Summary:

- I’ve maintained a significant short position on Tesla, Inc. due to declining EV demand, growing competition, and an expensive valuation, despite recent stock price increases.

- Tesla’s stock is highly sensitive to interest rates, and with rates likely peaking, the macro environment may no longer push the price lower.

- Q2 results show stalling growth and rising operating expenses, making Tesla’s auto segment comparable to BYD Company’s but at a much higher valuation.

- Given the potential bullish catalyst of decreasing interest rates, I upgrade Tesla to HOLD/Neutral despite long-term bearish views on its high valuation.

Richard Drury

Dear readers,

I’ve had a major short position on Tesla, Inc. (NASDAQ:TSLA) for quite some time.

I first initiated the position in March at $177 per share and informed my readers (here). Later, I published an article called 7 Reasons To Short The Stock and doubled down on my position mainly due to:

- declining demand for EVs globally,

- growing competition,

- declining revenue growth and margins,

- an expensive valuation,

- and a dangerous technical level.

Since that article, the stock price has jumped to $228 per share, which means that my short position is now around 25% underwater.

I believe that long-term, the short will pay off as many of the aforementioned concerns very much remain and have actually been confirmed by the Q2 earnings report released in late July.

At the same time, however, I recognize that interest rate cuts, which seem very likely in the coming months and quarters, are likely to be a bullish catalyst and could easily cause a surge in the price of Tesla stock.

Today, I publish an update to my thesis based on the most recently published numbers, focusing mainly on the sensitivity of the stock to interest rates, and weighing the pros and cons of keeping my short on.

The impact of high interest rates

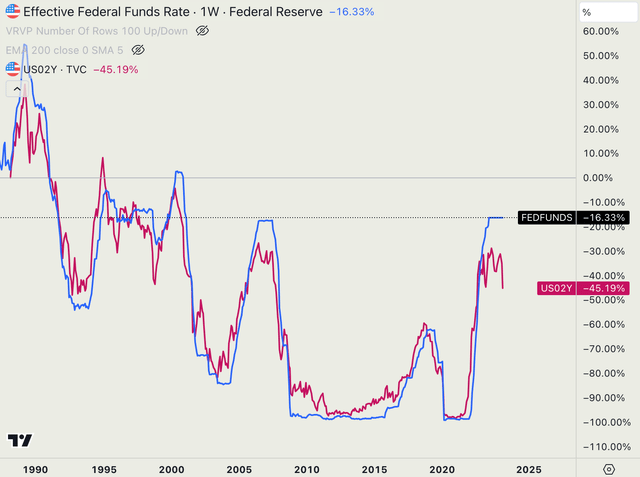

Most analysts here on Seeking Alpha use the Fed funds rate as their preferred measure of interest rates in the economy. Personally, however, I prefer to look at the 2-year treasury yield (US2Y). The two tend to move in tandem with each other, but as evident from the chart above, the 2-year yield is more forward-looking (and therefore tends to drive the Fed funds rate).

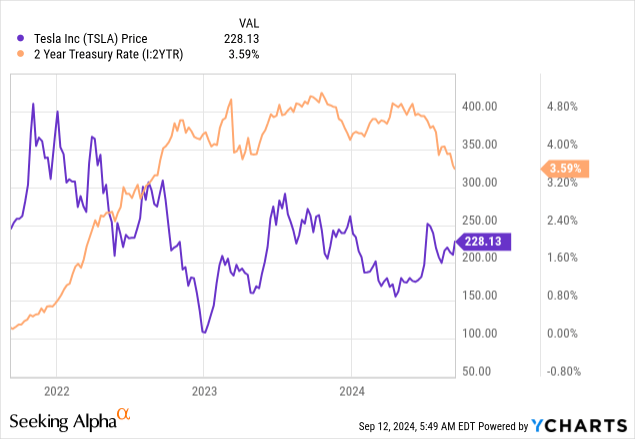

The chart below shows a clear negative relationship between interest rates (i.e., the 2-year treasury yield (US2Y)) and the price of Tesla stock. Since late 2022 and throughout 2023, Tesla declined by 75% from a high of $400 per share to just above $100 per share as interest rates increased from 0.5% to 4%. Importantly, the relationship also held quite well throughout 2024.

The moral of the story is that while there are, of course, other factors that influence the price, the price of Tesla is very sensitive to interest rates.

There are two fundamental reasons for this.

First, the demand for EVs, especially in the U.S., is quite highly affected by financing rates. And higher financing costs often lead to people postponing their decision to buy a new car. Management has been very aware of this and has (somewhat successfully) tried to motivate people with attractive financing options such as sub-2% rates for any Model Y bought before September.

Second, Tesla’s expensive valuation (at almost 100x forward earnings) relies heavily on (uncertain) cash flows far in the future (after full self-driving (“FSD”) is fully functional and integrated, etc.). Long-duration cash flows get discounted at the current interest rate to arrive at a fair value of a stock. It follows that higher interest rates are negatively related to stock price performance.

But here’s the thing.

It appears that interest rates have likely peaked and, as a result, we, as short sellers, can no longer depend on an unfavorable macro environment to push the price lower. It is time to re-evaluate how the company is actually doing and weigh the risk factors against the coming bullish catalyst in the form of lower interest rates.

Q2 results — things have indeed slowed down

Let’s start with the latest earnings.

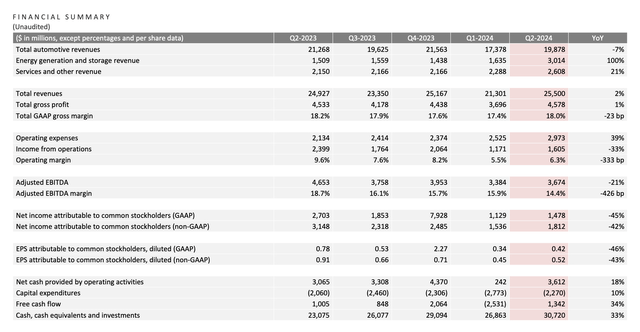

Tesla booked record quarterly revenues of $25.5 Billion, thanks to

- A rebound in vehicle deliveries from a low of 386k in Q1 to 443k, which is roughly in line with the average seen in 2023,

- Rapid growth in the energy storage business with 9.4 GWh of deployments in Q2, up 100% YoY, and

- Record regulatory credit revenues recognized during the quarter.

Continuing with the positives, the gross margin for the quarter came in at 18%, in line with previous quarters, as lower sale prices were largely offset by lower COGS due to lower raw material costs, freight, and duties.

On the negatives, it’s now clear that Tesla’s growth has basically come to a standstill with total revenues up only 2% YoY and automotive revenues, which form the bulk of Tesla’s business, down 7% YoY. Management insists that growth will pick up again in the future, but meanwhile Tesla’s biggest rival — BYD Company Limited (OTCPK:BYDDF) — is seeing strong 21% growth in their EV sales. This is one of many reasons why I don’t think Tesla deserves its premium multiple compared to other automakers (traditional and EV).

In addition to stalling growth, due to rising operating expenses, Tesla has been struggling to keep their operating margin. Just five to quarters ago, Tesla had an operating margin in the double digits. Today, despite no change to gross margin, the operating margin has been cut in half to just 6.3%. That is barely in line with BYD, despite trading at five times the valuation multiple.

Currently, it’s difficult to argue that Tesla’s auto segment is any better than BYD’s as it exhibits significantly less growth and a similar margin.

Why Am I Upgrading Tesla?

Of course, Tesla has other divisions beyond car manufacturing, and the bulls will argue that these are worth the pricey premium. But the problem is that, except for Energy, none of the other divisions are profitable, and their profit prospects are uncertain and far in the future.

Meanwhile, the stock trades at 98x forward earnings. Such a high multiple only makes sense if earnings grow exponentially in the future, which in the case of Tesla implicitly assumes that divisions beyond auto manufacturing translate into profits.

I continue to be long-term bearish on Tesla, Inc. stock because I don’t see its high valuation multiple as justified. But in the short to medium term, I see too many risks to shorting the stock.

In particular, I worry that (1) the re-rating to a lower multiple may take a long time as the stock has tons of die-hard fans, (2) we may now be in a period of trough earnings due to peaking interest rates, and (3) the expected decrease in interest rates could act as a significant bullish catalyst given Tesla, Inc. stock’s sensitivity to interest rates.

For these reasons, I upgrade the stock to a HOLD / Neutral.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.