Summary:

- Tesla, Inc. revolutionized the EV industry and became one of the most valuable companies in the world, but things are changing.

- The company is now facing competitive headwinds, with its market share dropping, and actions by CEO Elon Musk are adding fuel to the flames.

- With multiple headwinds converging, I believe the company’s current high earnings multiple justifies a hedged short position in the company.

Magnus Kvandal/iStock Editorial via Getty Images

There are a few ways to look at Tesla, Inc.’s (NASDAQ:TSLA) growth, in past and future.

Looking back, the company has revolutionized the way we think about electric vehicles, or EVs, and created the first, and one of the best, all-electric mass-produced vehicles in the United States. Its growth in unit sales, revenues and profits were (somewhat) quick to follow and the company and its stock price made a roar recently, briefly becoming one of the top most valuable companies in the world. (Not that there’s anything wrong with the over $580 billion market capitalization it currently has).

But as I and many others here on Seeking Alpha have written about over the years, there exists a time when hypothetical headwinds become real ones, and it seems like that time has come, along with other ones, which none of us saw coming, like CEO Elon Musk substituting countless hours per day from the Tesla factory floor to replying to random people on Twitter, now named X.

Most of these are competitive headwinds, which we’re now living through. Companies like Toyota Motor (TM) reported a big boost in EV and plug-in hybrid sales in the first quarter of 2024, as well as higher-end carmakers like Mercedes-Benz (OTCPK:MBGAF) and Cadillac (GM), while Tesla saw its sales decline relative to a year ago.

This has resulted in the company’s U.S. market share dropping to just over 51%, down from 62% last year and from almost 80% just 4 years ago. The company’s global EV market share also dropped from 22% to 20% in the first quarter of this year. While I don’t think many people expected that share to have stayed the same, it’s a sharper decline than expected, especially since they’ve been ramping up production in faster-growing markets in the Asia-Pacific and European regions.

Overall, it’s hard for me to see these competitive factors slowing down, and I do believe they will accelerate. The question for me is how much – is it enough to warrant a short position on the company’s current-70x earnings multiple?

Let’s dive in a little.

Tesla’s Past Is Brighter Than Its Future

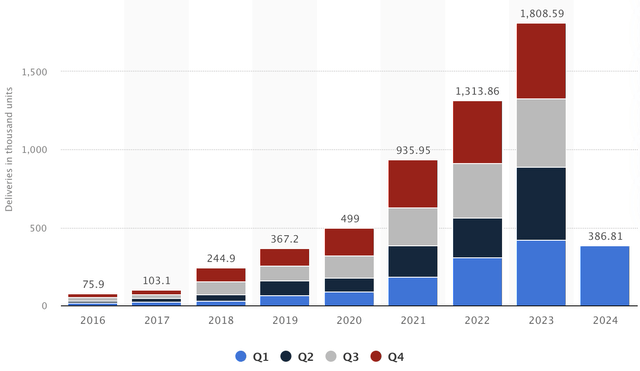

Tesla is still the largest producer of all-electric vehicles in the United States and is still doing so globally, although not for long. China’s BYD Company (OTCPK:BYDDF) sold about 1.6 million all-electric vehicles in 2023 compared to Tesla’s 1.8 million. The Chinese auto behemoth sold 3 million total new-energy-vehicles in the same year, which includes hybrids and other tech vehicles.

While this trend in the United States isn’t expected to change anytime soon, with other companies selling just a few tens of thousands each year, there are 3 competitive factors here to consider.

The first is that almost every automobile company is investing in all-electric and plug-in hybrid technologies and have offers similar to Tesla‘s in both price and function, either already on the market or expected to be within the coming year. This means that although no other company even has the capacity to, let alone is producing, the over 2 million vehicles that Tesla is expected to in 2024, there are enough of them that people who are shopping for all-electric vehicles have several suitable options to choose from. This wasn’t the case over the past few years, when Tesla enjoyed a de facto monopoly.

The second is that a big advantage that Tesla had early on is that it was second to none in its technological innovations within the car itself. As I’ve stated in past analysis, it appears that the biggest improvements, beyond safety, that the automobile industry had over the 20 years before Tesla’s launch were very minor and then Tesla’s cars came out, revolutionizing in-car technology and various experience-improving features in and out the car.

The third is the price. While Tesla is still one of the cheapest for their basic add-ons vehicle, other automakers have either launched or are going to launch sub-$40,000 vehicles, which was a main selling point for the company’s Model 3. Even though the company’s Model 3 ends up being just as expensive as other cars when you add on some basic features, it’s still been one of the lowest priced all-electric cars available in the United States, for the high-tech car which it is, but that’s already changing.

There’s A Political Problem Too

While I don’t believe this will be a determinative factor for an ultimate position in the company (long or short), it’s worth mentioning, since in the current political climate we’ve seen how large an effect trends can have on sales.

According to recent surveys, more than 60% of politically conservative Americans say they have an unfavorable view of electric vehicles and only 20% said they would even consider buying one when looking to purchase a new car. This contrasts with politically liberal Americans, 70% of whom consider electric vehicles when looking to purchase a new car and over 65% of whom have a favorable view.

As I’ve noted before, Tesla’s CEO Elon Musk has taken quite a sharp political turn after purchasing Twitter, which he rebranded as X, and has spent a considerable amount of time using the platform to tweet, retweet, reply and like tweets which have a far-right and often conspiratorial leaning. He spent the last 3 weeks before buying the platform tweeting roughly once per hour, and that number has increased by multiples since then, and he’s been taking time to tweet and respond to random posts until late at night and then first thing in the morning, signaling a rather classic social media addiction we all experienced, or are still experiencing.

Besides causing mainstream advertisers to flee the platform within the first few months of his acquisition due to amplifying controversial tweets, it also is seemingly a factor in the company’s recent slowdown in sales, since as we know, it is mostly liberal-leaning folks who have been buying Tesla vehicles, at least until now. According to research, Democrats made up roughly 40% of sales in both 2022 and 2023 but only 14% in the first quarter of 2024, likely driving the 13% decline in sales the company reported.

Key Risk: Robotaxi and “Other”

While I believe that the factors I laid out point to a company whose headwinds outweigh their tailwinds, at least for now, there are some longer-term factors which have the potential to counteract them.

As many have discussed here on Seeking Alpha, the company’s recent announcement that it is working towards an August release of its robotaxis, which are self-driving-capable taxis, does have the potential to generate a meaningful bump in sales as companies like Uber (UBER) and others have discussed the long-term benefits of taxicabs being one of the first self-driving vehicles which will result in significant savings for users because they don’t need, at least theoretically, to employ a driver.

Even so, there are 2 parts to this theory which don’t sit well with me as a justification for long-term growth.

The first is that in that same announcement, Elon Musk announced that they are cancelling their plans to manufacture and release a lower-cost all-electric vehicle, which was part of the last bump in share price. There’s little to convince me that the company will actually follow through on this robotaxi production in a way which will be significantly adaptable within the next 2 years.

The second is that, as we’ve previously seen with Tesla’s own autonomous driving adaptation, cities and governments aren’t so quick to allow these operations and all but 4 states only allow the testing of these systems with a human present but do not allow the free use of such technology (the mentioned 4 states allow for driverless testing on their roads). That’s even before you have the powerful taxi and Uber driver lobbies descend on Washington and local government to try and delay or stop altogether the implementation of these vehicles, which do not need a driver to be present.

The chances are that Tesla will roll these out in a few select markets, get some theoretical future orders placed by bigger companies but then face regulatory setbacks and ultimately produce very little of these vehicles in favor of their other models which have been hyped up.

Conclusion: I Think It’s Time To Short

While shorting a growth company is very risky, there’s little to prove to me that Tesla, at 78x forward earnings multiple, has room to grow at anywhere near the rate needed to justify that multiple as competitive and growth headwinds continue to mount.

Given that the negative factors I presented likely mean that the company will underperform their current expectations, even after downward revisions, I believe that the company’s multiple should be closer to 40x to 50x for the coming year, meaning that there’s some significant downward potential.

For this position, I will be shorting shares, since the company pays no dividends and has the potential for a slow descent in share price. To hedge that position, I am going to use longer-term call options with the August 2nd $250 strike price and October 18th $275 strike price. These, for me, are milestones in which the company’s share price has seen a lot of activity. Of course, before placing any trade, please fully understand the risks of shorting stocks and of options.

In short, pun intended, I am increasingly bearish on this Tesla growth story.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Opinion, not investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.