Summary:

- Tesla, Inc.’s stock is overvalued, driven by hype and unrealistic future expectations, making it a risky investment despite the company’s impressive business achievements.

- Cathie Wood’s lofty price targets for Tesla are more hype than analysis, perpetuating froth in an already overvalued stock.

- Tesla’s valuation is unsustainable, trading at 9x P/S compared to automotive peers’ 1.5x, indicating a significant downside risk.

- Key risks include Elon Musk’s potential incapacitation, geopolitical tensions with China, and increasing competition from Chinese EV manufacturers like BYD Company.

3alexd

Introduction

Tesla, Inc. (NASDAQ:TSLA) is a name that just about every investor on the planet will be familiar with. It is a somewhat divisive name that has generated a bit of a cult following in the investment community and is led by undoubtedly the world’s most flamboyant CEO in Elon Musk.

Tesla has been a long-time favorite of Cathie Wood, an investor who despite a big reputation has trailed the market significantly at times. Tesla has for a long time been the largest holding of her flagship ETF, Ark Innovation (NYSEARCA:ARKK), a fund which over the last five years has under-performed the broader market by nearly a factor of ten.

Wood recently made calls for Tesla to hit $2,600 by 2029, a move that would require a 10x move higher from current levels. I do not see such a move in Tesla by 2029 as credible.

There is no denying that both the underlying Tesla business and its stock have had a tremendous run over the past decade. I think, however, it is critically important for investors to perform a sober analysis of investment ideas.

Tesla trades at an extreme valuation today, and critics will argue that the stock has always been expensive, but that has been no impediment to stock price performance. This backward looking analysis does not hold water for me, as stocks naturally start to mature their valuations normalize. If we look at Meta Platform’s (NASDAQ:META) chart below as an example, we see that earlier in the company history it traded at very lofty multiples, but as the business matured it settled into a more stable valuation.

This article will effectively lay out why I think Tesla is a tremendous business, but the stock is not a good investment given the level of future expectation already discounted in the price. I rate Tesla as a Sell.

Recent Earnings

Tesla reported its Q3 earnings last week with a set of numbers which were well received by investors. Investors sent shares higher by close to 22% as revenues and EPS grew by 8% & 9% respectively. Some on Wall Street were quick to point out expectations were significantly depressed coming into the print following a disappoint Robotaxi event in the lead up to earnings.

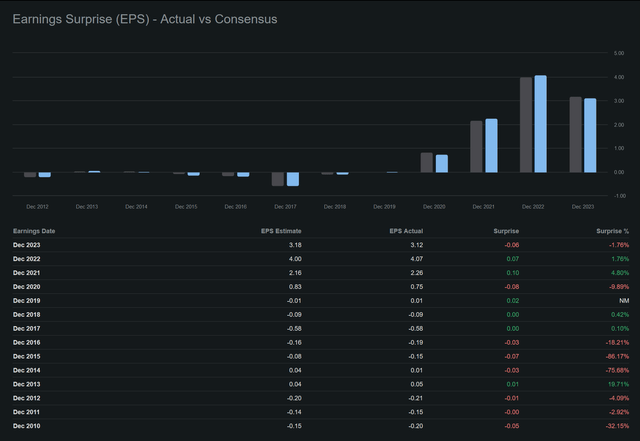

Perhaps the most bullish reveal on the call was Musk stating 2025 could see an increase in vehicle deliveries by 20-30%. The energy storage business was the standout revenue line item as it grew 52% year-on-year, though it did decline on a sequential basis. Overall, earnings were positive as Tesla broke a streak of four consecutive EPS misses.

Business vs. Stock

To be clear, I want to distinguish between Tesla the business and Tesla the stock. The underlying business has been a wonderful success story of engineering, disruption of a long unchanged industry and disciplined execution. Tesla is at one and the same time an automotive company, an energy generation and storage company and, in due course, likely an autonomous taxi and personal robotics company.

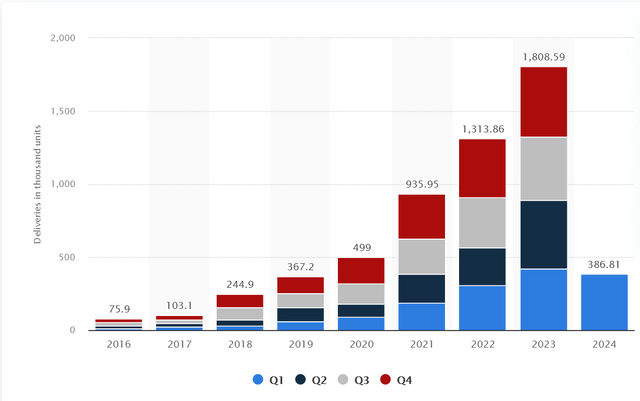

A cursory glance at Tesla’s vehicle deliveries history clearly shows a business that has executed upon an expansion road map, though admittedly not quite to the level of Musk’s often lofty targets. Importantly, and unsurprisingly, this growth in vehicle shipments has seen a booming growth of the top line. Tesla saw revenue grow nearly 9x in a mere six years from 2017 to 2023. The firm has transitioned from the classic high growth loss-making type to a solid profit generator with margins in line with key auto competitors like Toyota (NYSE:TM), BYD Company (OTCPK:BYDDF), and BMW (OTCPK:BMWYY).

However, as I see it, the market is giving the company full credit for achievements they have both made and have yet to make. In essence, the stock is priced on the assumption that Musk’s firm will achieve all of his lofty ambitions. Of course, all equities are priced by the market to incorporate expectations about the future, which can, of course, be both positive and negative. Consider, for instance, how European oil names trade at a meaningful discount to history based upon future expectations of European ESG standards, vs. US oil names which continue to trade at historically normal valuations.

The issue with Tesla specifically is that it is priced for perfection, this means that the risks look skewed to the downside. Of course, as with any investment, we face an uncertain future and outcomes can fall across a wide range of potential outcomes within a probability distribution. Utilizing a valuation framework, hopefully I can illustrate the level of optimism embedded in the prevailing stock price, lowering prospective future returns and creating vulnerability to downside risks, which I will lay out at the end of this article.

Valuation

Unsurprisingly, this is where the Tesla investment case gets derailed. If we look at the Tesla business today, we see the firm making c80% of its revenue from the sale of automobiles. I know this will be unpopular with some readers, but the valuation of Tesla should bear at least some resemblance to other car companies over the long run. Tesla trades on a price-to-sales ratio of just shy of 9x. If we look at its car company peers we see that the highest P/S ratio achieved by key competitors was Toyota which registered a multiple of just over 1.5x back in the early 2000s. That is the highest sector multiple recorded in a moment of frothiness in auto valuations.

Now of course, Tesla is a different animal to its auto competitors, naturally I understand that. However, with 80% of its revenue from selling automobiles, which while different from internal combustion engine, or ICE, vehicles, electric vehicles are after all a car. They sell for similar prices, anywhere from $25,000 as Tesla hopes to achieve in the not too distant future, to premium tier models costing $80,000–$100,000. For now at least, the margin profile from selling cars is broadly the same whether it’s electric or ICE. This is hardly surprising given our input costs will have broad similarity in terms of metals, protective coatings, tires, semiconductors and so forth. The result is Tesla’s gross margin trades pretty much in-line with auto peers like Toyota and BMW.

So, let’s say Tesla is so much better than all the other car companies because of its tech, and it deserves to trade at a 3x premium to the highest multiple ever achieved by Toyota. This gives us a long-term P/S target multiple of 4.5x, which is a 50% discount to the current valuation. In my view, using a 4.5x P/S target for Tesla is already baking in substantial optimism.

Looking at growth expectations, market forecasts are for Tesla to generate about 15% EPS growth over the medium term. Critics might say estimates are just that, estimates. Companies are known to consistently outperform them. However, when we look at Tesla’s history, we see that analysts have actually been pretty accurate when forecasting where earnings would land. Based on the current EPS forecasts, Tesla is trading on a forward PEG ratio of over 7x. This multiple looks very high, both in the absolute and relative to competitors like BYD, which trades on just 1x. Its Chinese peer should trade with a “China discount” but a 7x difference looks excessive.

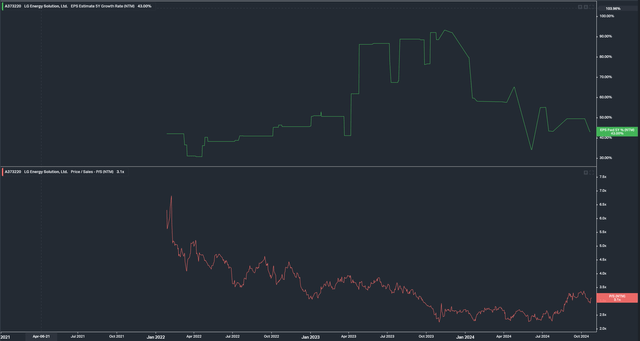

What about the energy storage business though, it’s a fast-growing business, so how much is that side of the business worth? Energy storage, per the most recent quarter, makes up about 10% of Tesla. YTD, the business generates about a 26% gross margin, a better margin profile than automobiles but not by a major amount. Looking to Tesla’s high-growth energy storage peer LG, we see the firm trades on a P/S basis of around 3x, despite boasting forecast earnings close to 3x Tesla’s.

So if a reasonable long-term premium P/S ratio for an automotive company is somewhere between 3x – 4.5x and high-growth energy storage trades at 3x, then Tesla trading at 9x implies to me that more than 50% of the business value is based on future expectations. As I have shown, earnings are expected to be strong but not astounding, and analysts have historically been fairly on the money in terms of predicting Tesla earnings.

All this leads me to believe that Tesla’s valuation is discounting a huge amount of hope and expectation. As the business continues to mature I expect Tesla will continue to trade at a premium to automotive peers, however, I see the current valuation as embedding considerable optimism which sets the stock up for downside risks.

Risks

The clearest and most acute risk to Tesla would be the possible incapacitation of Elon Musk. The business is very much a leader-driven workshop, and Musk is renowned for his relentless work ethic and incessant drive to ever improve Tesla and break boundaries. One could argue that Tesla has reached such a scale now that the business would be certainly capable of functioning without him. I would be highly skeptical whether it would be the same beast without him. I think there would be no question the stock would see its valuation decline significantly as many people betting on Tesla are doing so because they believe in the brilliance of its CEO, not the rest of the executive team.

The second obvious risk is geopolitics. Tesla is caught in a difficult balancing act, trying to straddle the growing conflict between the US and China. It appears inevitable that Tesla cars will face significant tariffs in China in the near future. This will be either as a retaliatory action to EV tariffs in the US on Chinese cars, or as part of a push by the CCP to champion domestic producers like BYD. China represents about 20% of company revenue at present. Hence, I think a fifth of the top-line looks quite vulnerable.

The third risk I see is competition. Tesla already faces a significant challenge from Chinese players like BYD. I think the hawkish bipartisan stance on China in Washington somewhat mitigates the challenge posed by Chinese cars, but in doing so, increases the risk of Chinese retaliation, as per the above risk listed. So on one hand, if the US doesn’t impose hefty tariffs on Chinese electric vehicles, Tesla faces the risk of lost sales from meaningful competition in its home market. On the other hand, a protectionist measure by the US government will almost certainly hurt Tesla sales in its second-largest market, China.

Conclusion

In conclusion, I rate Tesla stock as a Sell. It is hard not to be impressed by the success the company has had in growing its revenue and profits, especially over the last five year or so. However, this is a stock priced for perfection, with most of the current stock value based on the long-term future rather than the current business and its earnings outlook for the medium term.

This to me is simply a case of too much hype, as investors have pulled forward far too much of the potential future into the present day valuation of the business. This leads me to believe the risks to the current price are skewed to the downside, and hence I see no reason to bear this risk to reward dynamic.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.