enjoyed significant growth that makes the optimism understandable.

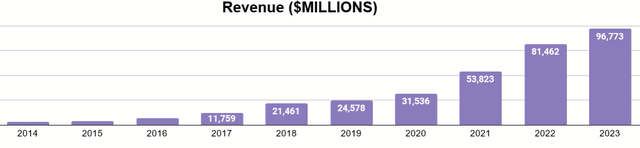

Author’s display of 10K data

Revenue has growth each year, such that 2023’s sales dwarf those of 2014.

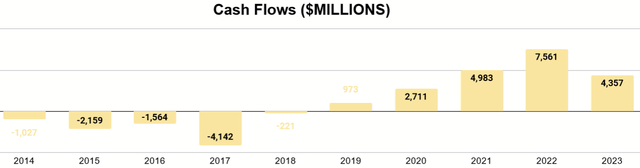

Author’s display of 10K data

Free cash flow history roughly follows this trend, and the stock’s spike in value follows the period that it transitioned from negative to positive numbers. Even then, it’s generally only been a few billion dollars.

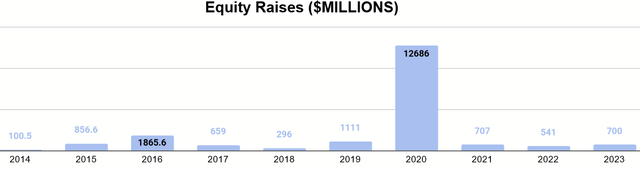

Author’s dispaly of 10K data

Where many of the megacaps are known for buybacks, even while their shares trade at all-time highs, Tesla is interesting in that it has continually raised capital by selling new shares, generally preferring to keep its level of debt low. In 2020, it responded to the explosion of its share price by raising over $12B. All things considered, it does show that Tesla has an eye for what its shares are worth and what make for a good return on capital.

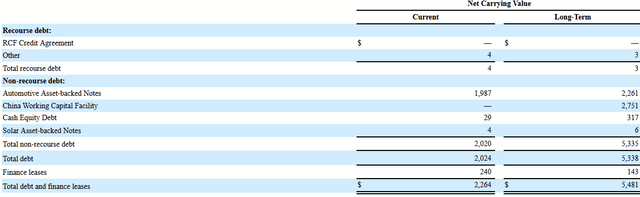

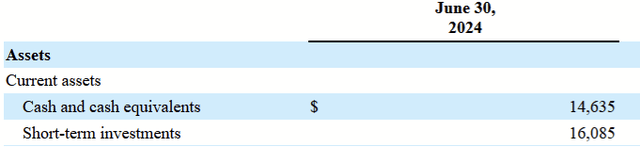

Q2 2024 Form 10Q

As of Q2 2024, Tesla has just over $7 billion in debt, with maturities staggered across the next decade.

Q2 2024 Form 10Q

This is compared to its $30B in liquid assets, indicating a very financially healthy company and no major risks stemming from its balance sheet.

Not Just an Auto Play

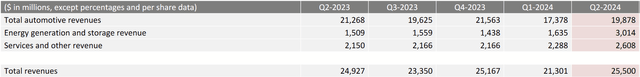

If we look at the make up of their revenues over recent quarters, most of Tesla’s money from its automotive segment.

Q2 2024 Company Presentation

In the past, this is as been an area of concern for me in the valuation, as their total revenues and cash flows are comparable to those of other car manufacturers. If Ford (F), General Motors (GM), and Toyota (TM) are at market caps of $43B, $52B, and $245B respectively, why is TSLA at $670B? Such a valuation suggests that one day they will subsume the whole car market.

Elon Musk think Tesla’s value is elsewhere, however. When asked, during Q2 earnings, about potentially losing the benefit of the Inflation Reduction Act, Musk swatted away such concerns, observing:

I guess that there would be like some impact, but I think it would be devastating for our competitors…and it would hurt Tesla slightly but long-term probably actually helps Tesla, would be my guess…but I’ve said this before on earnings calls, it — the value of Tesla overwhelmingly is autonomy. These other things are in the noise relative to autonomy. So I recommend anyone who doesn’t believe that Tesla will solve vehicle autonomy should not hold Tesla stock. They should sell their Tesla stock. You should believe Tesla will solve autonomy, you should buy Tesla stock. And all these other questions are in the noise.

Earlier in the call, he explained his view on the value of fully autonomous vehicles.

Although the numbers sound crazy, I think Tesla producing at volume with unsupervised FSD essentially enabling the fleet to operate like a giant autonomous fleet. And it takes the valuation, I think, to some pretty crazy number. ARK Invest thinks, on the order of $5 trillion, I think they are probably not wrong.

One might wonder how far into the future his “long-term” is for a valuation of $5 trillion, but it’s worth examining because it’s still several times the current market cap of TSLA.

In addition to that, the chart I showed above also indicates that their energy generation and storage segment is their fastest-growing business. As this scales out, there is also potential for Tesla to benefit here, but as most of the potential is in autonomy, that’s where I’ll focus.

Progress in Autonomous Driving

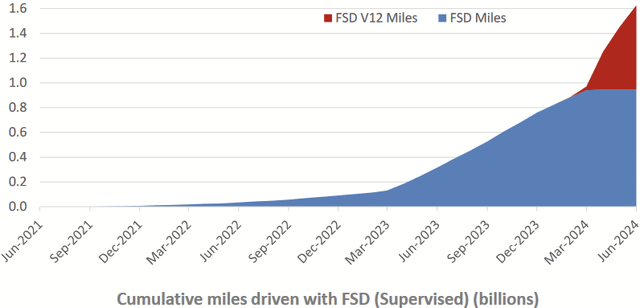

Musk’s remarks follow recent progress the company has made in training models operating their vehicles.

Fully Self-Driving Miles (Q2 2024 Company Presentation)

His view is that once enough miles of training have been accumulated to prove that self-driving cars (even unsupervised ones) are safer than manually operated ones, regulators will have no choice but allow it.

A major way that Tesla earns money off of this is through its Robotaxi business, which it announced earlier this year. Part of the value to be unlocked is the fact the entire Tesla network can immediately be fitted to serve this role. Musk clarified:

You just literally open the Tesla app and summon a car and resend a car to pick you up and take you somewhere. And you can — our — we’ll have a fleet that’s I don’t know, on order of 7 million dedicated global autonomy soon. In the years come it’ll be over 10 million, then over 20 million. This is immense scale.

He even mentioned how folks who buy Teslas could contribute to this:

And now this is for a customer on fleet. So you can think of that as being a bit like Airbnb, like you can choose to allow your car to be used by the fleet, or cancel that and bring it back. It can be used by the fleet all the time. It can be used by the fleet some of the time, and then Tesla would take — would share on the revenue with the customer. But you can think of the giant fleet of Tesla vehicles as like a giant sort of Airbnb equivalent fleet, Airbnb on wheels.

There’s a reason he has had to clarify so much, however. These ideas are still new, and the analysts themselves have only just begun to consider it. It’s well ahead of any execution and thus any material gains for shareholders.

One of the major limits to production, and this was discussed in the call, was the lack of availability of GPUs to purchase from Nvidia. Demand is just too high. Consequently, Tesla will need to step up the production of their own chips.

Valuation

Over the past three years, Tesla has averaged $5.6B in free cash flow. With a valuation of $670B, that’s a multiple over 100. The company would need to find ways to generate significantly more cash. One would even think that the current market cap supports the kind of future implied by successful implementation of their autonomous driving technology, both as it concerns individual car sales, the Robotaxi business, and how the advancements can be leveraged into other non-vehicular uses (as with their budding Optimus line).

To go from a few billion in FCF to tens of billions (the financial capacity implied bu the current market cap) is major feat for any company. For a long-term valuation of $5 trillion from of their autonomous tech implies not mere revenue but free cash flow of hundreds of billions per year. I’ll quote Musk once more:

I mean, at that point, I’m not sure what money even means, but in the benign AI scenario, we are headed for an age of abundance where there is no shortage of goods and services.

I’m not saying this won’t happen, but it is something of a distant future. If TSLA shoots to $5 trillion ten years from now, then that’s at least 7x for today’s buyer. If you have the patience for it, fine, but I personally want more confirmation that Tesla will successfully launch such a business, as others could conceivably do it too. Consequently, I think $670B more likely reflects the upper end of the fair value of the business for what we currently know.

Conclusion

Tesla is a great company. If their ambitions with autonomous driving are realized, it may trade for much more than it does today and not even be overvalued. That, however, would be based on business developments that are almost entirely speculative.

For what it does now (car sales and a smaller segment of energy generation and storage), the company is already trading at a multiple that suggests tremendous growth, while other automakers are more modestly priced. Tesla’s tech advantage over them likely explains this, but before I buy into the story, I want to see more progress, more signs that businesses like Robotaxi will be real and not just potential.

Until then, I just consider the shares a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.